Did you know that even the best traders can't predict the market's next move with a magic crystal ball? Instead, they rely on tools like leading and lagging indicators to inform their strategies. In this article, we'll dissect the differences between these two vital types of indicators in day trading. You'll learn how leading indicators help anticipate market movements, while lagging indicators confirm trends after they’ve occurred. We’ll explore common examples of each, discuss their unique benefits and risks, and provide insights on how to effectively combine them in your trading strategy. With the right knowledge from DayTradingBusiness, you’ll be better equipped to navigate the complexities of day trading and make informed decisions.

What Are Leading Indicators in Day Trading?

Leading indicators in day trading are tools that predict future price movements based on current market conditions. Common examples include moving averages, momentum indicators like the Relative Strength Index (RSI), and the Stochastic Oscillator. These indicators help traders anticipate potential reversals or continuations in trends, allowing for proactive decision-making. Unlike lagging indicators, which confirm trends after they occur, leading indicators aim to forecast future price changes.

How Do Lagging Indicators Work in Day Trading?

Lagging indicators in day trading confirm trends after they have occurred. They use historical price data to help traders identify the direction of the market. Common examples include moving averages and the Relative Strength Index (RSI).

Traders look for signals like crossovers or trend confirmations. For instance, if a short-term moving average crosses above a long-term moving average, it signals a potential upward trend. While they help validate trends, lagging indicators may not predict future movements, making them more useful for confirming existing trends rather than initiating trades.

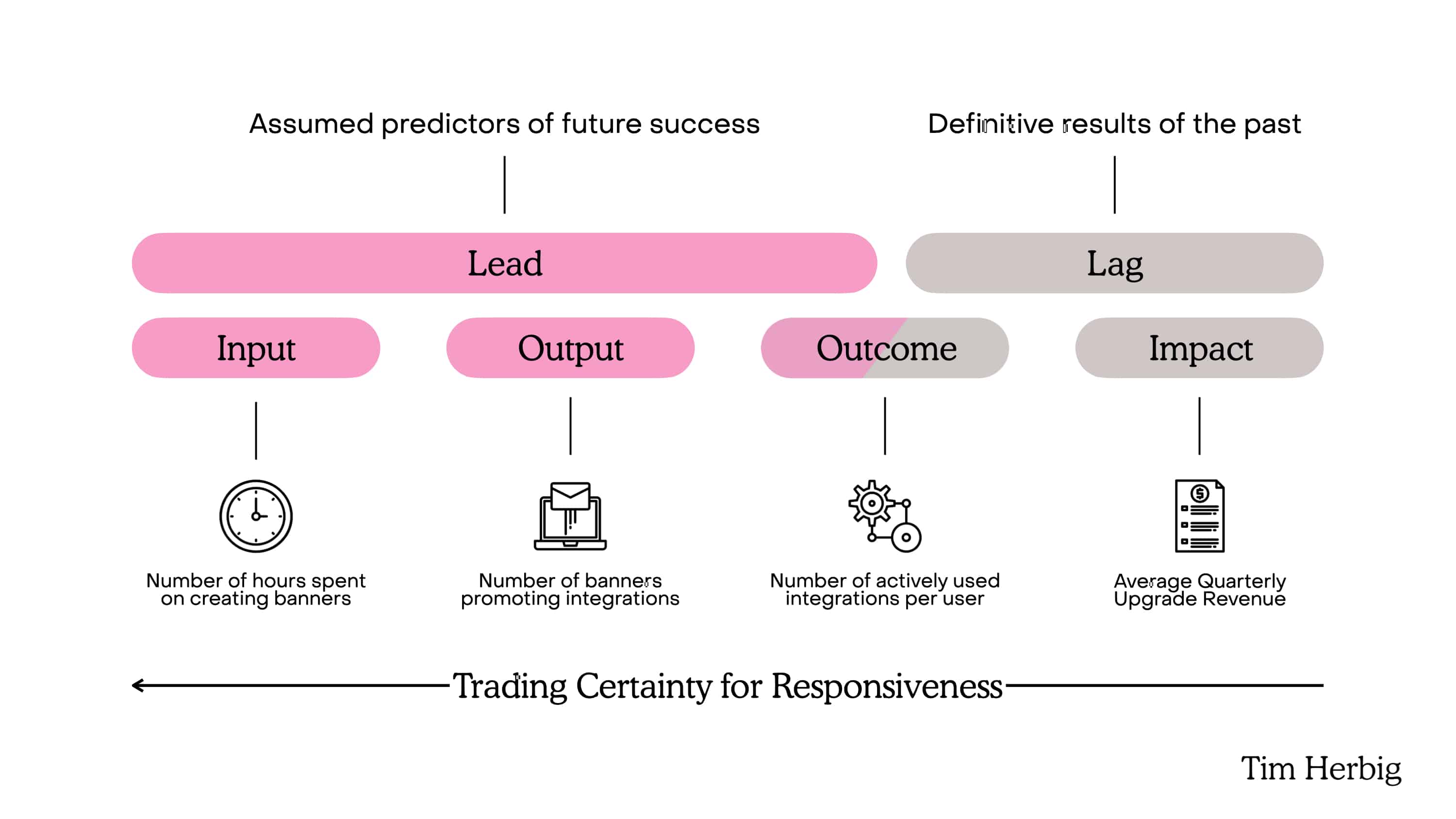

What Are the Key Differences Between Leading and Lagging Indicators?

Leading indicators predict future price movements, helping traders anticipate market trends. Examples include moving averages and RSI. Lagging indicators confirm trends after they occur, providing insights based on past data, like MACD or Bollinger Bands. In day trading, leading indicators can signal entry points, while lagging indicators help verify those signals.

Why Use Leading Indicators for Day Trading?

Use leading indicators in day trading to anticipate price movements before they happen, enhancing your ability to make timely decisions. They help identify potential trend reversals and entry or exit points, allowing traders to react quickly to market changes. Unlike lagging indicators, which confirm trends after they occur, leading indicators provide insights that can lead to profitable trades. Examples include the Relative Strength Index (RSI) and moving average convergence divergence (MACD). These tools can improve your strategy's effectiveness by offering a proactive approach to market conditions.

What Are Common Examples of Leading Indicators?

Common examples of leading indicators in day trading include the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), Stochastic Oscillator, and Fibonacci retracement levels. These indicators help traders predict future price movements by analyzing market momentum and potential reversals. Other examples are volume analysis, trend lines, and chart patterns like head and shoulders or flags, which signal upcoming market direction.

How Can Lagging Indicators Help in Day Trading?

Lagging indicators help in day trading by providing insights based on past price movements. They confirm trends and help traders identify potential entry and exit points. For example, moving averages smooth out price data to show the overall trend, while the Relative Strength Index (RSI) indicates overbought or oversold conditions. Using these tools, traders can make more informed decisions, reducing the risk of false signals from price fluctuations. Overall, lagging indicators provide a reliable framework for analyzing market behavior after it occurs, aiding in strategic trading.

What Are Popular Lagging Indicators for Traders?

Popular lagging indicators for traders include moving averages (like the 50-day and 200-day), the Relative Strength Index (RSI), and the Moving Average Convergence Divergence (MACD). These tools help confirm trends after they've started. Traders often use them to identify buy or sell signals, assess momentum, and determine market conditions.

How Do You Choose Between Leading and Lagging Indicators?

Choose leading indicators for predicting future price movements and identifying trends early. They provide signals before price changes, helping in proactive decision-making. Use lagging indicators to confirm trends after they occur, ensuring you’re on the right side of the market. Balance both: leading indicators for entry points and lagging indicators for confirmation. This approach enhances your day trading strategy by combining foresight with validation.

Can You Combine Leading and Lagging Indicators Effectively?

Yes, you can effectively combine leading and lagging indicators in day trading. Leading indicators, like RSI or MACD, help predict future price movements, while lagging indicators, such as moving averages, confirm trends. By using both, you can identify potential entry and exit points more accurately. For example, if a leading indicator signals an upcoming upward trend, a lagging indicator can confirm that trend before you make a trade. This combination enhances your trading strategy and helps manage risk better.

What Are the Benefits of Using Leading Indicators?

Leading indicators help traders predict future price movements, allowing for timely decisions. They can signal potential reversals or trends before they happen, enhancing entry and exit points. By using leading indicators, traders can identify market momentum and adjust strategies proactively, potentially increasing profits and reducing losses. Overall, they provide a competitive edge in day trading by offering insights that lagging indicators do not.

What Are the Risks of Relying on Lagging Indicators?

Relying on lagging indicators in day trading can lead to several risks. First, they react to past price movements, which means you may miss out on timely market changes. This can result in entering or exiting trades too late, reducing profit potential. Second, lagging indicators can create false signals during volatile market conditions, leading to poor trading decisions. Additionally, over-reliance on these indicators may cause traders to ignore critical market news or events that influence price action. Finally, they can foster complacency, making traders less responsive to real-time data.

How Do Market Conditions Affect Leading and Lagging Indicators?

Market conditions directly influence leading and lagging indicators in day trading. Leading indicators, like moving averages or RSI, predict future price movements based on current market trends. In volatile conditions, these indicators can give false signals due to rapid price changes.

Lagging indicators, such as MACD or moving average crossovers, confirm trends based on past price data. In stable markets, they provide reliable signals, but in choppy conditions, their delayed nature can lead to missed opportunities or late entries.

Understanding how market conditions affect these indicators helps traders make better decisions. In strong trends, rely more on leading indicators; in uncertain markets, lagging indicators may offer safer confirmations.

Learn about How Market Conditions Affect HFT Strategies

What Role Do Indicators Play in Day Trading Strategies?

Indicators in day trading help traders make informed decisions by analyzing price movements. Leading indicators signal potential future price movements, allowing traders to anticipate changes. Examples include the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD). Lagging indicators, like moving averages, confirm trends after they happen, helping traders identify entry and exit points. Using both types effectively can enhance a trader's strategy, balancing anticipation with confirmation.

Learn about What Role Does Compliance Play in Day Trading Platform Certification?

How Can You Interpret Signals from Leading Indicators?

To interpret signals from leading indicators in day trading, focus on the following steps:

1. Identify Trends: Use leading indicators like moving averages or RSI to spot potential trend reversals before they occur.

2. Analyze Patterns: Look for patterns such as divergence between price and indicators, which can signal upcoming price movements.

3. Confirm with Volume: Check trading volume alongside leading indicators to validate the strength of a signal.

4. Set Entry/Exit Points: Use signals from leading indicators to determine optimal entry and exit points for trades.

5. Combine Indicators: Use multiple leading indicators together for stronger confirmation of potential trades.

By focusing on these aspects, you can effectively interpret signals from leading indicators to enhance your day trading strategy.

What Are the Limitations of Leading and Lagging Indicators in Trading?

Leading indicators can provide early signals about potential price movements, but they often generate false signals and can be unreliable in volatile markets. Lagging indicators, while confirming trends, react too late to price changes, potentially causing missed opportunities or losses. Both types can be affected by market noise, leading to misinterpretation. Additionally, relying solely on one type can limit a trader's perspective, as each offers different insights into market behavior. Balancing both indicators is crucial for more effective trading decisions.

Conclusion about Understanding Lagging vs. Leading Indicators in Day Trading

In summary, understanding the distinction between leading and lagging indicators is essential for effective day trading. Leading indicators can provide early signals for potential market movements, while lagging indicators confirm trends after they occur. Both types of indicators have their unique advantages and risks, and savvy traders often combine them to enhance their strategies. By leveraging the insights offered by DayTradingBusiness, traders can make more informed decisions, ultimately improving their chances of success in the dynamic trading environment.

Learn about Daily vs. Weekly Indicators for Day Trading