Did you know that some traders spend more time customizing their indicators than they do on their actual trades? Customizing day trading indicators can significantly enhance your trading strategy and improve your market insights. In this article, we delve into the most popular indicators to personalize, including moving averages, RSI, MACD, and Bollinger Bands. We’ll cover how to create alerts, backtest your settings, and choose the best software for customization. Additionally, you'll learn how to combine indicators for a tailored approach, avoid common pitfalls, and adapt to changing market conditions. Whether you're on a mobile trading app or desktop, mastering these techniques can lead to smarter trading decisions. Let’s explore how DayTradingBusiness can help you optimize your trading experience!

What are the most popular day trading indicators to customize?

The most popular day trading indicators to customize include Moving Averages (MA), Relative Strength Index (RSI), Bollinger Bands, and MACD (Moving Average Convergence Divergence).

For Moving Averages, adjust the time period to suit your trading style—shorter for quick trades, longer for a broader trend. With RSI, you can set the overbought and oversold levels to fit your strategy better. Customize Bollinger Bands by changing the standard deviation settings to increase or decrease volatility sensitivity. Finally, tweak MACD settings for faster or slower signal generation based on your trading frequency.

Tailoring these indicators helps align them with your specific trading goals and market conditions.

How can I personalize my moving averages for day trading?

To personalize your moving averages for day trading, start by choosing the right time frame that aligns with your trading strategy, such as 5-minute or 15-minute charts. Adjust the periods of your moving averages based on your trading style; for example, a 9-period EMA can react quickly, while a 50-period SMA provides smoother signals. Experiment with different combinations, like using a short-term moving average for entry signals and a longer one for exit points.

Incorporate other indicators, like RSI or MACD, to confirm moving average signals. Finally, backtest your personalized settings on historical data to fine-tune your approach before trading live.

What settings should I adjust for RSI in day trading?

To customize the RSI for day trading, adjust the following settings:

1. Period Length: Set the RSI period to 14 for standard use, but consider shortening it to 7 or 9 for more sensitivity in day trading.

2. Overbought and Oversold Levels: Modify the overbought level to 70 and the oversold level to 30. You might tighten these to 80 and 20 for quicker signals.

3. Chart Type: Use candlestick charts for better visual insights.

4. Time Frame: Focus on lower time frames, like 5 or 15 minutes, to capture short-term movements.

5. Alert Settings: Set alerts for when RSI crosses key levels to act quickly.

These adjustments can enhance your trading strategy and improve entry and exit timing.

How do I modify MACD for better day trading results?

To modify MACD for better day trading results, adjust the standard settings from 12, 26, and 9 to shorter periods, like 5, 13, and 5. This makes the indicator more responsive to price changes. Use a 0.5 signal line to generate quicker buy and sell signals. Incorporate additional filters, like volume or price action, to confirm MACD signals. Finally, backtest your modified MACD with historical data to ensure it aligns with your trading strategy.

What customizations can enhance Bollinger Bands for day trading?

To enhance Bollinger Bands for day trading, consider these customizations:

1. Adjust Periods: Change the default 20-period setting to suit your trading style, like 10 or 15 periods, for faster signals.

2. Modify Standard Deviations: Instead of the standard 2 deviations, experiment with 1.5 or 2.5 for tighter or wider bands.

3. Incorporate Moving Averages: Use a different type of moving average, like an exponential moving average (EMA), for potentially more responsive bands.

4. Color Coding: Differentiate the bands with unique colors to quickly identify market conditions.

5. Volume Overlay: Add volume indicators to see the strength of movements alongside the Bollinger Bands.

6. Alerts: Set up alerts for when price touches or breaches the bands to act quickly on potential trades.

7. Combine with Other Indicators: Pair with RSI or MACD for confirmation on buy/sell signals.

These tweaks can help tailor Bollinger Bands to better fit your day trading strategy.

How can I create alerts based on customized indicators?

To create alerts based on customized day trading indicators, follow these steps:

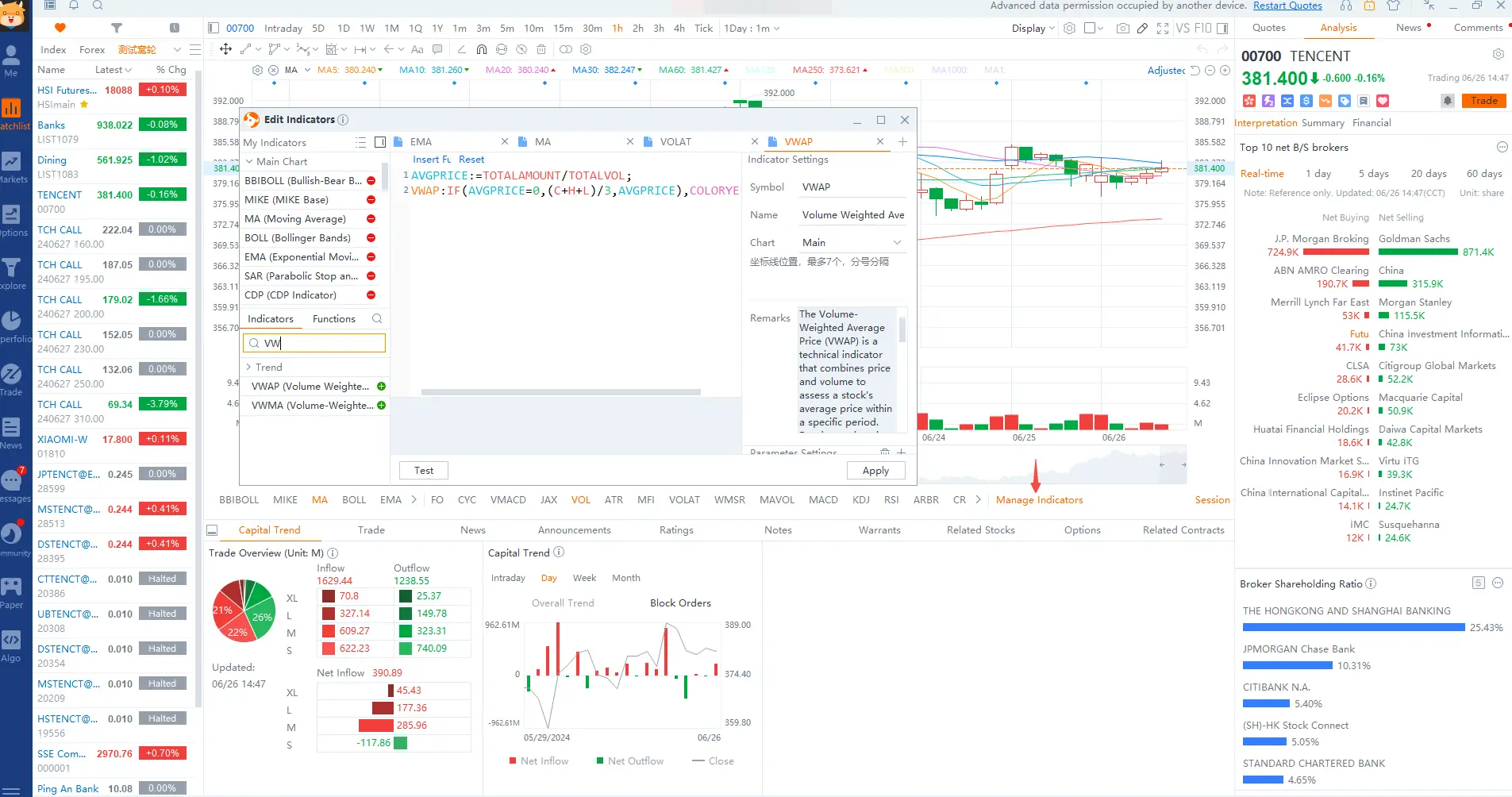

1. Choose Your Trading Platform: Use a platform that supports custom indicators, like TradingView or Thinkorswim.

2. Develop the Indicator: If using a coding platform, write or modify the indicator script to suit your trading strategy.

3. Set Alert Conditions: Once the indicator is active, access the alert settings. Define the conditions that trigger alerts, such as crossing a specific value or meeting a trend criterion.

4. Choose Alert Type: Select how you want to be notified—via email, SMS, or in-app notifications.

5. Test Your Alerts: Simulate conditions to ensure your alerts work as intended before trading live.

6. Monitor and Adjust: Regularly review the alerts to refine the conditions based on your trading results.

This process allows you to stay updated on market movements aligned with your customized indicators.

What are the benefits of using custom indicators in day trading?

Custom indicators in day trading offer several benefits:

1. Tailored Analysis: They can be designed to fit your specific trading strategy, allowing for better alignment with your goals and market conditions.

2. Enhanced Signals: Custom indicators can provide unique entry and exit signals that standard indicators might miss, increasing your chances of profitable trades.

3. Improved Accuracy: By incorporating your own data and preferences, you can enhance the accuracy of your technical analysis.

4. Adaptability: You can modify indicators based on changing market dynamics, ensuring they remain effective over time.

5. Greater Insight: Custom indicators can help you visualize data in ways that resonate with your trading style, leading to more informed decisions.

Using custom indicators helps create a more personalized trading experience, ultimately aiming for better performance.

How do I backtest my customized day trading indicators?

To backtest your customized day trading indicators, follow these steps:

1. Select a Trading Platform: Choose a platform that supports backtesting, like TradingView or MetaTrader.

2. Create Your Indicators: Use the platform's scripting language (like Pine Script for TradingView) to code your customized indicators.

3. Access Historical Data: Ensure you have a reliable source of historical data for the asset you're trading.

4. Set Up the Backtest: Define your trading strategy, including entry and exit signals based on your indicators.

5. Run the Backtest: Execute the backtest on historical data to analyze performance, looking for metrics like win rate and risk-reward ratio.

6. Analyze Results: Review the backtest results, making adjustments to your indicators as needed to optimize performance.

7. Iterate: Repeat the process, tweaking your indicators and strategy based on the results until you achieve satisfactory performance.

What software is best for customizing day trading indicators?

The best software for customizing day trading indicators includes TradingView, Thinkorswim, and MetaTrader 4/5. TradingView offers extensive customization options with its Pine Script, allowing you to create and modify indicators easily. Thinkorswim provides advanced tools and scripts for in-depth analysis. MetaTrader 4/5 supports custom indicators through MQL programming, giving you flexibility in customization. Choose based on your trading style and technical needs.

How can I combine multiple indicators for a personalized strategy?

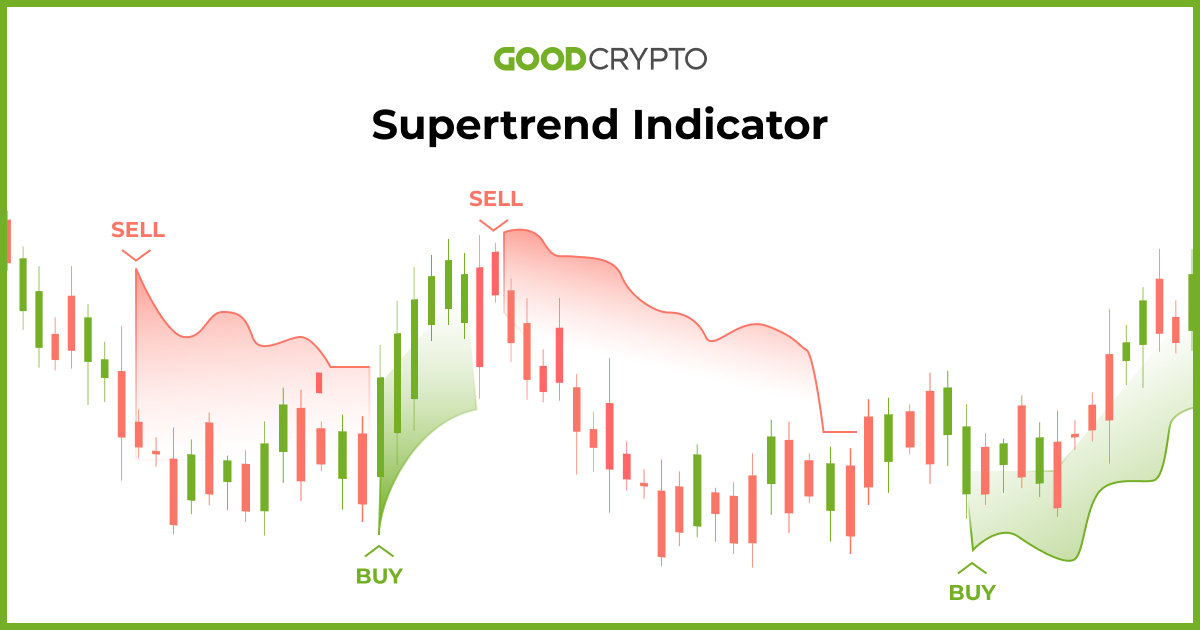

To combine multiple indicators for a personalized day trading strategy, start by selecting indicators that complement each other. For example, pair a trend indicator like the Moving Average with momentum indicators like the RSI. Use the Moving Average to determine the overall trend direction and the RSI to identify overbought or oversold conditions.

Next, define your entry and exit rules. For instance, enter a trade when the price is above the Moving Average and the RSI drops below 30, signaling a potential buy opportunity. Set a stop-loss based on recent support levels to manage risk.

Test your strategy using historical data to refine your settings and ensure effectiveness. Finally, continuously monitor and adjust your indicators based on market conditions to keep your strategy relevant and effective.

What mistakes should I avoid when customizing day trading indicators?

Avoid these mistakes when customizing day trading indicators:

1. Overcomplicating Settings: Don’t make indicators too complex. Stick to a few key adjustments that align with your strategy.

2. Ignoring Backtesting: Always backtest your customizations. Failing to do so can lead to poor decision-making in live trading.

3. Neglecting Market Conditions: Customize indicators based on current market conditions, not just historical performance.

4. Relying Solely on One Indicator: Use a combination of indicators for confirmation, rather than relying on a single one.

5. Disregarding Timeframes: Ensure your indicators are suited for your trading timeframe. What works on daily charts may not work on minute charts.

6. Skipping Regular Reviews: Periodically review and adjust your indicators as market dynamics change.

7. Ignoring Psychological Factors: Don’t let emotional biases dictate your customizations. Stick to your trading plan.

Learn about Common Mistakes in Day Trading Analysis to Avoid

How do market conditions affect indicator customization in day trading?

Market conditions significantly influence how you customize day trading indicators. In a volatile market, you might prioritize indicators that respond quickly to price changes, like moving averages or the Relative Strength Index (RSI). In contrast, during stable conditions, you could focus on trend-following indicators, adjusting their sensitivity to avoid false signals.

For example, in a bullish market, you might tweak your Bollinger Bands to widen, capturing larger price movements, while in a bearish market, you could narrow them to react quickly to downturns. Always consider the time frame; shorter periods may require more aggressive settings, while longer periods can benefit from smoother, less reactive indicators. Tailoring your indicators based on current market dynamics enhances your trading strategy's effectiveness.

Learn about How Do Market Makers and Liquidity Providers Affect Day Trading?

Can I use custom indicators on mobile trading apps?

Yes, you can use custom indicators on some mobile trading apps, but availability varies by platform. Look for apps that allow customization or support third-party indicators. Common options include MetaTrader, TradingView, and Thinkorswim. Ensure your chosen app has the features you need to create or import those indicators effectively.

How do I interpret the signals from my customized indicators?

To interpret signals from your customized day trading indicators, first identify the specific conditions that trigger buy or sell signals. Monitor the indicator values closely; for instance, if a moving average crosses above a price, it may signal a buy. Conversely, if it crosses below, consider it a sell signal. Pay attention to divergence between indicators and price movements, as this can indicate potential reversals. Combine signals from multiple indicators for confirmation, and always consider the broader market context. Finally, backtest your indicators to ensure their reliability before using them in live trading.

What are the top resources for learning indicator customization?

1. Books: "Technical Analysis of the Financial Markets" by John Murphy provides foundational knowledge for customizing indicators.

2. Online Courses: Websites like Udemy and Coursera offer courses specifically on technical analysis and indicator customization.

3. YouTube Channels: Channels like "The Trading Channel" and "Chart Guys" feature practical tutorials on customizing indicators for day trading.

4. Trading Platforms: Platforms like TradingView and ThinkorSwim have extensive documentation and community forums for customizing indicators.

5. Forums: Sites like Elite Trader and Trade2Win have discussions where traders share their custom indicators and strategies.

6. Blogs: Follow blogs like "The Chartist" or "DailyFX" for insights and tips on indicator customization in day trading.

How often should I review and adjust my customized indicators?

You should review and adjust your customized indicators at least once a month. Monitor their performance regularly, especially after significant market changes or personal trading shifts. If your trading strategy evolves or if market conditions change, reevaluate your indicators immediately. Consistent assessment helps ensure they remain effective for your day trading.

Conclusion about How to Customize Day Trading Indicators

Customizing day trading indicators is essential for optimizing your trading strategy and improving decision-making. By personalizing tools like moving averages, RSI, MACD, and Bollinger Bands, you can tailor your approach to market conditions and individual trading styles. Leveraging alerts, backtesting, and combining multiple indicators further enhances your trading effectiveness. Remember to regularly review and adjust your indicators to stay aligned with evolving market dynamics. For expert insights and comprehensive guidance, DayTradingBusiness is here to support your journey in mastering customized day trading indicators.

Learn about How to Choose the Right Indicators for Day Trading