Did you know that some traders spend more time backtesting than actually trading? It's true! This article dives into the essential process of backtesting day trading indicators, covering everything from its importance to interpreting results. You'll learn how to choose the right indicators, what data is needed, and common pitfalls to avoid. We’ll explore effective methodologies, the best software tools, and how to automate your backtesting process. Plus, we’ll discuss the optimal timeframes and metrics to focus on, ensuring your strategies are refined and performance is evaluated. With insights from DayTradingBusiness, you’ll be equipped to enhance your trading approach and make informed decisions.

What is backtesting in day trading?

Backtesting in day trading is the process of testing a trading strategy or indicator using historical data to see how it would have performed in the past. To backtest day trading indicators, follow these steps:

1. Select Your Indicators: Choose the technical indicators you want to test, such as moving averages, RSI, or MACD.

2. Gather Historical Data: Obtain historical price data for the asset you're trading. This data should include open, high, low, and close prices.

3. Set Up Your Trading Rules: Define the specific buy and sell signals based on your chosen indicators.

4. Simulate Trades: Use the historical data to simulate trades based on your rules, tracking entry and exit points.

5. Analyze Results: Evaluate the performance metrics, such as win rate, profit factor, and maximum drawdown.

6. Refine Your Strategy: Adjust your indicators or rules based on the backtesting results to improve performance.

Backtesting helps traders validate their strategies before risking real money in live markets.

Why is backtesting important for day trading indicators?

Backtesting is crucial for day trading indicators because it allows traders to evaluate the effectiveness of their strategies using historical data. By simulating trades based on past market conditions, traders can identify which indicators perform well and under what circumstances. This process helps in minimizing risks, optimizing strategies, and boosting confidence in trading decisions. Ultimately, backtesting provides tangible evidence of a strategy’s potential profitability before applying it in real-time trading.

How do I choose the right day trading indicators for backtesting?

To choose the right day trading indicators for backtesting, start by identifying your trading strategy and goals. Focus on indicators that align with your approach, such as moving averages for trend-following or RSI for momentum. Select a mix of leading and lagging indicators to balance signals. Ensure the indicators you choose have a proven track record for your specific market conditions. Finally, backtest each indicator using historical data to evaluate performance and adjust based on results.

What data do I need for backtesting day trading strategies?

To backtest day trading strategies, you need historical price data, including open, high, low, and close (OHLC) prices for the assets you're trading. Additionally, ensure you have volume data, as it helps gauge market activity. You'll also need to define your trading indicators and rules, such as entry and exit points. Finally, consider including slippage and transaction costs to simulate realistic trading conditions.

How can I backtest day trading indicators effectively?

To backtest day trading indicators effectively, follow these steps:

1. Choose Your Indicators: Select specific indicators like moving averages, RSI, or MACD relevant to your strategy.

2. Gather Historical Data: Obtain high-quality historical price data for the assets you're trading, ideally with minute-level granularity.

3. Define Your Strategy: Clearly entry and exit rules based on the indicators you selected. Include risk management parameters.

4. Use Backtesting Software: Implement a backtesting tool like TradingView, MetaTrader, or specialized software that allows for strategy simulation.

5. Run the Backtest: Input your strategy and run the backtest on historical data. Look for performance metrics like win rate, profit factor, and drawdown.

6. Analyze Results: Evaluate the outcomes critically. Identify patterns, strengths, and weaknesses in your strategy.

7. Optimize and Retest: Adjust your strategy based on findings, then retest to ensure improvements are statistically valid.

8. Practice Live: Once satisfied with the backtest results, practice your strategy on a demo account to refine execution before going live.

By following these steps, you can backtest your day trading indicators efficiently and make informed trading decisions.

What are the common pitfalls in backtesting day trading indicators?

Common pitfalls in backtesting day trading indicators include:

1. Overfitting: Tailoring indicators too closely to past data can lead to poor performance in live trading.

2. Ignoring Slippage and Commissions: Not accounting for transaction costs can skew results.

3. Using Inadequate Data: Relying on a limited dataset may not capture market variability.

4. Lack of Robustness Testing: Failing to test indicators across different market conditions can yield misleading outcomes.

5. Confirmation Bias: Selecting only favorable results while ignoring negative ones can distort findings.

6. Not Considering Market Impact: Large orders can affect price, which isn’t reflected in backtested results.

7. Neglecting Risk Management: Overlooking stop-loss and position sizing can lead to unrealistic expectations of profitability.

Avoid these traps to improve your backtesting accuracy and trading success.

How do I interpret backtesting results for day trading?

To interpret backtesting results for day trading, focus on these key metrics:

1. Win Rate: This shows the percentage of profitable trades. A higher win rate indicates a more effective strategy.

2. Risk-Reward Ratio: Analyze the average gain versus the average loss per trade. A ratio above 1:2 is often considered good.

3. Maximum Drawdown: This measures the largest drop from a peak to a trough in your equity curve. Lower drawdowns signify better risk management.

4. Total Return: Look at the overall profit or loss from your trades. Ensure it's significant enough to justify the risk.

5. Sharpe Ratio: This assesses risk-adjusted return. A higher Sharpe ratio means better returns for the risk taken.

6. Trade Frequency: Consider how often trades are executed. Too many trades can lead to higher costs.

7. Slippage and Commission Impact: Factor in potential slippage and commissions, as they can significantly affect real-world performance.

By analyzing these metrics, you can better gauge the effectiveness of your day trading strategy.

What software tools are best for backtesting day trading indicators?

The best software tools for backtesting day trading indicators include:

1. MetaTrader 4/5: Offers extensive backtesting capabilities with a user-friendly interface.

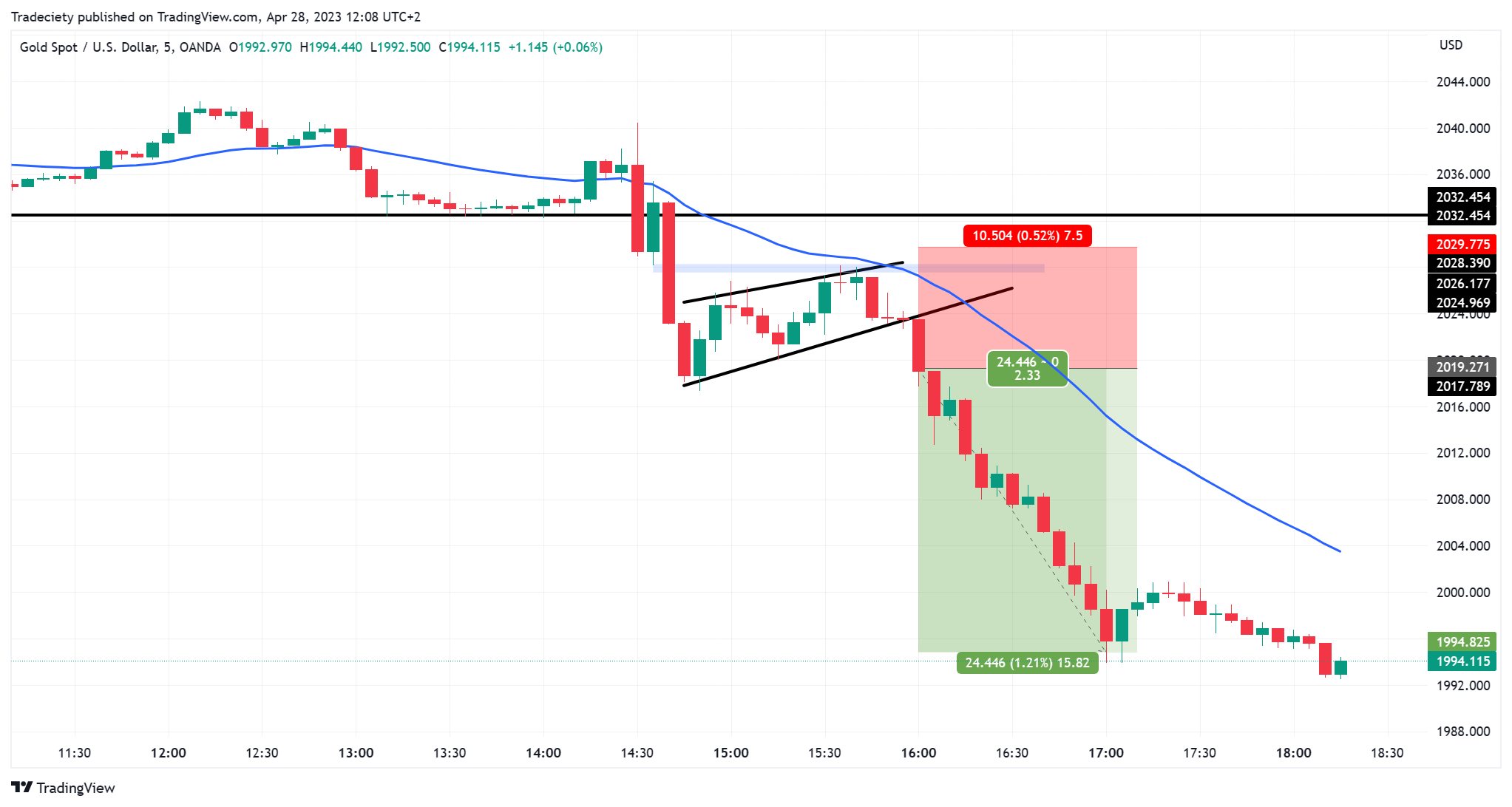

2. TradingView: Provides a powerful scripting language (Pine Script) to create and test custom indicators.

3. Amibroker: Known for its speed and flexibility, great for complex testing scenarios.

4. NinjaTrader: Excellent for futures and forex, with robust backtesting and simulation features.

5. Thinkorswim: A comprehensive platform with built-in tools for backtesting various strategies.

Choose based on your specific trading style and needs.

How can I automate my backtesting process?

To automate your backtesting process for day trading indicators, follow these steps:

1. Choose a Platform: Use a trading platform like MetaTrader, TradingView, or NinjaTrader that supports automated backtesting.

2. Script Your Strategy: Write your trading strategy in the platform’s scripting language (e.g., Pine Script for TradingView or MQL for MetaTrader).

3. Import Historical Data: Ensure you have access to historical price data for the assets you want to test.

4. Set Parameters: Define entry, exit, and risk management rules within your script.

5. Run Backtests: Execute the backtest using the platform's built-in tools, reviewing performance metrics like win rate and drawdown.

6. Optimize Settings: Adjust parameters and rerun the tests to find the most effective settings.

7. Analyze Results: Review the backtesting results to refine your strategy before live trading.

Following these steps will help you efficiently automate your backtesting process for day trading indicators.

What timeframes should I use for backtesting day trading indicators?

Use 1-minute to 5-minute timeframes for backtesting day trading indicators. This range allows you to capture short-term price movements and volatility effectively. Focus on the last 3 to 6 months of data to ensure relevance to current market conditions.

Learn about How to Use Backtesting to Improve Your Day Trading Performance

How do I evaluate the performance of my backtested strategies?

To evaluate the performance of your backtested day trading strategies, follow these steps:

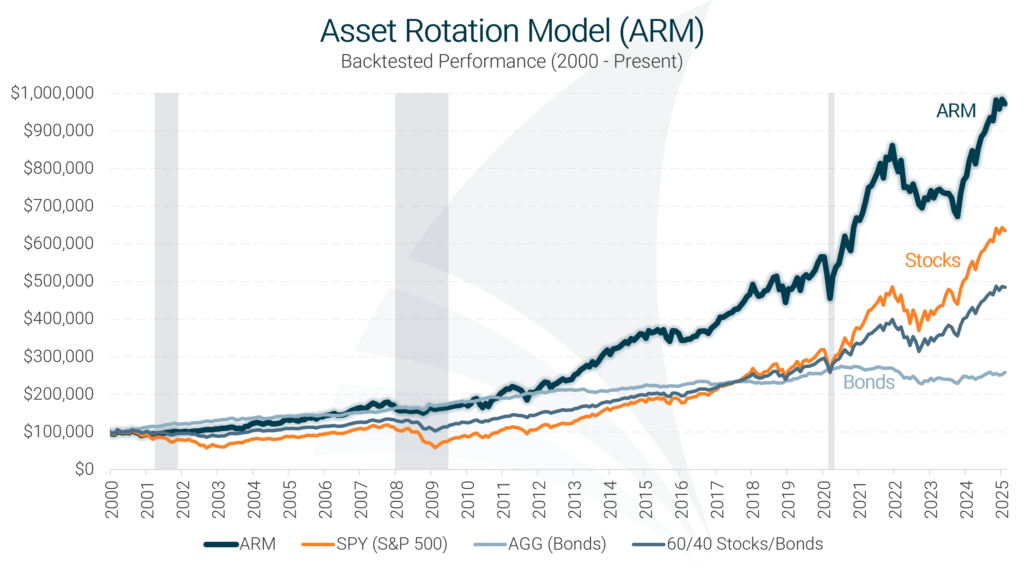

1. Analyze Key Metrics: Focus on metrics like profit factor, win rate, maximum drawdown, and average trade return. These indicate overall effectiveness and risk exposure.

2. Sharpe Ratio: Calculate the Sharpe ratio to assess risk-adjusted returns. A higher ratio suggests better performance relative to risk.

3. Consistency: Check if the strategy performs well across different time frames and market conditions to ensure robustness.

4. Trade Frequency: Evaluate the number of trades made. A balance between frequency and quality is crucial for sustainable performance.

5. Slippage and Commission: Factor in slippage and trading costs. Simulated returns can be misleading without accounting for these.

6. Visual Analysis: Review equity curves and drawdowns visually. This helps identify periods of underperformance and overall trend stability.

7. Out-of-Sample Testing: Validate your strategy with out-of-sample data to confirm its effectiveness beyond the initial backtest.

8. Statistical Testing: Conduct statistical tests like the t-test to determine if your results are statistically significant or due to chance.

By focusing on these areas, you can effectively evaluate the performance of your backtested day trading strategies.

Can I use historical data for backtesting day trading indicators?

Yes, you can use historical data for backtesting day trading indicators. Collect price data, including open, high, low, and close prices, along with volume. Input this data into your backtesting software or spreadsheet. Run simulations using your trading strategy and indicators, analyzing performance metrics like win rate and drawdown. Adjust parameters as needed to optimize your strategy.

Learn about The Role of Historical Data in Day Trading Backtesting

What metrics should I focus on during backtesting?

Focus on these key metrics during backtesting day trading indicators:

1. Win Rate: Percentage of profitable trades versus total trades.

2. Risk-Reward Ratio: Average profit per winning trade compared to average loss per losing trade.

3. Maximum Drawdown: Largest peak-to-trough decline in equity during the backtest period.

4. Sharpe Ratio: Measure of risk-adjusted return, comparing excess return to volatility.

5. Profit Factor: Ratio of gross profit to gross loss, indicating overall profitability.

6. Trade Duration: Average length of time trades are held, highlighting strategy pacing.

These metrics collectively help evaluate the effectiveness and reliability of your trading indicators.

How often should I update my backtesting results?

Update your backtesting results every time you make significant changes to your trading strategy, indicators, or market conditions. Regular updates, ideally monthly or quarterly, help ensure your approach remains relevant and effective. Adjust based on performance metrics and market trends to refine your strategy continually.

How can I refine my day trading strategies based on backtesting?

To refine your day trading strategies based on backtesting, follow these steps:

1. Select Indicators: Choose specific indicators to test, such as moving averages, RSI, or MACD.

2. Gather Historical Data: Obtain accurate historical price data for the assets you trade.

3. Set Parameters: Define the parameters for your indicators—timeframes, thresholds, etc.

4. Conduct Backtests: Use trading software to run backtests on your chosen indicators against historical data. Analyze performance metrics like win rate, average profit, and maximum drawdown.

5. Analyze Results: Review the outcomes. Look for patterns—did certain indicators perform better in specific market conditions?

6. Optimize Strategy: Adjust parameters based on your findings. Test variations to see if performance improves.

7. Forward Test: Implement the refined strategy in a demo account before trading live to ensure it works in real-time conditions.

8. Iterate: Continuously backtest and refine as market conditions change. Regularly updating your strategy is crucial for day trading success.

Learn about How to Combine Charting with Day Trading Strategies

What are some advanced techniques for backtesting day trading indicators?

1. Use Historical Data: Gather high-quality, granular historical data for accurate backtesting. Tick data is ideal for day trading.

2. Leverage Trading Platforms: Utilize platforms like TradingView or NinjaTrader for built-in backtesting tools. They allow easy implementation of indicators.

3. Employ Multiple Time Frames: Analyze indicators across different time frames to assess their effectiveness. For example, use a 5-minute chart along with a 1-hour chart.

4. Implement Monte Carlo Simulations: Run Monte Carlo simulations to test the robustness of your strategy against random market scenarios.

5. Optimize Parameters: Fine-tune your indicators by adjusting their parameters and testing various combinations to find the most profitable setups.

6. Incorporate Risk Management: Simulate different risk management strategies, like stop-loss and take-profit levels, to evaluate their impact on performance.

7. Analyze Trade Metrics: Focus on metrics like win rate, risk-reward ratio, and drawdown to assess the strategy’s viability.

8. Use Walk-Forward Testing: Conduct walk-forward analysis to refine your strategy over time, ensuring it adapts to changing market conditions.

9. Visual Backtesting: Manually review trades on historical charts to understand the context of each trade, which can reveal insights not captured by algorithms.

10. Combine Indicators: Test combinations of indicators to see how they interact and improve signal accuracy.

Learn about Advanced Techniques for Indicator Analysis in Day Trading

Conclusion about How to Backtest Day Trading Indicators

Backtesting day trading indicators is a crucial step in developing and refining effective trading strategies. By understanding the principles of backtesting, selecting appropriate indicators, and utilizing the right data and tools, traders can gain invaluable insights into their strategies' potential performance. Regularly updating and evaluating backtesting results can help in adapting to market changes. For those seeking comprehensive support and resources on this journey, DayTradingBusiness offers expert guidance to enhance your trading skills and decision-making process.

Learn about How to Backtest Day Trading Bots Effectively?