Did you know that even the best day traders sometimes treat indicators like magic eight balls, hoping for perfect predictions? In reality, the misuse of technical indicators can lead to significant pitfalls. This article dives into the common mistakes day traders make with indicators, including misinterpretation, over-reliance, and ignoring market context. Learn how to choose the right indicators for your strategy, avoid the risks of lagging indicators, and recognize false signals. We'll also explore the impact of emotional decisions on trading and the importance of backtesting. With insights from DayTradingBusiness, you'll discover best practices that can enhance your trading success and help you learn from past errors.

What Are the Most Common Mistakes Day Traders Make with Indicators?

The most common mistakes day traders make with indicators include:

1. Over-Reliance: Traders often depend too heavily on indicators without considering market context or price action.

2. Ignoring Multiple Time Frames: Focusing on one time frame can lead to misleading signals; traders should analyze multiple time frames for a clearer picture.

3. Misinterpreting Signals: Many misread indicator signals, confusing lagging indicators for leading ones, which can result in poor decision-making.

4. Lack of Confirmation: Failing to use indicators in conjunction with other analysis methods can lead to false entries or exits.

5. Not Adjusting Settings: Many traders use default settings without customizing indicators to their trading style or the specific market conditions.

6. Emotional Trading: Letting emotions influence trades rather than sticking to a strategy can lead to impulsive decisions based on indicator readings.

7. Ignoring Market News: Indicators can be rendered ineffective by sudden news events; neglecting to account for news can lead to unexpected losses.

Avoiding these mistakes can enhance day trading success.

How Can I Avoid Misusing Technical Indicators in Day Trading?

To avoid misusing technical indicators in day trading, focus on these key strategies:

1. Understand the Indicator: Know how each indicator works, including its strengths and weaknesses. Don't rely on them blindly.

2. Combine Indicators: Use multiple indicators to confirm signals rather than relying on one. For example, pair moving averages with RSI for better accuracy.

3. Set Clear Rules: Establish specific entry and exit criteria based on your indicators. Stick to your plan to avoid emotional decisions.

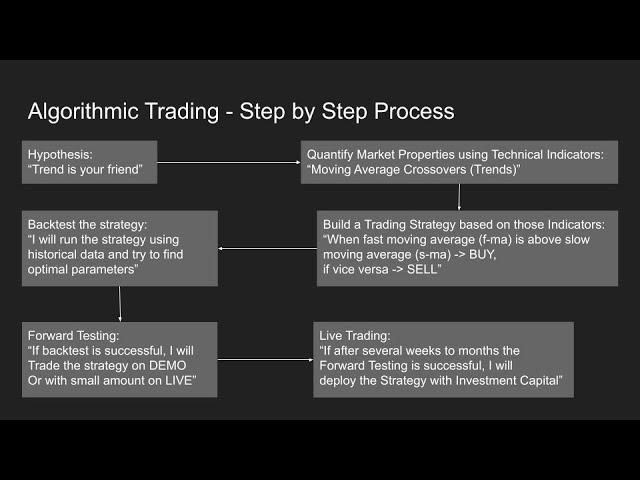

4. Backtest Your Strategies: Test your indicator setups on historical data to see how they perform before using them in real trades.

5. Avoid Overcomplication: Don't overload your charts with too many indicators. Keep it simple to maintain clarity in your analysis.

6. Stay Updated: Market conditions change. Regularly reassess your indicators and strategies to ensure they remain effective.

Implementing these practices can help you use technical indicators more effectively and improve your day trading results.

What Indicators Do Day Traders Often Misinterpret?

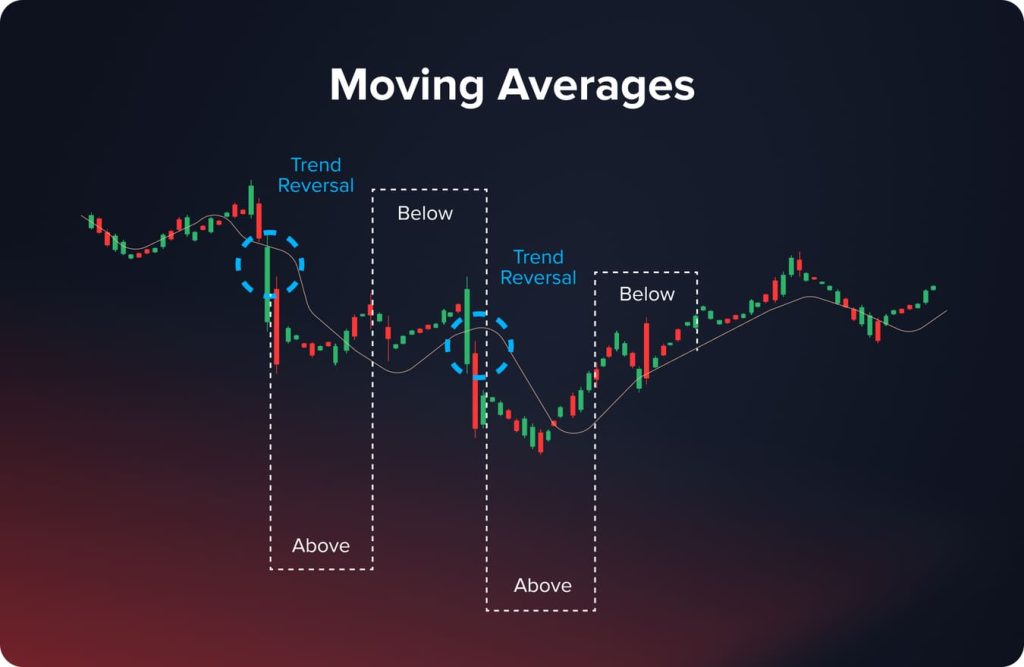

Day traders often misinterpret volume indicators, mistaking high volume for bullish trends without considering price action. They also struggle with moving averages, using them as buy/sell signals without accounting for market context. RSI can be misleading; traders might see overbought or oversold conditions and jump in too early. Additionally, using MACD without confirming trends can lead to false signals. Finally, many overlook the importance of news events, relying solely on technical indicators while ignoring fundamental factors that impact price movements.

How Does Over-Reliance on Indicators Affect Day Trading Success?

Over-reliance on indicators can lead to poor day trading decisions. Traders may become overly dependent on signals, ignoring market context or price action. This can result in missed opportunities or late entries and exits. Additionally, relying solely on indicators can create a false sense of security, causing traders to overlook risk management. Effective day trading requires a balanced approach that combines indicators with market analysis and personal judgment.

Why Do Many Day Traders Ignore Market Context with Indicators?

Many day traders ignore market context with indicators because they focus too heavily on signals rather than the broader market environment. This can lead to misinterpretation of trends and false signals. They may rely on indicators for quick decisions, neglecting factors like news events or overall market sentiment that can significantly impact price movements. Additionally, some traders believe that indicators alone can predict price action, which often results in missed opportunities or losses. Balancing indicators with market context is crucial for informed trading decisions.

What Are the Risks of Using Too Many Indicators in Day Trading?

Using too many indicators in day trading can lead to analysis paralysis, making it hard to make quick decisions. It can create conflicting signals, causing confusion and potential losses. Over-reliance on indicators might also distract from market fundamentals and price action. Additionally, excessive indicators can clutter your charts, hindering clarity and focus. Ultimately, this can result in missed opportunities and increased emotional stress during trades. Stick to a few reliable indicators to maintain clarity and improve decision-making.

How Can I Choose the Right Indicators for My Day Trading Strategy?

To choose the right indicators for your day trading strategy, avoid these common mistakes:

1. Overcomplicating: Don’t use too many indicators. Stick to a few that complement each other.

2. Ignoring Market Context: Ensure your indicators align with market conditions. A trend indicator may not work in a ranging market.

3. Neglecting Backtesting: Always test indicators on historical data to see how they would have performed.

4. Focusing Solely on Lagging Indicators: Combine lagging indicators with leading ones to anticipate price movements better.

5. Not Adapting to Your Style: Choose indicators that match your trading style—scalping, day trading, or swing trading.

6. Following the Crowd: Just because others use a popular indicator doesn’t mean it’s right for you. Find what works for your strategy.

7. Ignoring Risk Management: Indicators should complement your risk management strategy, not replace it.

Keep it simple, relevant, and aligned with your trading goals.

What Are the Consequences of Relying on Lagging Indicators?

Relying on lagging indicators can lead to missed opportunities and delayed reactions in day trading. Traders may enter or exit positions too late, resulting in smaller profits or losses. This reliance can also create false security, as lagging indicators often confirm trends after they've begun, making it harder to capitalize on early movements. Additionally, overemphasis on these indicators can lead to ignoring critical market news or changes, further impacting trading decisions negatively.

How Do Emotional Decisions Impact Indicator Usage in Day Trading?

Emotional decisions can lead to poor indicator usage in day trading. Traders might rely on indicators without proper analysis, driven by fear or greed, resulting in impulsive trades. For example, a trader might ignore a sell signal from a moving average indicator because they're emotionally attached to a stock. This can cause missed opportunities or bigger losses. Additionally, overreacting to market fluctuations can distort how traders interpret indicators, leading to inconsistent strategies. Staying disciplined and following a planned approach can mitigate these emotional pitfalls.

Why Is It Important to Understand Indicator Signals Before Trading?

Understanding indicator signals before trading is crucial because they help you make informed decisions. Misinterpreting signals can lead to poor trades and significant losses. For example, relying solely on a moving average without considering market context can result in missed opportunities or false entries. Additionally, knowing how indicators work together enhances your strategy, reducing the risk of common mistakes. Ultimately, grasping these signals improves your timing and increases your chances of success in day trading.

How Can Backtesting Help Prevent Indicator Misuse in Day Trading?

Backtesting helps prevent indicator misuse in day trading by allowing traders to evaluate the effectiveness of indicators based on historical data. It reveals whether an indicator consistently produces profitable signals or leads to losses. By analyzing past performance, traders can identify optimal entry and exit points, reducing the risk of relying on faulty signals. This process also highlights the conditions under which indicators perform best, helping traders avoid common mistakes like overtrading or misinterpreting signals. Ultimately, backtesting fosters a more disciplined trading approach, ensuring indicators are used effectively.

Learn about How Do Brokers Prevent Money Laundering and Fraud in Day Trading?

What Are the Best Practices for Using Indicators in Day Trading?

1. Avoid Overloading: Don't use too many indicators at once. Stick to a few that complement each other for clarity.

2. Understand Each Indicator: Know how your chosen indicators work and what they signal. Misinterpretation can lead to poor decisions.

3. Confirm Signals: Use multiple indicators for confirmation before acting on a trade signal to reduce false positives.

4. Adapt to Market Conditions: Recognize that indicators can behave differently in various market environments. Adjust your strategy accordingly.

5. Keep an Eye on Volume: Integrate volume indicators to assess the strength of a price move, ensuring your trades are backed by solid activity.

6. Stay Disciplined: Set predefined rules for entry and exit based on indicators, and stick to them to avoid emotional trading.

7. Regularly Review: Periodically analyze the effectiveness of your indicators and adjust your approach as needed.

8. Avoid Lagging Indicators: Be cautious with indicators that lag too much. Use leading indicators to anticipate price movements more effectively.

Learn about What Are the Best Practices for Using AI in Day Trading?

How Can I Recognize False Signals from Day Trading Indicators?

To recognize false signals from day trading indicators, watch for the following signs:

1. Divergence: If price moves in one direction while the indicator moves in the opposite direction, it may indicate a false signal.

2. High Volatility: During volatile market conditions, indicators can give misleading signals. Be cautious of trades in choppy markets.

3. Lagging Indicators: Indicators like moving averages can lag behind price action. If signals arrive too late, they may not be reliable.

4. Overbought/Oversold Conditions: Indicators like RSI can suggest overbought or oversold conditions, but they can remain in these areas longer than expected.

5. Lack of Confirmation: Always seek confirmation from multiple indicators or price action before acting on a signal. If other tools don’t align, it might be a false signal.

6. News Events: Major news can skew indicators temporarily. Avoid trading solely based on indicators during significant announcements.

By being aware of these pitfalls, you can better filter out false signals in your day trading strategy.

Learn about How to Calculate Taxable Income from Day Trading

Why Is It Vital to Combine Indicators with Other Analysis Tools?

Combining indicators with other analysis tools is crucial because it enhances decision-making by providing a more comprehensive view of market conditions. Indicators alone can generate false signals; using tools like trend analysis, chart patterns, or fundamental analysis helps confirm trends and reduce risk. For example, if an indicator suggests a buy but other tools indicate resistance, you might reconsider entering a trade. This multi-faceted approach leads to more informed and effective trading strategies.

How Can I Learn from My Mistakes with Trading Indicators?

To learn from your mistakes with trading indicators, first, review your past trades to identify where you misinterpreted signals. Keep a trading journal detailing your decisions, emotions, and outcomes related to each indicator used. Analyze patterns in your mistakes—did you rely too heavily on one indicator or ignore market context? Experiment with fewer indicators to avoid confusion and focus on mastering a few. Seek feedback from experienced traders or online communities, and continuously educate yourself on indicator strategies. Finally, adjust your trading plan based on these insights to improve future performance.

Learn about How to Learn from Day Trading Mistakes

What Resources Can Help Me Improve My Use of Day Trading Indicators?

To improve your use of day trading indicators, consider these resources:

1. Online Courses: Websites like Udemy and Coursera offer courses specifically on day trading and technical indicators.

2. Books: "Technical Analysis of the Financial Markets" by John Murphy provides a solid foundation on indicators.

3. Webinars: Many trading platforms host free webinars that focus on using indicators effectively.

4. Trading Communities: Join forums like Elite Trader or Reddit's r/Daytrading to exchange tips and learn from others’ mistakes.

5. YouTube Channels: Channels like Warrior Trading and ClayTrader often cover common pitfalls with indicators.

6. Brokerage Tools: Utilize demo accounts with your brokerage to practice using indicators without risk.

7. Newsletters: Subscribe to trading newsletters that analyze market trends and indicator effectiveness.

Focus on learning from these resources to avoid common mistakes with day trading indicators.

Learn about How to Use Market Microstructure Data to Improve Day Trading Outcomes

Conclusion about Common Mistakes with Day Trading Indicators

In summary, avoiding common mistakes with day trading indicators is essential for achieving success in the fast-paced trading environment. By understanding the limitations of indicators, recognizing market context, and combining them with other analysis tools, traders can make more informed decisions. DayTradingBusiness offers valuable resources and insights to help you refine your strategies, minimize misinterpretations, and ultimately enhance your trading performance. Prioritize backtesting and learn from your experiences to navigate the complexities of day trading effectively.

Learn about Common mistakes that increase stop-loss risk in day trading

Sources:

- The forecast ability of a belief-based momentum indicator in full-day ...

- The cost of market versus regulatory discipline in banking ...

- Dynamic portfolio rebalancing with lag-optimised trading indicators ...

- Stock price prediction with optimized deep LSTM network with ...

- Utilizing artificial neural networks and genetic algorithms to build an ...

- The impact and profitability of day trading following the relaxation of ...