Did you know that 90% of day traders actually lose money? But don’t worry; with the right techniques and tools, you can be part of the successful 10%! This article dives into essential methods to enhance your day trading analysis skills, covering everything from effectively reading stock charts to the impact of technical analysis on your trading success. Discover how to avoid common pitfalls, develop a robust trading strategy, and leverage market news and indicators to your advantage. Additionally, we’ll explore psychological factors, risk management strategies, and best practices for post-trade evaluations. Let DayTradingBusiness guide you on your journey to becoming a more disciplined and successful trader!

What are the best techniques to improve day trading analysis skills?

1. Practice with Simulators: Use trading simulators to gain hands-on experience without financial risk.

2. Study Charts: Focus on technical analysis by studying price charts and identifying patterns.

3. Learn Indicator Use: Familiarize yourself with indicators like moving averages, RSI, and MACD to make informed decisions.

4. Backtesting Strategies: Test your strategies on historical data to see what works and refine your approach.

5. Follow Market News: Stay updated with financial news and economic reports that impact market movements.

6. Join Trading Communities: Engage in forums or groups to share insights and learn from other traders.

7. Maintain a Trading Journal: Document your trades, strategies, and outcomes to identify strengths and weaknesses.

8. Set Realistic Goals: Establish clear, achievable goals to track your progress and keep motivation high.

9. Continuous Learning: Read books, take courses, and watch webinars to deepen your understanding of market dynamics.

10. Develop Discipline: Stick to your trading plan and manage emotions to avoid impulsive decisions.

How can I effectively read stock charts for day trading?

To effectively read stock charts for day trading, focus on these key elements:

1. Understand Candlestick Patterns: Learn to recognize bullish and bearish patterns, like doji, hammer, and engulfing patterns, to gauge market sentiment.

2. Use Technical Indicators: Familiarize yourself with indicators such as Moving Averages, RSI, and MACD to identify trends and potential reversals.

3. Identify Support and Resistance Levels: Mark key price levels where the stock has historically reversed or consolidated, helping you set entry and exit points.

4. Analyze Volume: Pay attention to volume spikes, as they indicate the strength of a price movement. High volume on a breakout signals a stronger trend.

5. Time Frames: Use multiple time frames (e.g., 1-minute, 5-minute, and daily charts) to get a comprehensive view of price action and trends.

6. Stay Updated on News: Monitor news that could impact stock prices, as sudden market movements often correlate with news events.

7. Practice Regularly: Consistently analyze charts and simulate trades to refine your skills and develop a strategy that suits your trading style.

By mastering these components, you'll enhance your day trading analysis skills and make more informed decisions.

What tools can enhance my day trading analysis?

To enhance your day trading analysis, consider using these tools:

1. Charting Software: Platforms like TradingView or ThinkorSwim provide advanced charting capabilities and technical indicators.

2. News Aggregators: Tools like Benzinga or MarketWatch help you stay updated on market-moving news that can impact your trades.

3. Stock Screeners: Use Finviz or Trade Ideas to filter stocks based on specific criteria, such as volume or price action.

4. Simulators: Practice with paper trading platforms like TD Ameritrade’s paperMoney to refine your strategies without risking real money.

5. Social Trading Platforms: Sites like eToro allow you to follow and learn from successful traders in real-time.

6. Risk Management Tools: Applications like TradeSafe can help you manage your trading risk more effectively.

Each of these tools can significantly improve your analysis and decision-making in day trading.

How does technical analysis impact day trading success?

Technical analysis enhances day trading success by providing tools to identify trends, support and resistance levels, and potential entry and exit points. By analyzing price movements and volume, traders can make informed decisions quickly. Mastering indicators like moving averages and RSI helps in recognizing patterns and forecasting price changes. This skill allows traders to minimize risks and maximize profits, leading to more consistent gains in the fast-paced day trading environment. Improving your analysis skills through practice and education is essential for achieving success in day trading.

What are common mistakes in day trading analysis to avoid?

1. Overtrading: Avoid taking too many trades based on emotions rather than analysis. Stick to a strategy.

2. Ignoring Risk Management: Don’t neglect stop-loss orders. Protect your capital by setting limits.

3. Lack of a Trading Plan: Failing to have a clear plan can lead to impulsive decisions. Define entry and exit points in advance.

4. Overreliance on Indicators: Relying solely on technical indicators can mislead you. Use them alongside price action and market context.

5. Neglecting Market News: Ignoring economic events or news can impact price movements. Stay informed to anticipate market shifts.

6. Not Reviewing Trades: Failing to analyze past trades prevents learning from mistakes. Regularly review your performance to improve.

7. Emotional Trading: Letting fear or greed dictate trades can lead to losses. Stay disciplined and stick to your strategy.

8. Poor Time Management: Misjudging time frames can result in missed opportunities. Align your analysis with the appropriate time frame for your strategy.

How can I develop a solid trading strategy for day trading?

To develop a solid trading strategy for day trading, focus on these key steps:

1. Set Clear Goals: Define your profit targets and risk tolerance.

2. Choose a Trading Style: Decide between scalping, momentum trading, or range trading based on your personality and market conditions.

3. Use Technical Analysis: Learn to read charts, identify patterns, and use indicators like moving averages and RSI to inform your trades.

4. Develop a Trading Plan: entry and exit points, position sizing, and stop-loss levels.

5. Practice Risk Management: Limit losses by risking only a small percentage of your capital on each trade.

6. Backtest Your Strategy: Test your strategy using historical data to evaluate its effectiveness before trading live.

7. Stay Informed: Keep up with market news and economic indicators that affect your trades.

8. Review and Adjust: Regularly analyze your trades to identify strengths and weaknesses, and adjust your strategy accordingly.

Implement these steps consistently to improve your day trading analysis skills and refine your trading strategy.

What role does market news play in day trading analysis?

Market news is crucial in day trading analysis as it influences price movements and volatility. Traders use real-time news to make quick decisions based on economic reports, earnings releases, and geopolitical events. Understanding how news impacts market sentiment allows traders to anticipate trends and react swiftly. Incorporating news analysis enhances your strategy, helping you identify potential entry and exit points more effectively. Stay updated on relevant news to gain an edge in your day trading.

How can I use indicators to improve my day trading?

To improve your day trading using indicators, start by choosing a few key indicators that suit your trading style. Common choices include Moving Averages for trend direction, Relative Strength Index (RSI) for overbought or oversold conditions, and Bollinger Bands for volatility analysis.

Use these indicators to identify entry and exit points. For example, look for buy signals when the price crosses above a moving average and the RSI is below 30. Monitor multiple time frames to confirm trends and signals.

Regularly analyze your trades to see how well your indicators performed. Adjust your strategy based on what works and what doesn’t. Lastly, combine indicators with strong risk management to protect your capital.

What are the key patterns to recognize in day trading?

Key patterns to recognize in day trading include:

1. Trend Patterns: Identify uptrends and downtrends through higher highs and higher lows or lower highs and lower lows.

2. Reversal Patterns: Look for formations like head and shoulders or double tops/bottoms that signal potential trend reversals.

3. Continuation Patterns: Spot flags, pennants, and triangles that suggest the current trend will continue.

4. Candlestick Patterns: Recognize significant formations such as dojis, engulfing candles, and hammers to gauge market sentiment.

5. Volume Patterns: Pay attention to volume spikes that can confirm price movements or signal potential reversals.

6. Support and Resistance Levels: Identify key price levels where the stock has historically bounced or reversed.

Improving your analysis skills involves studying these patterns, practicing chart reading, and backtesting strategies to understand their implications in real-time trading.

How do I set realistic goals for my day trading analysis?

To set realistic goals for your day trading analysis, start by assessing your current skill level and knowledge. Define specific, measurable objectives, like improving your win rate or reducing losses by a certain percentage. Break these down into daily or weekly targets, such as analyzing five new stocks daily or refining your strategy based on past trades. Keep your goals challenging but achievable, and adjust them based on your performance and market conditions. Regularly review your progress to stay on track and adapt as needed.

Learn about How to Set Realistic Goals in Day Trading

What resources can I use to learn day trading analysis?

To improve your day trading analysis skills, use these resources:

1. Books: "A Beginner's Guide to Day Trading Online" by Toni Turner and "How to Day Trade for a Living" by Andrew Aziz offer solid foundations.

2. Online Courses: Platforms like Udemy and Coursera have comprehensive day trading courses.

3. YouTube Channels: Channels like Warrior Trading and ClayTrader provide practical insights and live trading examples.

4. Trading Simulators: Tools like Thinkorswim and TradingSim allow you to practice without risking real money.

5. Forums and Communities: Joining communities like Reddit’s r/Daytrading or Trade2Win can provide valuable peer support and tips.

6. Market Analysis Tools: Use platforms like TradingView and StockCharts for charting and technical analysis.

7. News Websites: Follow financial news on Bloomberg or CNBC to stay updated on market-moving events.

These resources will enhance your day trading analysis skills effectively.

How can I backtest my day trading strategies effectively?

To backtest your day trading strategies effectively, follow these steps:

1. Choose a Trading Platform: Use software like TradingView or MetaTrader that offers backtesting features.

2. Define Your Strategy: Clearly entry and exit points, risk management rules, and the timeframe for trades.

3. Collect Historical Data: Ensure you have accurate, high-quality historical data for the market you are trading.

4. Run the Backtest: Input your strategy into the platform and run the backtest over your chosen historical period.

5. Analyze Results: Look at key metrics like win rate, profit factor, and maximum drawdown to evaluate performance.

6. Adjust and Optimize: Refine your strategy based on the results, then retest to see if there's an improvement.

7. Paper Trade: Before going live, use a demo account to test the refined strategy in real-time conditions without risking capital.

This process will help you gauge the effectiveness of your day trading strategies and make informed decisions.

Learn about How to Backtest Day Trading Bots Effectively?

What psychological factors should I consider in day trading?

Consider these psychological factors in day trading:

1. Emotional Discipline: Control emotions like fear and greed. Stick to your trading plan.

2. Risk Tolerance: Understand your comfort with risk to avoid panic during losses.

3. Overconfidence: Stay humble; don’t let past wins cloud your judgment.

4. Patience: Wait for the right opportunities instead of forcing trades.

5. Stress Management: Implement techniques like deep breathing to stay calm.

6. Cognitive Biases: Be aware of biases like loss aversion that can skew decision-making.

7. Mindset: Cultivate a growth mindset to learn from mistakes rather than getting discouraged.

Focusing on these factors can improve your day trading analysis and overall success.

How can I improve my risk management in day trading?

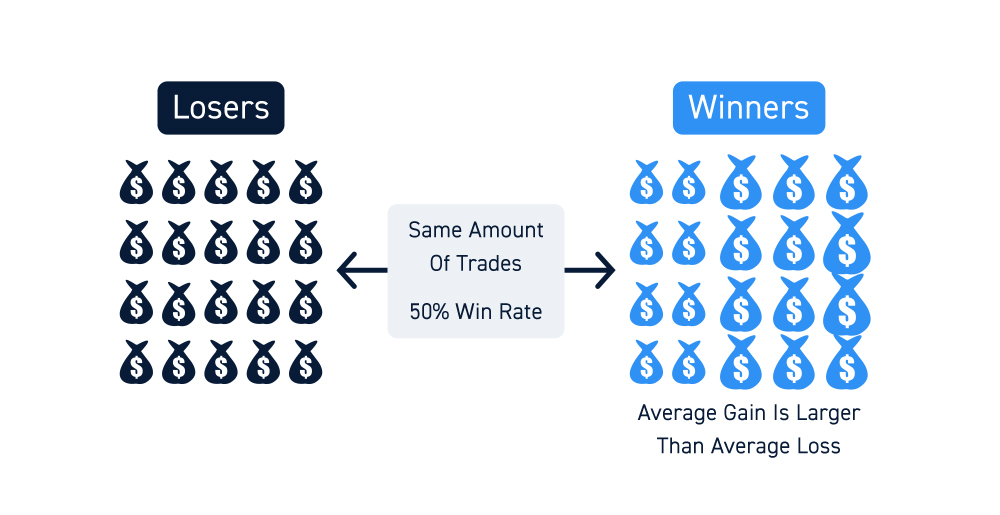

To improve your risk management in day trading, start by setting strict stop-loss orders for every trade to limit potential losses. Use position sizing to ensure no single trade risks more than 1-2% of your total capital. Diversify your trades to spread risk across different assets. Regularly review and adjust your strategy based on performance data to identify weaknesses. Incorporate a risk-reward ratio of at least 1:2, meaning you aim to gain twice what you risk. Stay disciplined and stick to your trading plan, avoiding impulsive decisions. Finally, keep a trading journal to analyze past trades and learn from mistakes.

Learn about How can poor risk management lead to losses in day trading?

What are the best practices for evaluating trades post-analysis?

1. Review Trade Outcomes: Analyze both winning and losing trades to identify patterns.

2. Assess Entry and Exit Points: Evaluate if your timing was accurate and if you followed your strategy.

3. Analyze Risk Management: Check if your stop-loss and position sizing were appropriate for each trade.

4. Document Emotions: Reflect on your emotional state during the trade to identify psychological influences.

5. Use Metrics: Track key performance indicators like win rate, average gain, and average loss.

6. Seek Feedback: Share your analysis with peers or mentors for external perspectives.

7. Adjust Strategies: Based on your findings, tweak your trading plan to improve future performance.

8. Continuous Learning: Stay updated with market trends and trading techniques to refine your analysis skills.

How can I stay disciplined in my day trading analysis?

To stay disciplined in your day trading analysis, establish a consistent routine that includes setting specific goals for each trading session. Use a trading journal to document your trades, strategies, and outcomes, which helps reinforce accountability. Stick to your trading plan without deviating based on emotions or market noise. Regularly review your analysis techniques and market conditions to refine your approach. Limit distractions during trading hours and practice mindfulness to maintain focus. Finally, set aside time for continued education to keep your skills sharp.

Learn about How to Stay Disciplined While Day Trading Scalping

Conclusion about How to Improve Your Day Trading Analysis Skills

In summary, enhancing your day trading analysis skills requires a multifaceted approach. Focus on mastering techniques like chart reading and technical analysis while avoiding common pitfalls. Utilize effective tools and indicators, stay updated with market news, and develop a solid trading strategy. Setting realistic goals, backtesting strategies, and maintaining psychological discipline are crucial for success. By following these guidelines, you can significantly improve your day trading analysis and decision-making process. For more insights and resources, consider exploring what DayTradingBusiness has to offer.

Learn about How Market Microstructure Insights Improve Day Trading Accuracy

Sources:

- Analyzing the nature of fund selection measures: Stock picking or ...

- The price discovery role of day traders in futures market: Evidence ...

- Advice on How to Become a Research Analyst | CFA Institute ...

- Skills That Separate You as an Investment Manager: Introspection ...

- Fragmentation and stability of markets - ScienceDirect