Did you know that the average day trader spends more time analyzing charts than a chef spends perfecting a soufflé? In the fast-paced world of day trading, mastering order flow analysis can be a game-changer. This article explores the essentials of order flow analysis, including its definition, importance, and how to effectively start analyzing market orders and limit orders. We’ll delve into key components and patterns to look for, while also highlighting common pitfalls to avoid. Additionally, discover best practices for integrating order flow analysis into your trading strategy and the tools you need for success. With insights from DayTradingBusiness, you'll be well-equipped to enhance your trading decisions and boost your profitability.

What is Order Flow Analysis in Day Trading?

Order flow analysis in day trading involves examining the flow of buy and sell orders to understand market dynamics and price movement. To conduct order flow analysis, follow these steps:

1. Use a Level 2 Quote: Monitor real-time bid and ask prices to see where orders are stacking up.

2. Analyze Time and Sales: Review the tape to identify large trades and volume spikes.

3. Identify Support and Resistance: Look for price levels where significant buy or sell orders accumulate.

4. Watch Volume: Pay attention to volume trends alongside price changes to confirm market strength.

5. Utilize Footprint Charts: These charts show volume at each price level, helping you visualize buying and selling pressure.

By focusing on these elements, you can make informed trading decisions based on actual market activity.

Why is Order Flow Analysis Important for Day Traders?

Order flow analysis is crucial for day traders because it provides insights into market dynamics and real-time supply and demand. By observing order flow, traders can identify potential price movements, detect market sentiment, and make informed decisions based on actual trading activity rather than relying solely on technical indicators. This analysis helps traders spot areas of support and resistance and anticipate reversals or breakouts, enhancing their ability to enter and exit positions effectively. Ultimately, mastering order flow analysis can improve trading precision and increase profitability.

How Do You Start with Order Flow Analysis?

To start with order flow analysis in day trading, follow these steps:

1. Choose a Trading Platform: Select a platform that offers advanced order flow tools, such as Level II quotes and footprint charts.

2. Understand Market Depth: Familiarize yourself with the order book to see buy and sell orders, which helps identify supply and demand levels.

3. Analyze Volume: Focus on volume spikes to assess market strength. High volume with price movement signals potential reversals or continuations.

4. Look for Imbalances: Identify areas where buy or sell orders dominate, which can indicate future price direction.

5. Use Time and Sales: Monitor real-time data of executed trades to gauge market sentiment and timing.

6. Combine with Technical Analysis: Use traditional indicators alongside order flow to confirm your trading decisions.

7. Practice Risk Management: Set stop-loss orders and position sizes based on your analysis to manage risk effectively.

Starting with these steps will help you effectively conduct order flow analysis and enhance your day trading strategy.

What Tools Are Essential for Order Flow Analysis?

Essential tools for order flow analysis in day trading include:

1. Level 2 Market Data: Provides real-time bid and ask prices, showing market depth.

2. Time and Sales Data: Displays actual trades as they occur, helping to track volume and price movement.

3. Footprint Charts: Visualizes order flow by combining price, volume, and delta information in a single view.

4. Volume Profile: Analyzes trading volume at various price levels, highlighting key support and resistance areas.

5. Order Flow Software: Tools like Sierra Chart or Jigsaw Trading that offer advanced order flow features for in-depth analysis.

6. Tick Charts: Capture price movements based on a set number of trades, providing a clearer view of market activity.

Using these tools effectively allows traders to make informed decisions based on real-time market dynamics.

How Can You Interpret Order Flow Data Effectively?

To interpret order flow data effectively in day trading, focus on these key steps:

1. Understand Market Depth: Analyze the order book to see pending buy and sell orders. Look for large orders that can indicate potential support or resistance levels.

2. Volume Analysis: Pay attention to the volume of trades at different price levels. High volume at a price can signal strong interest and potential reversals.

3. Time and Sales Data: Review the time and sales data to see executed trades. Look for patterns in buying and selling pressure to gauge market sentiment.

4. Identify Imbalances: Spot disparities between buy and sell orders. A significant skew towards buying can indicate bullish sentiment, while heavy selling suggests bearish trends.

5. Watch for Price Action: Combine order flow data with price charts. Confirm signals with price movement to increase the reliability of your analysis.

6. Use Footprint Charts: Employ footprint charts to visualize trades at specific price levels, helping you understand where buying or selling is happening most.

By integrating these techniques, you can make informed trading decisions based on order flow data.

What Are the Key Components of Order Flow Analysis?

The key components of order flow analysis in day trading include:

1. Market Depth: Examines the buy and sell orders at various price levels to gauge supply and demand.

2. Time and Sales: Tracks actual transactions, providing insights into the speed and volume of trades.

3. Volume Profile: Analyzes trading volume at different price levels, highlighting areas of support and resistance.

4. Footprint Charts: Displays detailed data on trade activity, including volume and order type at specific price points.

5. Order Book: Shows live data of pending orders, helping traders identify potential price movements.

6. Trade Execution: Observes how orders are filled, indicating market sentiment and potential reversals.

7. Cumulative Delta: Measures the difference between buying and selling volume over time, revealing market trends.

These components help traders make informed decisions based on real-time market dynamics.

How Do Market Orders Affect Order Flow?

Market orders impact order flow by prioritizing immediate execution at the current market price. This creates a surge in buying or selling activity, influencing price movements. When many traders execute market orders, it can lead to increased volatility and rapid price changes. Understanding this helps day traders gauge market sentiment and identify potential entry or exit points. Analyzing order flow with a focus on market orders reveals real-time demand and supply dynamics, crucial for making informed trading decisions.

What Role Do Limit Orders Play in Order Flow?

Limit orders are crucial in order flow analysis for day trading as they provide insight into market sentiment and price levels where traders are willing to buy or sell. They help identify support and resistance zones, revealing potential entry and exit points. By analyzing the volume of limit orders at various price levels, traders can gauge market strength and anticipate price movements. This data informs decision-making, allowing traders to execute strategies more effectively and manage risk.

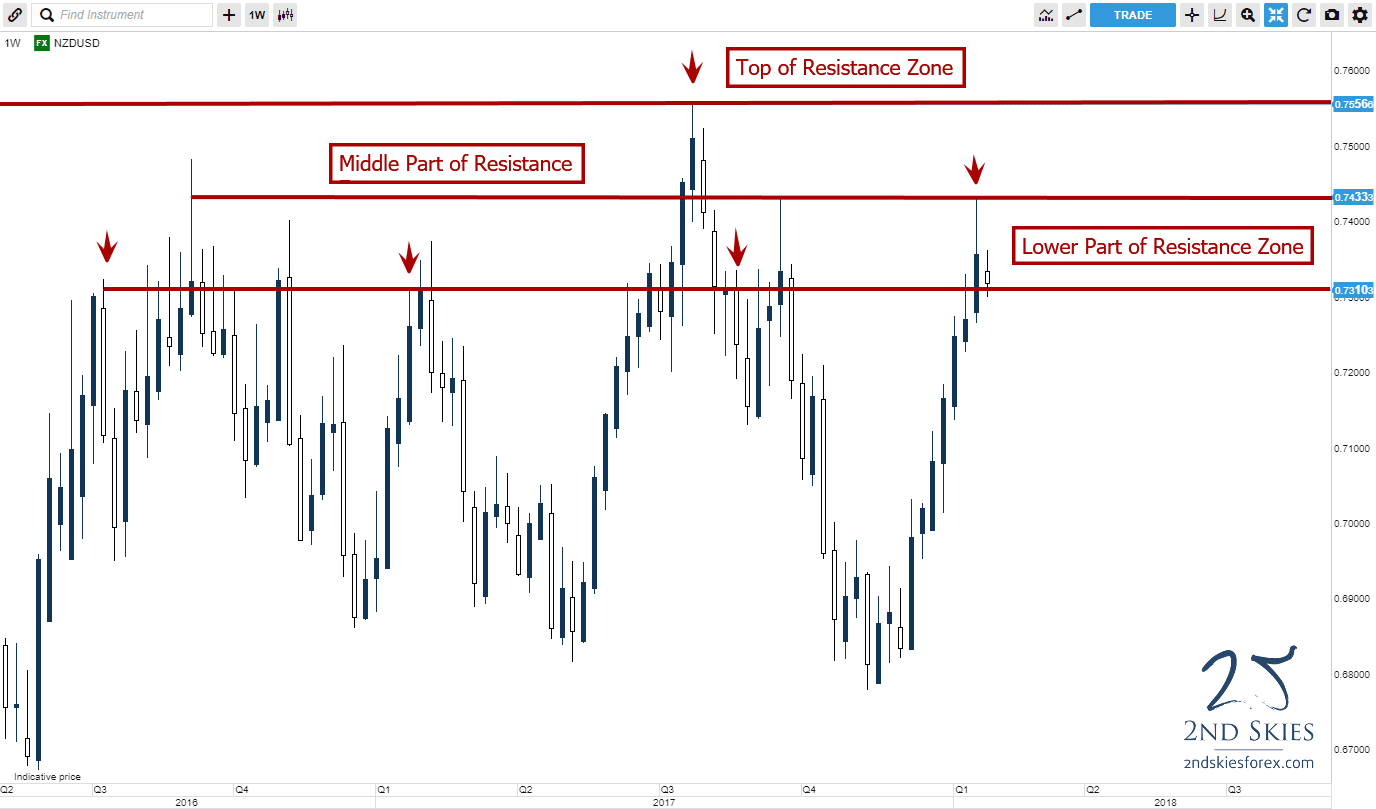

How Can You Identify Support and Resistance Through Order Flow?

To identify support and resistance through order flow in day trading, look for areas where large buy or sell orders cluster. Monitor the order book for significant volume spikes, which indicate strong interest at specific price levels. Use tools like footprint charts to visualize where buying and selling activity occurs. Watch for price reactions at these levels; if the price bounces off a level multiple times, it likely serves as support or resistance. Additionally, analyze the speed of orders; fast buying may signal strong support, while fast selling can indicate resistance.

What Patterns Should You Look for in Order Flow Analysis?

In order flow analysis for day trading, look for these key patterns:

1. Volume Spikes: Sudden increases in volume can indicate strong buying or selling interest.

2. Order Book Imbalances: Large buy or sell orders can signal potential price movements.

3. Price Rejections: Rapid reversals at specific price levels show market sentiment changes.

4. Support and Resistance Levels: Frequent testing of these levels often leads to breakouts or reversals.

5. Delta Changes: Monitor the difference between buying and selling volume to gauge market strength.

6. Limit Order Clusters: A concentration of limit orders can act as a barrier or target for price movement.

Identifying these patterns helps traders anticipate market moves and make informed decisions.

How Does Order Flow Analysis Differ from Technical Analysis?

Order flow analysis focuses on the actual buying and selling activity in the market, examining how trades are executed and the volume behind price movements. It emphasizes real-time data and market depth to gauge supply and demand. In contrast, technical analysis relies on chart patterns, indicators, and historical price data to predict future movements, often without considering the underlying order activity. While technical analysis might suggest potential price levels based on past trends, order flow analysis provides insight into current market sentiment and potential reversals based on live trading behavior.

Learn about How to Incorporate Order Flow Analysis into Your Trading Routine

What Common Mistakes Should You Avoid in Order Flow Analysis?

1. Ignoring Market Context: Always consider the broader market trend before making decisions based on order flow.

2. Focusing Solely on Volume: Don’t just look at volume; analyze the price action in conjunction with order flow for better insights.

3. Misinterpreting Large Orders: Large orders can be misleading. Assess whether they are buy or sell orders and their impact on price.

4. Overtrading: Avoid making too many trades based solely on order flow signals; be selective and patient.

5. Neglecting Risk Management: Always implement stop-loss orders to protect against unexpected market moves.

6. Disregarding Timeframes: Make sure your order flow analysis aligns with your trading timeframe—short-term signals may not apply to long-term strategies.

7. Not Using Multiple Tools: Combine order flow analysis with other indicators for a more comprehensive view of the market.

8. Ignoring News Events: Major news can drastically affect order flow; stay informed about economic announcements and market-moving events.

Learn about Common Mistakes in Order Flow Analysis for Day Traders

How Can Order Flow Analysis Improve Your Trading Strategy?

Order flow analysis improves your trading strategy by providing insights into market dynamics. It helps you understand the supply and demand behind price movements, allowing you to identify potential reversals and continuations. By analyzing buy and sell orders, you can gauge market sentiment and make informed decisions.

To conduct order flow analysis in day trading, start by using a trading platform that offers real-time order book data. Monitor the volume of trades at different price levels and look for large orders that can indicate market intent. Pay attention to the bid-ask spread; a narrowing spread often signals increased buying interest.

Additionally, utilize tools like footprint charts to visualize order flow and spot trends. Combine this analysis with technical indicators to confirm your findings and refine your entry and exit points. This approach enhances your ability to react swiftly to market changes, improving overall trading performance.

Learn about How to Incorporate Order Flow Analysis into Your Trading Routine

What Are the Best Practices for Using Order Flow Analysis?

1. Understand Market Structure: Identify key support and resistance levels to guide your analysis.

2. Use Volume Data: Pay attention to volume alongside order flow to confirm trends and reversals.

3. Watch the Bid-Ask Spread: Analyze the spread to assess market liquidity and potential entry or exit points.

4. Identify Large Orders: Look for significant buy or sell orders that can indicate institutional interest.

5. Monitor Time and Sales: Track transactions to see real-time buying and selling activity, which helps in understanding market sentiment.

6. Utilize Footprint Charts: These charts provide detailed insights into volume at specific price levels, aiding in decision-making.

7. Combine with Technical Analysis: Use order flow in conjunction with technical indicators to enhance your trading strategy.

8. Practice Risk Management: Always set stop-loss orders and define your risk-reward ratio before entering trades.

9. Stay Updated on News: Be aware of economic events that can impact order flow and market volatility.

10. Review and Adapt: Regularly analyze your trades to refine your order flow analysis skills and strategies.

How Can You Combine Order Flow Analysis with Other Trading Techniques?

Combine order flow analysis with technical indicators, price action, and market sentiment. Use order flow to identify real-time buying and selling pressure, while technical indicators like moving averages can confirm trends. Price action helps you spot key support and resistance levels, enhancing your entries and exits. Coupling order flow with market sentiment analysis allows you to gauge trader psychology and potential reversals. This multi-faceted approach helps in making informed trading decisions and improves overall strategy effectiveness.

Learn about How to Incorporate Order Flow Analysis into Your Trading Routine

What Resources Are Available for Learning Order Flow Analysis?

To learn order flow analysis for day trading, consider these resources:

1. Books: "Mind Over Markets" by Dalton and "Order Flow Trading for Fun and Profit" by Sweeney are excellent starts.

2. Online Courses: Platforms like Udemy and TradePro Academy offer specific courses on order flow analysis.

3. Webinars: Many trading firms host free webinars focusing on order flow techniques.

4. Trading Software: Tools like Sierra Chart and NinjaTrader provide order flow analysis features with tutorials.

5. YouTube Channels: Follow channels like "The Trading Coach" or "Sasha Evdakov" for practical insights.

6. Forums and Communities: Join trading communities on Reddit or Discord where traders share strategies and experiences.

7. Blogs: Websites like Tradeciety and SMB Capital offer articles and insights into order flow.

Utilizing a mix of these resources will enhance your understanding and skills in order flow analysis for day trading.

Conclusion about How to Conduct Order Flow Analysis in Day Trading

Incorporating order flow analysis into your day trading strategy can significantly enhance your decision-making and market understanding. By grasping the dynamics of market orders and limit orders, and recognizing key patterns, traders can identify support and resistance levels more effectively. Avoiding common pitfalls and employing best practices will further refine your approach. For in-depth guidance and resources on mastering order flow analysis, DayTradingBusiness is here to support your trading journey.

Learn about How to Incorporate Order Flow Analysis into Your Trading Routine