Did you know that even squirrels have a backtesting strategy for finding the best acorns? Just like our furry friends, day traders can benefit significantly from backtesting their analysis methods. In this article, we’ll explore the essentials of backtesting in day trading, including its importance and how to effectively implement it. You’ll learn how to start backtesting your strategies, the tools available, and how to choose the right historical data. We’ll also cover common pitfalls, interpretation of results, and ways to enhance your trading strategies. Plus, we’ll discuss the significance of market conditions and the limitations of backtesting. With insights from DayTradingBusiness, you’ll be well-equipped to refine your trading approach and maximize your success.

What is backtesting in day trading analysis?

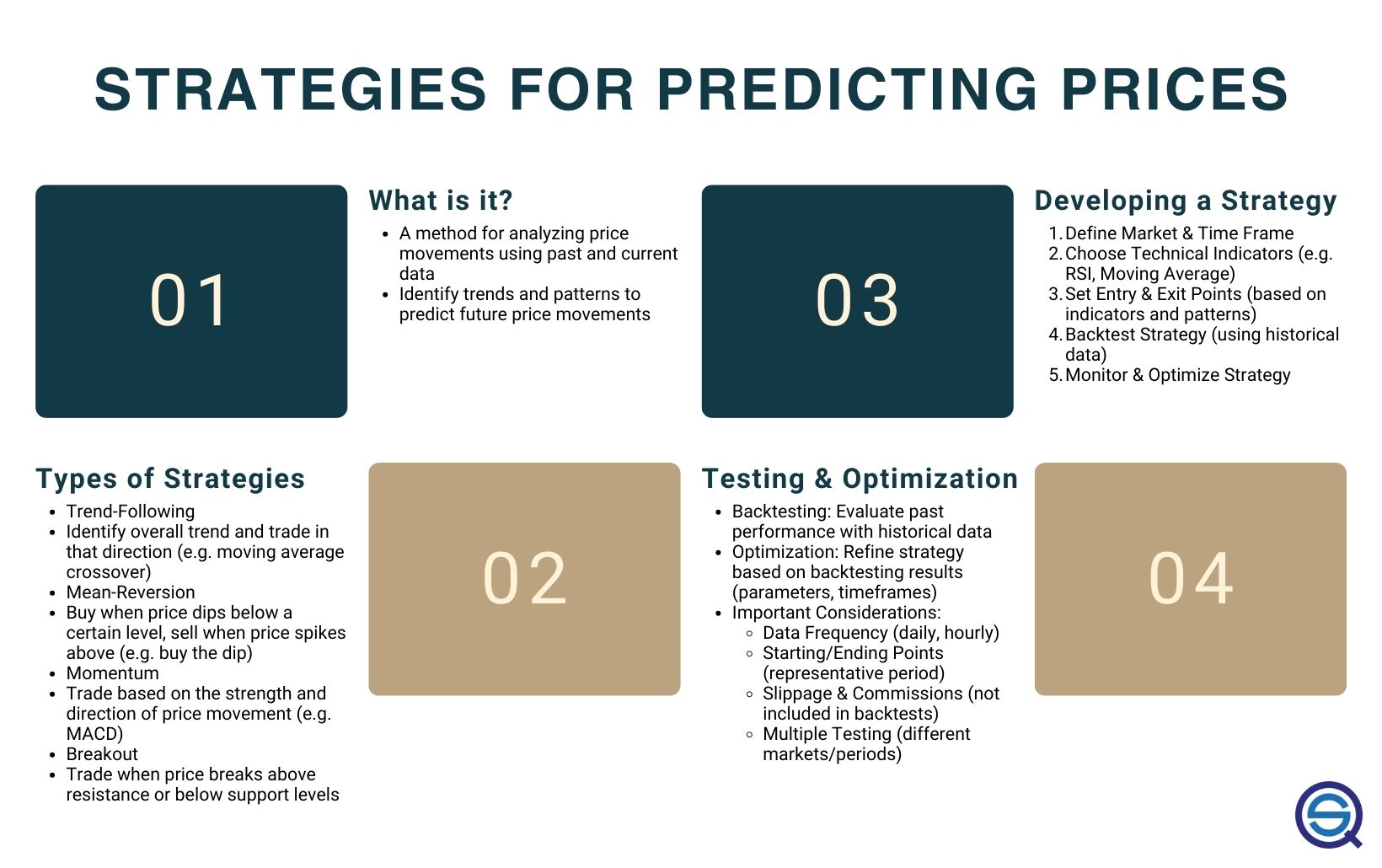

Backtesting in day trading analysis is the process of testing a trading strategy on historical data to see how it would have performed. It involves using past market data to simulate trades based on specific entry and exit criteria. This helps traders evaluate the effectiveness of their strategies, identify potential weaknesses, and refine their approach before risking real money. To backtest effectively, use software or tools that allow you to input your strategy, analyze results, and make data-driven decisions.

Why is backtesting important for day traders?

Backtesting is crucial for day traders because it helps validate trading strategies using historical data. It allows traders to assess the effectiveness of their analysis methods, identify potential risks, and refine their approach without financial exposure. By simulating trades based on past market conditions, day traders can recognize patterns and improve decision-making. Ultimately, backtesting builds confidence in strategies and increases the likelihood of consistent profitability in real-time trading.

How do I start backtesting my trading strategies?

To start backtesting your trading strategies, follow these steps:

1. Define Your Strategy: Clearly your trading rules, entry and exit points, and risk management.

2. Choose a Platform: Select a backtesting software or platform (like TradingView, MetaTrader, or specialized tools) that fits your needs.

3. Gather Historical Data: Obtain quality historical price data for the asset you want to test. Ensure it covers sufficient time to validate your strategy.

4. Input Your Strategy: Program your trading rules into the backtesting platform. This may involve coding or setting parameters depending on the tool.

5. Run the Backtest: Execute the backtest and analyze the results. Look for key metrics like win rate, profit factor, and drawdown.

6. Optimize: Adjust your strategy based on the results. Test different parameters to see if performance improves without overfitting.

7. Validate: Once optimized, validate your strategy on out-of-sample data to ensure it performs well in different market conditions.

8. Document Results: Keep detailed records of your backtesting results for future reference and strategy refinement.

Start small, and gradually refine your approach as you gain insights.

What tools are available for backtesting day trading methods?

For backtesting day trading methods, consider using these tools:

1. TradingView: Offers a robust scripting language (Pine Script) for custom strategies and backtesting.

2. MetaTrader 4/5: Widely used platforms with built-in backtesting features and expert advisors (EAs).

3. NinjaTrader: Provides advanced backtesting capabilities and a user-friendly interface for strategy development.

4. QuantConnect: A cloud-based platform for algorithmic trading with extensive historical data for backtesting.

5. Amibroker: Known for its powerful backtesting engine and custom scripting options.

6. Quantopian: Though now closed, its community still shares resources and tools for backtesting.

7. Excel: For manual backtesting, Excel can be effective with historical data and custom formulas.

Choose the tool that best fits your trading style and technical proficiency.

How can I choose the right historical data for backtesting?

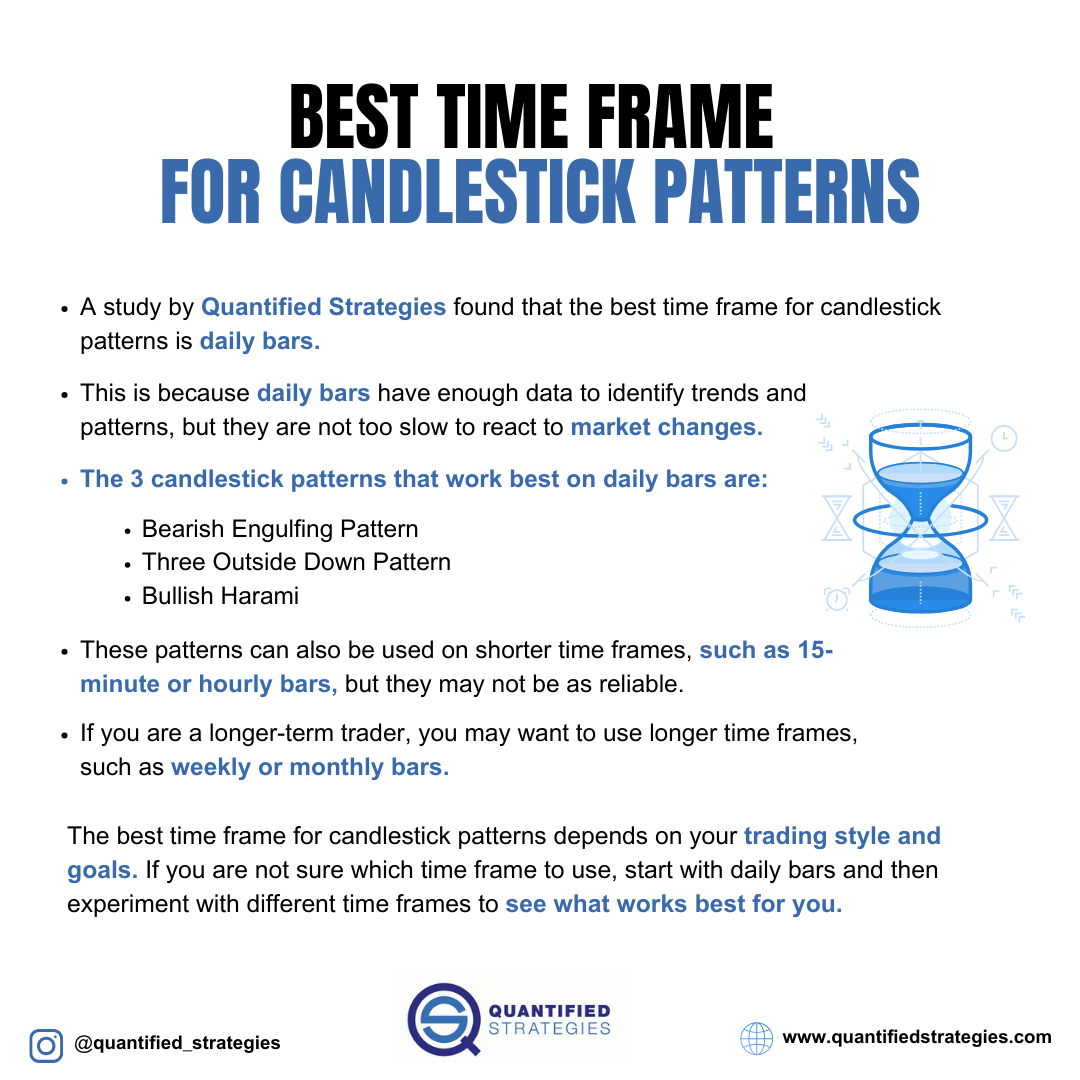

Choose historical data for backtesting by ensuring it matches your trading strategy's parameters. Use high-quality, clean data that includes relevant timeframes, such as minute or hourly data for day trading. Check for data completeness and accuracy, avoiding gaps that could skew results. Ensure the data reflects the market conditions relevant to your strategy, such as volatility and liquidity. Finally, consider using multiple datasets to validate your findings and mitigate biases.

What are the common mistakes in backtesting day trading strategies?

Common mistakes in backtesting day trading strategies include:

1. Overfitting: Tailoring a strategy too closely to historical data, which may not perform well in live markets.

2. Ignoring Slippage and Commissions: Not accounting for transaction costs can lead to unrealistic profit expectations.

3. Using Incomplete Data: Relying on insufficient or poor-quality data can skew results.

4. Not Testing Across Different Market Conditions: Failing to evaluate the strategy in various environments can hide its weaknesses.

5. Inconsistent Time Frames: Using different time frames for backtesting and live trading can lead to misleading results.

6. Confirmation Bias: Only selecting data that supports a preconceived notion while ignoring contradictory evidence.

7. Neglecting Risk Management: Overlooking how the strategy handles losses can result in unforeseen risks when trading live.

How do I interpret backtesting results effectively?

To interpret backtesting results effectively, focus on key metrics:

1. Win Rate: Calculate the percentage of profitable trades. A higher win rate indicates a more successful strategy.

2. Risk-Reward Ratio: Assess the average profit per trade against the average loss. A ratio above 1:2 is generally favorable.

3. Drawdown: Look at the maximum drawdown to understand potential losses during losing streaks. Smaller drawdowns indicate better risk management.

4. Sharpe Ratio: Evaluate risk-adjusted returns using the Sharpe ratio. A higher ratio signifies better performance relative to risk.

5. Consistency: Analyze results across different market conditions and timeframes to ensure the strategy holds up under various scenarios.

Compare these metrics to your trading goals and market conditions to determine if the strategy is viable.

How can I improve my day trading strategies based on backtesting?

To improve your day trading strategies through backtesting, follow these steps:

1. Define Your Strategy: Clearly your entry and exit rules, risk management, and position sizing.

2. Collect Historical Data: Use reliable data sources to gather historical price data for the assets you trade.

3. Choose Backtesting Software: Use platforms like TradingView, MetaTrader, or Thinkorswim to run your backtests.

4. Run Backtests: Implement your strategy on historical data to simulate trades and analyze the results.

5. Analyze Performance Metrics: Focus on key metrics like win rate, average return per trade, maximum drawdown, and risk-reward ratio.

6. Adjust Your Strategy: Identify weaknesses in your strategy based on backtesting results and make necessary adjustments.

7. Implement Walk-Forward Testing: After refining your strategy, conduct walk-forward analysis to validate performance on unseen data.

8. Maintain a Trading Journal: Document your trades and outcomes to identify patterns and continuously refine your approach.

By following these steps, you can enhance your day trading strategies effectively through backtesting.

What timeframes should I use for backtesting day trading?

For backtesting day trading, focus on timeframes that align with your trading strategy. Commonly used timeframes include:

1. 1-Minute Charts: Ideal for high-frequency strategies.

2. 5-Minute Charts: Suitable for short-term trades, balancing detail and overview.

3. 15-Minute Charts: Good for identifying trends and entry/exit points.

4. Hourly Charts: Helps with broader analysis and can fit swing trading styles.

Backtest over a minimum of six months to a year to capture various market conditions.

How do I backtest using trading simulators?

To backtest your day trading analysis methods using trading simulators, follow these steps:

1. Choose a Trading Simulator: Select a reliable trading simulator that offers historical data and allows for strategy testing.

2. Define Your Strategy: Clearly your trading strategy, including entry and exit points, risk management, and performance metrics.

3. Set Up the Simulator: Input your strategy parameters into the simulator. Ensure it mirrors your real trading conditions as closely as possible.

4. Run Historical Data: Execute the backtest over a significant historical period to gather ample data on how your strategy would have performed.

5. Analyze Results: Review the results, focusing on key metrics like win rate, profit factor, and maximum drawdown. Identify strengths and weaknesses.

6. Refine Your Strategy: Based on the results, adjust your strategy as needed. Consider optimizing parameters to enhance performance.

7. Re-Test: Conduct multiple backtests with different market conditions to validate the robustness of your strategy.

8. Document Findings: Keep a detailed record of your tests and adjustments for future reference and improvement.

By following these steps, you can effectively backtest your day trading methods and enhance your trading performance.

What metrics should I evaluate in my backtesting process?

Evaluate the following metrics in your backtesting process:

1. Win Rate: Percentage of profitable trades versus total trades.

2. Profit Factor: Ratio of gross profit to gross loss.

3. Maximum Drawdown: Largest peak-to-trough decline in your equity.

4. Average Trade Gain: Mean profit or loss per trade.

5. Sharpe Ratio: Measure of risk-adjusted return.

6. Trade Duration: Average time trades are held.

7. Risk-Reward Ratio: Average profit compared to average loss per trade.

These metrics will help you assess the effectiveness and risk profile of your day trading strategies.

How can I avoid overfitting during backtesting?

To avoid overfitting during backtesting, use these strategies:

1. Split your data: Divide your dataset into training and testing sets. Train on one and validate on the other.

2. Keep it simple: Use a simpler model with fewer parameters to reduce the risk of fitting noise in the data.

3. Cross-validation: Apply techniques like k-fold cross-validation to ensure your strategy performs well across different subsets of data.

4. Out-of-sample testing: Test your strategy on unseen data to confirm it generalizes well.

5. Limit optimization: Avoid excessive parameter tuning; stick to a reasonable range.

6. Use walk-forward analysis: Continuously update your model based on new data to maintain its effectiveness over time.

Implementing these methods will help you create a robust trading strategy that performs well in real market conditions.

What is walk-forward testing and how is it different from backtesting?

Walk-forward testing is a method where you test a trading strategy on a rolling basis using a sequence of data. You optimize the strategy on one segment of historical data and then validate it on the next segment, continuously moving forward.

In contrast, backtesting involves testing a strategy over a fixed historical dataset without the rolling aspect. While backtesting can show how a strategy would have performed in the past, walk-forward testing provides a more realistic assessment of performance in live market conditions by incorporating changes over time.

How do market conditions affect backtesting results?

Market conditions significantly influence backtesting results by altering the performance of trading strategies. For instance, volatile markets can lead to larger price swings, impacting stop-loss and take-profit levels, while stable markets may show different risk-reward ratios. Additionally, trends and liquidity can affect the execution of trades in backtests, making results less reliable if the historical data doesn't reflect current conditions. Overfitting to past data can also lead to false confidence if future market conditions diverge from those during the backtest period. Therefore, it's crucial to consider current market dynamics when interpreting backtesting outcomes.

Learn about How Market Conditions Affect HFT Strategies

What are the limitations of backtesting in day trading?

Backtesting in day trading has several limitations:

1. Historical Data Quality: Poor quality or incomplete data can lead to inaccurate results.

2. Market Conditions: Past performance doesn’t guarantee future results; market dynamics change.

3. Overfitting: Tailoring strategies too closely to historical data can create unrealistic expectations.

4. Execution Issues: Slippage and transaction costs in real trading can differ from backtested results.

5. Psychological Factors: Backtesting doesn’t account for emotional responses during live trading.

6. Timeframe Bias: Results may vary significantly based on the chosen timeframe for analysis.

Recognizing these limitations is crucial for effective day trading strategy development.

How can I combine backtesting with live trading for better results?

To combine backtesting with live trading effectively, start by thoroughly backtesting your day trading strategies using historical data. Analyze metrics like win rate, average profit, and drawdown to validate your approach. Once confident, transition to a live trading environment with a small capital allocation to minimize risk. Use the insights from backtesting to set realistic expectations and risk management rules. Continuously monitor live performance against backtested results, adjusting your strategy as needed based on real-time data. This iterative process allows you to refine your methods and enhance overall trading results.

Conclusion about How to Backtest Your Day Trading Analysis Methods

In summary, backtesting is an essential component of day trading that allows traders to evaluate the effectiveness of their strategies using historical data. By understanding its importance, utilizing appropriate tools, and avoiding common pitfalls, traders can refine their methods and enhance their performance. To achieve optimal results, consider combining backtesting with live trading and adapting to changing market conditions. For further insights and support in your day trading journey, DayTradingBusiness is here to help you navigate these complexities.

Learn about How to Backtest Day Trading Bots Effectively?