Did you know that the stock market has been around longer than sliced bread? While you might not be trading loaves, understanding the essentials of fundamental analysis is crucial for day traders looking to make informed decisions. This article dives into the significance of fundamental analysis in day trading, exploring its benefits, key metrics to watch, and how earnings reports and economic indicators can shape trading strategies. You'll also learn about the impact of news events, market sentiment, and valuation ratios on your trades. Plus, we’ll discuss the limitations of fundamental analysis and how to effectively integrate it with technical analysis. With insights on tools and common pitfalls, this guide from DayTradingBusiness will equip you to stay updated and enhance your trading success.

What is Fundamental Analysis in Day Trading?

Fundamental analysis in day trading involves evaluating a company's financial health, economic indicators, and market conditions to make informed trading decisions. It's important because it helps traders understand the intrinsic value of a stock, assess potential price movements, and identify trends that could impact short-term trading strategies. By focusing on earnings reports, news events, and macroeconomic data, day traders can capitalize on volatility and make quick, profitable trades.

How Does Fundamental Analysis Benefit Day Traders?

Fundamental analysis benefits day traders by providing insights into a stock's true value and potential price movements. It helps traders identify trends based on economic indicators, earnings reports, and news events that can cause short-term volatility. By understanding a company's financial health and market conditions, day traders can make informed decisions, improving their chances of executing profitable trades. This analysis also aids in risk management, allowing traders to set better entry and exit points based on solid data rather than mere speculation.

What Key Metrics Should Day Traders Focus On?

Day traders should focus on key metrics such as price action, volume, volatility, and liquidity. Fundamental analysis is important because it provides insights into a stock's intrinsic value, helping traders assess potential price movements based on earnings reports, news events, and economic indicators. This context can enhance decision-making, allowing traders to anticipate market reactions and adjust their strategies accordingly.

How Can Earnings Reports Influence Day Trading Decisions?

Earnings reports can significantly influence day trading decisions by providing essential insights into a company's financial health. Positive earnings can lead to stock price surges, prompting day traders to buy in anticipation of upward movement. Conversely, negative earnings may trigger sell-offs, leading traders to short the stock.

Day traders use fundamental analysis to assess how earnings reports impact market sentiment and volatility. Understanding key metrics like earnings per share (EPS) and revenue can help traders predict price movements. For instance, if a company beats earnings expectations, traders might capitalize on the momentum.

In summary, earnings reports offer critical data that informs day trading strategies, helping traders make quick, informed decisions based on real-time financial performance.

Why Are Economic Indicators Important for Day Traders?

Economic indicators are crucial for day traders because they provide insights into market trends and potential price movements. By analyzing indicators like GDP, unemployment rates, and consumer confidence, traders can gauge the overall economic health and make informed decisions. These indicators influence market sentiment and volatility, which day traders can leverage for short-term gains. Understanding fundamental analysis helps traders anticipate market reactions to economic news, allowing for timely entry and exit points in trades.

How Do News Events Impact Day Trading Strategies?

News events significantly impact day trading strategies by creating volatility and influencing stock prices. Fundamental analysis helps day traders gauge how news affects a company's financial health, market sentiment, and future performance. For example, positive earnings reports can lead to rapid price increases, while negative news can trigger sharp declines. Understanding these fundamentals allows traders to make informed decisions, identify entry and exit points, and manage risk effectively. Overall, staying updated on news helps day traders capitalize on market movements.

What Role Does Market Sentiment Play in Day Trading?

Market sentiment significantly influences day trading by affecting price movements and volatility. Day traders rely on sentiment to gauge investor mood and anticipate short-term price trends. Positive sentiment can drive prices up, while negative sentiment can lead to declines. Understanding this can help traders make informed decisions, enhancing their ability to capitalize on quick trades. Fundamental analysis complements this by providing insights into a company's financial health, which can impact sentiment and trading strategies.

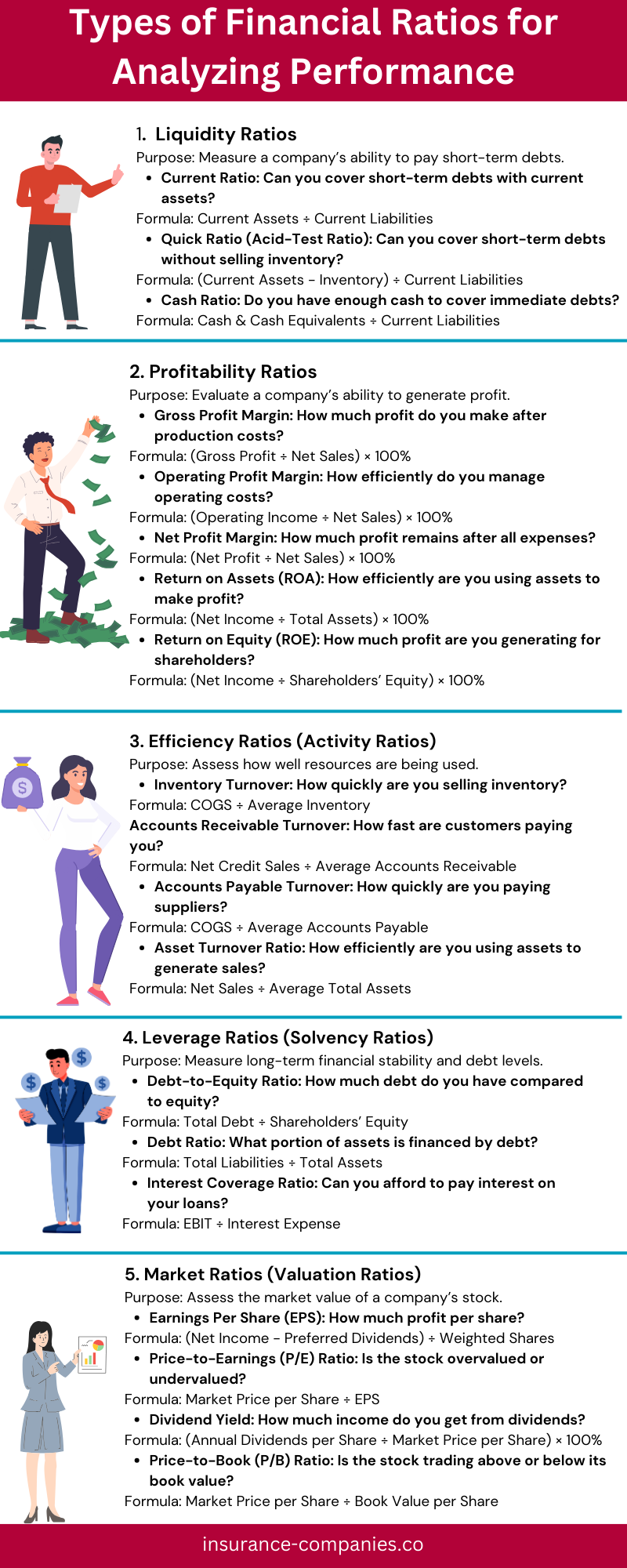

How Can Day Traders Use Valuation Ratios Effectively?

Day traders can use valuation ratios like P/E, P/B, and P/S to identify potential entry and exit points. These ratios help assess if a stock is overvalued or undervalued, guiding trading decisions. By incorporating fundamental analysis, traders can spot trends that might influence short-term price movements. For instance, a low P/E ratio compared to peers might indicate a buying opportunity, while a high P/B ratio could signal a sell. Understanding these ratios enhances decision-making, allowing day traders to act swiftly based on solid data rather than speculation.

Why Is Understanding Company Financials Crucial for Day Traders?

Understanding company financials is crucial for day traders because it provides insights into a company's performance and future potential. Financial metrics like earnings, revenue growth, and profit margins help identify strong stocks to trade. Analyzing financial health can reveal trends that influence stock price movements, allowing traders to make informed decisions. Additionally, being aware of upcoming earnings reports or financial announcements can help traders anticipate volatility and capitalize on price swings. Ultimately, solid fundamental analysis enhances a trader's ability to predict market behavior and manage risk effectively.

How to Analyze Industry Trends for Day Trading Success?

Fundamental analysis is crucial for day traders because it helps identify the underlying factors driving stock prices. By evaluating economic indicators, earnings reports, and industry news, traders can anticipate market movements. Understanding a company’s financial health and market position allows for informed decisions, reducing risks. For instance, if a company’s earnings surpass expectations, it might lead to a price surge, presenting a favorable trading opportunity. Ultimately, fundamental analysis equips day traders with the insights needed to capitalize on short-term price fluctuations effectively.

Learn about How to Analyze Market Trends for Day Trading

What Are the Limitations of Fundamental Analysis for Day Traders?

Fundamental analysis has several limitations for day traders. First, it focuses on long-term financial health, which may not reflect short-term price movements. Second, day traders need rapid decision-making, while fundamental analysis requires time to interpret financial statements and news. Third, market sentiment can overshadow fundamentals, causing price volatility that doesn't align with a company's intrinsic value. Additionally, day traders often rely on technical analysis for quick trades, making fundamental insights less relevant. Lastly, the availability of timely information can be limited, which can hinder effective trading decisions.

How Can Day Traders Integrate Technical Analysis with Fundamental Analysis?

Day traders can integrate technical analysis with fundamental analysis by using fundamental data to inform their trading strategies. For example, they can analyze earnings reports, economic indicators, or news events to identify potential price movements. This information helps in setting entry and exit points based on technical patterns.

Fundamental analysis is crucial for day traders because it provides context to price movements. Understanding a company’s financial health or broader economic trends can enhance decision-making. By combining the immediate signals of technical analysis with the broader insights from fundamental analysis, day traders can increase their chances of success and minimize risks.

Learn about How Do Institutional Traders Use Technical and Fundamental Analysis?

What Tools Are Available for Conducting Fundamental Analysis in Day Trading?

Tools for conducting fundamental analysis in day trading include:

1. Financial News Sites: Websites like Bloomberg, CNBC, and Reuters provide real-time news that can impact stock prices.

2. Earnings Reports: Accessing company earnings releases and conference calls helps assess performance and future outlook.

3. Economic Calendars: Tools like Forex Factory and Investing.com show upcoming economic indicators and events that can influence markets.

4. Stock Screeners: Platforms like Finviz and Yahoo Finance allow you to filter stocks based on financial metrics, helping identify potential trades.

5. Social Media: Twitter and Reddit can provide insights into market sentiment and breaking news.

6. Analyst Ratings: Checking analyst recommendations and target prices can give context to stock movements.

7. Financial Ratios: Tools that calculate P/E ratios, debt-to-equity, and other metrics assist in evaluating company fundamentals.

Using these tools helps day traders make informed decisions based on the underlying financial health of stocks rather than just price movements.

Learn about Tools for Effective Fundamental Analysis in Day Trading

How Often Should Day Traders Review Fundamental Data?

Day traders should review fundamental data daily, ideally before the market opens. This helps in understanding market sentiment and potential price movements. Key reports, earnings releases, and economic indicators can significantly impact stock prices. Staying updated allows traders to make informed decisions and adjust strategies accordingly. Regularly checking this data ensures traders remain responsive to changes that could affect their trades.

Learn about How Can Day Traders Benefit from Dark Pool Data?

What Common Mistakes Do Day Traders Make with Fundamental Analysis?

Day traders often overlook key economic indicators, misinterpret earnings reports, and fail to integrate news events into their strategies. They might focus too much on short-term price movements instead of understanding the underlying fundamentals. Additionally, many neglect to assess the broader market context, which can lead to poor decision-making. Another common mistake is relying solely on news headlines without analyzing the actual data. This can result in missed opportunities or unexpected losses. Understanding these pitfalls is crucial for effective fundamental analysis in day trading.

Learn about Common Mistakes in Order Flow Analysis for Day Traders

How Can Day Traders Stay Updated on Relevant News and Data?

Day traders can stay updated on relevant news and data by using financial news websites, subscribing to market alerts, and following economic calendars. Utilizing real-time news services like Bloomberg or Reuters helps them react quickly to market-moving events. Social media platforms like Twitter can provide instant updates from reputable analysts. Fundamental analysis is crucial for day traders as it helps them understand the underlying factors driving stock prices, informs their trading decisions, and enhances their ability to anticipate market reactions. Keeping an eye on earnings reports, economic indicators, and geopolitical developments can significantly improve trading outcomes.

Learn about How to Stay Updated on Crypto Market News for Day Trading

Conclusion about Why is Fundamental Analysis Important for Day Traders?

Incorporating fundamental analysis into day trading is essential for making informed decisions. By focusing on key metrics, understanding economic indicators, and analyzing market sentiment, traders can enhance their strategies and improve outcomes. While there are limitations to fundamental analysis, integrating it with technical analysis can provide a more comprehensive view of the market. Staying updated on relevant news and utilizing available tools can significantly aid in making timely, strategic trades. For more in-depth guidance on mastering these concepts, DayTradingBusiness offers valuable resources tailored for day traders.

Learn about Why Is Institutional Trading Important for Day Traders?