Did you know that interest rates can be as unpredictable as a cat on a hot tin roof? In the world of day trading, understanding the impact of interest rates is crucial for developing effective strategies. This article explores how interest rates influence day trading tactics, from the best strategies during low rates to the challenges posed by rising rates. We’ll delve into the relationship between interest rates and market volatility, profitability, and liquidity, as well as offer insights on adjusting trading strategies based on rate changes. Additionally, we’ll discuss the psychological effects of interest rate shifts and provide useful tools for tracking these changes. Equip yourself with invaluable knowledge from DayTradingBusiness to navigate the complex interplay between interest rates and day trading success.

How do interest rates influence day trading strategies?

Interest rates affect day trading strategies primarily through their impact on market volatility and liquidity. When interest rates rise, borrowing costs increase, potentially leading to lower spending and investment. This can create volatility in stocks, offering day traders opportunities for quick gains. Conversely, lower interest rates typically stimulate economic activity, often resulting in more stable price movements.

Traders might adjust their strategies based on these shifts. For example, in a rising interest rate environment, day traders may focus on shorting overvalued stocks or sectors negatively impacted by higher rates. In a low-rate environment, they might favor growth stocks that benefit from cheaper capital. Additionally, interest rate announcements can lead to sudden market movements, prompting traders to be agile and responsive.

What are the best day trading strategies during low interest rates?

The best day trading strategies during low interest rates include momentum trading, scalping, and news-based trading.

1. Momentum Trading: Focus on stocks with strong price movements. Low interest rates often boost market liquidity, creating opportunities for rapid price changes.

2. Scalping: Take advantage of small price fluctuations throughout the day. Quick trades can capitalize on the increased volatility that low rates can create.

3. News-Based Trading: Monitor economic news and earnings reports. Low interest rates can lead to market reactions based on news that impacts stock prices significantly.

Utilize technical analysis to identify entry and exit points, and manage risk with stop-loss orders.

How do rising interest rates affect day trading profitability?

Rising interest rates can decrease day trading profitability by increasing borrowing costs for leveraged positions. Higher rates often lead to lower stock prices, which can reduce volatility and trading opportunities. Additionally, sectors like technology may suffer more, affecting traders focused on those stocks. Conversely, if interest rates rise due to strong economic growth, some stocks might still perform well, but overall, traders need to adapt strategies to account for these changes.

What role do interest rates play in market volatility for day traders?

Interest rates significantly influence market volatility for day traders. When rates rise, borrowing costs increase, leading to reduced consumer spending and lower corporate profits, which can cause stock prices to drop. Conversely, lower interest rates can stimulate economic growth, resulting in rising stock prices. Day traders often react quickly to interest rate announcements, as these changes can lead to sharp price movements. Volatility increases around these events, creating both risks and opportunities for quick trades. Understanding interest rate trends helps day traders refine their strategies and manage risk effectively.

How can day traders adjust strategies for changing interest rates?

Day traders can adjust their strategies for changing interest rates by focusing on sectors sensitive to rate fluctuations, like financials or utilities. When rates rise, consider shorting stocks that typically underperform in a higher-rate environment, while looking for long opportunities in sectors that benefit, such as banks.

Additionally, watch for increased volatility in the market; adjust your stop-loss orders and position sizes accordingly. Use technical analysis to identify entry and exit points based on interest rate news. Finally, stay informed about central bank announcements, as they can create immediate trading opportunities.

What is the relationship between interest rates and stock market trends?

Interest rates significantly impact stock market trends, influencing day trading strategies. When interest rates rise, borrowing costs increase, leading to lower consumer spending and corporate profits, which can trigger stock price declines. Conversely, lower interest rates reduce borrowing costs, often boosting spending and investment, resulting in rising stock prices.

Day traders may adjust their strategies based on interest rate movements. For instance, in a low-interest environment, traders might favor growth stocks that benefit from increased consumer spending. In contrast, during rising rates, they might look for value stocks or sectors like utilities, which can perform better in a tightening economy. Understanding this relationship helps traders anticipate market shifts and refine their strategies accordingly.

How do interest rates impact day trading in different sectors?

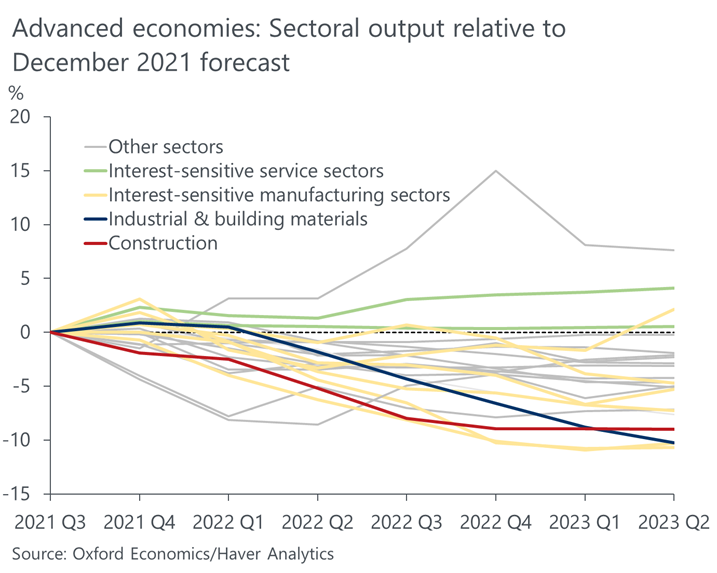

Interest rates influence day trading by affecting market volatility, sector performance, and trader psychology. In sectors like financials, higher rates can boost bank profits, leading to increased activity and potential price swings. Conversely, in interest-sensitive sectors like utilities and real estate, higher rates often lead to declines, prompting traders to adjust their strategies.

For tech stocks, lower rates typically support growth, making them more attractive; a rise in rates can trigger sell-offs. Overall, day traders must stay alert to rate changes and adjust their tactics based on sector reactions to optimize their trades.

What strategies work best when interest rates are expected to rise?

When interest rates are expected to rise, focus on these strategies for day trading:

1. Sector Rotation: Shift toward sectors that historically perform well in a rising rate environment, like financials and consumer staples.

2. Short Selling: Consider shorting stocks in interest-sensitive sectors, such as utilities and real estate, which may decline as borrowing costs increase.

3. Focus on Volatility: Look for stocks with high volatility; rising rates can lead to price swings, creating opportunities for quick trades.

4. Use Options: Implement options strategies like straddles or strangles to capitalize on expected market movements without needing to pick a direction.

5. Leverage: Be cautious with leverage; higher rates can increase margin costs, so use it judiciously to manage risk.

6. Monitor Economic Indicators: Stay updated on economic data releases that could impact interest rates and market sentiment, adjusting your trades accordingly.

Implementing these strategies can help navigate the challenges of rising interest rates effectively.

How do interest rates affect margin trading in day trading?

Interest rates impact margin trading by influencing the cost of borrowing funds. When interest rates rise, the cost to borrow on margin increases, making it more expensive for day traders to leverage their positions. This can reduce profit margins and deter traders from using high leverage. Conversely, lower interest rates decrease borrowing costs, encouraging more margin trading and potentially increasing trading activity. Overall, changes in interest rates can significantly affect traders' strategies and risk management in day trading.

What are the risks of day trading during periods of high interest rates?

Day trading during high interest rate periods carries several risks. First, increased volatility can lead to rapid price swings, making it harder to predict stock movements. Second, higher borrowing costs can reduce liquidity, affecting trade execution. Third, economic uncertainty may lead to broader market declines, increasing the chance of losses. Finally, traders may face tighter margins, limiting profitability on trades.

How can economic indicators related to interest rates inform day trading?

Economic indicators related to interest rates, like the Federal Reserve's rate decisions and inflation reports, directly impact market volatility and asset prices. When interest rates rise, borrowing costs increase, often leading to lower consumer spending and corporate profits, which can drive stock prices down. Conversely, falling interest rates can boost market optimism, encouraging buying.

Day traders can use this information to time their trades. For example, if indicators suggest an interest rate hike is imminent, traders might short stocks in sectors sensitive to borrowing costs, like real estate. On the flip side, positive indicators that suggest lower rates could lead to long positions in growth stocks. Monitoring these indicators helps traders anticipate market movements, adjust their strategies accordingly, and capitalize on short-term price fluctuations.

What tools can day traders use to track interest rate changes?

Day traders can use several tools to track interest rate changes:

1. Economic Calendars: Websites like Forex Factory or Investing.com provide real-time updates on interest rate announcements and economic indicators.

2. Financial News Platforms: Bloomberg, CNBC, and Reuters offer live updates and analysis on interest rate changes affecting the markets.

3. Trading Platforms: Tools like Thinkorswim or MetaTrader include features for tracking economic news and interest rates directly within the trading interface.

4. Central Bank Websites: Regularly check the Federal Reserve or other central banks' official sites for press releases and interest rate decisions.

5. News Aggregators: Use services like Feedly or Google News to create feeds specifically for interest rate news.

6. Market Data Services: Subscription-based services like FactSet or Morningstar provide detailed market analysis, including interest rate trends.

These tools help day traders stay informed and adjust their strategies based on interest rate fluctuations.

How do interest rates impact forex trading strategies for day traders?

Interest rates significantly impact forex trading strategies for day traders. When a country's interest rates rise, its currency typically strengthens, attracting investors seeking higher returns. Day traders often look to capitalize on these fluctuations by buying currencies with rising rates and selling those with falling rates.

Additionally, economic data releases and central bank announcements related to interest rates can create volatility. Day traders might time their trades around these events, leveraging short-term price movements. Understanding interest rate trends helps traders anticipate market reactions, refine entry and exit points, and adjust stop-loss levels.

Monitoring interest rate differentials between currency pairs is crucial. A widening gap can signal a stronger trend, guiding day traders in their strategy. In summary, incorporating interest rate analysis into trading plans enhances decision-making and can improve profitability in forex markets.

Learn about How Does Insider Trading Affect Day Traders?

What psychological effects do interest rates have on day traders?

Interest rates significantly impact day traders by influencing market volatility and trading strategies. When interest rates rise, borrowing costs increase, often leading to lower consumer spending and corporate earnings, which can drive stock prices down. This volatility can create both risks and opportunities for day traders.

Conversely, lower interest rates typically boost market confidence and can lead to higher stock prices, encouraging day traders to buy into upward trends. Additionally, changes in interest rates can affect the liquidity of the market; higher rates may deter speculative trading, while lower rates can encourage more aggressive trading strategies.

Day traders may adjust their strategies based on interest rate trends, focusing on sectors sensitive to rate changes, such as financials or real estate. Understanding these psychological effects helps traders anticipate market movements and refine their approaches accordingly.

How do interest rates affect liquidity in day trading markets?

Interest rates directly impact liquidity in day trading markets by influencing borrowing costs and trading volumes. When interest rates rise, borrowing becomes more expensive, leading traders to reduce their positions, which can decrease liquidity. Conversely, lower interest rates encourage borrowing and increase trading activity, enhancing market liquidity. Additionally, changes in interest rates can affect investor sentiment, leading to fluctuations in trading volume as traders adjust their strategies in response to perceived economic conditions.

Learn about How Does Insider Trading Affect Day Traders?

What should day traders know about interest rate announcements?

Day traders should know that interest rate announcements can significantly impact market volatility and stock prices. A rate hike usually strengthens the currency but might negatively affect stocks, especially in interest-sensitive sectors like utilities or real estate. Conversely, a rate cut can boost equities but weaken the currency. Traders should watch for market reactions immediately after announcements, as price swings can create trading opportunities. Additionally, understanding the economic context behind the rates helps in predicting market sentiment. Always have a risk management plan in place, as sudden moves can lead to losses.

Learn about What Should Day Traders Know About Regulatory Changes?

Conclusion about The Impact of Interest Rates on Day Trading Strategies

Interest rates significantly shape day trading strategies, influencing everything from market volatility to sector performance. As traders navigate low and rising interest rates, they must adapt their approaches to maintain profitability and manage risks. Understanding the relationship between interest rates and market trends, alongside utilizing tools to track changes, is essential for successful trading. For those looking to refine their strategies in light of these dynamics, resources from DayTradingBusiness can provide valuable insights and guidance.