Did you know that some analysts spend more time crafting their stock ratings than a chef spends perfecting a soufflé? In the fast-paced world of day trading, understanding analyst ratings can be crucial for making informed decisions. This article breaks down what analyst ratings are and their impact on stock prices, while highlighting the types traders should focus on. Learn how to read these ratings effectively, grasp the meanings behind buy, hold, and sell signals, and discover how to utilize analyst price targets in your trading strategies. We’ll also cover how to identify conflicting ratings, the frequency of updates, and the limitations of these ratings. Plus, find out how to combine analyst insights with technical analysis and the influence of earnings reports and social media. Dive in for a comprehensive guide from DayTradingBusiness to enhance your trading success!

What Are Analyst Ratings in Day Trading?

Analyst ratings in day trading are evaluations from financial analysts regarding the potential performance of a stock. These ratings typically include "buy," "hold," or "sell" recommendations based on the analyst's research and market conditions.

For day traders, interpreting these ratings involves looking at the consensus rating to gauge market sentiment. A strong buy might indicate upward momentum, while a sell could signal a potential drop. Pay attention to changes in ratings, as upgrades or downgrades can trigger significant price movements.

Also, consider the price target associated with the rating; it helps set entry and exit points. Combine this information with technical analysis to make informed trades.

How Do Analyst Ratings Impact Stock Prices?

Analyst ratings can significantly impact stock prices by influencing investor sentiment. Positive ratings often lead to buying pressure, driving prices up, while negative ratings can trigger selling, causing prices to drop. For day trading, it’s crucial to interpret these ratings quickly. Look for upgrades or downgrades, as they can create immediate volatility. Pay attention to the consensus rating and target price; they provide insight into potential price movements. Analyze the timing of these ratings in relation to earnings reports or market trends for better decision-making.

What Types of Analyst Ratings Should Day Traders Consider?

Day traders should focus on two main types of analyst ratings: buy/sell ratings and price target changes. Buy ratings indicate potential upward movement, while sell ratings suggest a possible decline. Pay attention to price target changes; upward revisions can signal bullish momentum, while downward revisions may indicate bearish trends. Additionally, consider the analyst's track record and their sector expertise. Look for recent upgrades or downgrades, as these can influence short-term price movements. Tracking analyst sentiment can also provide insights into market trends.

How to Read Analyst Ratings Effectively?

To read analyst ratings effectively for day trading, focus on the following steps:

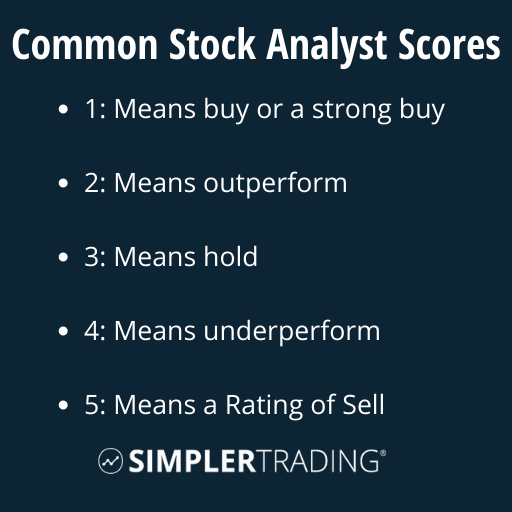

1. Check the Rating Scale: Understand the difference between buy, hold, and sell ratings. Look for strong buy or sell signals for clear trading decisions.

2. Look at Target Prices: Compare the current stock price to the analyst’s target price. A significant difference can indicate potential profit.

3. Review Recent Changes: Pay attention to upgrades and downgrades. A recent upgrade might suggest positive momentum, while a downgrade could signal caution.

4. Consider the Analyst's Track Record: Research the analyst’s past performance. A highly rated analyst with a good track record can offer more reliable insights.

5. Analyze Consensus Ratings: Look at the consensus rating from multiple analysts to gauge overall market sentiment. A strong consensus can indicate a robust trend.

6. Monitor Volume and Market Reaction: Observe how the stock reacts to ratings changes. Increased volume can validate the significance of the rating.

7. Stay Updated on Market News: Analyst ratings can be influenced by external factors. Keep an eye on news that may impact the stock or sector.

By combining these elements, you can effectively interpret analyst ratings and make informed day trading decisions.

What Do Buy, Hold, and Sell Ratings Mean?

Buy, hold, and sell ratings are indicators of an analyst's recommendation on a stock's potential performance.

– Buy: Analysts expect the stock price to increase significantly. It's a suggestion to purchase shares.

– Hold: The stock is deemed stable, with no significant price movement expected. Investors should maintain their position rather than buy or sell.

– Sell: Analysts predict a decline in the stock’s value, advising investors to sell their shares.

For day trading, these ratings can guide quick decisions based on expected price movements.

How Can Day Traders Use Analyst Price Targets?

Day traders can use analyst price targets to identify potential entry and exit points. By comparing a stock's current price to analyst targets, traders can gauge upside potential. If a stock is trading significantly below its target, it may indicate a buying opportunity. Conversely, if it's nearing or above the target, it might signal a sell or short opportunity.

Monitoring changes in analyst ratings can also provide insights into market sentiment. For example, an upgrade can lead to increased buying pressure, while a downgrade might prompt selling. Additionally, day traders should consider volume and volatility around these announcements for better timing. Always combine analyst targets with technical analysis for a more comprehensive trading strategy.

What is the Role of Analyst Ratings in Day Trading Strategies?

Analyst ratings can significantly influence day trading strategies. Traders often use these ratings to gauge market sentiment and potential price movements. A "buy" rating might signal an opportunity for a quick profit, while a "sell" rating could indicate a potential downturn.

To interpret analyst ratings effectively, look for recent upgrades or downgrades, as they can lead to immediate price changes. Consider the target price set by analysts; if it's significantly higher than the current price, it might attract buying interest.

Additionally, pay attention to the volume of ratings; a consensus among analysts can strengthen the signal. Combine this information with technical analysis to enhance your trading decisions. Always stay updated, as analyst opinions can change rapidly, impacting market dynamics.

How to Identify Conflicting Analyst Ratings?

To identify conflicting analyst ratings for day trading, follow these steps:

1. Gather Analyst Reports: Collect ratings from multiple sources like Bloomberg, Reuters, and investment banks.

2. Check Rating Types: Look for discrepancies in buy, hold, or sell recommendations.

3. Analyze Target Prices: Compare target prices; large differences can indicate conflicting views.

4. Review Recent Changes: Pay attention to any recent upgrades or downgrades, as these can signal shifts in sentiment.

5. Look for Consensus: Use tools like the Wall Street Consensus rating to see the overall market sentiment.

6. Read Commentary: Analyze the reasoning behind ratings; differing opinions often highlight market uncertainties.

7. Monitor Market Reaction: Observe how stocks react to news of ratings—this might indicate underlying conflicts.

By focusing on these aspects, you can effectively spot conflicting analyst ratings that may impact your day trading decisions.

How Often Are Analyst Ratings Updated for Day Trading?

Analyst ratings for day trading are typically updated frequently, often multiple times a day, especially during market hours. Major news events can trigger immediate updates, while earnings reports and significant price movements may also lead to revisions. For effective day trading, monitor real-time financial news and platforms that provide instant updates on analyst ratings.

What Are the Limitations of Analyst Ratings in Day Trading?

Analyst ratings often lag behind real-time market movements, making them less valuable for day trading. They can be influenced by biases or conflicts of interest, leading to unreliable recommendations. Ratings may not account for short-term volatility and sentiment shifts, which are crucial in day trading. Additionally, analysts typically focus on long-term performance, so their insights might not align with the rapid decision-making needed in day trading. Always consider combining analyst ratings with technical analysis and market trends for more informed trading decisions.

How to Combine Analyst Ratings with Technical Analysis?

To combine analyst ratings with technical analysis for day trading, start by reviewing recent analyst ratings and price targets. Look for upgrades or downgrades that align with your technical indicators, such as moving averages or support and resistance levels.

Next, assess the stock's price movement around these ratings. If an upgrade coincides with a breakout above a resistance level, it may signal a strong buy. Conversely, if a downgrade occurs near a support level, consider it a potential sell signal.

Use volume analysis to confirm trends indicated by both analyst ratings and technical patterns. High volume on a price move can validate the strength of the signal.

Finally, integrate sentiment analysis from social media or news to gauge market reactions to analyst ratings, enhancing your decision-making process in day trading.

What Sources Provide Reliable Analyst Ratings for Day Trading?

Reliable sources for analyst ratings in day trading include:

1. Yahoo Finance – Offers analyst ratings and price targets.

2. MarketWatch – Provides summaries of analyst recommendations and changes.

3. TipRanks – Aggregates analyst ratings and tracks their performance.

4. Bloomberg – Features in-depth analyst reports and insights.

5. Seeking Alpha – Offers user-generated content and analyst opinions.

6. CNBC – Covers market news and expert analysis.

Use these platforms to gauge sentiment and make informed trading decisions.

How Do Earnings Reports Affect Analyst Ratings?

Earnings reports significantly impact analyst ratings by providing new data that can lead to revisions in stock outlooks. When a company reports better-than-expected earnings, analysts may upgrade their ratings, predicting stronger future performance. Conversely, disappointing results can prompt downgrades, signaling potential declines. Day traders should watch for these changes, as they can influence stock prices immediately. An upgrade might lead to a price surge, while a downgrade could trigger a sell-off. Monitoring analyst reactions to earnings can be crucial for making informed trading decisions.

How to Analyze Analyst Rating Trends Over Time?

To analyze analyst rating trends over time for day trading, start by gathering historical rating data from reliable financial platforms. Look at changes in buy, hold, and sell ratings over various time frames. Focus on the frequency and timing of upgrades and downgrades, as these can indicate shifts in market sentiment.

Next, compare analyst ratings with stock price movements. If ratings improve but the stock price declines, it may signal a divergence worth investigating. Pay attention to the consensus rating and target price trends, as these can guide your entry and exit points.

Finally, monitor news and events that may influence analyst opinions, like earnings reports or market shifts. This will help you contextualize rating changes and make informed trading decisions.

What Should Day Traders Avoid When Using Analyst Ratings?

Day traders should avoid relying solely on analyst ratings without considering other market factors. Don't follow ratings blindly; evaluate the analyst's track record and the context behind the rating. Be cautious of ratings that conflict with current market trends or news events. Avoid acting on outdated ratings, as they can quickly lose relevance. Finally, steer clear of overreacting to upgrades or downgrades; use them as part of a broader strategy rather than the sole basis for trading decisions.

How Can Social Media Influence Analyst Ratings in Day Trading?

Social media can significantly influence analyst ratings in day trading by shaping public perception and sentiment. Traders often monitor platforms like Twitter and Reddit for real-time discussions about stocks, which can lead to rapid shifts in opinion on analyst ratings. Positive or negative comments can amplify or diminish the impact of those ratings, driving trading volume and price movements.

For day traders, it's crucial to interpret analyst ratings not just based on the ratings themselves but also in the context of social media sentiment. A high analyst rating might be bolstered by positive social media chatter, leading to increased buying pressure. Conversely, if there's a wave of negative sentiment online, even a favorable rating may not lead to price gains.

Stay alert to trends in social media discussions to gauge the weight of analyst ratings. Look for spikes in mentions or sentiment changes around stock ratings, as these can provide insights into potential price action.

Conclusion about How to Interpret Analyst Ratings for Day Trading

Incorporating analyst ratings into your day trading strategy can enhance your decision-making process, but it’s essential to approach them with caution. Understanding their implications, recognizing their limitations, and combining them with technical analysis are key to effective trading. By staying updated on trends and being aware of external influences, traders can leverage these ratings to optimize their strategies. For deeper insights and guidance on trading, DayTradingBusiness is here to support you.

Learn about How to Interpret Backtesting Results for Day Trading