Did you know that market sentiment can swing faster than a caffeinated squirrel on a trampoline? Understanding market sentiment is crucial for traders, as it drives price movements and influences decision-making. In this article, we delve into the essence of market sentiment, its measurement, and the tools available for effective analysis. We’ll explore popular sentiment analysis techniques, the impact of social media and news articles, and how to leverage these insights for stock trading. Additionally, we'll discuss the limitations of sentiment analysis, the role of machine learning, and how economic indicators tie into market trends. By the end, you’ll be equipped with a comprehensive guide to interpreting sentiment analysis data, all brought to you by DayTradingBusiness.

What is market sentiment and why is it important?

Market sentiment refers to the overall attitude of investors toward a particular security or financial market. It's important because it influences stock prices, trading volume, and market trends. Understanding market sentiment helps traders make informed decisions, identify potential reversals, and gauge the likelihood of price movements. Tools like surveys, social media analysis, and sentiment indicators can effectively measure this sentiment.

How can I measure market sentiment effectively?

To measure market sentiment effectively, use these tools and techniques:

1. Surveys and Polls: Conduct regular surveys to gather direct feedback from consumers about their feelings toward products or brands.

2. Social Media Monitoring: Analyze social media platforms for mentions, hashtags, and overall sentiment using tools like Hootsuite or Brandwatch.

3. Sentiment Analysis Software: Utilize AI-driven tools like Lexalytics or MonkeyLearn to analyze text data for positive, negative, or neutral sentiments.

4. News Sentiment Analysis: Track financial news outlets and use sentiment analysis to gauge how news events impact market perception.

5. Market Indicators: Observe indicators like the VIX (Volatility Index) or put/call ratios to assess investor sentiment regarding market risks.

6. Focus Groups: Organize focus groups to dive deeper into specific sentiments and motivations behind consumer behavior.

7. Customer Reviews: Analyze online reviews for common themes and sentiment trends related to products or services.

Combining these methods will give you a comprehensive view of market sentiment.

What tools are best for analyzing market sentiment?

The best tools for analyzing market sentiment include:

1. Twitter API – For tracking real-time sentiment through tweets.

2. Google Trends – To see search interest over time for specific terms.

3. Sentiment Analysis Tools – Such as Lexalytics or MonkeyLearn for processing text data.

4. Bloomberg Terminal – Offers advanced analytics and sentiment indicators.

5. Social Media Analytics Platforms – Like Hootsuite or Sprout Social for insights on engagement and sentiment shifts.

6. Reddit Analytics Tools – Tools like Swarm or Subreddit Stats for monitoring discussions and sentiment in relevant forums.

These tools help gauge public opinion and market trends effectively.

How do sentiment analysis tools work?

Sentiment analysis tools work by using natural language processing (NLP) algorithms to evaluate and interpret emotions in text. They analyze data from sources like social media, reviews, and surveys to determine whether the sentiment is positive, negative, or neutral.

These tools typically involve several steps:

1. Data Collection: Gather text data from various platforms.

2. Text Preprocessing: Clean and prepare the data by removing noise, such as stop words and punctuation.

3. Feature Extraction: Convert text into numerical data using techniques like bag-of-words or word embeddings.

4. Sentiment Classification: Apply machine learning models or lexicon-based approaches to classify the sentiment.

5. Output Generation: Present results in a user-friendly format, often including sentiment scores or visualizations.

Popular tools include VADER, TextBlob, and commercial platforms like IBM Watson and Google Cloud Natural Language.

What are the most popular sentiment analysis techniques?

The most popular sentiment analysis techniques include:

1. Lexicon-Based Approaches: These use predefined lists of words with associated sentiment scores to evaluate text.

2. Machine Learning: Techniques like Support Vector Machines (SVM), Naive Bayes, and Random Forests are trained on labeled datasets to classify sentiment.

3. Deep Learning: Neural networks, particularly Long Short-Term Memory (LSTM) and Convolutional Neural Networks (CNN), analyze complex patterns in text data.

4. Natural Language Processing (NLP): Tools like BERT and GPT utilize context to understand sentiment more accurately.

5. Hybrid Approaches: Combining lexicon-based and machine learning methods for improved accuracy.

These techniques help analyze market sentiment effectively, guiding investment decisions and strategies.

How can social media be used to gauge market sentiment?

Social media can gauge market sentiment by analyzing user-generated content, such as posts, comments, and reviews. Tools like sentiment analysis algorithms scan these platforms to identify positive, negative, or neutral emotions associated with brands or products. Monitoring hashtags and keywords helps track trends and public opinion. Engaging with followers and observing their reactions provides real-time insights. Surveys and polls on social media can also directly measure sentiment.

What role do news articles play in market sentiment analysis?

News articles influence market sentiment by shaping public perception and investor behavior. Positive news can boost confidence and drive stock prices up, while negative headlines can create fear and lead to declines. Analysts often track sentiment indicators derived from news articles, such as tone analysis and frequency of keywords, to gauge market trends. This information helps investors make informed decisions based on prevailing market sentiment rather than just raw data.

How can I use sentiment analysis for stock trading?

You can use sentiment analysis for stock trading by analyzing news articles, social media, and financial reports to gauge market sentiment around specific stocks. Start by utilizing tools like Natural Language Processing (NLP) algorithms to evaluate text data for positive, negative, or neutral sentiments.

For instance, track Twitter sentiments about a stock before earnings reports to predict market reactions. Combine sentiment scores with technical indicators to inform your trading decisions. Use platforms like AlphaSense or Bloomberg Terminal for real-time sentiment data. Finally, backtest your strategy to assess its effectiveness in past market conditions.

What are the limitations of market sentiment analysis?

Market sentiment analysis has several limitations. It often relies on subjective interpretations, leading to biases. Data sources can be noisy or misleading, skewing results. Sentiment can change rapidly, making it hard to capture real-time shifts. Additionally, sentiment analysis may overlook fundamental factors that influence market behavior. Finally, models may struggle with context, failing to understand nuances in language or cultural references.

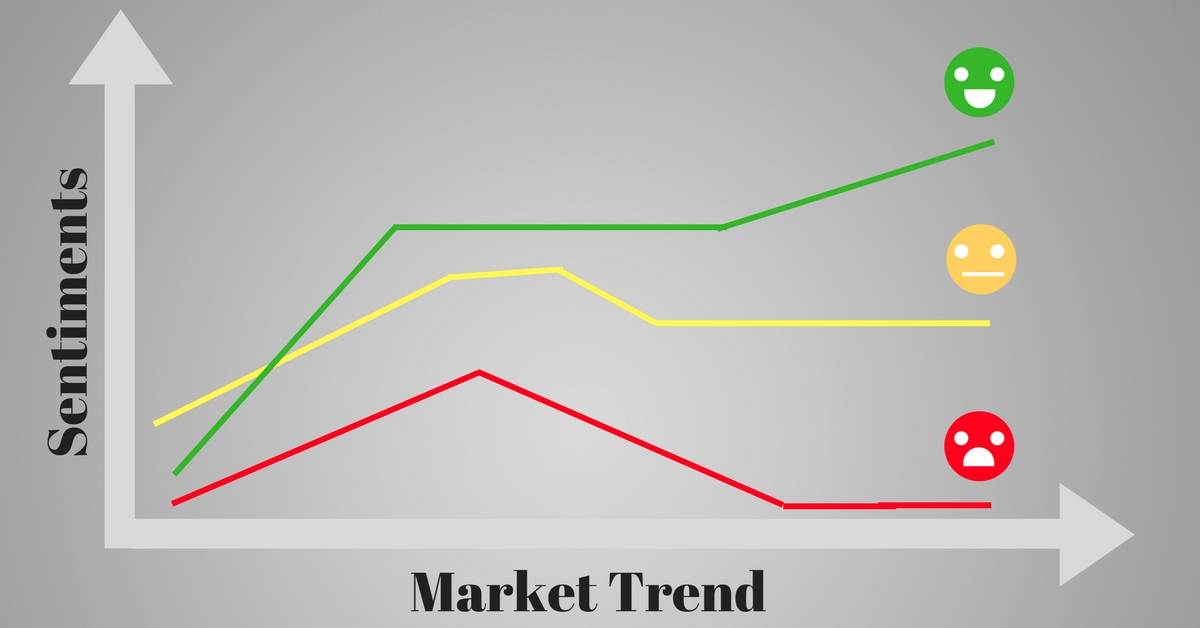

How does sentiment impact market trends?

Sentiment significantly impacts market trends by influencing investor behavior and decision-making. Positive sentiment can drive demand, leading to rising prices, while negative sentiment often results in selling pressure and declining prices. Tools like social media analysis, sentiment indices, and news sentiment tracking help gauge public perception. Techniques such as sentiment analysis of trading volumes and price movements can reveal underlying trends, indicating potential market shifts. Understanding sentiment allows traders to anticipate market reactions and adjust strategies accordingly.

What indicators suggest a positive or negative market sentiment?

Positive market sentiment indicators include rising stock prices, increasing trading volumes, bullish news headlines, and high consumer confidence metrics. Conversely, negative sentiment is indicated by falling stock prices, declining volumes, bearish news, and low consumer confidence. Additionally, sentiment analysis tools, like social media trends and investor surveys, can provide insights into overall market mood.

Can machine learning enhance market sentiment analysis?

Yes, machine learning can significantly enhance market sentiment analysis. It processes vast amounts of unstructured data, like social media posts and news articles, to detect patterns and trends. By using natural language processing (NLP), machine learning algorithms can accurately gauge public sentiment, identifying nuances in emotions and opinions. This leads to more precise predictions about market movements, helping investors make informed decisions. Techniques like sentiment scoring and clustering can further refine insights, allowing for a deeper understanding of market dynamics.

How do I interpret sentiment analysis data?

To interpret sentiment analysis data, start by examining the overall sentiment score, which indicates whether the sentiment is positive, negative, or neutral. Next, break down the data by sentiment categories to identify specific areas of concern or strength. Look for trends over time to see how sentiment evolves, and compare it against key events in the market.

Use visualization tools to highlight patterns and outliers. Analyze the context of the sentiments by reviewing relevant comments or posts to understand the reasoning behind positive or negative feelings. Finally, correlate sentiment data with market performance to see how sentiment influences buying or selling behavior.

What are some case studies on successful sentiment analysis?

1. Target's Customer Feedback Analysis: Target used sentiment analysis on social media and customer reviews to refine its product offerings, leading to a 20% increase in sales for certain categories.

2. Coca-Cola's Brand Monitoring: Coca-Cola employed sentiment analysis tools to gauge consumer reactions to its marketing campaigns, allowing them to adjust strategies in real-time and boost engagement by 30%.

3. Netflix's Content Recommendations: Netflix analyzed viewer sentiment from reviews and social media to tailor its content recommendations, significantly increasing viewer satisfaction and retention rates.

4. Airlines' Customer Experience Improvement: Delta Airlines implemented sentiment analysis to monitor customer feedback on flight experiences, resulting in a 15% improvement in customer satisfaction scores due to targeted service enhancements.

5. Amazon's Review Analysis: Amazon uses sentiment analysis to categorize product reviews, helping sellers optimize their listings. This led to a noticeable uptick in sales for products with improved ratings.

How do economic indicators relate to market sentiment?

Economic indicators directly influence market sentiment by providing data on economic health. Positive indicators, like rising GDP or low unemployment, typically boost investor confidence, leading to bullish market sentiment. Conversely, negative indicators, such as high inflation or declining consumer spending, can create bearish sentiment, prompting sell-offs. Traders analyze these indicators to gauge potential market movements and adjust their strategies accordingly. Thus, the relationship between economic indicators and market sentiment is crucial for making informed investment decisions.

What are the differences between qualitative and quantitative sentiment analysis?

Qualitative sentiment analysis focuses on understanding the underlying emotions and opinions in text, using methods like interviews or open-ended survey responses. It often involves subjective interpretation and provides rich insights into feelings and motivations.

Quantitative sentiment analysis, on the other hand, uses numerical data to measure sentiment, typically through surveys with scaled responses or algorithms that analyze large datasets. It provides statistical results, allowing for comparisons and trends over time.

In summary, qualitative is about depth and context, while quantitative emphasizes measurement and analysis.

Conclusion about Analyzing Market Sentiment: Tools and Techniques

In conclusion, understanding and analyzing market sentiment is crucial for making informed trading decisions. By utilizing effective measurement tools and techniques, traders can gain insights into market trends and potential price movements. Social media and news articles serve as valuable resources for gauging sentiment, while machine learning can further enhance analysis capabilities. Despite its limitations, sentiment analysis can significantly impact trading strategies. For more in-depth insights and resources on mastering market sentiment, explore what DayTradingBusiness has to offer.