Did you know that in the world of trading, the bid-ask spread can sometimes be wider than a hipster's beard? Understanding market microstructure is crucial for day traders, as it encompasses the mechanisms that underpin trading processes. This article delves into key aspects like order flow, liquidity, and the impact of market makers, all of which significantly influence trading strategies. Learn how bid and ask prices, trading volume, and depth affect your decisions, and discover the risks posed by microstructure noise. By grasping these concepts, you can enhance your trading performance and navigate the complexities of the market more effectively. Join us at DayTradingBusiness to explore these essential elements in detail.

What is market microstructure?

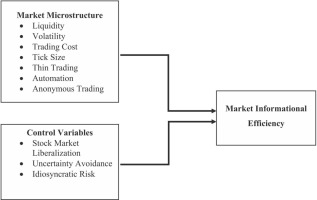

Market microstructure studies how securities are traded, focusing on the mechanisms, trading processes, and how information is reflected in prices. It examines order flow, bid-ask spreads, and execution methods that influence price formation. For day traders, understanding microstructure helps optimize entry and exit points, reduce trading costs, and anticipate price movements caused by order book dynamics.

How does market microstructure affect day trading?

Market microstructure shapes day trading by determining how quickly and efficiently trades execute, influencing bid-ask spreads, order flow, and liquidity. Tight spreads and high liquidity allow day traders to enter and exit positions without significant slippage. Microstructure details, like order book depth and price impact, affect trade timing and risk management. Understanding how trades are routed and how market makers operate helps traders anticipate short-term price movements. Essentially, microstructure insights give day traders an edge in timing, cost control, and managing market noise.

Why is order flow important in market microstructure?

Order flow reveals buy and sell activity, helping traders understand market sentiment and liquidity. It shows how traders are positioning, which influences price movements and execution quality. By analyzing order flow, day traders can anticipate short-term price changes and improve entry and exit timing. It’s essential for understanding market dynamics and making informed trading decisions.

How do bid-ask spreads influence day trading strategies?

Bid-ask spreads affect day trading by increasing transaction costs, making quick trades less profitable. Wider spreads mean traders pay more to enter and exit positions, squeezing potential gains. Tight spreads allow for more precise entries and exits, enabling sharper, faster trades. During volatile moments, spreads usually widen, raising risk and cost. Day traders monitor spreads to time trades better—narrow spreads signal better liquidity and lower costs. Overall, market microstructure, especially bid-ask spreads, shapes how efficiently traders can execute strategies.

What role does liquidity play in market microstructure?

Liquidity in market microstructure determines how easily traders can buy or sell assets without affecting the price. High liquidity means tighter bid-ask spreads, faster order execution, and less price impact, making it ideal for day trading. Low liquidity causes wider spreads, slippage, and increased risk, complicating quick trades. It influences price discovery, market efficiency, and the ability of day traders to capitalize on short-term moves.

How do bid and ask prices impact trading decisions?

Bid and ask prices determine the spread, influencing how quickly you can buy or sell a stock. A narrow spread means lower transaction costs and easier entry or exit, making quick trades more profitable. Wide spreads signal less liquidity and higher costs, pushing traders to be more cautious or wait for better prices. If the bid is close to the ask, you can execute trades instantly at favorable prices, which is crucial for day trading. Conversely, a large gap between bid and ask can cause slippage, reducing gains. So, understanding bid and ask prices helps day traders time entries, manage costs, and avoid unexpected losses.

What are the main components of market microstructure?

The main components of market microstructure are bid-ask spreads, order types (market, limit, stop), order flow, price formation, and trading mechanisms. These elements influence how quickly and efficiently trades occur, affecting liquidity, transaction costs, and price discovery—crucial factors for day traders.

How do trading volume and depth affect microstructure?

Trading volume and depth shape market microstructure by determining liquidity and price stability. High volume means more trades, tighter bid-ask spreads, and easier entry or exit. Depth shows how many buy and sell orders are at different prices; deeper markets resist big price swings. Together, they influence price discovery, reduce volatility, and affect how smoothly a day trader can execute orders without slippage.

What is the impact of market makers on day trading?

Market makers provide liquidity and narrow bid-ask spreads, making it easier for day traders to execute quick trades. Their activity can lead to increased price stability and smoother trading experiences. However, they can also influence short-term price movements, sometimes causing rapid fluctuations that day traders need to navigate carefully. Their presence often reduces trading costs, but they might also engage in strategies that impact short-term market dynamics.

How do microstructure changes influence price volatility?

Microstructure changes, like order book shifts, bid-ask spread fluctuations, and trade execution methods, directly impact price volatility. When liquidity drops or spreads widen, prices become more unpredictable, increasing volatility. Rapid order flow changes or sudden imbalances in supply and demand cause sharp price swings. In day trading, understanding these microstructure shifts helps traders anticipate short-term price movements and manage risk effectively.

What are common microstructure models used in trading?

Common microstructure models in trading include the Glosten-Milgrom model, which explains bid-ask spreads based on information asymmetry, and the Kyle model, focusing on order flow and insider trading. The Madhavan, Richardson, and Roomans (MRR) model analyzes bid-ask bounce and volume impacts. These models help traders understand how order execution, price formation, and market liquidity influence day trading strategies.

How does information asymmetry shape market microstructure?

Information asymmetry makes some traders better informed than others, leading to wider bid-ask spreads and increased trading costs. It causes prices to reflect insider knowledge unevenly, creating opportunities but also volatility. In day trading, this uneven info flow means quick moves and potential for profit or loss based on who has the edge. It can lead to market manipulation or unfair advantages, impacting liquidity and price discovery.

What are the risks of microstructure noise for traders?

Microstructure noise can cause traders to misinterpret price movements, leading to false signals and poor timing. It increases bid-ask spread variability, making it harder to execute trades at desired prices. This noise can result in higher transaction costs and slippage, reducing profitability. Rapid price fluctuations caused by microstructure effects can trigger unnecessary trades or stop-loss triggers. Overall, it adds unpredictability and complexity, risking misinformed decisions during fast-paced day trading.

How can understanding microstructure improve trading performance?

Understanding market microstructure reveals how bid-ask spreads, order flow, and liquidity impact price movements. It helps day traders time entries and exits better, avoid slippage, and anticipate short-term price shifts. Recognizing order book dynamics lets traders spot supply and demand imbalances before they move the market. This insight sharpens decision-making, reduces risk, and boosts trading precision.

Learn about How Market Microstructure Insights Improve Day Trading Accuracy

What tools help analyze market microstructure?

Tools like Order Book Analytics, Level II Quotes, Time & Sales data, and Market Depth charts help analyze market microstructure. Trading platforms such as ThinkorSwim, NinjaTrader, and TradingView integrate these tools. They reveal bid-ask spreads, order flow, and liquidity, essential for understanding how trades impact prices and timing your entries and exits effectively.

How do regulations impact market microstructure?

Regulations shape market microstructure by setting rules for order types, trading hours, and transparency, which influence liquidity and price discovery. They limit practices like high-frequency trading and manipulative behaviors, making markets more stable and fair. For day traders, regulations can restrict certain order strategies or impose reporting requirements, affecting how quickly and freely they can execute trades. Overall, regulations create the framework that determines how orders are placed, matched, and reported, directly impacting market efficiency and trading opportunities.

Conclusion about What Are Market Microstructure and Its Impact on Day Trading?

Understanding market microstructure is crucial for any day trader aiming to enhance their performance. By grasping concepts like order flow, bid-ask spreads, and liquidity, traders can make more informed decisions and develop effective strategies. The dynamics of trading volume, market makers, and information asymmetry further influence price movements and volatility. To navigate these complexities, utilizing analytical tools and being aware of regulatory impacts can significantly improve trading outcomes. For those looking to deepen their knowledge and skills in this area, DayTradingBusiness provides essential insights and resources.

Learn about What Is Market Microstructure in Day Trading?