Did you know that about 40% of all stock trades in the U.S. happen in the shadows, away from public exchanges? This article dives into the mysterious world of dark pools, unraveling what they are, how they operate, and why advanced traders are drawn to them. We explore the benefits, such as enhanced privacy and reduced market impact, alongside potential pitfalls like risks to market liquidity and price discovery. Additionally, we clarify the legal landscape governing dark pools, their implications for market manipulation, and how they differ from traditional exchanges. For traders looking to navigate this complex terrain, we offer insights on identifying dark pool activity and effective trading strategies. Whether you're a seasoned pro or a beginner, understanding dark pools is essential for informed trading. Join us at DayTradingBusiness as we illuminate this critical aspect of the trading world!

What Are Dark Pools and How Do They Work?

Dark pools are private stock exchanges where large traders, like institutional investors, buy and sell shares without revealing their orders to the public. They work by matching buy and sell orders anonymously, reducing market impact and preventing sudden price swings. Traders use dark pools to execute big transactions discreetly, avoiding the risk of moving the market against them. However, since dark pools lack transparency, they can hide information from retail traders and may lead to less fair price discovery.

Why Do Advanced Traders Use Dark Pools?

Advanced traders use dark pools to execute large orders without revealing their intentions, minimizing market impact. They access these private venues to avoid moving prices against them during big trades. Dark pools offer liquidity and better price execution for high-volume transactions. Traders seeking anonymity and reduced transaction costs prefer dark pools over public exchanges.

What Are the Benefits of Trading in Dark Pools?

Trading in dark pools offers benefits like reduced market impact, lower transaction costs, and greater anonymity. It allows advanced traders to execute large orders without revealing their strategies, preventing market moves against them. Dark pools can provide better prices through less price slippage and help maintain strategic confidentiality. Plus, they offer access to liquidity that might not be available on public exchanges, making large trades more efficient.

What Are the Risks of Dark Pool Trading?

Dark pool trading risks include lack of transparency, which can hide market manipulation or unfair practices. It can lead to information asymmetry, making it harder to assess true market prices. Executing large orders anonymously may cause sudden price swings or market impact when revealed. There's also the risk of limited regulation and oversight, increasing exposure to fraudulent schemes. Additionally, dark pools can create liquidity mismatches, resulting in worse execution prices for traders.

How Do Dark Pools Impact Market Liquidity?

Dark pools boost market liquidity by allowing large traders to execute big orders without moving the market, reducing price impact. They provide a private space where institutional investors can buy or sell significant amounts quietly, preventing sudden price swings. This increased liquidity helps stabilize prices and enables smoother trading. However, dark pools can also hide true market activity, sometimes creating less transparent conditions that may lead to reduced overall market transparency and potential for manipulation.

Are Dark Pools Legal and Regulated?

Yes, dark pools are legal and regulated in most countries, including the U.S., where they operate under strict rules by the SEC. They are private trading venues designed for large institutional traders to buy and sell securities discreetly. While they offer liquidity and reduced market impact, they also lack transparency, which can pose risks. Regulators monitor dark pools to prevent manipulation and ensure fair trading, but their opaque nature remains a concern for some investors.

How Do Dark Pools Affect Price Discovery?

Dark pools slow down price discovery by hiding large trades, reducing transparency and delaying the market’s ability to reflect true supply and demand. They can create price discrepancies between public markets and private trading, leading to less accurate pricing signals. This opacity can give institutional traders an advantage but also increases the risk of mispricing and market manipulation. Overall, dark pools can distort the normal flow of price discovery, impacting market efficiency.

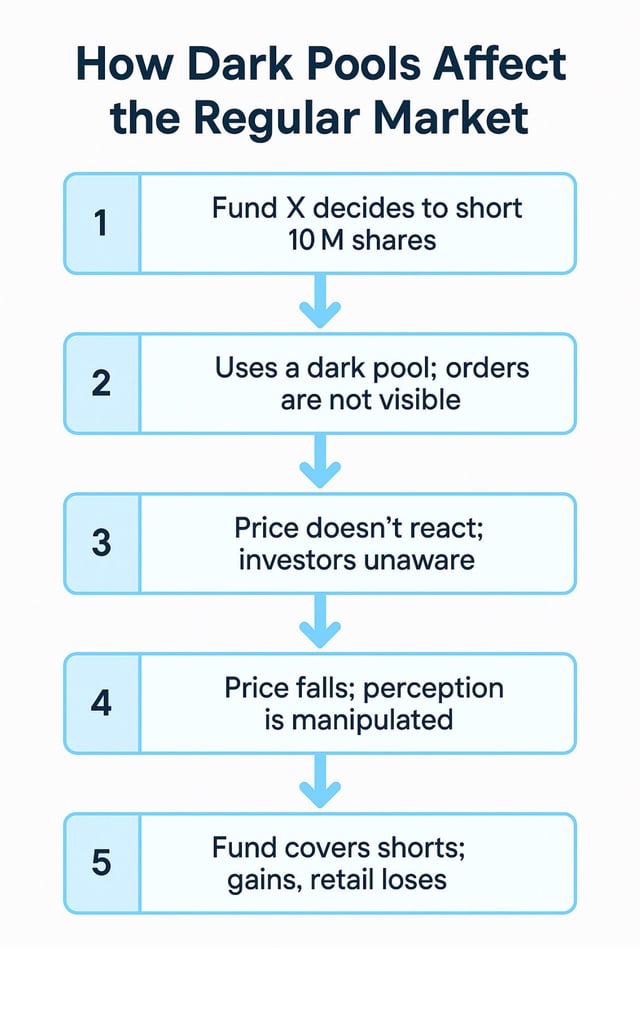

Can Dark Pools Be Used for Market Manipulation?

Yes, dark pools can be used for market manipulation, like spoofing or layering, because their anonymity makes it easier for traders to hide large orders and influence prices without revealing intentions.

What Are the Key Differences Between Dark Pools and Traditional Exchanges?

Dark pools are private trading venues where large orders are executed anonymously, avoiding market impact. Traditional exchanges are public markets with transparent order books, showing all bids and asks in real-time. Dark pools don’t display order depth, reducing the chance of price movement from big trades. They often prioritize speed and discretion for institutional traders, while exchanges focus on transparency and liquidity. Dark pools can offer better prices for big blocks but lack the immediate visibility and regulation of traditional exchanges.

How Do Orders in Dark Pools Avoid Moving the Market?

Orders in dark pools avoid moving the market because they’re executed privately without revealing size or intent until after completion. This prevents large trades from signaling to other traders, reducing market impact and price swings. Traders use dark pools to execute big orders quietly, avoiding the risk of pushing prices against themselves.

What Are the Costs Associated With Dark Pool Trading?

Dark pool trading costs include lower liquidity premiums, potential order execution fees, and sometimes higher spreads due to less transparency. Brokers may charge commissions or fees for accessing dark pools. Slippage can occur if large orders move markets unexpectedly. Hidden costs like reduced price transparency and increased risk of information asymmetry also impact overall expenses.

Learn about What Risks Are Associated with Dark Pool Trading?

How Can Traders Identify Dark Pool Activity?

Traders spot dark pool activity by monitoring unusual order flow, sudden volume spikes, and discrepancies between dark pool and public market prices. They use specialized tools like dark pool scanners, Level II quotes, and volume analysis software. Watching for large block trades executed off-exchange can also signal dark pool activity. Advanced traders analyze price patterns and volume shifts that diverge from public markets, indicating hidden trading.

Learn about How Can Day Traders Benefit from Dark Pool Data?

What Are the Best Strategies for Trading in Dark Pools?

Use advanced order types like iceberg or hidden orders to avoid revealing your full size. Analyze dark pool liquidity and track large block trades to gauge market sentiment. Maintain strict risk management, as dark pools can hide true market depth. Develop a solid understanding of price patterns and timing, since dark pools often execute large trades without impacting public prices. Stay informed about regulatory changes and dark pool-specific rules that can influence trading conditions. Always test strategies with small positions before scaling up in these opaque venues.

How Do Dark Pools Influence Overall Market Transparency?

Dark pools reduce overall market transparency by hiding large trades from public view, making it harder for traders to see supply and demand. This secrecy can lead to less informed price discovery and increase the risk of market manipulation. While dark pools offer opportunities for large traders to execute big orders without impacting prices, they also create opacity that can undermine trust and liquidity in the broader market.

Learn about How Do Dark Pools Obscure Market Transparency?

What Should Beginners Know About Dark Pools?

Beginners should know dark pools are private trading venues where large institutional investors buy and sell big blocks of stocks without revealing their intentions. This lack of transparency can prevent market impact but also hides potential risks, like less oversight and possible manipulation. They often offer better prices for huge trades but can increase price swings and limit access for retail traders. Understanding dark pools helps avoid surprises and recognizes their role in the broader market.

How Will Dark Pools Evolve in the Future?

Dark pools will become more sophisticated with advanced technology, offering faster, more private trades for institutional investors. They’ll integrate AI and machine learning to improve liquidity matching and reduce market impact. Transparency may increase through better reporting, but they’ll still prioritize anonymity for big traders. Regulation could tighten, balancing privacy with market fairness. Overall, dark pools will evolve to serve high-frequency, large-volume traders while trying to avoid increased scrutiny that could limit their effectiveness.

Conclusion about Understanding Dark Pools: Opportunities and Pitfalls for Advanced Traders

In conclusion, dark pools present both unique opportunities and significant risks for advanced traders. Understanding their mechanics, benefits, and potential pitfalls is crucial for effective trading. As you navigate this complex landscape, leveraging insights from DayTradingBusiness can help you make informed decisions and develop strategies that align with your trading goals. Stay informed to maximize your trading potential while minimizing risks associated with dark pool activity.

Sources:

- Machine learning, knowledge risk, and principal-agent problems in ...

- Financial markets: Exchange or Over the Counter

- Powering the Digital Economy: Opportunities and Risks of Artificial ...

- How has data-driven marketing evolved: Challenges and ...

- Artificial intelligence for cybersecurity: Literature review and future ...

- World Bank Document