Did you know that some of the biggest market moves happen in the shadows? Dark pools, those mysterious trading venues, play a significant role in day trading liquidity, often leaving traders scratching their heads. In this article, we delve into the essence of dark pools, exploring what they are and how they affect market dynamics. We discuss their legality, regulatory framework, and the reasons traders opt for these private exchanges. Additionally, we examine the risks and benefits of dark pool trading, their impact on market prices and volatility, and how they influence small investors. By the end, you'll gain valuable insights to navigate these enigmatic waters with confidence, courtesy of DayTradingBusiness.

What Are Dark Pools in Stock Trading?

Dark pools are private stock trading venues where large investors buy and sell shares without displaying orders publicly. They reduce market impact and prevent price swings caused by big trades. For day traders, dark pools can hide significant buying or selling activity, affecting liquidity and making it harder to gauge true market moves. While they help institutional players execute large trades quietly, dark pools can limit transparency and sometimes lead to less reliable liquidity signals for small traders.

How Do Dark Pools Affect Day Trading Liquidity?

Dark pools reduce visible liquidity for day traders, making it harder to see large order flows and impacting quick execution. They can cause sudden price swings because large trades happen away from public markets, leading to less transparency. This can increase volatility and make it riskier for day traders relying on real-time order book data. While dark pools might add some hidden liquidity, they generally decrease the overall transparency and immediacy of liquidity for short-term traders.

Why Do Traders Use Dark Pools?

Traders use dark pools to execute large trades without causing market disruptions or revealing their strategies. These private venues offer increased liquidity and reduce price impact, making it easier to buy or sell big blocks of stocks discreetly. Day traders sometimes tap into dark pools to access hidden liquidity, helping them execute sizable orders more efficiently without alerting the broader market.

Are Dark Pools Legal and Regulated?

Dark pools are legal but heavily regulated trading venues. They operate outside public exchanges, primarily for large institutional traders. Regulatory bodies like the SEC oversee dark pools to prevent market manipulation and ensure transparency. While their use is legal, strict rules limit their impact on day trading liquidity.

How Do Dark Pools Impact Market Prices?

Dark pools can lower market prices by shifting large trades off public exchanges, reducing visible supply and demand. They allow institutional traders to execute big orders without moving the market, which can lead to less price impact but may also cause less transparent price discovery. This reduced transparency can create price discrepancies between dark pools and public markets, potentially impacting day trading liquidity and causing sudden price swings when trades are revealed.

What Are the Risks of Trading in Dark Pools?

Trading in dark pools risks include limited transparency, which can hide order sizes and intentions, making it harder to gauge market impact. It can lead to less price discovery, increasing the chance of getting worse prices. Dark pools may cause price discrepancies between public markets and private trades, risking arbitrage. They also pose a risk of conflicts of interest, as brokers might prioritize their own dark pool trades over clients’. Lastly, reduced liquidity in public markets can increase volatility, making day trading more unpredictable.

How Do Dark Pools Differ from Public Exchanges?

Dark pools are private trading venues where large institutional investors buy and sell shares without revealing their orders to the public. Public exchanges, like NYSE or NASDAQ, display all orders openly, allowing retail and institutional traders to see bid and ask prices. Dark pools reduce market visibility, preventing front-running, but lower immediate liquidity for day traders. In contrast, public exchanges offer transparent, real-time data, making it easier for day traders to gauge liquidity and execute quick trades.

Can Dark Pools Be Manipulated?

Yes, dark pools can be manipulated. Traders with significant holdings might use dark pools to hide large orders and influence prices. Some firms have engaged in practices like quote stuffing or layering to sway perceptions and create false liquidity. While regulations aim to prevent manipulation, the lack of transparency in dark pools makes them vulnerable to such tactics.

How Do Dark Pools Influence Price Discovery?

Dark pools limit transparency, reducing public market visibility and delaying price discovery. They let institutional traders execute large orders without moving the market, which can cause the true market price to lag behind or differ from trades occurring in dark pools. This can lead to less accurate reflection of supply and demand, making day trading riskier as prices may not reveal real-time market sentiment. Overall, dark pools slow down the price discovery process and can create information asymmetry between public markets and large institutional trades.

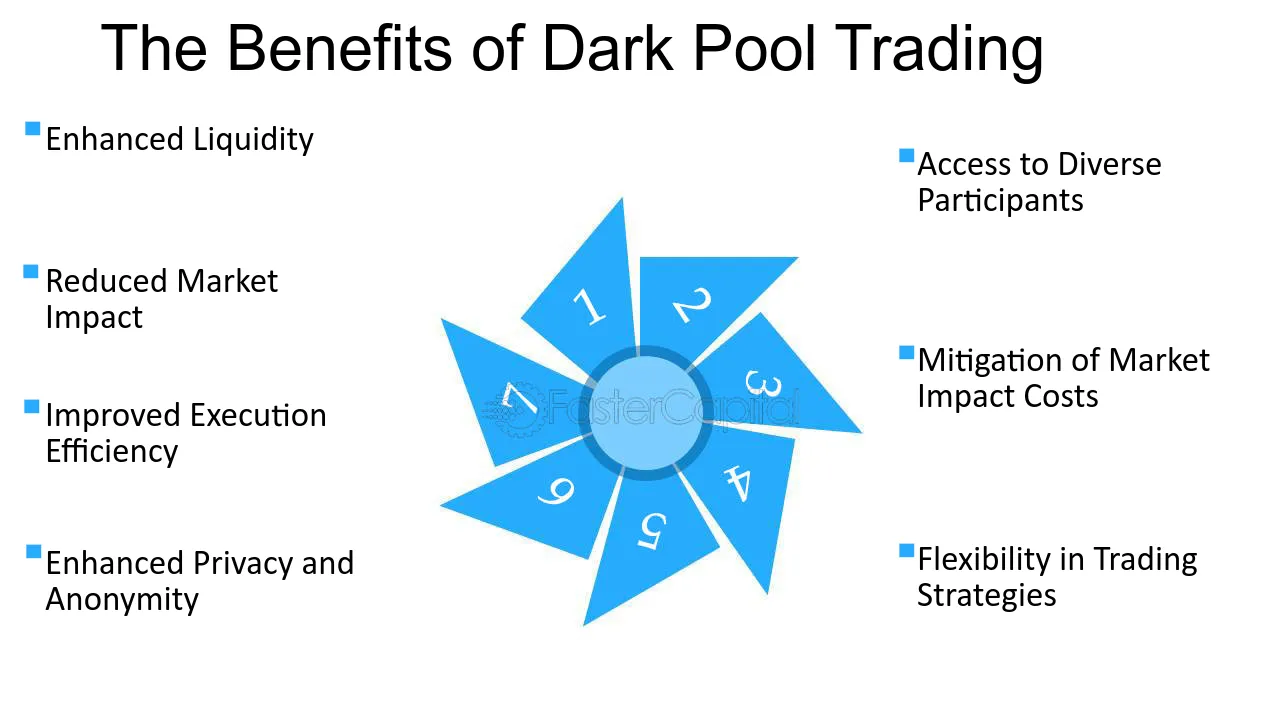

What Are the Benefits of Dark Pool Trading?

Dark pool trading offers benefits like increased privacy, reduced market impact, and better execution prices for large orders. It allows traders to buy or sell without revealing their strategies, preventing market moves against them. Dark pools help improve liquidity by providing alternative venues for large transactions, making it easier to execute big trades smoothly. For day traders, dark pools can mean less slippage and more discreet entry and exit points. Overall, they enhance trading efficiency by minimizing market noise and protecting trader anonymity.

How Do Dark Pools Affect Small Investors?

Dark pools reduce liquidity for small investors because large trades happen privately, making it harder to get accurate market prices. They can cause sudden price swings when big orders are revealed, impacting small traders who rely on transparent markets. Sometimes, dark pools give institutional traders an unfair advantage, leaving small investors at a disadvantage. Overall, dark pools can limit small investors’ ability to execute trades at fair prices and increase market volatility.

Learn about How Do Dark Pools Affect Price Discovery?

Are Dark Pools More Common in Certain Markets?

Yes, dark pools are more common in large, developed markets like the US and Europe where institutional traders seek anonymity for big orders. They’re less prevalent in smaller or emerging markets due to lower trading volumes and less regulatory focus.

How Do Dark Pools Impact Volatility?

Dark pools can increase volatility by hiding large trades that suddenly hit the market, causing sharp price swings when revealed. They reduce visible liquidity, leading to less predictable price movements. When big orders are executed in dark pools, the market may react abruptly once the trades are disclosed. This creates sudden spikes or drops, especially around earnings or economic news. For day traders, dark pools can make price action more unpredictable, as these hidden trades influence supply and demand without immediate transparency.

Learn about How Do Dark Pools Impact Market Fairness?

Can You Detect Dark Pool Activity?

Yes, you can detect dark pool activity through specialized trading tools and data feeds that track large, off-exchange transactions. These platforms reveal block trades and unusual volume spikes, giving clues about dark pool activity. However, since dark pools are designed to be discreet, full transparency isn’t possible, and some activity remains hidden from public view.

Learn about How to Detect Dark Pool Activity?

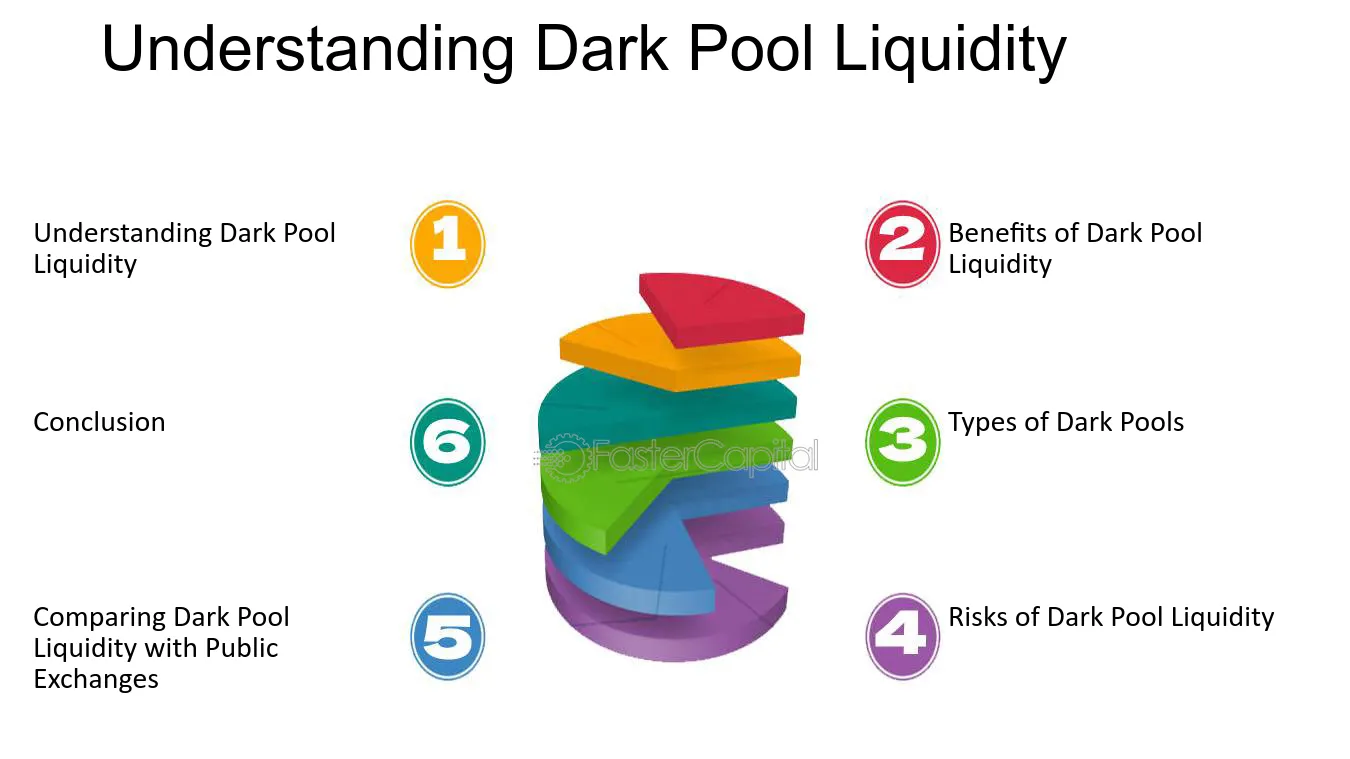

What Should Day Traders Know About Dark Pool Liquidity?

Day traders should know dark pools hide large trades away from public markets, which can distort real-time liquidity. Liquidity in dark pools isn't visible, so price movements might not reflect actual supply and demand. This can cause sudden slippage or unexpected price swings when dark pool trades are revealed. Be cautious—dark pools can impact market volatility and create false signals. Understanding that a significant chunk of trading activity happens off-exchange helps traders avoid surprises during fast markets.

Learn about What Should Day Traders Know About Regulatory Changes?

Conclusion about Understanding Dark Pools and Their Effect on Day Trading Liquidity

In summary, understanding dark pools is crucial for day traders as they significantly influence liquidity and market dynamics. These private trading venues can provide benefits like reduced market impact but also present risks such as potential manipulation and decreased price transparency. As traders navigate these complexities, leveraging insights from resources like DayTradingBusiness can enhance their strategies and decision-making in the evolving landscape of trading.

Learn about Are Dark Pools Used in Day Trading Strategies?