Did you know that the only thing more secretive than a cat's nap is insider trading? In the world of advanced day trading strategies, insider trading plays a pivotal role, impacting everything from stock prices to market volatility. This article explores the ins and outs of insider trading, including its legal implications, how it affects trading strategies, and the risks involved in relying on insider information. We'll also cover methods day traders can use to detect insider trading signals and ensure they stay on the right side of the law. Join DayTradingBusiness as we unravel the complexities of insider trading and its influence on the market landscape.

What is insider trading in day trading?

Insider trading in day trading involves trading stocks based on non-public, material information from insiders like executives or employees. It’s illegal and gives traders an unfair advantage by acting on confidential data before it hits the market. Advanced day traders might be tempted by this shortcut, but it risks severe legal penalties and market integrity. Genuine success in day trading relies on analysis, timing, and strategy—not illegal information.

How does insider information impact day trading strategies?

Insider information gives traders an unfair advantage, allowing them to predict stock movements before public news. It can lead to quick, high-profit trades but also increases the risk of legal trouble if caught. Relying on insider info skews risk management, making strategies more speculative and less based on market fundamentals. Advanced day traders may use it to time entries and exits precisely, but it’s illegal and can wipe out gains with legal penalties.

Can insider trading be legal in day trading?

No, insider trading is illegal in day trading. Even advanced strategies don’t make using non-public, material info lawful.

What are the risks of relying on insider information?

Relying on insider information risks legal penalties, including fines and prison. It damages reputation and trust, and can lead to market manipulation accusations. Insider trading creates unfair advantages, increasing volatility and destabilizing markets. It can result in account suspensions or bans from trading platforms. Legally obtained data is safer and more sustainable for strategic day trading.

How do day traders detect insider trading signals?

Day traders spot insider trading signals by tracking unusual stock movements, sudden volume spikes, and rapid price changes that lack news catalysts. They monitor insider buying or selling disclosures, often using SEC filings like Form 4, for clues of large transactions. Unexplained price jumps ahead of earnings or significant events can hint at insider information. Technical analysis tools, such as volume-weighted average price (VWAP) and order flow data, help detect irregular trading activity. Combining these signs with news leaks or social media chatter can also reveal potential insider trading, giving traders an edge in advanced strategies.

What legal consequences exist for insider trading in day trading?

Insider trading in day trading can lead to criminal charges, hefty fines, and prison time. Regulatory bodies like the SEC can sue for civil penalties, including large monetary fines and bans from trading. Convictions may also result in criminal records, damaging reputation and future trading prospects.

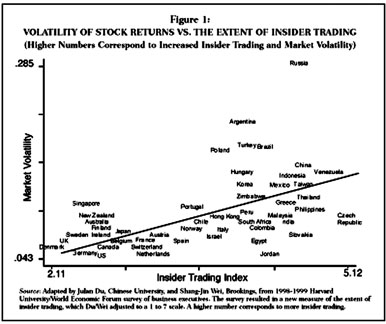

How does insider trading affect market volatility?

Insider trading increases market volatility by causing sudden price swings when non-insider traders react to leaked information. It creates unpredictable market movements, eroding trust and making prices less stable. This volatility can lead to sharp crashes or spikes as insiders capitalize on confidential info, disrupting the smooth flow of advanced day trading strategies.

What ethical issues surround insider trading in day trading?

Insider trading in day trading raises ethical issues like unfair market advantage, breach of trust, and potential manipulation. It undermines market integrity by giving insiders an illegal edge, disadvantaging regular traders. Using non-public information violates fairness and erodes investor confidence. It also damages relationships with clients and regulatory agencies, risking legal consequences. Overall, insider trading compromises ethical standards essential for transparent, equitable trading environments.

How can day traders protect themselves from illegal insider info?

Day traders can protect themselves from illegal insider info by sticking to publicly available data and avoiding rumors or unverified sources. Use reputable news outlets and official company filings to inform trades. Never attempt to access or use confidential or non-public information. Rely on technical analysis and proven trading strategies instead of tips or whispers. Stay compliant with securities laws to avoid legal risks and penalties.

What are the signs of potential insider trading activity?

Signs of potential insider trading include sudden, unexplained stock price spikes, unusual trading volume before major news, and traders executing large, rapid trades without clear public info. Watch for patterns where insiders or connected individuals seem to know news in advance, or if trades happen just before market-moving announcements. These signs can suggest someone is using non-public information, which is the hallmark of insider trading.

How do regulators monitor insider trading in day markets?

Regulators monitor insider trading in day markets through surveillance systems that track unusual trading patterns, volume spikes, and rapid price movements. They analyze real-time data from stock exchanges, flag suspicious trades, and cross-reference them with confidential information leaks. Investigators also use tips from market participants and employ forensic accounting to uncover illegal information sharing. Advanced algorithms and machine learning help detect anomalies indicating insider trading activity.

Learn about How Regulators Detect Insider Trading in Day Markets

Can insider trading give an unfair advantage in day trading?

Yes, insider trading can give an unfair advantage in day trading by providing non-public, material information that influences stock prices before the market reacts, enabling traders to make profitable moves that others can't predict legally.

Learn about What Is Insider Trading in Day Trading?

How does insider trading influence stock prices in short-term trading?

Insider trading causes short-term stock prices to move unpredictably as insiders buy or sell based on confidential info. These trades can create quick price spikes or drops before public news spreads. Day traders watch for these movements to capitalize on short-lived opportunities. Insider trading often leads to increased volatility, making stock prices less stable in the short term.

What are the differences between legal insider trading and illegal activity?

Legal insider trading occurs when company insiders, like executives or board members, buy or sell stock based on material, non-public information and follow proper disclosure rules. Illegal insider trading happens when someone trades on confidential information not available to the public, gaining an unfair advantage. The key difference is legality—lawful insider trading complies with regulations, while illegal insider trading violates securities laws.

Learn about Legal vs. Illegal Insider Trading in Day Trading

How do advanced day trading algorithms detect insider trading patterns?

Advanced day trading algorithms detect insider trading patterns by analyzing unusual trading volumes, rapid price movements, and timing anomalies that differ from typical market behavior. They scan for suspicious trades just before major news releases or earnings reports, flagging sudden spikes in activity. Machine learning models identify irregular patterns in order flow, bid-ask spreads, and trade sizes that suggest non-public information influence. These algorithms cross-reference historical insider trading cases, news sentiment, and regulatory disclosures to spot potential illegal activity.

Learn about How Regulators Detect Insider Trading in Day Markets

What role does insider trading play in market manipulation?

Insider trading enables traders with non-public information to manipulate markets by executing trades that influence stock prices, creating artificial moves. It can be used to pump or dump stocks, mislead other traders, and distort market signals, giving insiders an unfair advantage. In advanced day trading, insider trading skews price patterns and volume data, making it harder to make informed decisions and increasing market volatility.

How should day traders approach information sources to avoid illegal activities?

Day traders should rely only on public, legally obtained information and avoid any tips, leaks, or non-public data. Verify sources and stick to reputable news outlets, financial reports, and official disclosures. Never act on insider information or anything that suggests illegal insider trading. Stay informed about regulations, and use technical analysis and legitimate market data to guide trades.

Conclusion about The Role of Insider Trading in Advanced Day Trading Strategies

Incorporating insider trading insights into advanced day trading strategies can enhance decision-making, but it comes with significant risks and ethical considerations. Traders must navigate the thin line between leveraging legal insider information and avoiding illegal practices that can lead to severe penalties. Understanding the implications of insider trading on market volatility and stock prices is crucial for developing effective strategies. By staying informed and adhering to legal guidelines, day traders can mitigate risks while maximizing their trading potential. For comprehensive guidance on navigating these complexities, DayTradingBusiness offers valuable resources and support.

Learn about The Role of Insider Information in Day Trading

Sources:

- The impact of illegal insider trading in dealer and specialist markets ...

- Uncovering the distress anomaly: The role of insider silence and ...

- Insider Trading, Liquidity, and the Role of the Monopolist Specialist

- Legal insider trading and market efficiency - ScienceDirect

- Jeopardy, non-public information, and insider trading around SEC ...