Did you know that insider trading reportedly led to the downfall of not just individual investors but entire companies, proving that some secrets can be downright dangerous? In this article, we dive into the multifaceted impact of insider trading on market fairness and trading strategies. We’ll explore how insider trading affects market integrity, investor confidence, and price distortion. Learn about the legal consequences and regulatory detection methods while uncovering the common signs of insider trading activity. We’ll also discuss ethical concerns, implications for small investors, and the role of technology in identifying these practices. Lastly, we’ll address how insider trading influences market liquidity and volatility, the challenges of prosecution, and the historical context of trading scandals. For traders seeking to navigate this complex landscape, DayTradingBusiness offers essential insights and guidance.

How does insider trading affect market fairness?

Insider trading undermines market fairness by giving insiders an unfair advantage, making it impossible for regular investors to compete on equal footing. It erodes trust in the integrity of financial markets, discouraging honest participation. When insiders profit from non-public information, it distorts prices and hampers transparent price discovery. This creates an uneven playing field, leading to increased market volatility and reduced confidence among everyday investors.

What are the legal consequences of insider trading?

Insider trading can lead to criminal charges, fines, and imprisonment. Regulators like the SEC can impose heavy civil penalties, including hefty fines and bans from trading. Convictions can result in jail time, reputational damage, and loss of professional licenses. Courts may also order disgorgement of profits gained from illegal trades.

How does insider trading influence investor confidence?

Insider trading erodes investor confidence by undermining market fairness, making traders feel the playing field is rigged. When it’s perceived that insiders profit unfairly, retail and institutional investors lose trust in the integrity of the market. This skepticism can lead to reduced participation, lower trading volumes, and increased volatility. Knowing that some traders have unfair advantages discourages honest investment strategies and diminishes overall confidence in market regulation.

Can insider trading distort market prices?

Yes, insider trading can distort market prices by giving insiders an unfair advantage, causing prices to reflect privileged information rather than true market value. This manipulation undermines market fairness, misleads regular investors, and can lead to mispriced assets, which affects overall market integrity and efficiency.

How do regulators detect insider trading?

Regulators detect insider trading through surveillance of unusual trading patterns, tips from insiders or informants, and analyzing confidential information leaks. They use data analysis tools to spot suspicious trades before public news breaks, cross-checking trading activity with known insider information. Investigations often involve wiretaps, subpoenaing communication records, and tracking the flow of confidential info. They also monitor news and social media for leaks that correlate with suspicious trading spikes.

What are common signs of insider trading activity?

Common signs of insider trading include sudden, unexplained stock price jumps or drops, unusually high trading volumes before news becomes public, and profit spikes that don’t match typical market patterns. Watch for trades made just before major announcements or earnings reports that seem out of sync with the broader market. Also, repeated trading patterns by certain individuals or entities with no clear public reason can signal insider activity.

How does insider trading impact trading strategies?

Insider trading skews market fairness, giving insiders an unfair advantage. Traders who rely on public info can't compete with those using confidential data, leading to distorted price signals. This erosion of trust pushes honest traders to adjust by becoming more cautious or seeking alternative strategies, like technical analysis or arbitrage. Overall, it undermines confidence in the market, making strategies based solely on public information less effective.

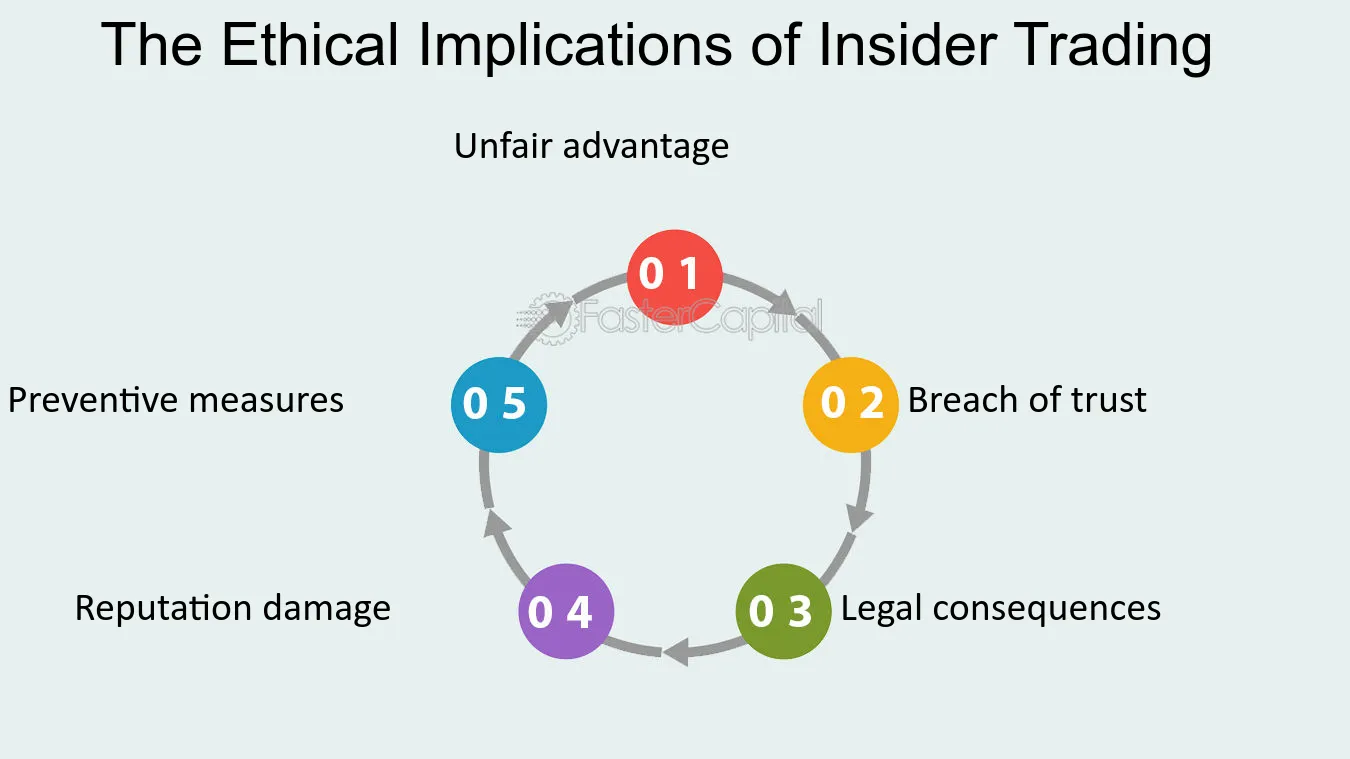

What ethical issues are involved in insider trading?

Insider trading undermines market fairness by giving insiders an unfair advantage, leading to unequal information access. It erodes trust in financial markets, causing investors to doubt transparency and integrity. This unethical practice distorts true market prices, harming honest traders and investors. It encourages illegal, risky trading strategies, jeopardizing market stability. Overall, insider trading damages the credibility and fairness essential for healthy financial markets.

How does insider trading affect small investors?

Insider trading gives small investors an unfair advantage, skewing market fairness. It can cause small investors to lose confidence, fearing they’re at a disadvantage. When insiders profit illegally, it distorts stock prices, making it harder for small investors to make informed decisions. This unfair edge discourages honest trading strategies and erodes trust in the market. Ultimately, insider trading harms the integrity of the market, leaving small investors vulnerable and less likely to participate confidently.

What role do technology and data analysis play in uncovering insider trading?

Technology and data analysis detect insider trading by analyzing trading patterns, identifying unusual activity, and spotting anomalies faster than humans. Algorithms sift through massive datasets—transaction records, communication logs, and market data—to flag suspicious behavior. Advanced analytics reveal hidden connections and timing patterns that suggest insiders are trading on non-public info. This helps regulators and firms uncover illegal activity, maintain market fairness, and refine trading strategies to prevent insider trading.

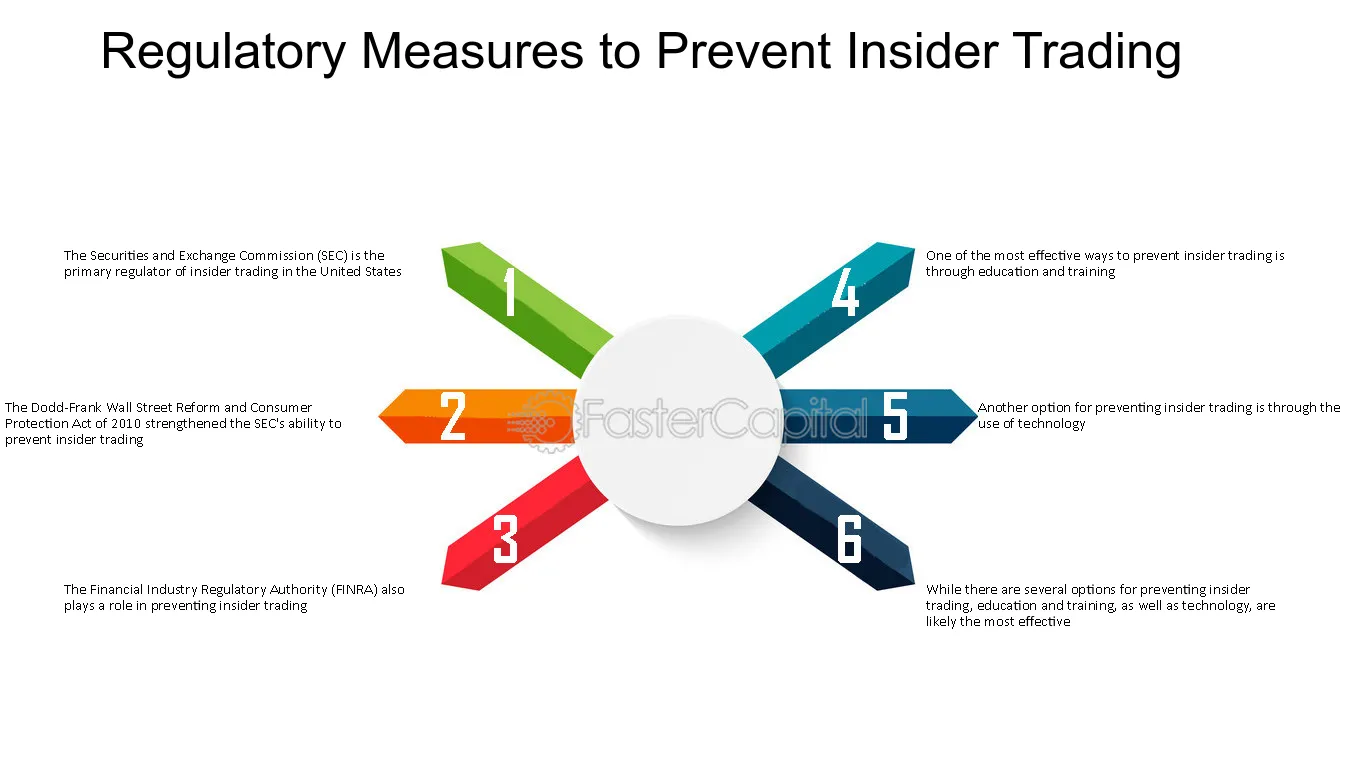

How can firms prevent insider trading within their organization?

Firms can prevent insider trading by enforcing strict confidentiality policies, conducting regular compliance training, and monitoring employee trading activity. Implementing robust internal controls, such as blackout periods before earnings releases, helps restrict sensitive information access. Establishing clear reporting channels for suspicious behavior and swift disciplinary actions deter misconduct. Using technology like trade surveillance software detects unusual trading patterns. Cultivating a culture of ethics and transparency encourages employees to report concerns without fear.

What are the differences between legal and illegal trading strategies?

Legal trading strategies follow regulations, use public information, and avoid deception. Illegal trading, like insider trading, exploits confidential information for unfair gains. Legal strategies rely on analysis and market trends, while illegal ones manipulate or misuse private info to profit unfairly.

How does insider trading impact market liquidity?

Insider trading reduces market liquidity by creating uncertainty and mistrust among investors. When traders suspect unfair advantages, they pull back, making it harder to buy or sell assets without affecting prices. This decrease in liquidity leads to wider bid-ask spreads and less efficient markets, discouraging honest traders from participating. Ultimately, insider trading damages market fairness and hampers healthy trading strategies.

Learn about Impact of Insider Trading Scandals on Market Confidence

What is the historical impact of insider trading scandals?

Insider trading scandals have eroded trust in financial markets, highlighting vulnerabilities in market fairness. They prompted stricter regulations, like the SEC’s enforcement actions, to deter illegal trading. These scandals led to increased transparency requirements and reinforced the need for ethical trading strategies. They also changed how investors perceive market integrity, influencing trading behaviors and risk management approaches.

How do international markets handle insider trading?

International markets handle insider trading through strict laws, regulatory agencies, and enforcement. Countries like the U.S. have the SEC, which prosecutes insider trading aggressively. Other nations, such as the UK’s FCA or Australia’s ASIC, impose heavy fines, criminal charges, and jail time. Markets also use surveillance technology to detect suspicious trades and insider activity. Penalties aim to deter misconduct and maintain fairness, ensuring that all traders compete on equal footing.

How does insider trading influence market volatility?

Insider trading increases market volatility by causing unpredictable price swings. When insiders trade on confidential info, it creates sudden, sharp movements in stock prices, eroding market stability. Investors lose confidence, leading to more cautious trading and wider bid-ask spreads. This unpredictability discourages regular traders, amplifying price fluctuations and reducing overall market fairness.

What are the challenges in prosecuting insider trading cases?

Prosecuting insider trading is tough because proving illegal intent requires clear evidence of confidential information being traded on. Traders often use complex, anonymous networks to hide their activities. Gathering direct proof of inside knowledge is difficult, as traders may rely on subtle hints or mislead investigators. The high legal standard for conviction—showing beyond a reasonable doubt—adds to the challenge. Additionally, distinguishing between aggressive but legal trading strategies and illegal insider trading can be blurry, making enforcement tricky.

Conclusion about The Impact of Insider Trading on Market Fairness and Trading Strategies

Insider trading significantly undermines market fairness, leading to distorted prices and eroding investor confidence. Legal consequences are severe, and regulators employ various methods to detect and prevent such activities. For traders, understanding the implications of insider trading is crucial for developing effective strategies and maintaining ethical standards. Small investors often bear the brunt of these unfair practices, highlighting the need for vigilance and education. By leveraging technology and data analysis, firms can mitigate risks associated with insider trading. Ultimately, a comprehensive grasp of these issues is essential for navigating today’s complex trading landscape, making resources like DayTradingBusiness invaluable for traders seeking to enhance their knowledge and strategies.

Learn about Impact of Insider Trading Scandals on Market Confidence

Sources:

- Insider trading regulation and trader migration - ScienceDirect

- The impact of insider trading laws on dividend payout policy ...

- Capital-market effects of tipper-tippee insider trading law: Evidence ...

- Advance disclosure of insider transactions: Empirical evidence from ...

- Strategic insider trading and its consequences for outsiders ...