Did you know that some day traders can turn their profits into enough money to buy a small island? While that sounds appealing, navigating the fine print in prop firm agreements is crucial for success. In this article, we break down the essential terms you need to know, including profit sharing, capital allocation, and risk management rules. We also explore how trading performance is evaluated, minimum trading volumes, and fee structures. Additionally, we cover important aspects like contract duration, payment terms, and dispute resolution processes. Whether you're just starting or looking to refine your understanding, this guide by DayTradingBusiness will equip you with the knowledge to make informed decisions in the world of prop trading.

What Are the Key Terms in Prop Firm Day Trading Agreements?

Key terms in prop firm day trading agreements include profit split percentage, trading capital limits, drawdown and loss limits, trading style restrictions, reporting and verification procedures, and termination conditions.

How Do Profit Sharing Terms Work in Prop Trading Firms?

Profit sharing in prop trading firms typically splits the trader’s earnings based on a fixed percentage, often 50/50 or 60/40, after deducting fees. Traders keep a portion of the profits they generate, but the firm usually takes a cut for providing capital, training, and infrastructure. The split can vary depending on experience, performance, and the firm’s policies. Some firms have tiered profit splits, rewarding top traders with higher percentages as they hit targets. Profit sharing terms are outlined clearly in the trading agreement, specifying how profits are calculated, when payouts occur, and any additional fees or conditions.

What Is the Typical Capital Allocation in Prop Firm Agreements?

Prop firm agreements usually allocate around 70-80% of profits to traders, with firms keeping 20-30%. They often provide an initial trading capital ranging from $50,000 to $500,000, depending on the firm. Most agreements specify a profit split percentage, risk management rules, and performance targets. Traders might pay a fee for training or evaluation, but the core capital is shared based on the agreed profit split.

What Are the Risk Management Rules in Prop Trading Contracts?

Risk management rules in prop trading contracts typically include strict position size limits, daily loss caps, and maximum drawdown thresholds to prevent excessive losses. Traders must adhere to predefined stop-loss levels and risk only a small percentage of their capital per trade, often 1-2%. Some agreements require real-time monitoring and immediate exit if losses hit specified limits. Additionally, traders may need to follow specific trading hours and avoid over-leveraging to protect firm capital.

How Is the Trading Performance Evaluated by Prop Firms?

Prop firms evaluate trading performance mainly through profit targets, consistency, risk management, and adherence to trading plans. They look at your ability to generate steady returns without excessive drawdowns. Metrics like maximum drawdown, win rate, and average profit per trade are key. They also review your discipline in following the firm’s risk limits and trading rules. If you meet their profit goals while managing risk, your trading performance is considered strong.

What Are the Common Fee Structures in Prop Firm Agreements?

Common fee structures in prop firm agreements include a one-time account setup fee, a monthly platform fee, and a profit split percentage. Some firms charge a challenge or evaluation fee for testing your trading skills before funding you. There may also be a performance fee if you hit certain profit targets. Overall, expect a combination of upfront costs and ongoing fees tied to your trading performance.

What Is the Minimum Trading Volume Required by Prop Firms?

Most prop firms require a minimum trading volume of around $10,000 to $50,000 per month. Some firms specify a minimum number of trades or daily trading targets, often around $1,000 to $5,000 daily. Meeting these volume requirements demonstrates consistent activity and helps qualify for funding or profit splits.

How Do Prop Firms Handle Drawdowns and Loss Limits?

Prop firms set specific drawdown limits, usually a percentage of the trading account, to prevent excessive losses. When a trader hits this limit, they’re often forced to stop trading or face account suspension. Loss limits are strict, and if exceeded, the trader may lose their trading privileges or face penalties. Firms monitor trades constantly and enforce these limits to manage risk and protect capital.

What Are the Contract Duration and Renewal Terms?

Contract durations in day trading prop firm agreements typically range from 6 to 12 months. Renewal terms usually involve automatic renewal unless either party gives notice 30 to 60 days before the end date. Some firms allow renegotiation or extension, while others require a new agreement. Always check specific firm policies for precise durations and renewal conditions.

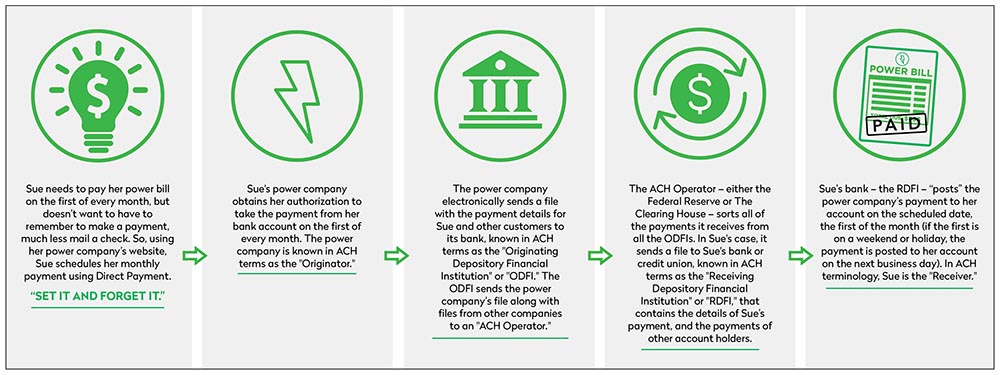

What Are the Payment Terms and Payout Schedules?

Payment terms typically specify how and when traders receive payouts, often on a weekly or monthly basis. Payout schedules usually depend on achieving profit targets, passing evaluation phases, and meeting risk management rules. Some prop firms pay immediately after successful trading periods, while others have a set schedule, like the last day of each month. Always check if payouts are based on gross profit, net profit, or a share split.

How Do Prop Firms Define Trading Restrictions and Allowed Strategies?

Prop firms define trading restrictions by specifying which securities, instruments, or markets you can trade, often excluding options, futures, or highly volatile assets. Allowed strategies typically include scalping, momentum trading, or swing trading, but they usually ban strategies like news trading or arbitrage. They set limits on position sizes, leverage, and holding periods to manage risk. Violating these rules can lead to penalties or account termination.

Learn about How Do Prop Firms Affect Day Trading Strategies?

What Are the Terms for Account Termination or Suspension?

Common terms for account termination or suspension in day trading prop firm agreements include violations of trading rules, risk limits exceeded, unauthorized trading, or failure to meet performance targets. The firm may also suspend or terminate accounts if there’s suspicious activity or breach of the agreement’s compliance policies. Usually, they reserve the right to close accounts immediately without prior notice if these conditions occur.

How Do Prop Firms Address Intellectual Property and Trading Strategies?

Prop firms usually claim ownership of trading strategies developed during their programs, requiring traders to sign agreements that specify IP rights. They often include clauses that prevent traders from sharing proprietary strategies outside the firm. Some firms may allow traders to retain rights if they develop strategies independently, but most enforce confidentiality to protect their IP. Trading strategies created using firm resources are typically considered the firm’s property.

Learn about How Do Prop Firms Affect Day Trading Strategies?

What Are the Confidentiality and Non-Compete Clauses?

Confidentiality clauses in day trading prop firm agreements prevent you from sharing proprietary strategies or firm info. Non-compete clauses restrict you from working with or starting competing firms during and after your contract, usually for a set period. Both clauses protect the firm's business secrets and market position, ensuring your actions don’t harm their interests.

What Are the Dispute Resolution Processes in Prop Agreements?

Dispute resolution in prop firm agreements usually involves arbitration or mediation. Arbitration is common, requiring disputes to be settled by a neutral third party outside court. Mediation involves a mediator helping both sides reach an agreement voluntarily. Some agreements specify jurisdiction clauses, meaning disputes are handled in specific courts. Always check if the contract includes escalation procedures or dispute resolution clauses before signing.

How Do Prop Firms Verify Trader Identity and Background?

Prop firms verify trader identity through government-issued ID, proof of address, and sometimes biometric checks. They may also run background checks, review trading experience, and ask for financial statements. Some firms use video verification or live interviews to confirm the trader's identity and background.

What Are the Training and Support Options Provided?

Training options often include onboarding webinars, video tutorials, and mentorship programs. Support usually involves dedicated account managers, customer service teams, and trading platform assistance. Some firms offer ongoing education like live coaching, trading workshops, or access to trading communities.

How Are Violations of the Agreement Handled?

Violations of the agreement usually lead to immediate account suspension or termination. The prop firm may revoke profits, restrict trading privileges, or impose penalties. Repeated breaches can result in permanent bans and loss of funding. Some firms may require remediation or a corrective action plan before restoring access.

Conclusion about What Are the Common Terms in Day Trading Prop Firm Agreements?

Understanding the key terms in day trading prop firm agreements is essential for any trader looking to navigate the complexities of this business. From profit-sharing structures to risk management rules, each aspect plays a vital role in shaping your trading experience. Familiarizing yourself with these terms will not only enhance your trading strategy but also ensure you make informed decisions. For comprehensive insights and support on trading agreements and more, DayTradingBusiness is here to help you succeed in your trading journey.

Learn about Using Prop Firm Capital to Scale Your Day Trading Operations

Sources:

- A Profitable Day Trading Strategy For The U.S. Equity Market by ...

- Doing Business 2020: Comparing Business Regulation in 190 ...

- Do Proprietary Traders Provide Liquidity?

- What are Sales and Trading Professionals? | CFA Institute

- Firm-Level Risk Exposures and Stock Returns in the Wake of COVID ...

- Trading and Capital-Markets Activities Manual | Federal Reserve ...