Did you know that the bid-ask spread is often compared to the gap in a bad marriage? It can be a significant source of friction in trading! In this article, we delve into the essential concept of market microstructure in day trading. We explore how it shapes trading strategies, the importance of bid-ask spreads, and the impact of order types on market dynamics. Additionally, we discuss how liquidity and volume influence decision-making, the role of price volatility, and the effects of order flow on trade execution. Understanding these components is crucial for traders, and we’ll also touch on the significance of transparency and the implications of trading algorithms and high-frequency trading. By mastering these concepts, day traders can enhance their trade timing and navigate common microstructure challenges more effectively. Join us at DayTradingBusiness as we unpack these vital insights!

What is market microstructure in day trading?

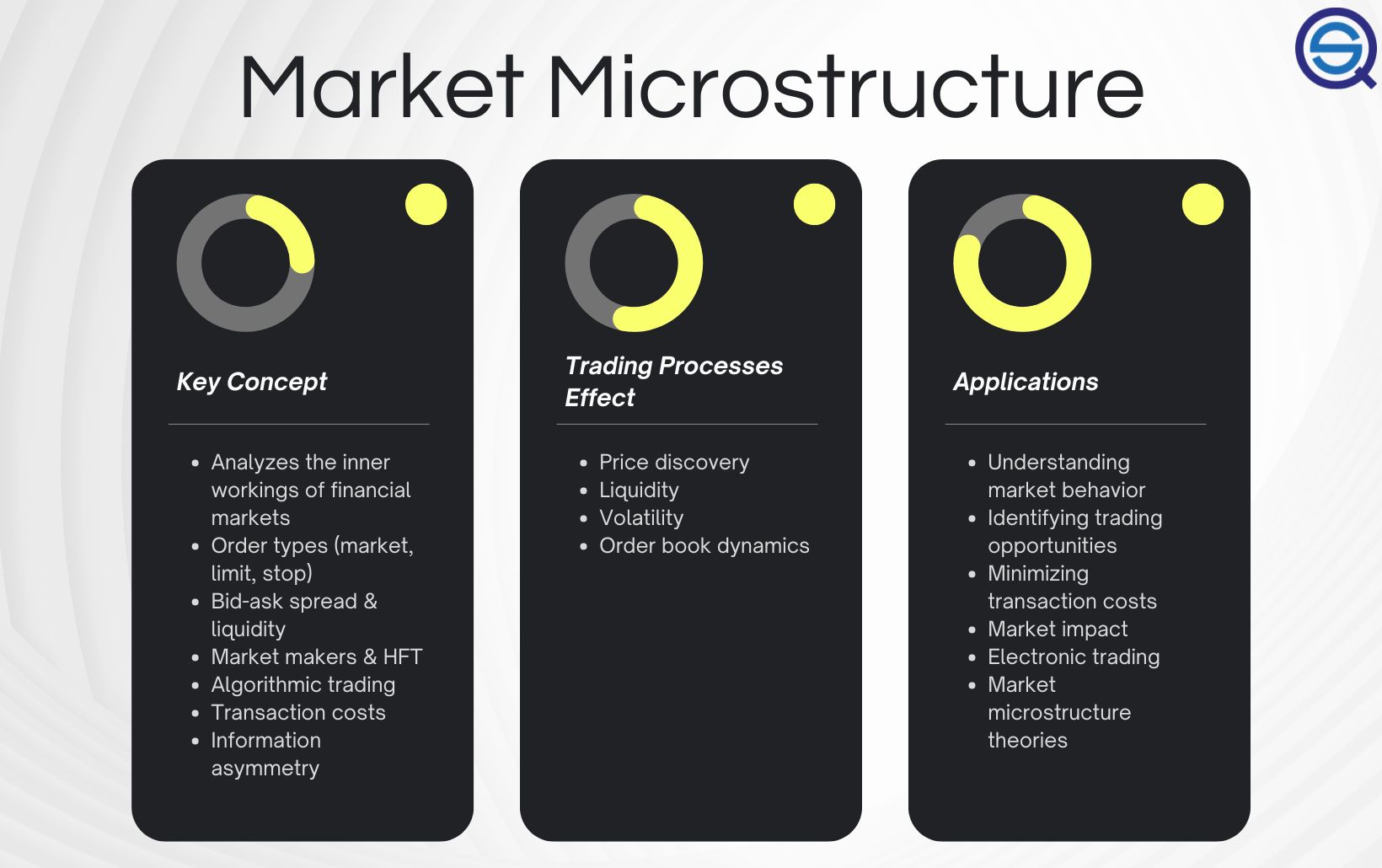

Market microstructure in day trading refers to the way financial markets operate at a granular level, focusing on the processes and mechanisms behind trade execution, order flow, bid-ask spreads, and price formation. It involves understanding how orders are processed, how liquidity is provided, and how these factors influence short-term price movements. Day traders analyze market microstructure to optimize entry and exit points, minimize costs, and anticipate price swings caused by order book dynamics.

How does market microstructure affect day trading strategies?

Market microstructure influences day trading by shaping how quickly and efficiently trades execute, impacting bid-ask spreads, order types, and price movements. It determines the depth of liquidity and how information is reflected in prices, affecting entry and exit points. Traders rely on microstructure insights to time trades, avoid slippage, and manage risks effectively. For example, understanding order flow and market depth helps day traders anticipate short-term price changes and execute rapid trades with precision.

Why is understanding bid-ask spreads important in day trading?

Understanding bid-ask spreads is crucial in day trading because it affects transaction costs and speed of execution. A narrow spread means lower costs and quicker trades, while a wide spread can eat into profits or delay entries and exits. Knowing how spreads fluctuate helps traders avoid costly trades during illiquid times and optimize timing for better gains. It also reveals market liquidity and volatility, key factors in making informed, fast decisions in day trading.

What role do order types play in market microstructure?

Order types shape how trades are executed, affecting liquidity, price discovery, and market efficiency. They determine the timing, priority, and price at which trades happen, influencing bid-ask spreads and volatility. In day trading, understanding order types helps traders navigate market microstructure to execute strategies effectively and avoid adverse selection.

How do liquidity and volume impact day trading decisions?

Liquidity and volume are crucial in day trading because high liquidity lets you enter and exit positions quickly without big price shifts, reducing slippage. Higher volume confirms stronger market interest, making price moves more reliable and easier to predict. Low liquidity or volume can cause unpredictable swings, increasing risk and making it harder to execute trades at desired prices. Traders prefer markets with ample liquidity and volume to ensure smoother, more confident trades.

What are the key components of market microstructure?

The key components of market microstructure are bid-ask spreads, order types, order flow, trading venues, price formation, and information asymmetry. These elements shape how trades are executed, how prices are set, and how information impacts market behavior in day trading.

How does market microstructure influence price volatility?

Market microstructure affects price volatility by determining how bid-ask spreads, order flow, and trading mechanisms create short-term price fluctuations. Wide spreads, low liquidity, or sudden order imbalances can cause sharp price swings. The way trades are executed—whether through electronic platforms or manual trading—also impacts how quickly and erratically prices move. In day trading, understanding microstructure helps predict when prices might jump due to order book changes or sudden liquidity shifts.

What is the effect of order flow on day trading?

Order flow directly impacts day trading by revealing the buying and selling pressure in the market. Heavy buy orders can push prices up, while selling pressure can drag prices down. Day traders analyze order flow to anticipate short-term price movements and spot quick trading opportunities. It provides insight into market sentiment, helping traders execute timely entries and exits. Understanding order flow allows day traders to gauge liquidity and the likelihood of price swings, making their strategies more precise.

How do bid-ask dynamics impact trade execution?

Bid-ask dynamics determine the price at which you can buy or sell quickly. Tight spreads mean faster, cheaper trades; wide spreads cause delays and higher costs. When the bid–ask spread narrows, execution is smoother and more predictable. Large spreads can lead to slippage, making your trades less precise. So, in day trading, understanding bid-ask behavior helps you time entries and exits better, reducing costs and improving execution quality.

Why is transparency in market microstructure crucial for traders?

Transparency in market microstructure ensures traders get accurate, timely information about bid-ask spreads, order flow, and liquidity. It helps them spot genuine price movements, avoid hidden costs, and execute trades efficiently. Without transparency, traders risk making decisions based on incomplete or manipulated data, leading to losses. Clear market microstructure details build trust, reduce uncertainty, and enable better risk management in day trading.

How do trading algorithms interact with market microstructure?

Trading algorithms interact with market microstructure by analyzing bid-ask spreads, order book depth, and trade timing to optimize entry and exit points. They detect patterns in order flow, liquidity, and price movements, allowing rapid execution that leverages micro-level market features. Algorithms adapt to microstructure variations like quote updates and trade speed, enabling high-frequency trading and arbitrage within the market’s granular framework.

What are common microstructure issues faced by day traders?

Common microstructure issues faced by day traders include bid-ask spread fluctuations, order book depth changes, slippage during rapid trades, and unpredictable price movements caused by high-frequency trading. These issues can lead to increased transaction costs, execution delays, and difficulty in predicting short-term price action.

How can understanding microstructure improve trade timing?

Understanding microstructure helps day traders identify the best moments to buy or sell by revealing how order flow, bid-ask spreads, and price movements work in real-time. It shows when liquidity is high or low, allowing traders to avoid slippage and execute trades at optimal prices. Recognizing patterns like order book imbalances or rapid price changes helps time entries and exits precisely. This knowledge reduces guesswork, sharpens decision-making, and boosts the chances of quick profits in fast-moving markets.

What is the impact of high-frequency trading on microstructure?

High-frequency trading (HFT) increases market microstructure liquidity and reduces bid-ask spreads, making trading more efficient. It accelerates order flow, sharpens price discovery, and adds depth to order books. However, HFT can also cause increased short-term volatility and lead to flash crashes, impacting market stability. It changes the dynamics of order placement, execution speed, and information asymmetry in day trading.

How do market makers influence day trading environments?

Market makers influence day trading environments by providing liquidity and stabilizing prices through continuous bid-ask quotes. They help ensure traders can buy or sell quickly without causing large price swings. Their activity narrows spreads, making trades cheaper and more efficient. This liquidity encourages faster execution and tighter margins, vital for day traders aiming for quick profits. Their presence also reduces volatility spikes, creating a more predictable trading environment.

Learn about How Do Market Makers and Liquidity Providers Affect Day Trading?

Conclusion about What Is Market Microstructure in Day Trading?

In conclusion, grasping the nuances of market microstructure is vital for effective day trading. Understanding factors such as bid-ask spreads, order types, and liquidity can significantly enhance your trading strategies and execution. By recognizing the influence of order flow and price volatility, traders can make more informed decisions. Ultimately, a solid foundation in these concepts not only improves trade timing but also helps navigate common microstructure challenges. For those looking to elevate their trading skills, insights from DayTradingBusiness can provide the necessary guidance to thrive in today's dynamic market environment.

Learn about What Are Market Microstructure and Its Impact on Day Trading?

Sources:

- Market Microstructure - an overview | ScienceDirect Topics

- Intraday Trading Invariance in the E-Mini S&P 500 Futures Market by ...

- Intraday trading patterns in an intelligent autonomous agent-based ...

- Market Microstructure - ScienceDirect

- Market microstructure and price discovery on the Tokyo Stock ...