Did you know that the speed of light is outpaced by the speed of today's high-frequency trading systems? In the fast-paced world of trading, execution speed plays a crucial role in market microstructure. This article delves into why swift trade execution is vital, exploring its impact on trading costs, risks associated with delays, and its influence on market liquidity and price discovery. We’ll also discuss the role of technology in enhancing execution speed, the challenges traders face, and the significance of executing trades quickly during volatile market conditions. Discover how traders can optimize their systems for efficiency and stay ahead in the game with insights from DayTradingBusiness.

Why is trade execution speed important in market microstructure?

Trade execution speed is crucial in market microstructure because it affects price accuracy and liquidity. Faster execution reduces slippage, ensuring traders get the best possible prices. It also minimizes the risk of adverse price movements during order processing. In volatile markets, quick execution can mean the difference between a profitable trade and a loss. Overall, speed enhances market efficiency and helps maintain fair, transparent trading environments.

How does execution speed impact trading costs?

Faster execution reduces slippage and minimizes price changes during a trade, lowering overall trading costs. Slow execution can lead to worse prices, increased spread costs, and missed opportunities, raising the total expense. Quick trades ensure you get closer to your intended price, saving money, especially in volatile markets.

What are the risks of slow trade execution?

Slow trade execution increases the risk of price changes between order placement and fill, leading to higher transaction costs. It can cause missed trading opportunities if prices move unfavorably during delays. Slow execution also raises the chance of partial fills or order rejection, impacting strategy effectiveness. In volatile markets, delays can result in slipping away from optimal entry or exit points, reducing profitability. Overall, sluggish trade execution hampers precision, increases slippage, and can erode trading performance.

How does fast execution affect market liquidity?

Fast execution boosts market liquidity by allowing traders to buy and sell quickly without causing large price swings. It reduces order book gaps and slippage, encouraging more active trading. When trades execute instantly, market participants gain confidence, leading to tighter spreads and deeper liquidity pools. Conversely, slow execution can cause order cancellations and hesitation, shrinking liquidity and increasing volatility.

Why do high-frequency traders prioritize quick execution?

High-frequency traders prioritize quick execution to capitalize on fleeting price movements and arbitrage opportunities before they vanish. Rapid trades allow them to stay ahead of slower market participants, reduce exposure to market risk, and lock in small, frequent profits that add up over milliseconds. Speed gives them a competitive edge in the fast-paced microstructure of modern markets, where even milliseconds matter.

How does execution speed influence price discovery?

Faster execution speed enables traders to react quickly to market changes, reducing slippage and capturing more accurate prices. It sharpens the price discovery process by reflecting new information in real-time, leading to more efficient market prices. When execution is slow, prices lag behind actual supply and demand, causing inefficiencies and wider bid-ask spreads. Quick trades help markets incorporate information faster, aligning prices closer to true value. Overall, higher execution speed accelerates and refines price discovery, making markets more transparent and efficient.

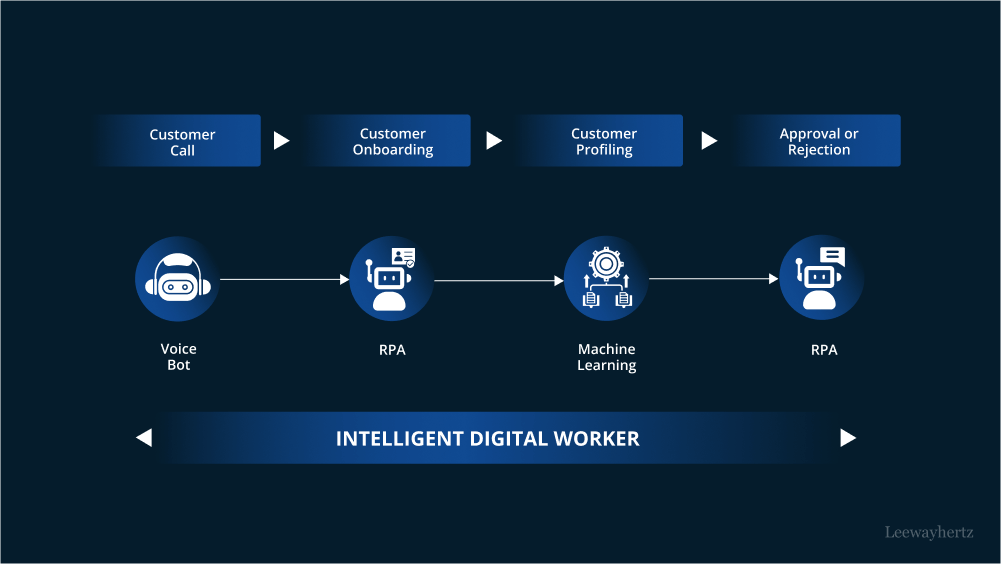

What role does technology play in improving trade execution speed?

Technology accelerates trade execution by automating order placement, reducing latency, and enabling real-time market data analysis. High-speed connectivity, algorithmic trading, and advanced platforms cut delays, letting traders react instantly to market changes. This boosts efficiency, minimizes slippage, and ensures orders fill at desired prices, critical in fast-moving markets.

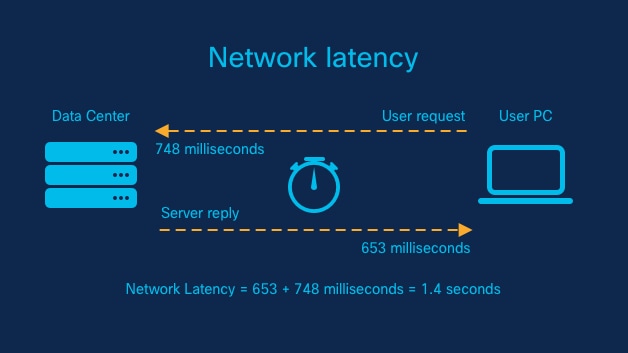

How do latency and network delays impact trading performance?

Latency and network delays slow down trade execution, causing traders to miss optimal prices or enter unfavorable positions. High latency increases the chance of price changes before a trade completes, leading to slippage and reduced gains. In high-frequency trading, even milliseconds matter—delays can erode profit margins and make strategies less effective. Faster execution ensures trades happen closer to real-time market prices, boosting overall trading performance.

What are the advantages of low-latency trading systems?

Low-latency trading systems enable faster trade execution, capturing fleeting market opportunities before others. They reduce the risk of slippage and improve order accuracy. Faster systems allow traders to react instantly to market news, leading to better profit margins. They help avoid missed trades caused by delays, especially in volatile markets. Overall, low latency gives a competitive edge by ensuring trades are executed at the desired price and time.

How does trade speed affect market stability?

Faster trade speed reduces price volatility by enabling quick, accurate order matching, which stabilizes markets. Quick execution minimizes order book imbalances and prevents sudden price swings caused by delayed trades. When trades execute rapidly, it improves liquidity and confidence, making markets less prone to flash crashes. Slow trade speed can lead to erratic price movements, increased spreads, and decreased market stability due to delayed reactions and uncertainty.

What are the challenges in achieving fast trade execution?

Challenges in achieving fast trade execution include network latency, order processing delays, market volatility causing rapid price changes, limited liquidity, and technology infrastructure bottlenecks. These factors can slow down order matching and increase the risk of slippage, making quick execution difficult.

How does order type influence execution speed?

Order type directly impacts execution speed by determining how quickly your trade is processed. Market orders execute instantly because they fill at the current best price, while limit orders may take longer or not fill at all, depending on market conditions. Stop orders activate only when a certain price is reached, causing delays until that point. The complexity and priority rules associated with each order type influence how fast your trade gets executed in the market microstructure.

Why is execution speed critical during high volatility?

Execution speed is critical during high volatility because market conditions change rapidly, and delays can cause orders to be filled at unfavorable prices or missed entirely. Fast execution ensures traders capitalize on quick price movements, avoid slippage, and maintain a competitive edge. In microstructure, even milliseconds matter; slow trades can turn profitable strategies into losses, especially when prices swing unpredictably.

How do exchanges and trading platforms differ in speed?

Exchanges typically process trades faster than trading platforms because they have dedicated infrastructure and direct market access, reducing latency. Trading platforms rely on external connections and software layers, which add delays. For high-frequency traders, even milliseconds matter, making exchange speed crucial. Platforms often introduce slight delays due to order routing and interface processing, while exchanges prioritize rapid execution to attract traders.

What regulations exist around trade execution speed?

Regulations on trade execution speed mainly target market fairness and stability, often through rules like the Regulation National Market System (Reg NMS) in the US, which promotes best execution and transparency. High-frequency trading firms must comply with rules that prevent manipulative practices and ensure fair access, such as the SEC's Regulation SCI, which mandates robust infrastructure and risk controls to support rapid trade execution. Some exchanges impose minimum order resting times or throttling measures to slow ultra-fast trading. Overall, regulations aim to prevent unfair advantages from ultra-low latency trading and protect market integrity.

How can traders optimize their systems for faster execution?

Traders can optimize their systems for faster execution by upgrading to low-latency hardware, using direct market access (DMA), and implementing co-location near exchange servers. Streamlining algorithms, reducing order processing steps, and optimizing network connections also cut delays. Using real-time data feeds and staying updated on exchange protocols helps traders react instantly. Automating order strategies and minimizing manual inputs further speed up trade execution.

Conclusion about The Significance of Trade Execution Speed in Microstructure

In summary, trade execution speed is a crucial element of market microstructure that significantly impacts trading costs, market liquidity, and overall trading performance. Slow execution can lead to increased risks and inefficiencies, while fast execution enhances price discovery and market stability. To succeed in today's fast-paced trading environment, leveraging advanced technology and understanding the nuances of execution speed is essential. For traders looking to optimize their strategies and systems, DayTradingBusiness offers valuable insights and resources to navigate these complexities effectively.