Did you know that the bid-ask spread is often wider than a toddler's tantrum? Understanding market microstructure is crucial for grasping how trading conditions influence price volatility. This article delves into the intricate relationship between market microstructure and volatility, covering essential topics such as the impact of bid-ask spreads, order types, and liquidity. We'll also explore the role of market makers, information asymmetry, and the effects of high-frequency trading on stability. With insights from DayTradingBusiness, you'll discover how knowledge of microstructure can enhance your trading strategies and mitigate risks in both emerging and developed markets. Get ready to dive into the complex world of market dynamics!

What is market microstructure?

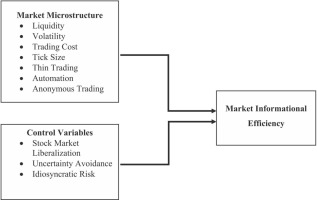

Market microstructure is the study of how trading mechanisms, order flows, and market design influence price formation and liquidity. It examines how bid-ask spreads, order types, and trading protocols affect market efficiency. In relation to volatility, market microstructure impacts how quickly and smoothly prices adjust to new information, with certain structures either dampening or amplifying price swings. High transaction costs or illiquid markets can increase short-term volatility, while well-designed markets promote stability.

How does market microstructure influence price volatility?

Market microstructure affects price volatility by shaping how trades occur, bid-ask spreads, and order book depth. Narrow spreads and deep liquidity reduce volatility, while wide spreads and thin order books increase it. High-frequency trading and order flow dynamics can cause rapid price swings. The design of trading mechanisms, like auction rules and market makers, also influences how quickly prices react to new information. Overall, microstructure determines the efficiency of price discovery and the stability of prices.

Why do bid-ask spreads affect market volatility?

Bid-ask spreads influence market volatility because wider spreads increase trading costs, discourage quick trades, and reduce liquidity. When spreads widen, prices can move more sharply as traders react to larger transaction costs, causing bigger price swings. Narrow spreads typically mean more frequent, smaller trades, stabilizing prices. Conversely, wider spreads create uncertainty and amplify price fluctuations, making the market more volatile.

How do order types impact market stability?

Order types influence market stability by affecting liquidity and price movements. Limit orders add stability by providing a predictable supply and demand, reducing sudden swings. Market orders can cause volatility because they execute immediately, often at less favorable prices, especially in thin markets. Stop-loss orders can trigger rapid price drops or spikes when activated, amplifying volatility. Overall, the mix of order types shapes how smoothly markets absorb shocks and manage price fluctuations.

What role does liquidity play in market microstructure?

Liquidity determines how easily assets can be bought or sold without affecting prices, directly impacting market stability and microstructure efficiency. High liquidity reduces bid-ask spreads and minimizes price jumps, leading to smoother trading and less volatility. Low liquidity causes wider spreads and price swings, increasing market microstructure noise and volatility. It influences order flow, price discovery, and the ability of traders to execute large trades without disrupting the market.

How do trading volume and frequency relate to volatility?

Higher trading volume and frequency usually reduce volatility because they add liquidity, making it easier to buy and sell without big price swings. Conversely, low volume and infrequent trades can increase volatility, as fewer transactions cause larger price jumps. Active markets with consistent trading dampen sharp price moves, while thin markets with sporadic trades often see exaggerated volatility.

Can market microstructure explain sudden price swings?

Yes, market microstructure can explain sudden price swings. Liquidity gaps, order flow shocks, and bid-ask spread widenings create rapid price movements. Hidden orders or algorithmic trading can amplify these effects. Microstructure dynamics directly influence short-term volatility, causing abrupt market changes.

How do market makers affect volatility levels?

Market makers influence volatility by providing liquidity, which stabilizes prices during normal trading. When they withdraw or reduce their activity, volatility spikes as fewer traders can execute large orders without impacting the price. Their continuous bid-ask spreads help dampen sudden price swings, but if they tighten spreads or exit the market, volatility increases sharply. Essentially, active market makers smooth out price fluctuations, lowering volatility; their absence or reduced presence causes more pronounced swings.

What is the impact of information asymmetry on volatility?

Information asymmetry increases market volatility by creating uncertainty and uneven pricing. When some traders have better information than others, it leads to unpredictable price swings as the informed trade on their knowledge, causing larger and more frequent fluctuations. This imbalance makes markets less stable, amplifies short-term price movements, and raises the risk of sudden crashes or spikes.

How do market regulations influence microstructure and volatility?

Market regulations impact microstructure by controlling order flow, trading hours, and transparency, which shapes liquidity and price discovery. Stricter rules can reduce high-frequency trading and short-term speculation, lowering volatility. Conversely, relaxed regulations may increase rapid trading and information asymmetry, boosting volatility. Regulations also influence bid-ask spreads and market depth, affecting how prices react to new information, thus directly shaping microstructure and volatility levels.

What are the effects of high-frequency trading on market stability?

High-frequency trading increases short-term market volatility by rapid order placement and cancellation, causing sudden price swings. It can amplify market instability during crises when algorithms react unpredictably. However, it also improves liquidity and price efficiency, which can stabilize markets over the long term. Overall, high-frequency trading can both destabilize and stabilize markets depending on the context.

How does order flow imbalance cause volatility changes?

Order flow imbalance causes volatility changes by creating sudden supply and demand shifts. When buy orders outpace sell orders, prices jump quickly; the opposite happens with excess sell orders. These imbalances disrupt normal trading patterns, leading to larger price swings. High order flow imbalance indicates less liquidity and more uncertainty, increasing short-term volatility. Conversely, balanced order flow stabilizes prices, reducing volatility.

In what ways does market depth affect price fluctuations?

Market depth influences price fluctuations by determining how easily large trades move prices. Thin order books mean fewer buy and sell orders, so even small trades cause big swings. Deep markets absorb large orders smoothly, reducing sudden price jumps. Shallow depth increases volatility because limited liquidity amplifies price changes during trading. When market depth varies, prices become more unpredictable, especially in volatile conditions or during news events.

How do transaction costs relate to market volatility?

Higher transaction costs can increase market volatility by discouraging quick trades, which reduces liquidity and makes prices more sensitive to large trades or news. When transaction costs rise, traders hesitate, leading to wider bid-ask spreads and less frequent trades, amplifying price swings. Conversely, low transaction costs encourage active trading, smoothing out prices and decreasing volatility. In market microstructure, elevated transaction costs often reflect or cause instability, making markets more reactive to shocks.

What is the connection between microstructure noise and volatility?

Microstructure noise causes short-term price fluctuations that inflate observed volatility. It reflects bid-ask bounce, order flow, and trading frictions, making volatility appear higher than the true underlying level. When microstructure noise is high, apparent market volatility increases, but this doesn’t necessarily mean the actual asset risk is rising.

How can understanding microstructure improve volatility forecasting?

Understanding microstructure reveals how order flow, bid-ask spreads, and liquidity impact short-term price movements, leading to more accurate volatility forecasts. It helps identify how market frictions and trader behaviors drive price swings, enabling better prediction models. Recognizing micro-level trading dynamics allows traders to anticipate sudden volatility spikes, improving risk management.

What are the risks of poor market microstructure on investors?

Poor market microstructure increases bid-ask spreads, reduces liquidity, and heightens price volatility, making it harder for investors to execute trades at fair prices. It can cause sudden price swings, leading to higher trading costs and increased risk of losses. Investors face greater exposure to market manipulation and information asymmetry, which undermines fair price discovery. Overall, these microstructure issues can lead to unpredictable returns and diminished market confidence.

How do different market structures (centralized vs decentralized) impact volatility?

Centralized markets tend to have lower volatility because they streamline order flow, reduce information asymmetry, and improve liquidity. Decentralized markets often experience higher volatility due to fragmented trading, less transparency, and increased price swings from individual trader actions. When trading is concentrated, prices stabilize more easily; when dispersed, sharp moves happen more frequently.

How does market microstructure affect emerging versus developed markets?

Market microstructure influences volatility differently in emerging and developed markets. In emerging markets, less transparent trading systems, lower liquidity, and weaker regulation lead to higher bid-ask spreads and price swings. These factors cause increased short-term volatility and susceptibility to manipulation. Developed markets have efficient trading mechanisms, deep liquidity, and stronger regulation, which reduce microstructure-induced volatility. As a result, emerging markets often experience more unpredictable price movements driven by microstructure inefficiencies, while developed markets benefit from stability due to mature trading infrastructure.

Learn about How Does Market Microstructure Affect Bid-Ask Spreads and Price Movements?

What role do technological advancements play in microstructure and volatility?

Technological advancements improve market microstructure by enabling faster trade execution, better order book transparency, and more precise data analysis. These tools can increase market efficiency but may also amplify volatility by allowing rapid reactions to news or order flow changes. High-frequency trading, driven by technology, often heightens short-term volatility, while improved microstructure helps traders better understand and manage risk.

Conclusion about The Relationship Between Market Microstructure and Volatility

In summary, understanding market microstructure is crucial for comprehending price volatility and its various influences. Factors such as bid-ask spreads, liquidity, and order types play a significant role in determining market stability. Additionally, elements like trading volume, information asymmetry, and high-frequency trading further complicate these dynamics. By grasping these concepts, traders can enhance their strategies and better forecast volatility. For those looking to deepen their trading knowledge, DayTradingBusiness provides essential insights and resources to navigate these complexities effectively.