Did you know that high-frequency trading (HFT) can execute millions of trades in the blink of an eye—faster than you can say "market volatility"? This article delves into the intricate impact of HFT on market microstructure, covering essential topics such as its effects on market liquidity, stability, and price volatility. We explore how HFT influences bid-ask spreads, market efficiency, and order book dynamics, while also addressing its risks, regulatory challenges, and potential for market manipulation. Discover the advantages HFT offers individual investors and its role in price discovery and market depth. Join DayTradingBusiness as we navigate the complex landscape of high-frequency trading and its profound implications for modern markets.

How does high-frequency trading affect market liquidity?

High-frequency trading boosts market liquidity by providing rapid buy and sell orders, narrowing bid-ask spreads, and enabling quick price adjustments. It increases trading volume, making it easier to enter or exit positions without large price impacts. However, it can also cause fleeting liquidity gaps during rapid price swings, sometimes amplifying volatility. Overall, HFT generally improves market liquidity but can introduce short-term instability.

What are the risks of high-frequency trading for market stability?

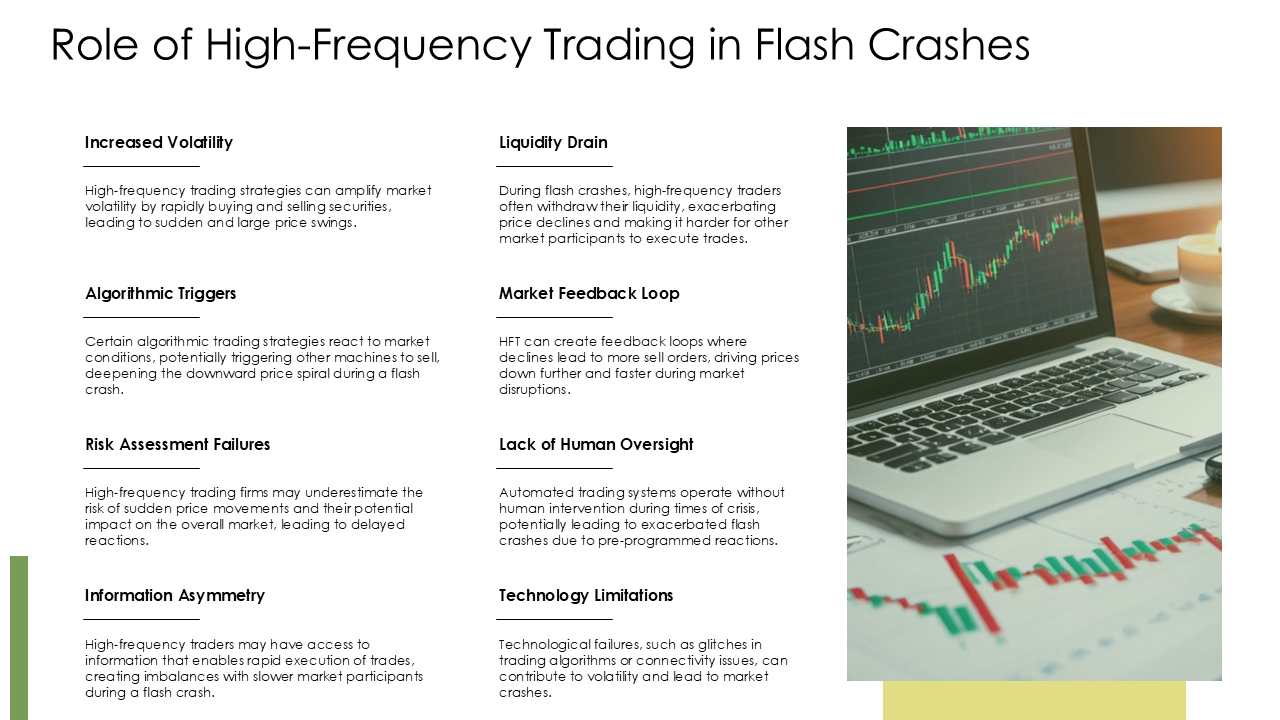

High-frequency trading increases market volatility, causes flash crashes, and can lead to sudden liquidity shortages. It can exacerbate price swings and reduce market transparency, making it harder for investors to trust fair pricing. Rapid, automated trades may trigger cascading failures, destabilizing the overall market microstructure.

How does high-frequency trading influence price volatility?

High-frequency trading increases price volatility by executing rapid trades that can cause sharp, short-term price swings. It amplifies market noise and can lead to sudden price jumps or drops, especially during moments of low liquidity. HFT algorithms react instantly to market signals, often fueling rapid price movements and reducing the stability of prices over very short periods.

What role does high-frequency trading play in market efficiency?

High-frequency trading improves market efficiency by providing liquidity and narrowing bid-ask spreads, enabling faster price discovery. It allows markets to react quickly to new information, reducing delays in reflecting asset values. HFT algorithms execute trades in milliseconds, helping smooth out price fluctuations and enhance overall market transparency. However, it can also introduce volatility and rapid price swings if not properly managed.

How do high-frequency traders impact bid-ask spreads?

High-frequency traders narrow bid-ask spreads by providing quick liquidity and tight quotes, making trading cheaper for everyone. Their rapid order placement and cancellation create more efficient markets, reducing the gap between buying and selling prices. However, they can also cause short-term volatility and occasional spikes in spreads during sudden market moves. Overall, HFT tends to improve market efficiency but adds complexity to the bid-ask dynamics.

Does high-frequency trading increase or decrease market transparency?

High-frequency trading decreases market transparency by providing faster, more complex order placements that obscure true supply and demand.

How does high-frequency trading affect order book dynamics?

High-frequency trading (HFT) sharpens order book dynamics by adding rapid, small trades that increase liquidity and narrow bid-ask spreads. It causes order book depth to fluctuate quickly, often leading to fleeting liquidity and increased order cancellations. HFT can create more efficient price discovery but also introduces short-term volatility and potential for market manipulation through strategies like quote stuffing. Overall, HFT transforms the order book into a more active, fast-moving environment, impacting how prices reflect supply and demand.

What are the advantages of high-frequency trading for individual investors?

High-frequency trading offers individual investors faster order execution, better bid-ask spreads, and increased liquidity. It can reduce trading costs and enable quick responses to market movements. However, it also introduces competition and potential market volatility.

How does high-frequency trading contribute to market manipulation risks?

High-frequency trading (HFT) increases market manipulation risks by enabling strategies like quote stuffing, spoofing, and layering. These tactics can create false signals, distort prices, and mislead other traders. HFT firms can quickly place and cancel large orders to manipulate supply and demand, triggering price movements they can exploit. The speed and automation of HFT make it easier to execute manipulative schemes before regulators can intervene.

What regulatory challenges are posed by high-frequency trading?

High-frequency trading faces regulatory challenges like ensuring fair access, preventing market manipulation such as quote stuffing and spoofing, and managing systemic risks from algorithmic errors. Regulators struggle to keep up with rapid tech advances, enforce transparency, and mitigate unfair advantages for firms with superior infrastructure. There's also pressure to curb excessive order cancellations and reduce flash crashes caused by algorithmic volatility.

How do high-frequency trading strategies impact market fairness?

High-frequency trading (HFT) can undermine market fairness by giving firms with advanced algorithms and faster technology an edge over retail investors. It can cause market manipulation, such as quote stuffing and spoofing, which distort true supply and demand signals. HFT can lead to increased market volatility and flash crashes, making markets less predictable and more susceptible to manipulation. It often results in an uneven playing field, where speed and technology outweigh genuine investing skill, eroding trust among regular traders.

Learn about How Do Dark Pools Impact Market Fairness?

What is the effect of high-frequency trading on market depth?

High-frequency trading (HFT) can improve market depth by adding more liquidity, making it easier to buy or sell large orders without impacting prices. It often narrows bid-ask spreads and increases order book density, which can lead to more efficient price discovery. However, HFT can also cause short-term volatility and fleeting liquidity, sometimes giving an illusion of depth that evaporates during market stress.

How does high-frequency trading influence price discovery?

High-frequency trading speeds up price discovery by executing rapid trades that reflect new information instantly, narrowing bid-ask spreads, and increasing market efficiency. It allows markets to incorporate data faster, making prices more accurate and responsive. However, it can also cause short-term volatility and market noise, sometimes distorting true value signals. Overall, HFT accelerates the process of reflecting information into prices but raises concerns about market stability.

Can high-frequency trading lead to flash crashes?

Yes, high-frequency trading can cause flash crashes by rapidly executing large volumes of orders that destabilize the market, leading to sudden and severe drops in asset prices.

What technological factors enable high-frequency trading to dominate markets?

Low-latency networks, advanced algorithms, powerful hardware, and colocated servers enable high-frequency trading to dominate markets. These technologies minimize execution times, allowing HFT firms to react faster than competitors. Cutting-edge data feeds and direct market access also give HFTs an edge in exploiting tiny price movements.

Conclusion about The Impact of High-Frequency Trading on Market Microstructure

In summary, high-frequency trading significantly shapes market microstructure, influencing liquidity, volatility, and efficiency while presenting both opportunities and risks for investors. Understanding these dynamics is crucial for navigating the complexities of modern trading environments. For those seeking deeper insights and strategies in this evolving landscape, DayTradingBusiness is here to guide you.

Sources:

- High frequency market microstructure - ScienceDirect

- High-Frequency Trading, Asset Pricing, and Market Microstructure ...

- The Impact of High-Frequency Trading on Volatility. Evidence from ...

- A Blessing or a Curse? The Impact of High Frequency Trading on ...

- Estimating the price impact of trades in a high-frequency ...

- Finance & Development, March 2010 - Opaque Trades