Did you know that during market turbulence, trading can feel like trying to dance on a rollercoaster? Understanding market microstructure is crucial for navigating these unpredictable environments. This article dives into the essence of microstructure in trading, exploring its impact during volatility, including key factors like order flow, bid-ask spreads, liquidity, and trading volume. We also discuss the risks associated with high-frequency trading and how traders can adapt their strategies to manage market swings effectively. With insights from DayTradingBusiness, you’ll learn how to leverage microstructure to enhance your trading performance and mitigate risks during turbulent times.

What is microstructure in trading?

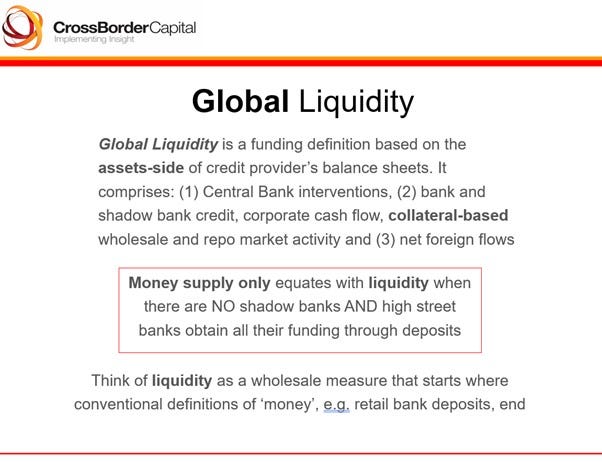

Microstructure in trading refers to how market mechanics—like bid-ask spreads, order types, and trade execution—affect price movements. It focuses on the small-scale details of how trades happen and how information is reflected in prices during volatile markets. Understanding microstructure helps traders navigate rapid price changes, avoid slippage, and improve order execution.

How does microstructure affect trading during volatility?

Microstructure determines how quickly and efficiently trades execute during volatility. During volatile markets, a tight bid-ask spread and high liquidity allow for faster, more accurate order fills. Poor microstructure, like wide spreads or low liquidity, causes slippage and higher transaction costs. It influences price discovery, making rapid price changes harder to follow and increasing risk. Traders with better microstructure access can react faster and manage volatility more effectively.

What are the key microstructure factors in volatile markets?

Key microstructure factors in volatile markets include bid-ask spreads, order book depth, price impact of trades, order flow dynamics, and liquidity availability. These elements influence how quickly prices move and how easily trades can be executed without excessive cost. Wide spreads and shallow order books increase trading costs and volatility, while rapid order flow shifts can cause sudden price swings. Managing these microstructure factors is crucial for effective trading during high volatility.

How does order flow impact microstructure during turbulence?

Order flow during turbulence increases bid-ask spread volatility and short-term liquidity fluctuations. It causes rapid changes in order book depth, leading to unpredictable price movements. High order flow variability can trigger quick shifts in market microstructure, making execution more challenging. During turbulence, order flow dynamics amplify the impact of large trades, causing increased price impact and potential slippage.

What role do bid-ask spreads play in volatile conditions?

Bid-ask spreads widen during volatile conditions, increasing trading costs and reducing liquidity. They reflect market uncertainty, making it harder to execute trades at favorable prices. Larger spreads can cause slippage, leading to less predictable fills and increased risk. Traders face higher costs and need to be more cautious, as spreads can rapidly fluctuate with market swings.

How do liquidity and depth change in volatile markets?

In volatile markets, liquidity drops because traders pull back, making it harder to buy or sell large amounts without impacting prices. Depth shrinks as order books thin out, increasing bid-ask spreads and causing prices to jump with small trades. This reduced liquidity and shallow depth lead to more unpredictable price movements and higher trading costs.

What are the risks of high-frequency trading in volatile periods?

High-frequency trading in volatile markets can cause sudden liquidity gaps, amplify price swings, and increase the risk of flash crashes. It can also lead to erroneous trades from algorithm errors or lag, worsening market instability. During rapid price moves, HFT algorithms might react too aggressively, worsening volatility and causing unpredictable market behavior.

How can traders adapt microstructure strategies during market swings?

Traders can adapt microstructure strategies during market swings by widening spreads to manage liquidity risk, reducing trade sizes to avoid slippage, and focusing on order book dynamics like bid-ask spread and depth. They should prioritize limit orders over market orders to control entry points and avoid aggressive execution during volatility. Monitoring real-time price movements and volume patterns helps identify liquidity gaps or rapid price shifts, enabling quick adjustments. Using algorithms designed for fast market conditions can also optimize execution and minimize costs.

What is the impact of market orders vs. limit orders in volatility?

Market orders execute immediately, often worsening price swings during volatility, leading to slippage and wider spreads. Limit orders, set at specific prices, help control entry and exit points but may not fill in fast-moving markets. During high volatility, market orders can exacerbate price swings, while limit orders offer better control but risk non-execution.

How do price discovery mechanisms work in turbulent markets?

Price discovery in turbulent markets relies on rapid information flow and high trading volume, which help set accurate prices despite volatility. Market makers and electronic order books adjust bid-ask spreads quickly, reflecting increased uncertainty. Traders’ willingness to buy or sell at certain prices reveals new info, pushing prices toward fair value. Order flow and trade execution speed become critical, with high-frequency trading algorithms reacting instantly to news. Market depth may thin, causing wider spreads, but continuous matching of buy and sell orders still facilitates price discovery amid chaos.

What microstructure signals indicate increased market risk?

Spreads widening and order book thinness signal increased market risk.

High bid-ask spreads suggest liquidity issues and potential price swings.

Order book depth reduction indicates lower capacity to absorb large trades, increasing volatility.

Frequent order cancellations and rapid quote changes reflect uncertain market sentiment.

Increased quote volatility and sudden spread jumps signal rising risk during volatile markets.

How do market makers' behaviors change in volatile conditions?

In volatile markets, market makers widen spreads, reduce order sizes, and increase quote updates to manage risk. They pull back from illiquid stocks, prioritize liquidity-providing actions, and become more cautious about inventory. Their bid-ask spreads expand, and they may hedge more aggressively to avoid losses. Overall, they become more cautious, aiming to preserve capital amid unpredictable price swings.

What is the effect of trading volume on microstructure during volatility?

High trading volume during volatility increases liquidity, reducing bid-ask spreads and making execution smoother. It also accelerates price discovery, leading to more accurate reflection of market info. However, it can cause increased order book volatility, triggering rapid price swings and potential market noise. Overall, elevated volume during volatility enhances microstructure efficiency but can amplify short-term trading risks.

How can understanding microstructure improve trading performance in volatile markets?

Understanding microstructure reveals how order flow, bid-ask spreads, and liquidity shifts happen during volatility. This knowledge helps traders anticipate price moves, avoid false signals, and execute trades more efficiently. Recognizing liquidity gaps or sudden spread widening allows for better timing, reducing slippage and improving entry and exit points. Overall, microstructure insights enable more informed decisions, minimizing risk and capturing opportunities amid market swings.

Learn about How Market Microstructure Insights Improve Day Trading Accuracy

What are best practices for managing microstructure risks during turbulence?

Monitor bid-ask spreads and order book depth closely to detect liquidity shifts. Use tighter stop-losses to limit exposure to sudden price swings. Avoid placing large orders that could cause market impact. Focus on high-quality, liquid assets to reduce microstructure noise. Adjust trading algorithms to account for increased bid-ask spread and spread widening. Stay alert for fast order cancellations and increased order flow volatility. Incorporate real-time microstructure analytics to identify transient liquidity issues. Maintain flexible execution strategies, like VWAP or TWAP, to minimize market impact during turbulence.

Conclusion about Microstructure Considerations for Trading During Volatile Markets

In volatile markets, understanding microstructure is essential for effective trading. Key factors such as order flow, bid-ask spreads, and liquidity directly influence trading strategies and risk management. By adapting to market signals and employing best practices, traders can navigate turbulence more successfully. Leveraging insights from microstructure can enhance trading performance, allowing for smarter decision-making during uncertain times. For comprehensive guidance on navigating these complexities, DayTradingBusiness is here to help you refine your trading strategies.