Did you know that in the world of trading, price gaps can sometimes be as unpredictable as a cat on a hot tin roof? Understanding market microstructure is crucial for navigating these sudden price movements. This article dives into the intricacies of market microstructure and its profound influence on price gaps and jumps. We’ll explore how different order types can create gaps, the impact of liquidity and bid-ask spreads, and how external factors like news events and high-frequency trading algorithms play a role. Additionally, we’ll cover the risks traders face during volatile periods and how to identify potential price gaps. With insights from DayTradingBusiness, you'll gain the knowledge needed to better navigate these market dynamics.

What is market microstructure and how does it influence price movements?

Market microstructure examines how trading processes, order flow, and bid-ask spreads shape price changes. It explains gaps and jumps by showing how sudden shifts in supply and demand, order book imbalances, or large trades cause abrupt price movements. Liquidity gaps, triggered by low trading volume or news, lead to sharp jumps, while micro-level trading mechanics determine how quickly and smoothly prices adjust.

How do order types cause price gaps in trading?

Order types cause price gaps in trading because market orders can execute at different prices than expected, especially if liquidity is thin. When a large market order hits a lack of buy or sell orders at current prices, it jumps to the next available bid or ask, creating a gap. Limit orders placed away from the current price set new levels, and if the market moves quickly, these levels become gaps when no orders fill in between. This mismatch between order types and available liquidity causes sudden price jumps and gaps.

Why do price jumps happen during high market volatility?

Price jumps happen during high market volatility because liquidity drops and order flow becomes unpredictable. When many traders rush to buy or sell, the order book thins out, causing larger price moves with fewer trades. Sudden news or shocks trigger rapid order cancellations and placements, widening bid-ask spreads. This imbalance makes prices gap or jump instead of moving smoothly. Market microstructure shows that during volatile times, fewer limit orders and increased order flow imbalance lead to abrupt price changes.

How does liquidity affect price gaps and jumps?

Liquidity affects price gaps and jumps by limiting the number of buy and sell orders available. Low liquidity causes wider bid-ask spreads, making it easier for prices to jump when large trades occur. In thin markets, sudden trades can skip over price levels, creating noticeable gaps. High liquidity buffers these jumps by providing continuous order flow, reducing abrupt price movements.

What role do bid-ask spreads play in price discontinuities?

Bid-ask spreads create price gaps because trades occur at different prices—buy orders match the ask, sell orders match the bid. When a market moves quickly or liquidity drops, these spreads widen, causing sudden jumps or gaps in prices. Large spreads can lead to abrupt price discontinuities, as the next trade may jump over the previous bid or ask levels. Essentially, bid-ask spreads act as barriers, and their fluctuations help explain why prices sometimes jump sharply instead of moving smoothly.

How do news and macroeconomic events create sudden price jumps?

News and macroeconomic events cause sudden price jumps by rapidly changing investor expectations, leading to a mismatch between buy and sell orders. When new information hits, traders quickly revise their valuations, but order flow can lag, creating gaps between previous and new prices. Market microstructure shows that limited liquidity and order book depth amplify these jumps, as fewer orders at certain levels cause prices to skip over previously supported price points. This dynamic explains why unexpected news often results in sharp, immediate price movements.

Can market microstructure explain overnight price gaps?

Yes, market microstructure explains overnight price gaps through the dynamics of order flow, liquidity, and trading mechanisms that differ outside regular trading hours. Low liquidity, wide bid-ask spreads, and limited market participants after hours can cause sharp price movements when the market reopens. These microstructure factors lead to price gaps as new information is incorporated quickly once trading resumes.

How do high-frequency trading algorithms impact price jumps?

High-frequency trading algorithms can cause sudden price jumps by rapidly executing large volumes of orders, often exploiting small price discrepancies. Their speed and automation can amplify order flow imbalances, leading to abrupt shifts in supply and demand. When these algorithms withdraw or add liquidity suddenly, they create gaps in the order book, resulting in sharp price gaps. This microstructure-driven activity can trigger or worsen price jumps, especially during volatile periods.

Why are price gaps more common in less liquid markets?

Price gaps are more common in less liquid markets because low trading volume leads to wider bid-ask spreads, making it easier for prices to jump between trades. In thin markets, fewer transactions mean prices can move abruptly when a large order hits, skipping over intermediate levels. Limited market depth reduces the number of buy and sell orders near the current price, increasing the chance of sudden jumps. Less liquidity means fewer market participants to absorb shocks, causing larger price gaps during sudden trades or news events.

How do stop-loss orders contribute to price jumps?

Stop-loss orders can trigger sudden price jumps when the market hits a stop level. Once the stop-loss is activated, it turns into a market sell order, often causing a quick surge in supply. This rapid influx of sell orders pushes the price sharply downward, creating gaps or jumps. In thin markets, a cluster of stop-loss triggers can amplify this effect, leading to sharp price movements and gaps.

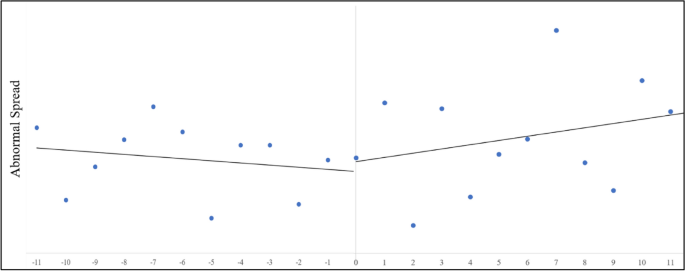

What is the impact of order book imbalance on price gaps?

Order book imbalance can cause price gaps by creating a mismatch between buy and sell orders. When there's a large imbalance, a sudden market order can sweep through the thin side of the book, skipping over several price levels. This results in a jump or gap in the price because the next available bid or ask is far away. Such gaps often happen after news releases or during periods of low liquidity, where the order book lacks depth. The imbalance signals a potential shift in supply and demand, making gaps more likely when one side dominates.

How do market makers influence price stability and gaps?

Market makers influence price stability by providing liquidity and narrowing bid-ask spreads, which reduces sudden price swings. They step in during low volume or volatile periods to buy or sell, smoothing out abrupt jumps. However, when market makers withdraw or face large order imbalances, gaps and jumps can occur because there's no one to absorb the excess supply or demand. Their presence helps keep prices steady, but their absence or sudden shifts can cause significant price gaps.

Why do retail traders experience more price jumps?

Retail traders cause more price jumps because they trade in smaller, less liquid market segments, which lack sufficient depth to absorb large orders. Their trades often happen in thin markets, where a single order can move prices sharply. Limited access to sophisticated trading tools and slower reactions also lead to delayed responses, increasing volatility. In contrast, institutional traders and market makers provide liquidity that smooths out price movements, making retail-driven jumps more frequent.

How can traders predict or identify potential price gaps?

Traders spot potential price gaps by analyzing order book imbalances, sudden volume spikes, and news events that cause market surprises. Monitoring pre-market or after-hours trading can reveal gaps when opening prices jump from previous close. Large, fast trades or shifts in bid-ask spread often signal upcoming gaps. Additionally, understanding market microstructure helps identify moments when liquidity dries up, making gaps more likely during low-volume periods or around major economic releases.

What are the risks associated with trading during price jumps?

Trading during price jumps risks catching volatile swings that can lead to significant losses. Price gaps can trap traders in unfavorable positions if they enter or exit during rapid moves. Liquidity dries up around jumps, making it hard to execute trades at desired prices. Sudden jumps often reflect news or order flow shocks, increasing unpredictability and slippage. These moves can trigger stop-loss executions or margin calls, amplifying losses. Overall, trading during price jumps exposes you to higher market risk and unpredictability.

How does market microstructure theory help in understanding flash crashes?

Market microstructure theory explains flash crashes by showing how order flow, bid-ask spreads, and liquidity gaps lead to sudden price jumps. It highlights that rapid, automated trading can trigger cascading sell-offs when liquidity vanishes, causing sharp price gaps. Microstructure reveals how bid-ask imbalance and high-frequency trading amplify short-term price volatility during crashes.

Conclusion about How Market Microstructure Explains Price Gaps and Jumps

In summary, understanding market microstructure is essential for comprehending price gaps and jumps. Factors such as order types, liquidity, bid-ask spreads, and macroeconomic events all play significant roles in these phenomena. By recognizing how these elements interact, traders can better anticipate market movements and mitigate risks. For those looking to deepen their trading knowledge, DayTradingBusiness offers valuable insights and resources tailored to navigating these complexities effectively.

Learn about How Does Market Microstructure Affect Bid-Ask Spreads and Price Movements?