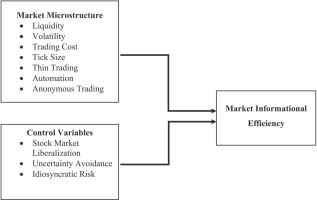

Did you know that the bid-ask spread can sometimes be wider than a politician's promises? Understanding market microstructure is crucial for day traders looking to maximize profits and minimize risks. This article dives deep into how microstructure impacts trading strategies, covering essential elements like liquidity, order book depth, and the influence of market makers. We’ll explore the significance of execution speed, trading costs, and volatility, as well as the risks associated with slippage. Additionally, we’ll highlight how knowledge of microstructure can enhance entry and exit timing, predict short-term price trends, and help avoid common pitfalls in varying market environments. Join us as we unravel the intricate relationship between market microstructure and successful day trading strategies, brought to you by DayTradingBusiness.

How Does Market Microstructure Impact Day Trading?

Market microstructure shapes day trading by influencing bid-ask spreads, order flow, and price movements. Narrow spreads and high liquidity allow quick entry and exit, reducing costs and slippage. Order book depth reveals supply and demand, guiding trade timing and size. Price discovery speed depends on trading venue rules and technology. Understanding microstructure helps traders anticipate short-term volatility and avoid false signals, making their strategies more precise and profitable.

What Are the Key Elements of Market Microstructure?

The key elements of market microstructure include bid-ask spreads, order types and flow, price discovery process, liquidity levels, and trading volume. These factors influence how quickly and efficiently trades happen, impacting bid-ask spreads and transaction costs. For day traders, understanding microstructure helps optimize entry and exit points, minimize costs, and adapt to liquidity conditions. It affects the precision of order execution and the potential for price slippage, directly shaping effective short-term trading strategies.

How Do Bid-Ask Spreads Influence Day Trading Profits?

Bid-ask spreads directly cut into day trading profits by increasing transaction costs. Narrow spreads mean lower costs per trade, boosting profit potential. Wide spreads make quick trades more expensive, squeezing margins. Traders rely on tight spreads to execute frequent, small-profit trades efficiently. Larger spreads force traders to cover the cost before profiting, reducing overall gains. Market microstructure, including spread size, determines how easily traders can capitalize on short-term price movements.

Why Is Liquidity Important for Day Traders?

Liquidity is crucial for day traders because it allows quick entry and exit without big price swings. High liquidity means tighter bid-ask spreads, reducing trading costs. It also helps traders execute large orders smoothly, avoiding slippage. Without enough liquidity, trades can cause unpredictable price moves, increasing risk. For day traders, liquidity ensures they can capitalize on short-term moves efficiently.

How Does Order Book Depth Affect Trading Decisions?

Order book depth shows supply and demand at different price levels, helping day traders identify support and resistance zones. A deeper order book indicates liquidity, making it easier to enter and exit positions without large price moves. Thin order books suggest low liquidity, increasing risk of slippage and sudden price jumps. Traders use this info to time trades, avoid false breakouts, and gauge market strength, adjusting their strategies accordingly.

What Role Does Price Impact Play in Short-Term Trading?

Price impact determines how quickly and cost-effectively a trader can enter or exit positions during short-term trading. High price impact means large trades move the market, increasing costs and slippage, which can erode profits. Day traders rely on low price impact to execute quick, precise moves without causing significant price shifts. Understanding market microstructure helps traders anticipate how their trades affect prices, optimizing timing and order placement to minimize adverse effects in fast-paced markets.

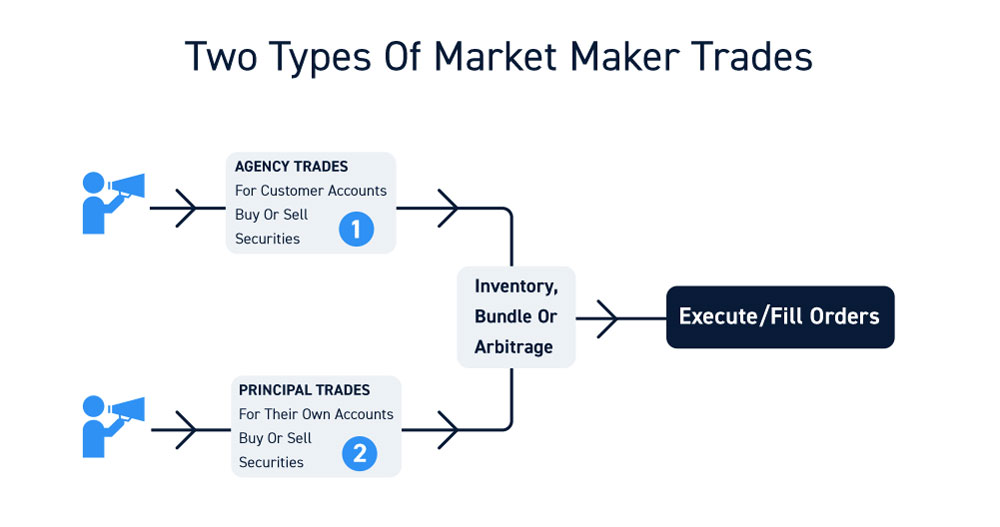

How Do Market Makers Affect Day Trading Strategies?

Market makers influence day trading by providing liquidity and tight spreads, making quick trades more feasible. Their bid-ask quotes set the price environment, affecting entry and exit points. When market makers adjust their quotes, it can create short-term price movements traders can exploit. They can also cause sudden liquidity shifts, leading to slippage or rapid price changes. Understanding how market makers operate helps day traders time trades better and avoid being caught in unpredictable spreads or false signals.

What Is the Effect of Trade Execution Speed on Profits?

Faster trade execution speeds can boost profits by reducing slippage and ensuring orders fill at desired prices. Slow execution risks missing optimal entry or exit points, leading to less favorable prices and lower gains. In day trading, rapid execution allows traders to capitalize on quick market moves and avoid adverse price changes. Delays can turn profitable setups into losses, especially in volatile markets. Overall, high-speed trade execution enhances the ability to implement precise, timely strategies, directly impacting profitability.

How Do Trading Costs and Fees Connect to Microstructure?

Trading costs and fees are directly influenced by market microstructure because they depend on bid-ask spreads, order types, and liquidity. Microstructure determines how easily traders can execute orders with minimal impact and expense. Narrow spreads and high liquidity lower trading costs, making day trading more profitable. Conversely, wide spreads and low liquidity increase fees, squeezing margins. Understanding microstructure helps traders choose optimal entry and exit points to reduce costs and improve strategy efficiency.

How Does Volatility Interact With Market Microstructure?

Volatility influences day trading by amplifying price swings, making quick trades more profitable but riskier. Market microstructure determines how efficiently trades are executed, affecting bid-ask spreads and order flow. When microstructure features narrow spreads and high liquidity, volatility can be exploited with smaller risks. Conversely, poor microstructure leads to wider spreads and slippage, increasing trading costs and unpredictability. Traders monitor microstructure signals, like order book depth, to anticipate short-term price movements in volatile conditions.

What Are the Risks of Slippage in Day Trading?

Slippage in day trading can cause losses when orders fill at worse prices than expected, especially in volatile markets. It reduces profit margins and can lead to unexpected negative results. Rapid price changes due to market microstructure, like order book gaps or high bid-ask spreads, increase slippage risk. It makes precise entry and exit points harder to achieve, impacting strategy effectiveness. Overall, slippage erodes gains and adds unpredictability to day trading outcomes.

How Can Understanding Microstructure Improve Entry and Exit Timing?

Understanding market microstructure reveals order flow and bid-ask spreads, helping traders spot optimal entry and exit points. It shows when liquidity is high or thin, allowing precise timing to avoid slippage. By analyzing how orders are executed and canceled, traders can anticipate short-term price moves. This insight helps in timing trades to maximize profit and minimize risk, especially during volatile periods. Microstructure knowledge turns gut feelings into informed decisions, improving overall trading precision.

How Do News and Microstructure Changes Impact Price Movements?

News and microstructure changes cause sudden price jumps or drops by altering supply and demand, creating short-term trading opportunities. Microstructure shifts—like order flow, bid-ask spreads, and liquidity—affect how quickly prices respond to news. When news hits, traders react immediately, causing rapid price movements driven by order book dynamics. Changes in market microstructure can increase volatility, making prices more unpredictable and challenging for day traders to time entry and exit. Understanding microstructure helps traders anticipate these quick moves and adjust strategies accordingly.

Learn about How Does Market Microstructure Affect Bid-Ask Spreads and Price Movements?

What Are Common Microstructure-Related Trading Pitfalls?

Common microstructure-related trading pitfalls include slippage from bid-ask spreads, order execution delays, and false signals caused by market noise. Poor understanding of order types can lead to unintended fills or missed opportunities. Liquidity gaps can cause sudden price jumps, trapping traders. Overreliance on short-term price patterns ignores microstructure nuances, increasing risk. Ignoring bid-ask spread dynamics can erode profits, especially in volatile conditions. Lastly, failing to adapt to changing market microstructure features can cause unexpected losses during rapid shifts.

How Do Different Market Environments Shape Trading Tactics?

Market microstructure influences day trading tactics by determining how quickly prices move and how easily traders can execute orders. In highly liquid markets, traders rely on rapid, small-profit trades and tight spreads. Less liquid markets force traders to adapt with larger price swings, requiring patience and larger stop-losses. Bid-ask spreads, order book depth, and execution speed all shape strategies—tight spreads favor scalping, while wider spreads may push traders toward swing or momentum trading. Understanding these microstructure features helps traders choose the right entry and exit points, manage risk, and optimize trade timing for different market conditions.

How Can Microstructure Data Help Predict Short-Term Price Trends?

Microstructure data reveals order flow, bid-ask spreads, and liquidity patterns, helping day traders detect short-term price movements. By analyzing how large orders and trading volume influence price fluctuations, traders can anticipate immediate trend shifts. This data uncovers market inefficiencies and short-term supply-demand imbalances, enabling quick, informed trade decisions. Essentially, understanding microstructure helps anticipate price moves before they become obvious, boosting short-term profit chances.

Conclusion about How Does Market Microstructure Affect Day Trading Strategies?

Understanding market microstructure is crucial for refining day trading strategies. Key elements such as bid-ask spreads, liquidity, and order book depth directly influence trading decisions and profitability. By recognizing the significance of trade execution speed and the role of market makers, traders can optimize their entries and exits. Additionally, awareness of trading costs, slippage risks, and the impact of news on price movements can lead to better-informed decisions. Embracing these concepts will empower day traders to navigate market complexities more effectively. For comprehensive insights and strategies tailored to your trading needs, consider leveraging the expertise of DayTradingBusiness.

Learn about How Do Prop Firms Affect Day Trading Strategies?