Did you know that the term "market maker" sounds like someone who crafts fine art instead of facilitating trades? In the world of day trading, market makers and liquidity providers play crucial roles that can significantly influence your trading success. This article dives into how market makers shape market dynamics, maintain stability, and manage risks, while liquidity providers ensure efficient transaction flow and impact price movements. Understanding these concepts is vital for any day trader, as they directly affect bid-ask spreads, market depth, and overall trading volatility. With insights from DayTradingBusiness, you'll discover strategies to navigate these complex interactions and enhance your trading strategies.

How Do Market Makers Influence Day Trading?

Market makers influence day trading by providing liquidity, narrowing bid-ask spreads, and facilitating quick execution of trades. They set the prices at which traders buy and sell, often acting as the counterparty to trades. Their presence can cause short-term price fluctuations, especially around news or large orders. Day traders rely on market makers for smoother, faster transactions but must also watch for potential manipulative tactics like stop-loss hunting or false breaks.

What Role Do Liquidity Providers Play in Day Trading?

Liquidity providers, or market makers, supply the buy and sell orders that keep the market active. They ensure there's always enough volume for quick trades, reducing slippage. For day traders, this means tighter spreads and faster execution, making it easier to enter and exit positions. Without them, markets would be jagged and unpredictable, complicating short-term trading strategies.

How Do Market Makers Keep Markets Stable?

Market makers keep markets stable by continuously offering buy and sell quotes, narrowing spreads, and providing liquidity. They quickly step in to buy when there's selling pressure and sell when there's buying interest, smoothing out price swings. This activity prevents sharp price fluctuations, ensuring smoother trading conditions for day traders. Their presence reduces volatility and makes it easier to enter or exit positions without dramatic price gaps.

How Do Liquidity Providers Impact Price Movements?

Liquidity providers and market makers influence price movements by adding buy and sell orders, narrowing the bid-ask spread, and ensuring smooth trading. Their activity can cause short-term price fluctuations as they adjust their quotes based on market conditions. When liquidity providers quickly buy or sell, they can create rapid price changes, especially during high volatility. Their presence stabilizes prices but can also lead to sudden swings if they pull back or react to large trades. In day trading, their actions often determine short-term price trends and liquidity levels.

Why Are Market Makers Important for Day Traders?

Market makers are essential for day traders because they provide liquidity, ensuring there's always someone ready to buy or sell at fair prices. This tight bid-ask spread minimizes costs and allows quick execution of trades. Without market makers, prices could gap sharply, making day trading riskier and less predictable. They help stabilize the market, making it easier for day traders to capitalize on short-term movements.

How Do Market Makers Make Money?

Market makers make money by charging the spread—the difference between bid and ask prices—on each trade they facilitate. They buy at the bid price and sell at the ask price, profiting from this margin. Additionally, they earn from order flow payments and sometimes through quick arbitrage opportunities created by market fluctuations. Their goal is to provide liquidity, but their profit comes from the bid-ask spread and related trading fees.

How Do Liquidity Providers Ensure Market Liquidity?

Liquidity providers, or market makers, ensure market liquidity by continuously quoting buy and sell prices, ready to execute trades instantly. They fill the order book, preventing wide bid-ask spreads, which keeps trading smooth and efficient. By quickly stepping in to buy or sell, they stabilize prices and prevent sudden jumps, making day trading less risky. Their presence means traders can enter and exit positions rapidly without causing large price swings. Essentially, they keep the market active and liquid, giving day traders confidence to execute quick trades.

What Are the Risks Market Makers Face?

Market makers face risks like sudden price swings, which can cause losses if they can't adjust quickly. They also risk inventory imbalances if the market moves against their positions. Spreads can shrink unexpectedly, reducing profit margins. Additionally, regulatory changes or penalties can impact their operations. Market makers must manage these risks while providing liquidity in volatile markets.

How Do Market Makers Affect Bid-Ask Spreads?

Market makers narrow bid-ask spreads by providing liquidity, making it easier for traders to buy and sell quickly. Their continuous quoting reduces the gap between buying and selling prices. When market makers are active, spreads shrink, lowering trading costs for day traders. Conversely, if they withdraw or reduce quotes, spreads widen, increasing the price gap and potential trading costs.

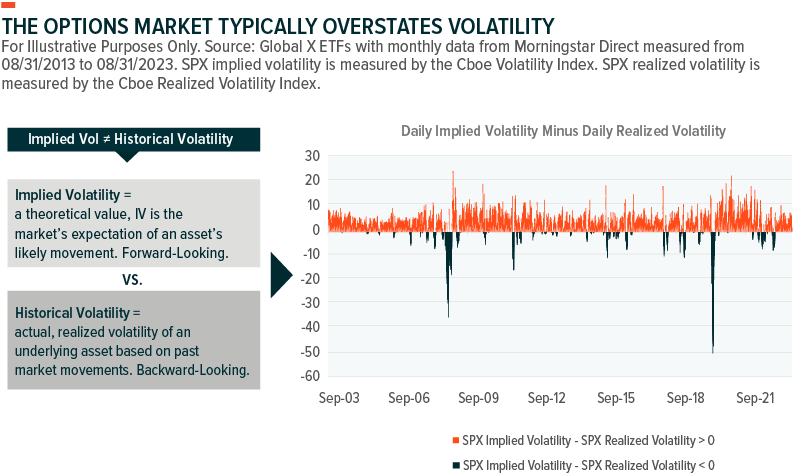

How Can Market Makers Impact Trading Volatility?

Market makers add liquidity, narrowing bid-ask spreads, which stabilizes prices and reduces sudden swings. When they quickly buy or sell, they can dampen volatility, making price movements smoother. Conversely, if market makers withdraw or tighten spreads, trading can become more volatile due to less liquidity. Their actions influence short-term price swings, impacting day traders' ability to execute trades without large slippage.

How Do Market Makers Use Order Book Data?

Market makers use order book data to set bid and ask prices, gauge supply and demand, and identify potential price shifts. They analyze real-time buy and sell orders to place their own trades, ensuring market liquidity. By monitoring order size and depth, they can spot large orders that signal future price movements. This helps them manage risk, execute quick trades, and maintain tight spreads, ultimately influencing day trading by stabilizing prices and providing trading opportunities.

Learn about How Do Institutional Traders Use Volume and Order Flow Data?

What Strategies Do Liquidity Providers Use?

Liquidity providers use tight bid-ask spreads, rapid order execution, and market depth analysis to ensure smooth trading. They often employ algorithmic trading, arbitrage, and inventory management to balance supply and demand. By continuously quoting buy and sell prices, they facilitate quick trades, reduce slippage, and keep markets efficient. Their strategies help day traders execute orders with minimal price impact and maintain liquidity during volatile periods.

How Do Market Makers Handle Large Orders?

Market makers handle large orders by breaking them into smaller trades to avoid moving the price, using algorithms to execute quietly, and sometimes stepping in to buy or sell directly to maintain liquidity. They aim to absorb big orders without causing significant price swings, ensuring smooth trading for day traders.

How Do Liquidity Providers Affect Market Depth?

Liquidity providers increase market depth by adding buy and sell orders, making it easier to execute large trades without moving the price. They narrow spreads, reduce price volatility, and create a more stable trading environment. Their presence makes the market more liquid, allowing day traders to enter and exit positions quickly and with less slippage.

Can Market Makers Cause Price Manipulation?

Yes, market makers can cause price manipulation by placing large buy or sell orders to influence the stock’s price, creating false signals that traders might follow.

How Do Market Makers Respond to High-Volume Trades?

Market makers widen spreads or temporarily pause trading to manage risk during high-volume trades. They may also adjust their bid-ask prices quickly to absorb large orders without causing excessive price swings. This helps maintain liquidity and stabilize the market amid sudden volume spikes.

How Do Market Makers and Liquidity Providers Interact?

Market makers and liquidity providers supply buy and sell quotes, ensuring there's always a market for traders. They interact by continuously posting bid and ask prices, narrowing spreads, and enabling quick trades. Their activity boosts liquidity, making it easier for day traders to enter and exit positions without large price swings. When market makers adjust quotes based on order flow, liquidity providers step in to fill gaps, helping maintain market stability. For day traders, this dynamic means smoother, more predictable trading conditions and tighter spreads.

What Are the Benefits of Market Makers for Day Traders?

Market makers provide immediate liquidity, allowing day traders to buy and sell quickly without drastic price swings. They narrow bid-ask spreads, reducing trading costs. Their continuous presence stabilizes prices, making it easier to execute trades at predictable levels. This increases market efficiency and helps traders enter and exit positions smoothly. Without market makers, price gaps and slippage would be more common, making day trading riskier and more expensive.

How Do Market Makers Affect Stop-Loss Orders?

Market makers can trigger stop-loss orders by quickly moving the bid or ask prices, causing stops to execute at worse prices than expected. They sometimes use this to sweep out stop-losses, creating liquidity gaps or price swings. When liquidity providers manipulate spreads, stop-loss orders get hit unexpectedly, leading to sudden price drops or spikes. This affects day traders by increasing the risk of stop-loss hunts and unpredictable market movements.

How Do Liquidity Providers Impact Market Efficiency?

Liquidity providers improve market efficiency by ensuring there's enough buying and selling interest, which narrows bid-ask spreads and reduces price volatility. Their continuous quotes help traders execute orders quickly at fair prices, making markets more transparent and less prone to sudden swings. This smooths out price fluctuations, allowing day traders to enter and exit positions with confidence. Without them, markets would be less liquid, wider spreads would increase trading costs, and price discovery would slow down, making day trading riskier and less predictable.

Conclusion about How Do Market Makers and Liquidity Providers Affect Day Trading?

In summary, understanding the roles of market makers and liquidity providers is crucial for day traders aiming to navigate the complexities of the trading landscape. Market makers stabilize markets and influence bid-ask spreads, while liquidity providers ensure sufficient market depth and efficiency. By leveraging this knowledge, traders can make more informed decisions and enhance their strategies. For deeper insights and guidance on optimizing your trading approach, consider exploring the resources available through DayTradingBusiness.