Did you know that the big players in the market sometimes make moves that resemble a game of chess—strategic and calculated? Understanding institutional trading data is crucial for day traders looking to refine their strategies and make informed decisions. This article dives into the essence of institutional trading, explaining its impact on market prices and why day traders should pay attention to these influential trades. We'll explore tools for accessing this valuable data, how to identify large trades, and the signs of institutional buying and selling. Additionally, you'll learn about the limitations of using institutional data, the relationship between trading volume and institutional activity, and the importance of order flow analysis. By the end, you’ll be equipped with strategies to leverage institutional insights effectively, ensuring your day trading approach is both informed and responsive. Join us at DayTradingBusiness as we navigate these key concepts!

What is institutional trading data?

Institutional trading data is information about large-scale trades made by institutions like hedge funds, mutual funds, and investment banks. It includes details on trade volumes, order sizes, and timing of big transactions. Day traders use this data to identify market moves driven by institutional activity, helping predict short-term price swings. Analyzing institutional trading data reveals when big players are entering or exiting positions, giving traders an edge in timing their moves.

How does institutional trading influence market prices?

Institutional trading moves large volumes, which can cause significant price swings and liquidity shifts. When big firms buy or sell heavily, it can create rapid price changes, signaling trends or reversals. Their trades often set market sentiment, influencing retail traders’ decisions. Monitoring institutional activity helps day traders anticipate price movements and avoid false signals caused by smaller trades. Overall, institutional trading impacts market prices by adding volatility and guiding short-term price direction.

Why should day traders analyze institutional trades?

Day traders analyze institutional trades to identify large market moves and gauge market sentiment. Institutional trades reveal where big money is flowing, helping traders anticipate price swings. Understanding these trades can uncover potential support or resistance levels, improving entry and exit timing. It also helps avoid false signals caused by retail noise, giving a clearer picture of genuine market trends. Ultimately, analyzing institutional trades boosts decision-making accuracy and increases the chance of profitable trades.

What tools can I use to access institutional trading data?

You can use Bloomberg Terminal, Thomson Reuters Eikon, FactSet, and S&P Capital IQ to access institutional trading data. These platforms provide real-time market insights, large order flows, and institutional trading activity. Additionally, tools like Trade Alert, QuantHouse, and Sentieo offer data on institutional trades, large block transactions, and market sentiment. Some brokerage platforms also provide institutional order flow data for active traders.

How can I identify large institutional trades?

Look for unusually large trade sizes compared to typical volumes, often flagged by trading platforms. Check for block trades reported in real-time feeds or institutional trade indicators like dark pool activity. Monitor volume spikes and sudden shifts in price that coincide with large order execution. Use institutional trading data sources or tools that highlight large block transactions, which often signal institutional interest.

What are the signs of institutional buying activity?

Signs of institutional buying include large volume spikes, steady upward price movements, increased order book depth, and high trade sizes. Watch for unusual activity in Level 2 data, such as sustained bid support, and rising open interest in derivatives. Also, multiple large trades at or near the ask suggest institutions accumulating shares. These signs indicate strong institutional interest and can signal potential trend shifts.

How do institutional sell-offs affect short-term prices?

Institutional sell-offs typically cause short-term prices to drop sharply. When large institutions sell off assets quickly, supply floods the market, pushing prices down. This sudden increase in selling volume can trigger rapid declines and increased volatility. Traders often see these sell-offs as signals of potential short-term momentum shifts, creating opportunities for quick profits or caution.

Can institutional trading data predict market trends?

Yes, institutional trading data can predict market trends because institutions often move large volumes based on detailed analysis, influencing price directions. Monitoring their activity reveals shifts in supply and demand early, giving traders clues about upcoming trends. For example, increased buying by institutions might signal an upcoming rally, while heavy selling could suggest a downturn. Using this data helps day traders anticipate moves before they become obvious in the broader market.

What are the limitations of using institutional data for day trading?

Institutional data can be delayed or incomplete, making it less reliable for real-time day trading. It often lacks the speed needed for quick trades, leading to missed opportunities. Privacy restrictions limit access to detailed order flow and volume data. Data can be costly or hard to obtain, reducing practical usability. Relying on institutional data might also cause traders to follow lagging signals instead of current market movements.

How do trading volumes relate to institutional activity?

Higher trading volumes often indicate increased institutional activity, as institutions trade large blocks of shares. When volume spikes, it signals institutional moves that can drive price trends. Tracking volume alongside institutional trading data helps day traders identify potential breakouts or reversals caused by big players. Large institutional trades usually precede significant price movements, making volume a key indicator of their activity.

Which indicators best reflect institutional trading?

High trading volume, large order sizes, and frequent trades are the best indicators of institutional trading. Look for heavy activity in specific stocks, sudden spikes in volume, and block trades. Market depth and bid-ask spreads also reveal institutional presence. Institutional traders often use dark pools, so unusual trade patterns here can signal their activity. Tracking institutional holdings and changes in large positions provides insight into their trading behavior.

How can I distinguish between retail and institutional trades?

Retail trades are typically smaller in size, made by individual investors, and often executed through retail brokers. Institutional trades involve large volumes, executed by hedge funds, mutual funds, or banks, and are generally executed through direct market access or block trades. Look for unusually large trade sizes, faster execution times, and specific trading platforms used by institutions. Monitoring trade size, timing, and source can help distinguish between retail and institutional trading data.

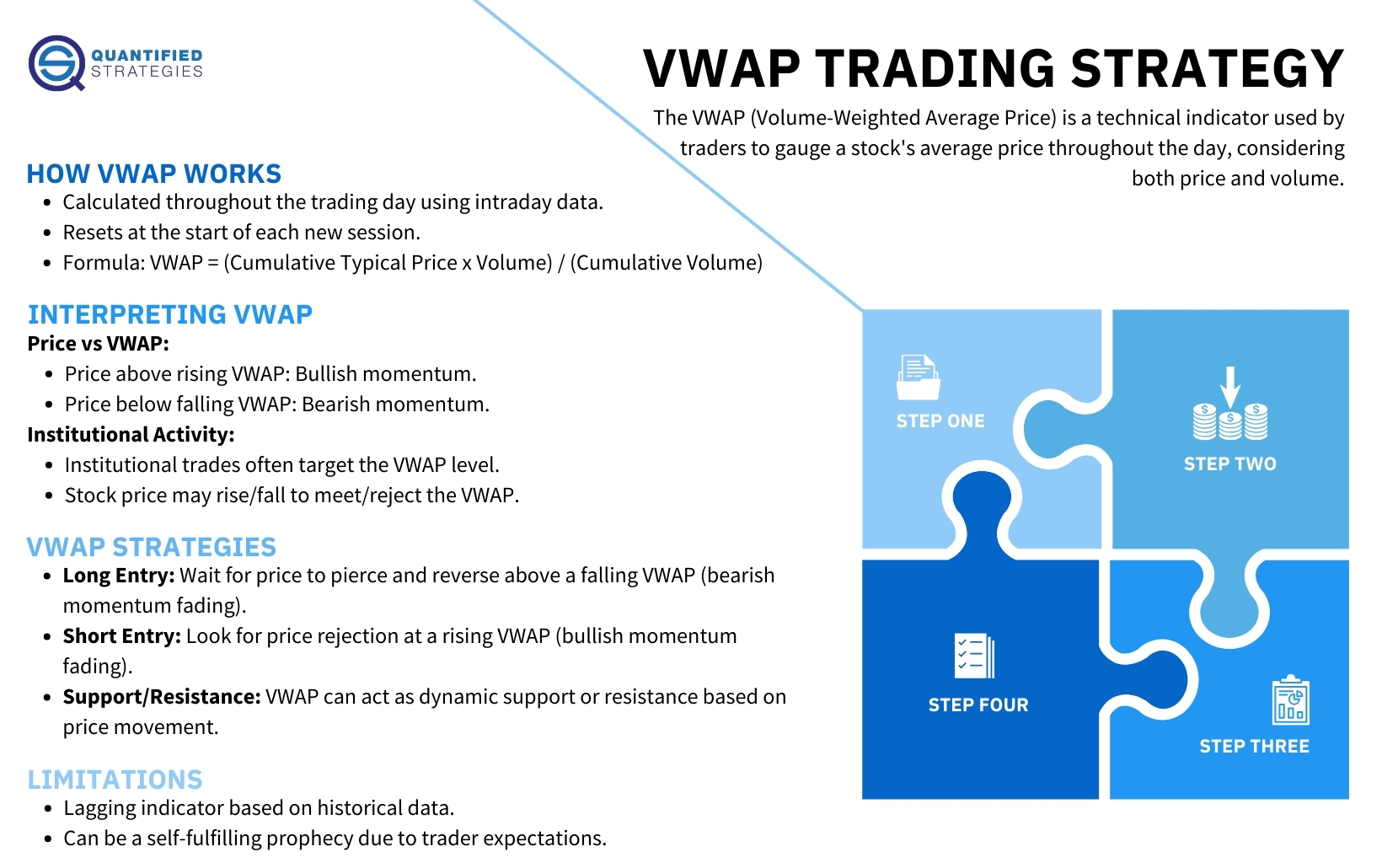

What strategies leverage institutional data for quick trades?

Use real-time order book analysis to spot large institutional trades, signaling potential quick moves. Monitor dark pool activity to detect hidden large orders that can impact short-term prices. Analyze bid-ask spreads and volume spikes to identify institutional interest before price swings. Incorporate historical institutional trade patterns to anticipate market reactions. Use algorithmic tools that track institutional flow data to execute rapid trades based on emerging trends.

How often should I monitor institutional trading data?

Check institutional trading data daily. Monitor it during market hours to spot big moves and trend shifts. Regular updates help you react quickly to large trades that can influence stock prices.

What risks are involved in relying on institutional data?

Relying on institutional trading data risks missing real-time market shifts, as such data often lags. It may also be incomplete or aggregated, hiding critical nuances. Overdependence can lead to delayed reactions, causing missed opportunities or losses. Institutional data might reflect large trades that aren’t indicative of broader market sentiment. Relying solely on this data can cause traders to overlook smaller, rapid moves driven by retail traders or news.

How does news impact institutional trading patterns?

News causes institutional traders to adjust their positions quickly, creating sharp volume spikes and price moves. When news hits, institutions often execute large trades, leading to increased liquidity and volatility. Their reactions set the tone for short-term market direction, influencing day trading patterns. Tracking institutional trading data reveals these shifts, helping day traders anticipate sudden moves and adapt their strategies accordingly.

Learn about Institutional Trading Patterns and How They Impact Day Trading Opportunities

Are there legal considerations when analyzing institutional trades?

Yes, analyzing institutional trades involves legal considerations like respecting confidentiality agreements, avoiding market manipulation, and adhering to insider trading laws. Using publicly available data is safe, but accessing or sharing non-public information can lead to legal trouble. Always ensure your data sources are legitimate and compliant with regulations.

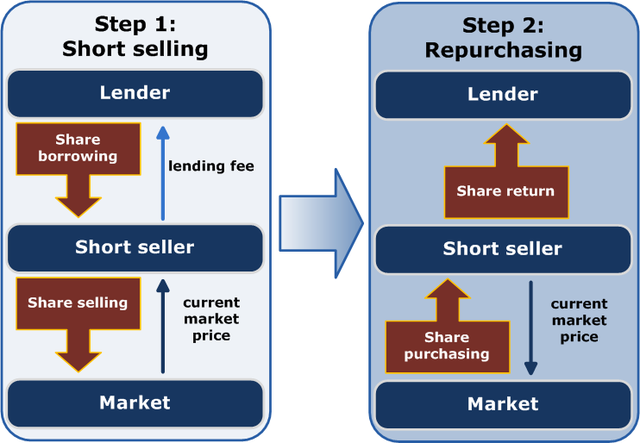

How does dark pool trading relate to institutional activity?

Dark pool trading reflects institutional activity by allowing large investors to buy or sell significant positions without moving the market. It provides insight into institutional strategies, as big trades often go through these private venues before hitting public exchanges. Monitoring dark pool data can reveal institutional interest in specific stocks, helping day traders gauge market sentiment and potential price moves.

Learn about What Is Dark Pool Trading and How Does It Work?

What role does order flow analysis play in day trading?

Order flow analysis reveals real-time buying and selling activity, helping day traders identify market momentum, potential reversals, and entry or exit points. It shows how institutional traders move markets, giving clues on where price might go next. By understanding order flow, traders can anticipate large trades and avoid false signals, improving decision accuracy. Essentially, it turns raw trading data into actionable insights, making day trading more precise and less guesswork.

Learn about Order Flow Analysis vs. Technical Analysis in Day Trading

How can sentiment analysis complement institutional data?

Sentiment analysis adds emotional context to institutional trading data, revealing market mood shifts that raw numbers miss. It helps day traders anticipate market moves by understanding investor confidence, fear, or optimism. Combining sentiment insights with institutional data uncovers hidden patterns, improving timing and decision accuracy. For example, detecting rising positive sentiment before a price surge offers a strategic edge.

Conclusion about Leveraging Institutional Trading Data for Better Day Trading Decisions

Incorporating institutional trading data into your day trading strategy can significantly enhance decision-making and improve trade outcomes. By understanding how institutional activity influences market prices, identifying large trades, and recognizing signs of buying or selling pressure, traders can position themselves advantageously. However, it’s crucial to stay aware of the limitations and risks associated with this data. Continuous analysis and the use of appropriate tools can empower traders to leverage institutional insights effectively. For comprehensive guidance and resources, DayTradingBusiness is here to support your trading journey.

Sources:

- Leveraging the momentum effect in machine learning-based ...

- Institutional trading and satellite data - ScienceDirect

- CryptoMamba: Leveraging State Space Models for Accurate Bitcoin ...

- Global Financial Stability Report, April 2024, Chapter 2: “The Rise ...

- Global Financial Stability Report, April 2023: Nonbank Financial ...