Did you know that some day traders can analyze data faster than a cheetah can run? In the high-stakes world of institutional day trading, a unique set of skills is essential for success. This article dives into the fundamental abilities institutional traders need, from market analysis and technical expertise to risk management and software proficiency. It also highlights the importance of financial knowledge, discipline, and understanding market psychology. Plus, we explore how these traders stay updated on news, develop strategies, and adapt to changing conditions. For anyone looking to thrive in day trading, insights from DayTradingBusiness will provide the competitive edge you need.

What basic skills do institutional day traders need?

Institutional day traders need strong market analysis, quick decision-making, risk management, technical chart reading, and discipline. They must interpret real-time data, execute trades rapidly, and adapt to volatile conditions. Understanding financial instruments, news impact, and maintaining emotional control are essential. Proficiency in trading platforms and algorithms also helps execute strategies efficiently.

How important is market analysis for institutional day traders?

Market analysis is crucial for institutional day traders because it helps them identify profitable opportunities quickly. It enables them to interpret price patterns, volume data, and news events accurately. Without solid market analysis, they risk making impulsive trades or missing key trends. It’s the foundation for their decision-making, risk management, and maintaining a competitive edge in fast-paced trading environments.

What technical skills are essential for institutional day trading?

Institutional day traders need strong quantitative analysis, advanced charting and technical analysis skills, programming knowledge (like Python or R), familiarity with trading algorithms, and proficiency in using trading platforms and data feeds. They also require risk management expertise, real-time decision-making ability, and understanding of market microstructure.

How do institutional traders manage risk effectively?

Institutional traders manage risk by using advanced risk management tools like stop-loss orders, position sizing, and diversification. They analyze market data thoroughly, set clear trading limits, and monitor positions constantly to avoid large losses. They also rely on detailed research and real-time information to make quick, informed decisions. Strong discipline and adherence to strategic plans are essential to prevent emotional trading.

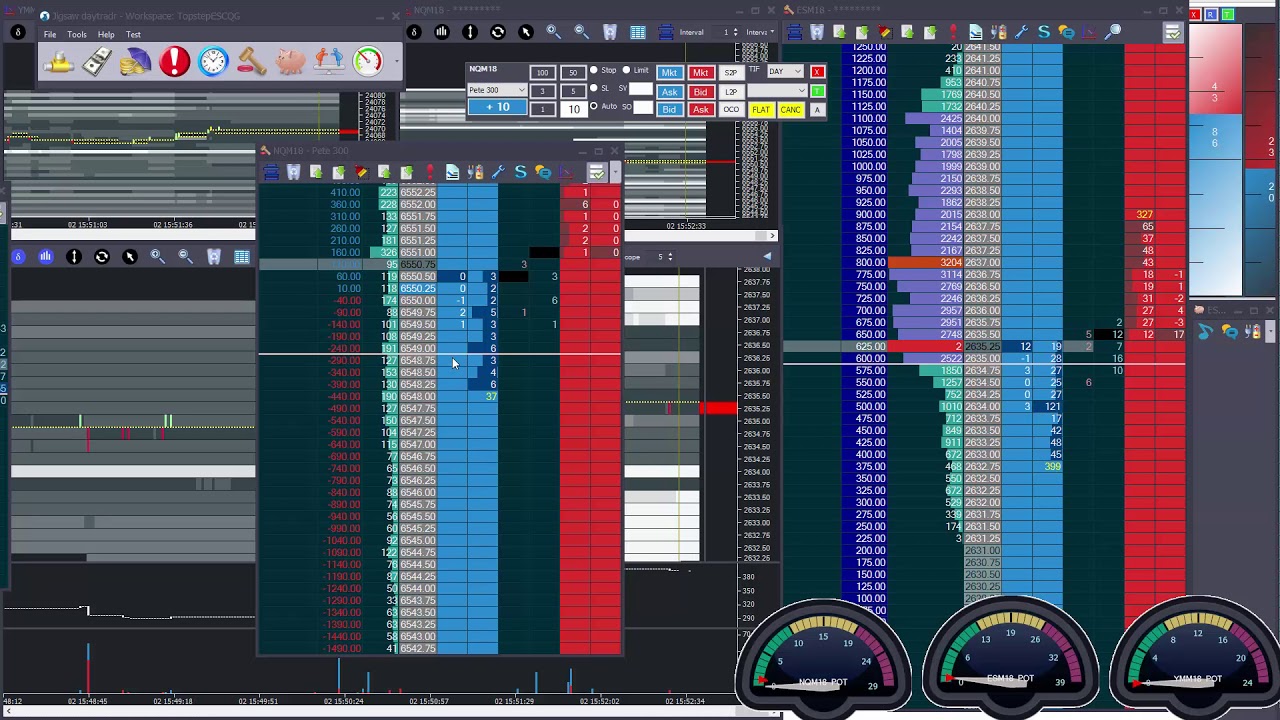

What software tools do institutional day traders use?

Institutional day traders use trading platforms like Bloomberg Terminal, Eikon, and MetaTrader. They rely on real-time data feeds, advanced charting tools, and order execution software such as TradeStation or Thinkorswim. They also use risk management tools, algorithmic trading software, and custom analytics platforms. Strong skills in technical analysis, quick decision-making, and understanding of market microstructure are essential.

How do institutional traders develop a trading strategy?

Institutional traders develop a trading strategy by analyzing market data, identifying patterns, and setting clear risk management rules. They use technical and fundamental analysis, leverage advanced tools, and backtest strategies with historical data. Continuous learning from market trends and refining their approach ensures adaptability. Strong analytical skills, discipline, and experience in executing large trades are essential. They also develop strategies that balance profit targets with risk controls, often using algorithms and quantitative models.

What financial knowledge is crucial for institutional day traders?

Institutional day traders need a solid understanding of market fundamentals, technical analysis, and risk management. They must interpret real-time data quickly, use advanced trading platforms, and understand order types and execution strategies. Knowledge of market liquidity, volatility, and macroeconomic indicators is essential to make rapid, informed decisions. They also need to manage large positions without impacting market prices and stay compliant with trading regulations.

How do institutional traders stay updated on market news?

Institutional traders stay updated on market news by using real-time financial news feeds, subscribing to premium news services like Bloomberg or Reuters, and monitoring official economic reports. They rely on advanced trading platforms with integrated news alerts, track economic calendars, and follow industry analysts on social media. Staying connected to market data providers and financial analytics tools helps them react quickly to news that impacts stocks, currencies, or commodities.

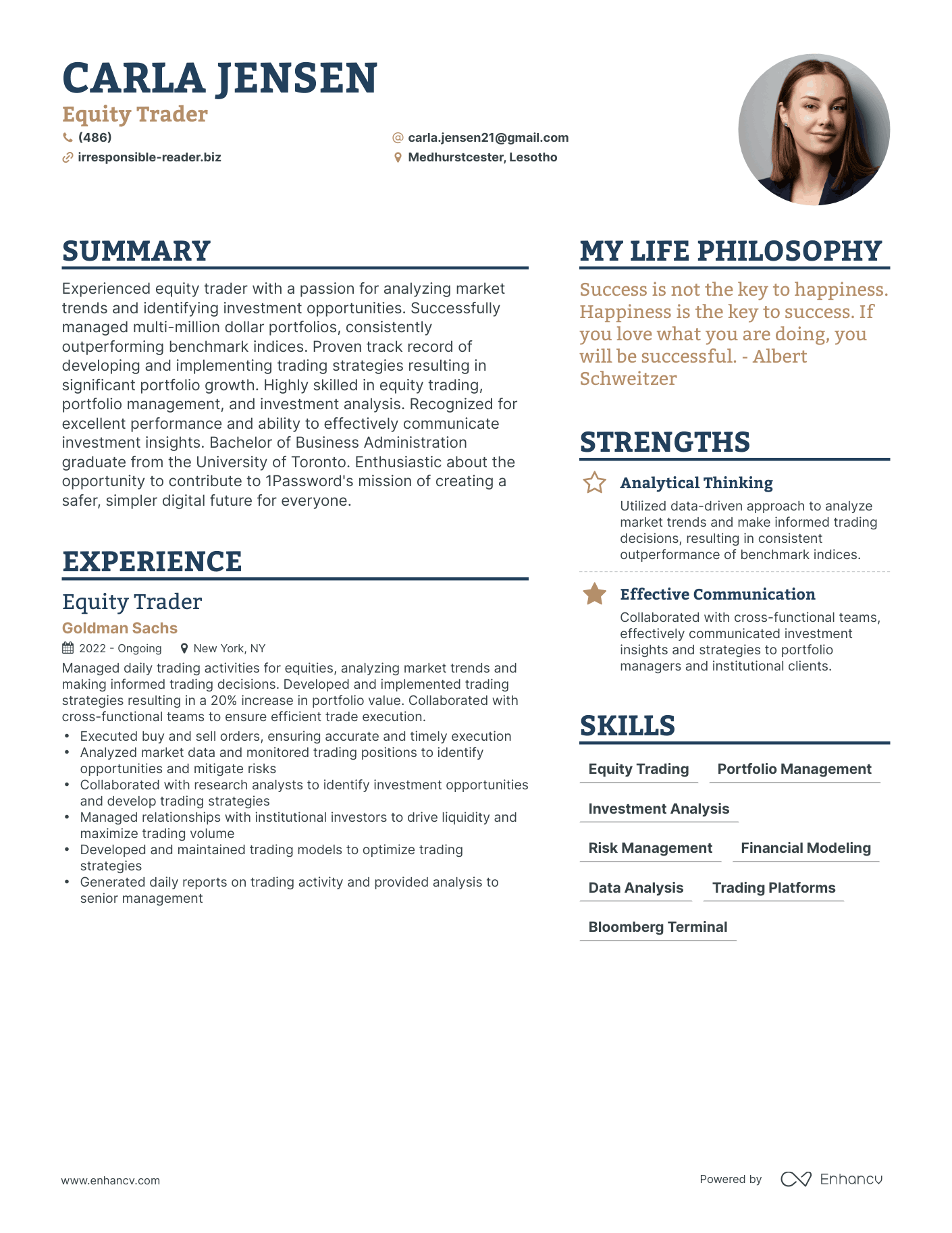

What are common behavioral skills for successful institutional traders?

Institutional day traders need strong decision-making, risk management, discipline, and emotional control. They must analyze markets quickly, adapt to volatility, and execute trades precisely. Communication skills and teamwork are important for collaborating with analysts or brokers. Staying focused under pressure and maintaining discipline to follow trading plans are key. They also need to stay updated on market news and economic indicators to make informed decisions.

How do institutional traders handle high-pressure situations?

Institutional traders handle high-pressure situations by staying calm, sticking to their trading strategies, and relying on solid risk management. They quickly analyze market data, make decisive moves, and avoid emotional reactions. Experience helps them remain focused and adapt to rapid changes without panic. They also use advanced tools and team support to stay level-headed during volatile moments.

What role does discipline play in institutional day trading?

Discipline is crucial in institutional day trading because it ensures traders stick to predefined strategies, manage risk effectively, and avoid impulsive decisions. It helps maintain consistency, prevent emotional reactions, and follow strict entry and exit rules, which are vital for profitable trading. Without discipline, even skilled traders can deviate from their plan, leading to losses.

How important is understanding market psychology for institutional traders?

Understanding market psychology is crucial for institutional traders because it helps predict investor behavior, manage risk, and make smarter decisions. Recognizing herd mentality, panic selling, or euphoria allows them to time entries and exits better. Without this skill, even the best data analysis can fall flat if they miss the emotional undercurrents driving market moves. It’s a core component of successful trading strategy for institutional players.

What regulatory knowledge do institutional day traders need?

Institutional day traders need knowledge of SEC and FINRA regulations, trading compliance rules, and reporting requirements. They must understand market rules for exchanges like NYSE and NASDAQ, including order execution standards and short-selling regulations. Regulatory awareness of insider trading laws and anti-manipulation measures is crucial. Staying updated on changes in trading rules, margin requirements, and licensing standards is essential to operate legally and avoid penalties.

How do institutional traders analyze market data?

Institutional traders analyze market data by interpreting real-time price movements, volume trends, and economic indicators. They use advanced tools like algorithmic models and technical analysis to spot patterns. Fundamental analysis also plays a role, assessing company reports and macroeconomic data. They rely on quantitative skills to process large datasets quickly and identify trading opportunities. Experience in reading market sentiment and understanding news impacts is crucial.

Learn about How Do Institutional Traders Use Volume and Order Flow Data?

What skills are needed for quick decision-making in day trading?

Institutional day traders need sharp analytical skills to interpret market data quickly, strong risk management to limit losses, emotional control to avoid impulsive trades, and quick decision-making ability to act on fleeting opportunities. They also require deep knowledge of technical analysis, real-time data processing, and the discipline to stick to trading strategies under pressure.

How do institutional traders adapt to changing market conditions?

Institutional traders adapt to changing market conditions by analyzing real-time data, adjusting strategies quickly, and managing risk effectively. They stay informed on economic news, use advanced trading algorithms, and have strong decision-making skills. Flexibility, sharp analytical abilities, and the capacity to pivot quickly are crucial. They also rely on deep market knowledge and experience to anticipate shifts and protect assets.

Conclusion about What Skills Do Institutional Day Traders Need?

In summary, institutional day traders require a diverse skill set that encompasses market analysis, technical proficiency, and effective risk management. Mastering software tools and financial knowledge is crucial, along with the ability to stay informed and adapt to market dynamics. Behavioral skills, discipline, and an understanding of market psychology further enhance their trading success. For those looking to excel in this competitive field, resources and insights from DayTradingBusiness can provide valuable support in developing these essential skills.