Did you know that institutional traders often have access to more market information than most of us have access to our own kitchen cabinets? In the world of trading, institutional strategies significantly diverge from those of individual traders in several key areas. This article explores the fundamental differences, including the goals and risk management approaches of each group, the types of financial instruments they trade, and how trading volumes influence their strategies. We’ll also delve into how institutional traders access market information, the algorithms they use, and the costs associated with their trades. Additionally, we’ll examine how investment scale, regulatory requirements, and trading timeframes shape their decision-making processes. By the end, you’ll have a clearer understanding of how these two trading worlds operate, thanks to insights from DayTradingBusiness.

How do institutional trading strategies differ from individual trading?

Institutional trading strategies focus on large volumes, often using algorithms and market impact analysis, while individual trading involves smaller, personal investments with less emphasis on market impact. Institutions use advanced tools, research, and risk management to execute big trades efficiently, whereas individuals rely on simpler platforms and strategies. Institutional traders aim for steady, long-term gains and may trade multiple assets simultaneously, unlike individuals who often trade for quick gains or personal goals.

What are the main goals of institutional traders versus individual traders?

Institutional traders aim to execute large volume transactions efficiently, minimize market impact, and achieve optimal prices for clients or funds. They focus on sophisticated strategies like algorithmic trading, portfolio management, and risk mitigation. Individual traders seek personal profit through smaller, more flexible trades, often relying on technical analysis, market trends, and intuition. Their goal is to capitalize on short-term movements or long-term gains without the scale and complexity institutions handle.

How do risk management approaches vary between institutions and individuals?

Institutions use formal risk management like diversified portfolios, stop-loss orders, and advanced analytics. They set strict limits on exposure and regularly monitor market shifts. Individuals often rely on personal judgment, smaller buffers, and less structured controls. Institutional strategies prioritize stability and regulatory compliance, while individuals focus on flexibility and personal risk tolerance.

What types of financial instruments do institutions typically trade compared to individuals?

Institutions typically trade stocks, bonds, derivatives, and large-scale ETFs, using complex strategies like algorithmic trading and hedging. Individuals mostly trade stocks, options, and mutual funds, often focusing on personal goals and shorter-term gains. Institutions handle massive volumes with advanced tools, while individuals usually trade smaller amounts with simpler platforms.

How do trading volumes influence institutional and individual strategies?

Higher trading volumes give institutions more liquidity, enabling large trades without moving the market, so they can execute big positions efficiently. They often rely on volume analytics to time entries and exits, aiming to minimize market impact. Individuals, facing lower volumes, tend to trade smaller sizes, which can cause slippage and less optimal prices. When volumes spike, institutions might adjust strategies—like scaling back or increasing activity—while individuals may follow trends or react impulsively. Overall, trading volume shapes how both groups plan, execute, and manage risk in their strategies.

In what ways do institutional traders access market information differently?

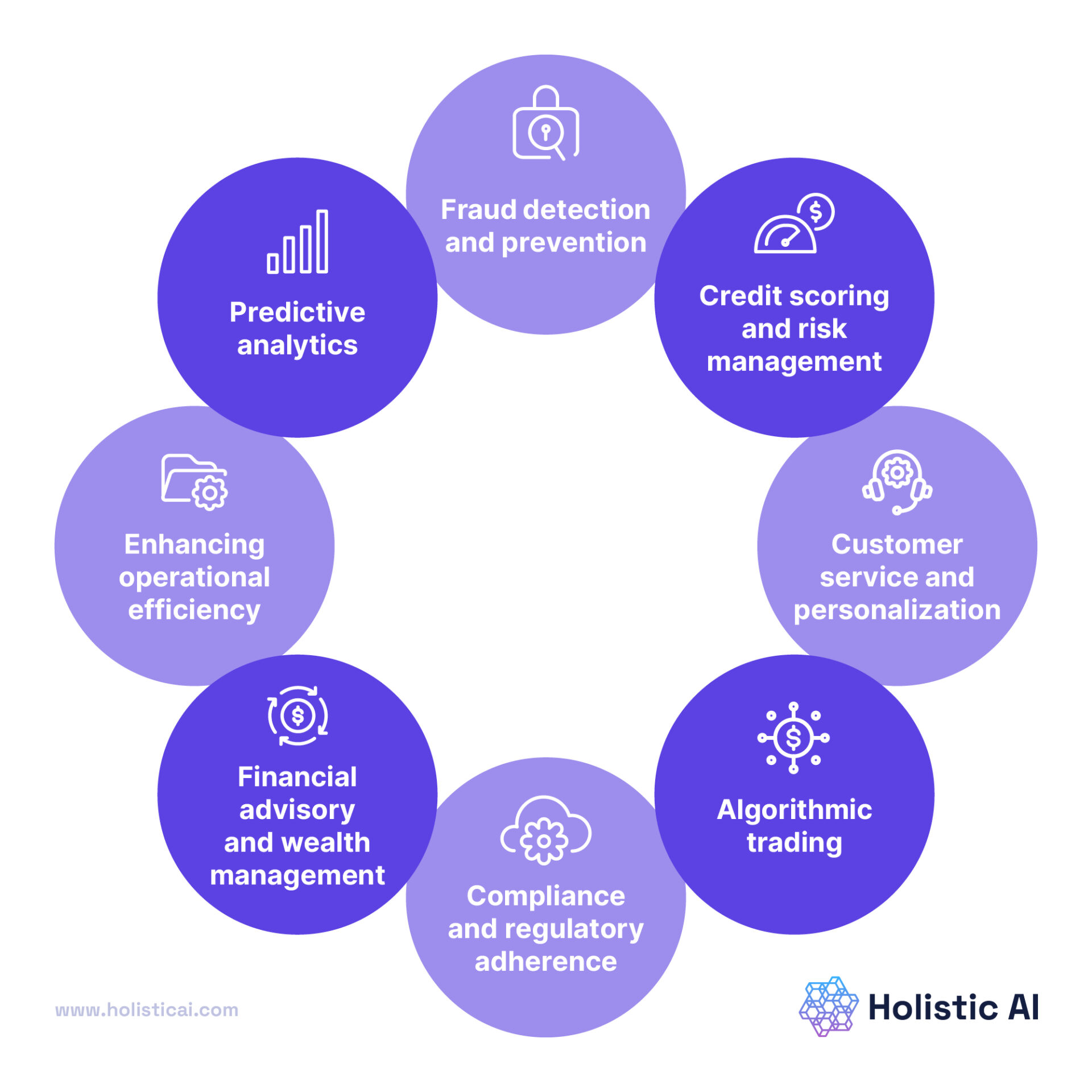

Institutional traders access market information through proprietary research, advanced analytics, and direct feeds from multiple exchanges, giving them real-time, comprehensive data. They often have dedicated teams analyzing economic indicators, news, and market trends continuously. Unlike individual traders relying on public news, basic charts, or third-party platforms, institutions use custom algorithms and high-frequency trading systems that process vast data faster. They also receive exclusive insights from industry networks and expert analysts, enabling more informed, strategic decisions.

How do institutional trading algorithms differ from retail trading methods?

Institutional trading algorithms use advanced, high-speed algorithms to execute large volumes of trades quickly and efficiently, often across multiple markets. They rely on sophisticated data analysis, real-time market insights, and automated decision-making to optimize timing and minimize market impact. Retail trading methods, on the other hand, involve individual investors using simpler platforms, manual order placement, and basic chart analysis. Unlike institutions, retail traders typically operate with smaller capital, less automation, and longer timeframes, making their trades less optimized for speed and scale.

What are the costs associated with institutional trading versus individual trading?

Institutional trading costs include large order execution fees, algorithmic trading expenses, advanced technology infrastructure, and higher brokerage commissions. They also face market impact costs from sizable trades moving prices. Individual trading costs are typically smaller, mostly limited to standard broker commissions, spreads, and occasional slippage. Institutional traders often pay lower per-unit costs due to bulk order sizes and negotiated rates, whereas individuals pay more per trade with less bargaining power.

How does the scale of investment impact trading strategies for institutions and individuals?

Larger investments allow institutions to use complex, algorithmic, and high-frequency trading strategies, leveraging their scale for better execution and lower costs. Individuals, with smaller capital, rely on simpler strategies like swing trading or buy-and-hold, often facing higher transaction costs and less market influence. Institutional size enables access to advanced tools, research, and market influence, shaping their trading approaches differently from individuals.

What role does market impact play in institutional trading decisions?

Market impact influences institutional trading decisions by affecting trade execution costs. Large orders can move prices, so institutions strategize to minimize this effect through methods like order slicing or timing trades carefully. Reducing market impact helps avoid unfavorable price shifts, protecting their investment and ensuring more efficient trades.

How do regulatory requirements shape institutional trading strategies?

Regulatory requirements force institutional traders to follow strict rules on transparency, reporting, and risk management, shaping strategies to prioritize compliance and reduce legal risks. They limit certain high-risk practices, influence order execution methods, and require detailed record-keeping, making strategies more disciplined and structured compared to individual trading.

Learn about How Do Institutional Traders Influence Day Trading Strategies?

In what ways do trading timeframes differ between institutions and individuals?

Institutional traders operate on longer, more strategic timeframes, often holding positions for weeks or months, focusing on large-scale market trends. Individuals typically trade on shorter timeframes—days, hours, or even minutes—driven by quick gains and market volatility. Institutions use advanced algorithms and deep research, while individuals rely more on technical analysis and personal judgment. Institutional trading involves significant capital, enabling big position swings; individuals usually trade smaller amounts, risking less per trade. Overall, institutions prioritize stability and long-term growth, whereas individuals chase immediate opportunities.

How do institutional traders handle liquidity compared to individual traders?

Institutional traders handle liquidity by using large orders that are often broken into smaller chunks to avoid market impact and utilize advanced algorithms for optimal execution. They have access to deeper liquidity pools, enabling quicker entry and exit without significant price movement. Individual traders typically place smaller orders, which may cause more noticeable price shifts and rely less on sophisticated strategies. Institutions also use their scale to negotiate better transaction costs, while individuals usually face higher spreads and slippage.

What are the differences in leverage use between institutions and retail traders?

Institutions use larger leverage, often 10:1 or higher, due to their access to bigger capital pools and risk management tools. Retail traders typically get limited leverage, usually between 2:1 and 10:1, because brokers cap it to protect clients. Institutions can afford to take on more leverage because of their advanced risk controls and diversified portfolios, while retail traders often face stricter leverage limits to reduce individual risk.

How do trading strategies adapt during volatile market conditions for each group?

During volatile markets, institutional traders rely on advanced algorithms, risk management tools, and liquidity strategies to protect large positions. They might reduce trade size, hedge positions, or use algorithmic trading to minimize impact. Individual traders often shift to shorter timeframes, set tighter stop-loss orders, or avoid high-risk trades altogether. While institutions use sophisticated data analysis and automated systems, individuals tend to react emotionally or impulsively, making quick adjustments or pausing trading to avoid losses.

Learn about What are the risks of trading during volatile market conditions?

How does access to research and analytics differ between institutional and individual traders?

Institutional traders have access to advanced research tools, proprietary analytics, and extensive market data, giving them insights individual traders can't easily obtain. They use in-depth market models, real-time analytics, and large-scale research teams, while individual traders rely on public sources, basic charts, and personal analysis. This access allows institutions to execute complex strategies with precision, whereas individuals often operate with limited data and less sophisticated tools.

Conclusion about How Do Institutional Trading Strategies Differ from Individual Trading?

In summary, the disparity between institutional and individual trading strategies is marked by distinct goals, risk management approaches, and access to resources. Institutional traders leverage advanced algorithms, larger trading volumes, and comprehensive market data, enabling them to make informed decisions and manage liquidity more effectively. Conversely, individual traders often operate with limited resources, which can influence their strategies, trading costs, and adaptability to market volatility. Understanding these differences is crucial for anyone looking to enhance their trading skills. For deeper insights and tailored strategies, consider exploring the resources offered by DayTradingBusiness.

Learn about How Insider Trading Differs from Regular Trading Strategies