Did you know that some traders have more algorithms than friends? While it might sound lonely, institutional traders rely on sophisticated algorithmic strategies to navigate the fast-paced world of trading. This article delves into how these traders implement, develop, and optimize their algorithms to gain a competitive edge. Key points include the types of algorithms they use, the data that informs their strategies, and how they manage risk. We'll also explore the role of machine learning and AI, the importance of compliance, and the common challenges faced in algorithmic trading. With insights from DayTradingBusiness, you’ll gain a clearer understanding of this complex yet fascinating aspect of trading.

How Do Institutional Traders Implement Algorithmic Strategies?

Institutional traders use algorithmic strategies by programming computers to execute trades based on predefined rules, market data, and signals. They develop algorithms that analyze real-time price movements, volume, and other indicators to identify optimal entry and exit points. These algorithms can automatically place orders to minimize market impact and maximize speed, often running complex calculations or machine learning models. Traders customize algorithms for specific goals like arbitrage, trend following, or liquidity provision, then deploy them across multiple markets. They continuously monitor and refine these algorithms to adapt to changing market conditions and maintain competitive edge.

What Are the Main Types of Algorithms Used by Institutional Traders?

Institutional traders mainly use execution algorithms, such as VWAP (Volume Weighted Average Price), TWAP (Time Weighted Average Price), and POV (Percent of Volume), to minimize market impact. They also rely on predictive algorithms for market making, arbitrage, and trend-following, which analyze data patterns to execute trades at optimal times. Additionally, risk management algorithms adjust positions dynamically, and machine learning models help forecast price movements and identify opportunities.

How Do Institutional Traders Develop Their Trading Algorithms?

Institutional traders develop trading algorithms by analyzing market data, identifying patterns, and coding strategies based on statistical models. They use advanced programming languages like Python or C++, backtest algorithms against historical data, and refine them to optimize performance. They rely on proprietary research, quantitative analysis, and machine learning to create algorithms that execute trades automatically, minimizing human emotion and maximizing speed.

What Data Do Institutional Traders Use for Algorithmic Strategies?

Institutional traders use market data, order book data, historical price data, volume, bid-ask spreads, and real-time news feeds for algorithmic strategies. They analyze macroeconomic indicators, earnings reports, and economic calendars. They also incorporate sentiment analysis from news and social media, plus proprietary data like client orders and inventory levels. This data helps algorithms identify trading signals, manage risk, and execute rapid trades.

How Do Institutional Traders Manage Risk with Algorithms?

Institutional traders manage risk with algorithms by setting predefined parameters like stop-loss orders and position limits. They use real-time data analysis to adjust trades dynamically, avoiding large losses during market swings. Algorithms also diversify across multiple assets to spread risk. They incorporate risk models that measure volatility and market conditions, automatically reducing exposure when conditions turn unfavorable. This systematic approach ensures disciplined execution and minimizes emotional decision-making.

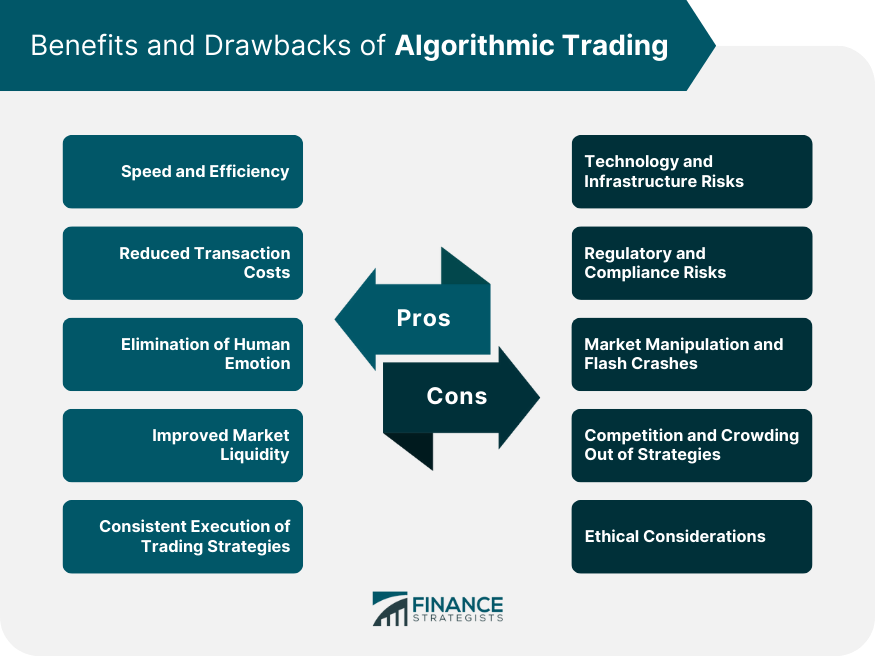

What Are the Benefits of Algorithmic Trading for Institutions?

Institutional traders use algorithmic strategies to execute large orders quickly and precisely, minimizing market impact. These algorithms improve trading efficiency, reduce costs, and help optimize timing based on market conditions. They enable rapid data analysis and decision-making, allowing institutions to capitalize on fleeting opportunities. Algorithms also enhance risk management by automating stop-loss and profit-taking, and they provide better trade execution transparency and compliance.

How Do Institutional Traders Backtest Their Algorithms?

Institutional traders backtest algorithms by running them on historical market data to see how they'd perform. They use specialized software to simulate trading conditions, tweak parameters, and analyze performance metrics like profit, risk, and drawdowns. This process helps identify weaknesses before deploying the strategies live. They often incorporate real-world factors like transaction costs and market impact to make tests more accurate.

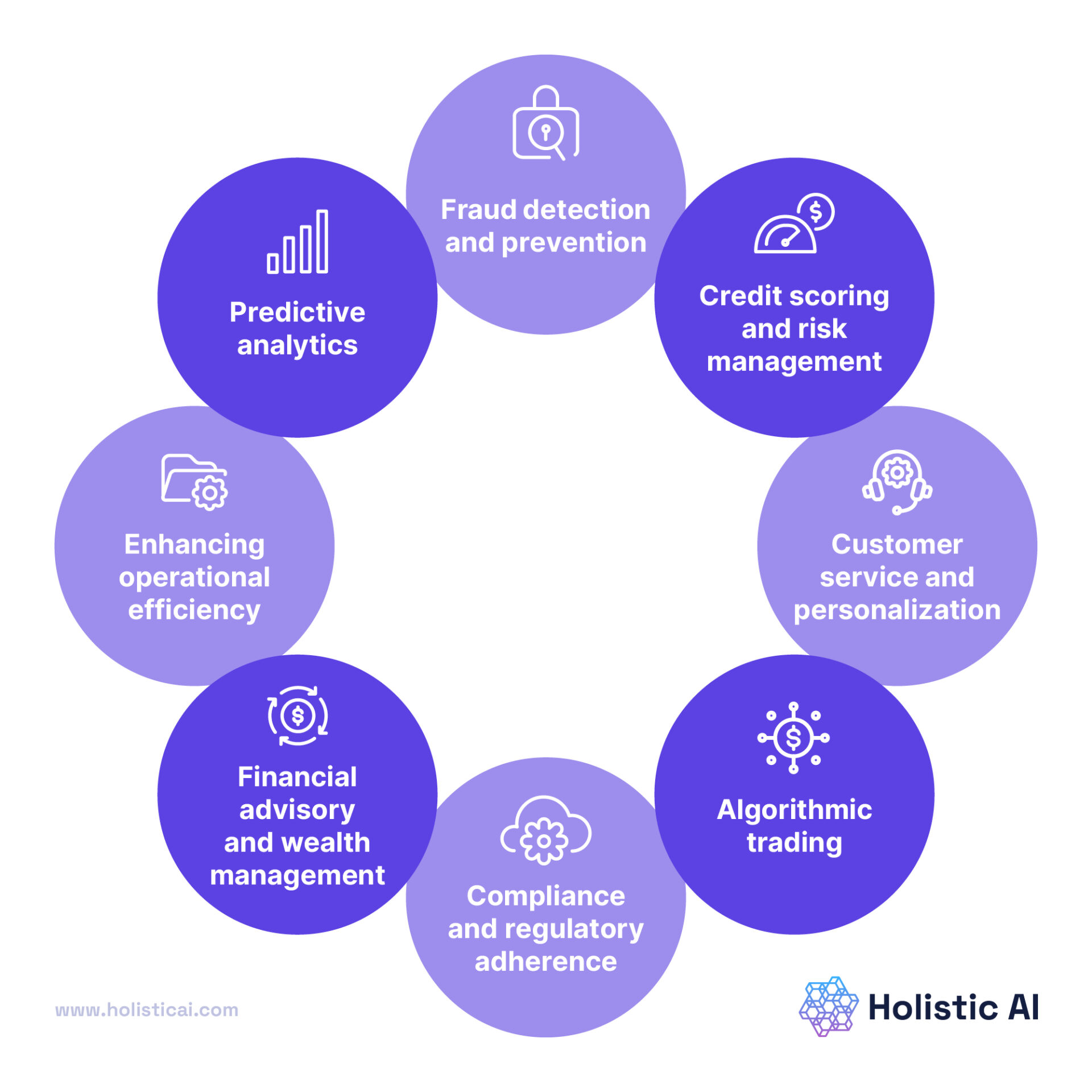

What Role Do Machine Learning and AI Play in Institutional Trading?

Machine learning and AI help institutional traders develop sophisticated algorithmic strategies by analyzing vast market data, recognizing patterns, and predicting price movements. They automate trade execution, optimize timing, and manage risk more efficiently. AI-driven algorithms adapt to changing market conditions in real-time, enabling faster, more informed decisions. This reduces human bias, increases trading speed, and enhances overall portfolio performance.

How Do Institutional Traders Ensure Algorithmic Compliance?

Institutional traders ensure algorithmic compliance by embedding strict risk controls, adhering to regulatory standards, and continuously monitoring algorithm performance. They use automated checks to prevent deviations from trading mandates, perform regular audits, and implement compliance flags that flag suspicious activity. Training teams on regulatory updates and maintaining detailed audit trails also help keep algorithms within legal and internal guidelines.

What Are Common Challenges Faced by Institutional Traders in Algorithmic Trading?

Institutional traders face challenges like algorithmic model risk, where faulty algorithms cause losses. They struggle with data quality and latency, which can delay decision-making. Overfitting models to historical data reduces effectiveness in live markets. Regulatory compliance adds complexity, requiring constant updates. Market volatility can disrupt algorithm performance. Managing infrastructure costs for high-frequency trading is tough. Lastly, ensuring algorithms adapt to changing market conditions without human intervention remains a constant challenge.

How Do Institutional Traders Optimize Algorithm Performance?

Institutional traders optimize algorithm performance by continuously backtesting strategies on historical data, fine-tuning parameters to adapt to market conditions. They monitor real-time analytics, adjusting algorithms to improve execution speed and reduce slippage. They incorporate machine learning models to predict market movements and refine decision-making. Regularly reviewing and updating algorithms based on market trends ensures they stay effective. They also use advanced risk management tools to limit exposure and prevent losses, ensuring algorithms perform efficiently under different scenarios.

How Do Institutional Traders Use Market Data to Inform Algorithms?

Institutional traders analyze market data like price movements, volume, and order book depth to develop algorithms that identify trading opportunities. They use real-time data to fine-tune algorithms for quick execution, aiming to capitalize on small price discrepancies or market trends. By integrating historical data, they optimize algorithms for better prediction and risk management. These traders rely on machine learning models trained on vast datasets to enhance decision-making and automate trades efficiently.

Learn about How Do Institutional Traders Use Technical and Fundamental Analysis?

What Is High-Frequency Trading and How Do Institutions Use It?

High-frequency trading (HFT) is a form of algorithmic trading where institutions use powerful computers to execute thousands of trades in milliseconds. They rely on algorithms to identify tiny price discrepancies, market trends, or liquidity patterns. Institutions use HFT to gain quick advantages, like capturing arbitrage opportunities or improving order execution speed. This strategy allows them to make profits from small price movements, often staying ahead of other traders. They integrate HFT into their broader algorithmic strategies to enhance trading efficiency and reduce costs.

How Do Institutional Traders Handle Algorithm Failures?

Institutional traders handle algorithm failures by implementing automated risk controls like stop-loss orders and circuit breakers. They constantly monitor algorithm performance and have manual override options ready. When failures occur, they quickly deactivate the algorithm, assess the issue, and switch to manual trading if needed. They also run thorough testing and simulation before deploying algorithms to minimize failures.

What Regulations Affect Institutional Algorithmic Trading?

Regulations like the SEC's Regulation ATS and MiFID II in Europe govern institutional algorithmic trading. They require algorithmic traders to have risk controls, pre-trade risk checks, and ongoing compliance monitoring. The SEC mandates registration for certain algorithmic trading desks and imposes order and trade reporting rules. MiFID II demands transparency, algorithm testing, and record-keeping. Additionally, rules against market manipulation and rules on best execution directly impact how institutions deploy algorithms.

Learn about What Regulations Affect Institutional Day Trading?

How Do Institutional Traders Use Algorithms for Market Making?

Institutional traders use algorithms for market making by automating bid-ask quotes, providing liquidity, and managing risk. They deploy algorithms to quickly adjust prices based on real-time data, ensuring tight spreads and continuous market presence. These algorithms analyze order flow, volume, and price movements to optimize trade execution and minimize spreads. They also use them to hedge positions and respond to market fluctuations instantly, maintaining competitiveness and liquidity in the markets.

Learn about How Do Institutional Traders Use Technical and Fundamental Analysis?

How Do Institutional Traders Integrate Algorithms with Human Decision-Making?

Institutional traders combine algorithms with human judgment by using automated systems to handle data crunching, speed, and pattern recognition. They set algorithmic parameters for entry, exit, and risk management, then make manual adjustments based on market context or news. Human traders oversee and fine-tune algorithms, interpreting market signals that algorithms might miss. They use algorithms to execute trades efficiently while relying on their expertise to adapt strategies during volatile conditions or unexpected events.

Conclusion about How Do Institutional Traders Use Algorithmic Strategies?

In conclusion, institutional traders leverage algorithmic strategies to enhance their trading efficiency, manage risks, and optimize performance. By utilizing various types of algorithms and advanced technologies like machine learning and AI, they can navigate the complexities of the financial markets more effectively. Understanding these strategies can provide valuable insights for all traders. For more in-depth information and support on trading strategies, turn to DayTradingBusiness.

Learn about How Do Institutional Traders Use Technical and Fundamental Analysis?