Did you know that large institutional orders can be as disruptive as a herd of elephants at a tea party? In the world of trading, understanding institutional orders is crucial for grasping their significant influence on market liquidity. This article explores how these large trades affect market dynamics, including their role in liquidity, price volatility, and bid-ask spreads. We’ll delve into what institutional orders are, their impact during market crises, and how high-frequency trading firms interact with them. Additionally, we’ll discuss strategies institutions use to minimize their liquidity impact and how retail investors can detect these trades. Stay tuned as we unpack the complexities of institutional orders and their implications for traders, with insights from DayTradingBusiness to guide your understanding.

How Do Institutional Orders Affect Market Liquidity?

Institutional orders can significantly boost market liquidity because they involve large trade volumes that increase the availability of buyers and sellers. When institutions place sizable buy or sell orders, they tighten bid-ask spreads, making trading more efficient. Their participation often attracts other traders, encouraging more active trading and reducing price volatility. However, large institutional trades can also temporarily drain liquidity if executed quickly, causing short-term price swings. Overall, institutional orders generally improve market liquidity by providing depth and stability.

What Are Institutional Orders in Financial Markets?

Institutional orders are large buy or sell transactions executed by institutions like mutual funds, pension funds, or hedge funds. They significantly impact market liquidity by either adding substantial volume, which can boost liquidity, or by causing temporary price swings if executed quickly. These orders often require careful execution strategies to prevent market disruption. When institutions place big orders, they influence price discovery and can cause short-term volatility, affecting overall market liquidity.

Why Do Large Institutional Orders Influence Market Prices?

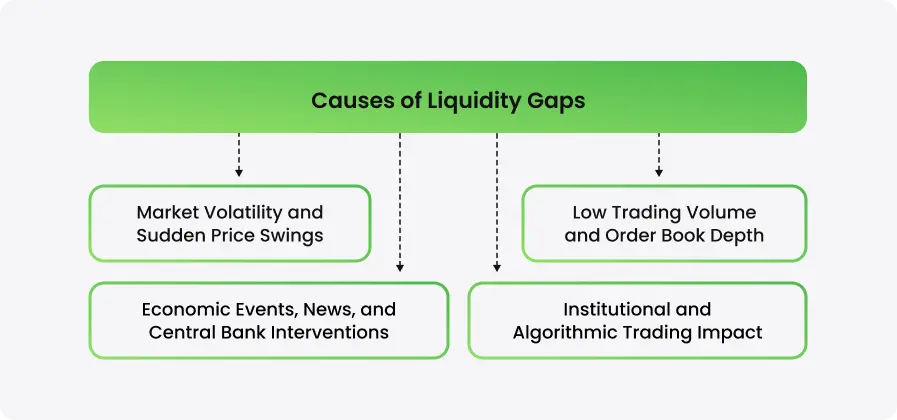

Large institutional orders impact market prices because they involve significant buying or selling volume that can surpass the usual market activity. When institutions place big orders, they can absorb available liquidity or create supply and demand imbalances. This shifts prices as other traders react to the increased activity, either by adjusting their bids or asks. Essentially, these orders can move prices quickly because they often require crossing multiple price levels, reducing liquidity and making the market more volatile.

How Do Institutional Trades Impact Short-Term Liquidity?

Institutional trades can temporarily reduce short-term market liquidity because large orders absorb available shares, causing wider bid-ask spreads and slower trading. When institutions buy or sell big blocks, it can create temporary price movements and make it harder for smaller traders to execute quick, low-cost trades. This impact is most noticeable during large transactions, especially in less liquid markets or stocks.

Can Institutional Orders Cause Market Volatility?

Yes, large institutional orders can cause market volatility by quickly shifting supply and demand, especially if they’re executed all at once or in illiquid markets.

How Do Market Makers Respond to Institutional Orders?

Market makers adjust bid-ask spreads, increase trading volume, and provide additional liquidity to accommodate large institutional orders. They may also temporarily widen spreads to manage risk or execute block trades discreetly. This response helps prevent significant price swings and maintains market stability during big trades.

What Strategies Do Institutions Use to Minimize Liquidity Impact?

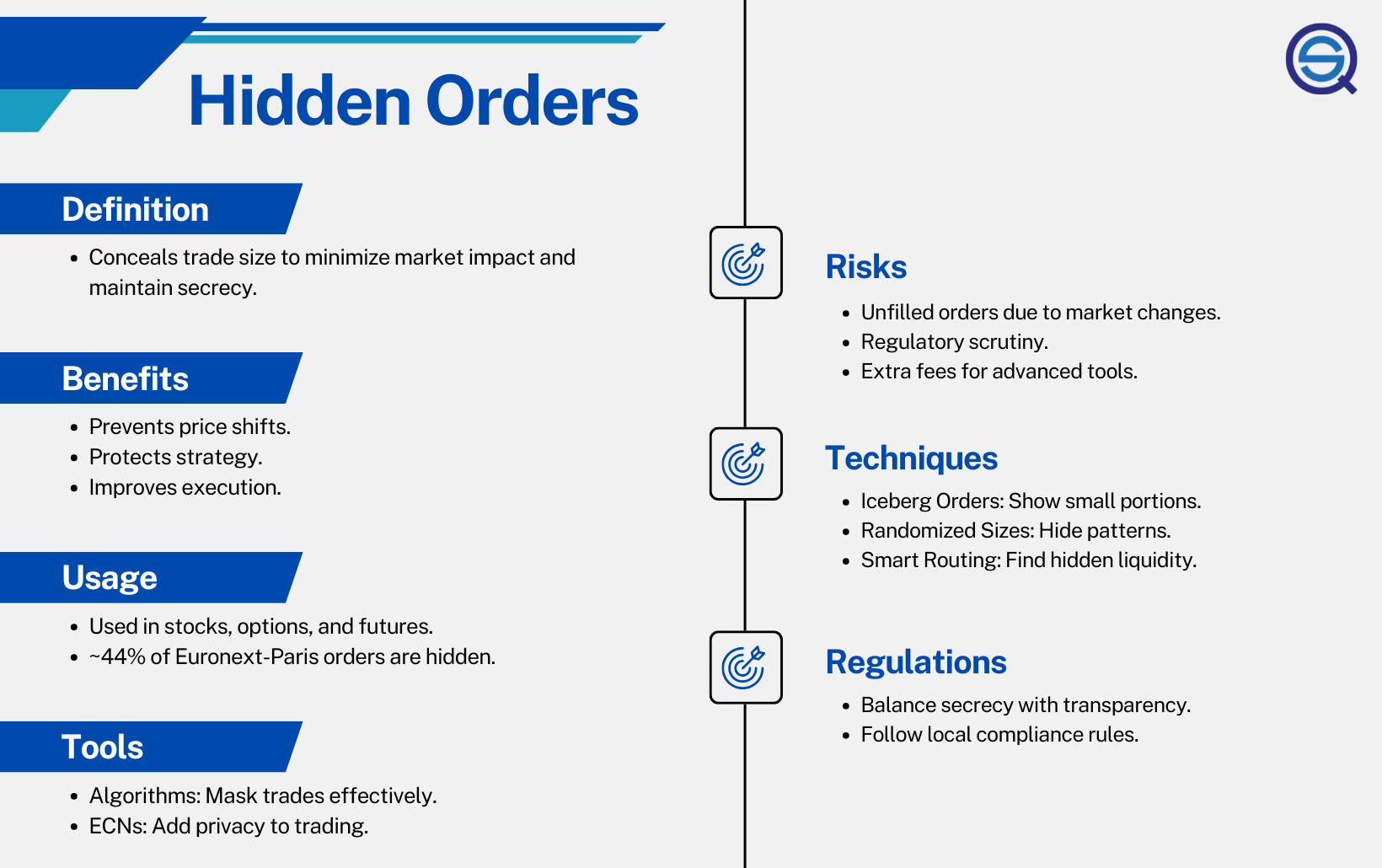

Institutions minimize liquidity impact by using algorithmic trading to break large orders into smaller chunks, reducing market disruption. They often employ dark pools to execute trades privately, avoiding public market swings. Timing trades during low-volume periods, like after-hours, also lessens liquidity strain. Additionally, they use pre-trade analysis and order routing strategies to find the best venues with deeper liquidity. These approaches help prevent large orders from causing significant price swings and preserve market stability.

How Do Institutional Orders Affect Bid-Ask Spreads?

Institutional orders often increase bid-ask spreads because large trades can disrupt market liquidity. When institutions place big buy or sell orders, other traders see potential volatility and widen their spreads to manage risk. This reduced liquidity makes it harder to execute small trades quickly, leading to higher bid-ask spreads. In some cases, institutional orders can temporarily drain liquidity, causing spreads to widen further until the market absorbs the volume.

Do Institutional Trades Lead to Price Manipulation?

Institutional trades can impact market liquidity, but they don't inherently lead to price manipulation. Large institutional orders can cause short-term price swings due to their size, but this is different from intentional manipulation. When institutions buy or sell significant amounts, it can temporarily affect prices, especially in less liquid markets. However, such trades are typically monitored and regulated to prevent manipulation. Overall, while institutional orders influence liquidity and short-term price movements, they don’t automatically equate to manipulation.

How Does Order Size Relate to Market Liquidity?

Larger institutional orders can reduce market liquidity temporarily by absorbing available supply or demand, causing wider bid-ask spreads. When institutions place big trades, they often need to execute across multiple orders, which can deplete liquidity pools and push prices away from current levels. This impact is more pronounced in less liquid markets or with less common assets. Conversely, in highly liquid markets, large orders are absorbed more smoothly, with minimal price disruption. So, bigger orders tend to challenge market liquidity, especially in thin markets, by increasing trading costs and causing short-term price swings.

What Role Do Institutional Orders Play During Market Crises?

Institutional orders can either stabilize or destabilize market liquidity during crises. Large buy or sell orders from institutions can drain liquidity quickly, causing sharp price swings. Conversely, they can also provide liquidity by stepping in when retail traders pull back, helping to prevent chaos. Their size and timing influence market depth, often amplifying volatility or offering unexpected stability amid turmoil.

How Do High-Frequency Trading Firms Interact with Institutional Orders?

High-frequency trading firms interact with institutional orders by quickly analyzing, splitting, and executing small trades to match the large orders without causing significant market moves. They often act as liquidity providers, filling gaps and smoothing out price impact. When institutions place big orders, HFT firms step in to provide rapid liquidity, reducing slippage and stabilizing prices. Their algorithms detect large orders and respond instantly, either by offering to buy or sell just ahead of the institutional trade or by executing partial fills across multiple venues. This interaction helps keep markets liquid, ensuring institutional investors can execute large trades efficiently without overly disrupting prices.

Can Retail Investors Detect Institutional Trading?

Retail investors can sometimes spot institutional trading through unusual volume spikes, large block trades, or sudden price movements. Watching for big trades on Level 2 order books or noticing significant volume during quiet periods hints at institutional activity. However, institutions often execute in stealth, making detection challenging. Tools like trade alerts or analyzing order flow can help, but most retail investors won't reliably identify all institutional orders.

How Do Regulations Limit Institutional Order Impact?

Regulations restrict the size and timing of institutional orders, reducing their ability to move markets sharply. They impose limits on order size, trading hours, and reporting, which disperses large trades and prevents sudden liquidity drains. This containment prevents institutions from exerting outsized influence, stabilizing market liquidity.

What Is Slippage, and How Is It Related to Institutional Orders?

Slippage is the difference between the expected price of a trade and the actual execution price. When institutional orders—large trades from banks, hedge funds, or mutual funds—hit the market, they can cause significant price movements, increasing slippage. These big orders often consume available liquidity, pushing prices away from initial estimates and leading to execution at less favorable prices.

How Do Institutional Orders Affect Market Depth?

Institutional orders significantly increase market depth by adding large volumes, which provide more liquidity and reduce price volatility. When institutions place sizable buy or sell orders, they create a broader order book, making it easier for other traders to execute large trades without causing big price swings. This increased market depth generally stabilizes prices and narrows bid-ask spreads, attracting more trading activity. Conversely, sudden institutional order withdrawals can thin market depth, making prices more sensitive to smaller trades and increasing volatility.

Conclusion about How Do Institutional Orders Impact Market Liquidity?

In summary, institutional orders play a crucial role in shaping market liquidity, influencing price movements and volatility. Their size and execution strategies can significantly affect bid-ask spreads and market depth, especially during times of crisis. Understanding these dynamics is essential for traders looking to navigate the complexities of the financial markets. For more insights and strategies tailored to your trading journey, explore the resources available at DayTradingBusiness.

Sources:

- Measuring institutional trading costs and the implications for finance ...

- Does better liquidity for large orders attract institutional investors and ...

- Transaction fees: Impact on institutional order types, commissions ...

- Hidden liquidity: An analysis of order exposure strategies in ...

- The impact of large orders in electronic markets - ScienceDirect