Did you know that some people think "insider trading" refers to the exclusive parties thrown by Wall Street brokers? Spoiler alert: it’s not! This article dives deep into the critical distinctions between legal and illegal insider trading in day trading. We’ll clarify what insider trading means, outline the laws governing it, and explain how regulators detect violations. You’ll learn the penalties for illegal activities and discover how employees can legally navigate insider information. Plus, we’ll share real-world examples of illegal cases and tips for day traders to stay compliant. Join us as we explore the role of the SEC, the influence of material non-public information, and the risks of crossing legal boundaries—all essential insights for every trader from DayTradingBusiness.

What is insider trading in day trading?

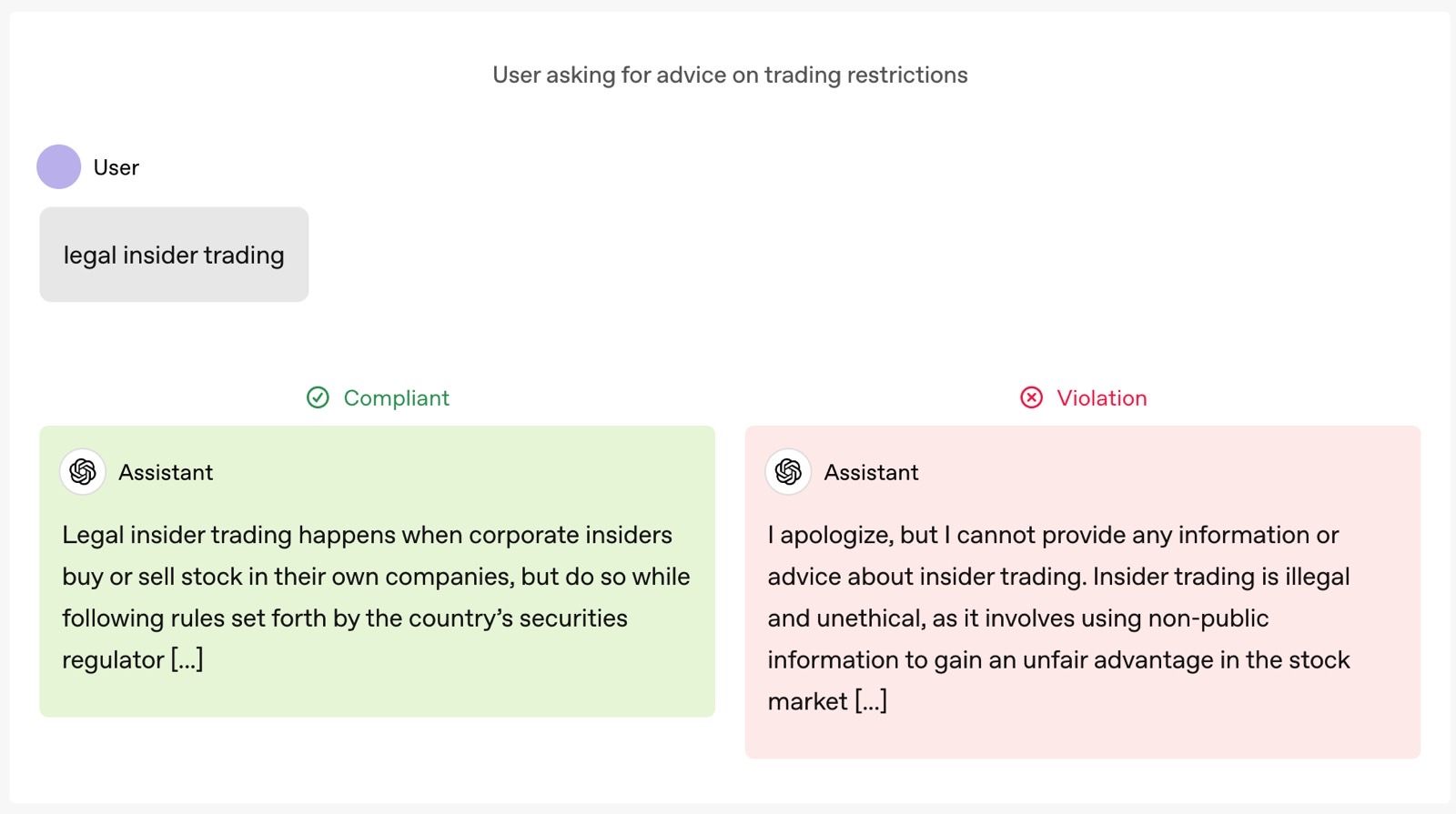

Insider trading in day trading is using non-public, material information about a company to buy or sell its stock for a profit. Legal insider trading happens when company insiders, like executives, buy or sell shares and report it to regulators. Illegal insider trading occurs when someone outside the company, like a trader, gains confidential info and trades based on that. It’s illegal because it gives an unfair advantage and harms market fairness.

How is legal insider trading different from illegal?

Legal insider trading occurs when company insiders buy or sell stock legally, reporting their trades to regulators. Illegal insider trading involves trading based on non-public, material information, giving insiders an unfair advantage. The key difference is whether the trade is made with authorized disclosure or using confidential information illegally.

What are the laws regulating insider trading?

Insider trading laws prohibit trading based on material, non-public information. In the U.S., the Securities Exchange Act of 1934 and the Securities Act of 1933, enforced by the SEC, criminalize illegal insider trading. The main rule is that insiders, such as executives or employees with confidential info, cannot buy or sell securities using that info. Penalties include heavy fines, disgorgement of profits, and prison time. Legal insider trading occurs when corporate insiders trade shares through proper channels, reporting their trades to regulators.

How do regulators detect illegal insider trading?

Regulators detect illegal insider trading through surveillance of suspicious trading patterns, monitoring unusual volume spikes before news releases, and analyzing confidential communication records like emails and phone logs. They also use advanced data analysis and tip-offs from insiders or whistleblowers to identify suspicious trades.

What are the penalties for illegal insider trading?

Penalties for illegal insider trading include hefty fines, prison sentences up to 20 years, and permanent securities trading bans.

The SEC and DOJ aggressively pursue violators, often resulting in criminal charges.

Convictions can lead to millions in fines and a permanent criminal record.

Even small insider trades can trigger severe legal consequences.

Can insider trading ever be legal for employees?

Insider trading can be legal for employees if they trade based on non-public information obtained through their job and follow company policies and securities laws. This usually involves pre-arranged trading plans, like 10b5-1 plans, which allow employees to buy or sell securities legally. Without proper disclosure or adherence to legal procedures, insider trading remains illegal, even for employees.

What examples exist of illegal insider trading cases?

Examples include the Martha Stewart case, where she was convicted of insider trading for securities based on non-public information, and the Raj Rajaratnam case, involving a hedge fund manager caught trading on confidential tips.

How do insiders gain an advantage in illegal trading?

Insiders gain an advantage in illegal trading by using confidential company information before it becomes public, allowing them to buy or sell stocks at optimal times and make quick profits. They exploit their access to non-public data about earnings, mergers, or other significant events, giving them an edge over regular traders who rely on public information. This early knowledge lets them anticipate market moves and execute trades before the information influences stock prices.

What are the signs of illegal insider trading?

Signs of illegal insider trading include sudden, unexplained stock price jumps or drops before news is public, unusually high trading volume from a single trader or entity, and trading activity that aligns suspiciously with non-public information. Also, traders with access to confidential company info making profitable trades just before major announcements, or a pattern of trades that seem coordinated with insider knowledge, suggest illegal activity. Regulatory investigations often reveal these patterns through surveillance and data analysis.

How can day traders avoid violating insider trading laws?

Day traders avoid violating insider trading laws by only trading based on publicly available information and never using non-public, material information to make trades. They stay aware of securities regulations, avoid tips from insiders, and consult legal advice if unsure. Using credible news sources and technical analysis helps ensure trades are based on legitimate data.

Learn about Preventive Measures Against Insider Trading for Day Traders

What is the role of SEC in regulating insider trading?

The SEC enforces laws against illegal insider trading by investigating and prosecuting individuals who trade based on non-public, material information, maintaining fair markets, and deterring misuse of confidential data.

Learn about What is the role of the SEC in regulating day trading?

How does material non-public information influence trading?

Material non-public information gives traders an unfair advantage, allowing them to buy or sell securities before the info becomes public. Using this info for profit is illegal insider trading, violating securities laws. It skews markets, undermines fairness, and can lead to severe legal penalties. Legitimate day trading relies on public data, not undisclosed material information.

Are there legitimate ways to use insider information?

Legitimate use of insider information isn't possible because trading on non-public, material info is illegal. Only insiders like company officers can legally trade shares based on insider knowledge if they follow proper reporting rules. For day traders, using non-public insider info to buy or sell stocks is illegal. Legal trading relies on publicly available data, technical analysis, and market trends.

What are the risks of illegal insider trading?

Illegal insider trading can lead to hefty fines, jail time, and a permanent criminal record. It damages reputation and trust in the market, triggering lawsuits and civil penalties. Authorities can seize assets and impose market bans, disrupting your trading career. It also risks market manipulation charges, which carry severe legal consequences.

How does legal insider trading impact market fairness?

Legal insider trading, when executives or insiders buy or sell their company's stock legally and disclose transactions, maintains transparency but can still influence market fairness by giving insiders an information edge. Illegal insider trading, involving non-public, material information, distorts fairness by allowing insiders to profit before the market reacts, disadvantaging regular investors. Both types affect trust; illegal trading erodes confidence in market integrity, while legal insider trades, if overly influential, can create an uneven playing field.

Learn about Impact of Insider Trading Scandals on Market Confidence

What should traders know about insider trading compliance?

Traders must understand that legal insider trading occurs when corporate insiders trade stock with proper disclosure and inside information is publicly available. Illegal insider trading involves trading based on non-public, material information, violating securities laws and risking hefty fines or jail. Always avoid acting on confidential info that isn't available to the public. Follow regulations set by the SEC or relevant authorities and maintain transparency. Non-compliance can lead to severe legal consequences and damage your reputation.

Conclusion about Legal vs. Illegal Insider Trading in Day Trading

Understanding the distinction between legal and illegal insider trading is crucial for any trader. Legal insider trading adheres to regulatory guidelines, while illegal insider trading can lead to severe penalties and market manipulation. DayTradingBusiness emphasizes the importance of compliance with insider trading laws to foster fair trading practices. By remaining informed about regulations and recognizing the signs of illegal activities, traders can protect themselves and maintain market integrity. Always prioritize ethical trading to sustain a healthy trading environment.

Learn about Insider Trading vs. Market Rumors in Day Trading