Did you know that the term "insider trading" might conjure up images of secret meetings and shadowy deals, but in reality, it’s often just a poorly timed coffee break? In this article, we delve into the complex world of insider trading—what it is, how it occurs, and the signs to look for. We’ll explore the legal repercussions and the role of companies in prevention, as well as best practices for employees to steer clear of risks. Learn how traders can protect themselves and the importance of compliance programs in safeguarding against insider information. We’ll outline common scenarios to be wary of, reporting methods, necessary training, regulatory monitoring, and the ethical implications surrounding insider trading. Arm yourself with the insights from DayTradingBusiness to navigate this intricate landscape safely.

What is insider trading and how does it happen?

Insider trading is buying or selling stocks based on confidential information not available to the public. It happens when someone with access to non-public company info, like an executive or employee, leaks or uses that info for personal gain. To protect yourself from insider trading risks, avoid acting on tips from insiders, stay within legal trading windows, and follow company policies on confidential information.

How can I recognize signs of insider trading?

Look for sudden spikes in stock prices without news, unusual trading activity by insiders, or trades that don't match public information. Be wary if someone seems overly secretive about their stock transactions or pushes confidential info. Notice if insiders consistently profit from early access to non-public company news. Keep an eye on irregular trading patterns around earnings reports or major announcements. If you suspect insider trading, consult a financial advisor or report it to authorities.

What are the legal penalties for insider trading?

The legal penalties for insider trading include fines up to three times the profits gained or losses avoided, and prison sentences up to 20 years.

How do companies prevent insider trading?

Companies prevent insider trading by enforcing strict confidentiality policies, restricting access to sensitive information, and monitoring employee communications. They conduct regular training to educate staff on legal boundaries. Companies also implement internal controls like trading blackout periods before earnings releases, and use surveillance tools to detect suspicious trading activity. Legal compliance programs and clear reporting channels help catch insider trading early.

What are best practices for employees to avoid insider trading?

To avoid insider trading, employees should never buy or sell company stock based on non-public information. Always wait for official disclosures before making trades. Keep confidential information secure and share it only with authorized colleagues. Follow company policies and legal guidelines strictly. Report any suspicious tips or leaks to compliance officers immediately. Stay informed about insider trading laws and company rules to understand what’s off-limits. Avoid discussing sensitive information in public or unsecured settings. Use insider trading training programs to stay aware of risks.

How can traders protect themselves from insider information risks?

Traders can protect themselves from insider trading risks by avoiding any trades based on non-public, material information. Always stick to publicly available data and avoid tips from insiders. Keep detailed records of your sources and transactions. Follow strict compliance policies and stay informed about legal boundaries. When in doubt, consult legal or compliance experts to ensure your trading activities are transparent and lawful.

What role do compliance programs play in insider trading prevention?

Compliance programs establish clear rules, training, and monitoring to prevent insider trading. They educate employees on legal boundaries, detect suspicious activities, and enforce consequences. By fostering a culture of integrity, compliance programs reduce the risk of insider trading and protect your organization.

How does confidential information increase insider trading risk?

Confidential information increases insider trading risk because it provides non-public, material data that can be exploited for profit. When someone uses this inside info to buy or sell securities before the market reacts, they gain an unfair advantage. Sharing or mishandling confidential info makes it easier for insiders or unauthorized individuals to trade on privileged knowledge. Protecting sensitive data reduces the chance that insiders will misuse it for illegal trading.

What are the common insider trading scenarios to watch out for?

Watch out for tips from someone with confidential company info, especially if they pressure you to trade. Be cautious if you notice unusual trading activity before big news releases. Avoid sharing or acting on non-public information you hear in casual conversations, emails, or meetings. Stay alert for colleagues or insiders who suddenly start trading heavily based on private data. Keep an eye out for tips from friends or contacts outside your organization that seem linked to inside knowledge. Always verify the source of information before making trades, and follow your company's compliance policies to avoid insider trading risks.

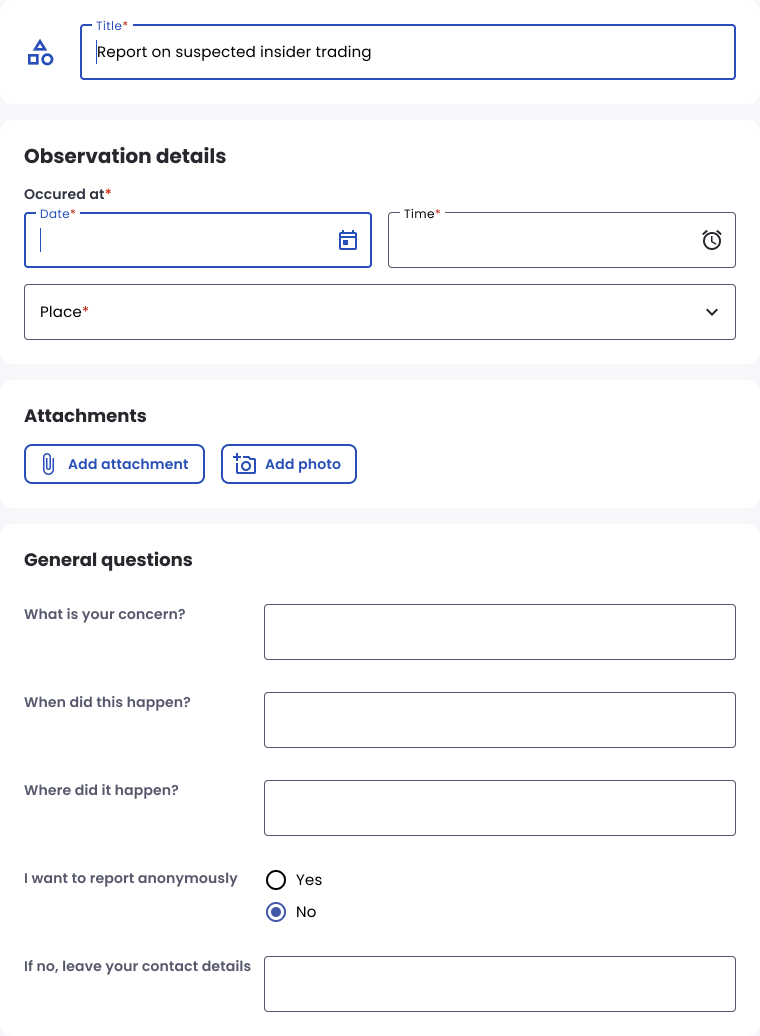

How can I report suspected insider trading safely?

Report suspected insider trading by contacting the SEC’s tip line or using their online whistleblower portal. Keep detailed records of any suspicious activity, including dates, times, and involved parties. Avoid confrontations or sharing sensitive information; instead, focus on documenting and securely submitting your concerns. If unsure, consult a legal professional before reporting to ensure your safety and compliance.

What training should employees receive about insider trading?

Employees should receive training on what constitutes insider trading, including legal definitions and penalties. They need clear guidance on handling non-public, material information and the importance of confidentiality. Training should cover company policies, reporting procedures for suspicious activity, and real-world examples to recognize risky situations. Regular updates and refresher courses ensure they stay informed about evolving laws and compliance standards.

How do regulatory agencies monitor insider trading?

Regulatory agencies monitor insider trading by analyzing trading patterns, reviewing suspicious transaction reports, and conducting investigations based on tips and market anomalies. They use surveillance systems to flag unusual trading activity around corporate disclosures and insider information. Agencies also track insider transactions filed with the SEC or relevant authorities and collaborate with exchanges to detect illegal trades.

Learn about How Do Regulatory Bodies Monitor Day Trading?

What are the risks of insider trading for investors?

Insider trading risks for investors include market manipulation, unfair advantages, and potential legal penalties. If an investor trades based on non-public, material information, they could face fines, suspension, or criminal charges. Such activity damages market integrity, leading to loss of trust and financial harm. Being unaware of insider trading risks can result in unknowingly participating in illegal trades, risking asset freezes or lawsuits. Protect yourself by avoiding trades based on confidential information and staying within legal boundaries.

How can technology help detect insider trading activity?

Technology detects insider trading by analyzing trading patterns, flagging unusual activity, and monitoring insider communications. Advanced algorithms identify anomalies in stock trades that don’t match typical market behavior. Surveillance tools scan emails, messages, and document uploads for insider information leaks. Machine learning models spot suspicious behavior across trading accounts. Real-time alerts notify compliance teams of potential illicit activity, enabling quick investigation. Using technology, firms can proactively identify and prevent insider trading risks before they escalate.

Learn about How Regulators Detect Insider Trading in Day Markets

What are the ethical considerations around insider trading?

Insider trading is unethical because it gives unfair market advantage, undermines trust, and harms honest investors. It breaches confidentiality agreements and legal standards, leading to severe penalties. Protect yourself by avoiding non-public information, reporting suspicious activity, and following securities laws. Engaging in insider trading damages your reputation and can result in criminal charges.

Conclusion about How to Protect Yourself from Insider Trading Risks

In summary, understanding insider trading and its associated risks is crucial for both traders and employees in the financial sector. By recognizing signs of insider activity, adhering to best practices, and engaging with compliance programs, individuals and companies can safeguard themselves against legal repercussions and ethical dilemmas. Staying informed about regulations and utilizing technology for detection further enhances protection. For more insights and guidance on navigating the complexities of trading, consider the resources offered by DayTradingBusiness.

Learn about How to Protect Your Capital from Day Trading Risks