Did you know that some traders believe the market has a mind of its own—like a cat that only comes to you when it wants to? Understanding market microstructure can help you decode its whims and enhance your day trading accuracy. This article dives deep into how microstructure influences trading, covering critical factors like order book data, bid-ask spreads, and liquidity levels. Learn how price volume analysis, market depth, and order flow can fine-tune your trading strategies and improve decision-making. We’ll also explore the role of trade timing, market maker actions, and the impact of news on short-term trading. With insights into common microstructure patterns and the best tools for analysis, you’ll discover how to reduce risks and optimize your entry and exit points. By leveraging these microstructure insights, you can elevate your trading algorithms and adapt to variations across different markets and assets—all with the expertise of DayTradingBusiness.

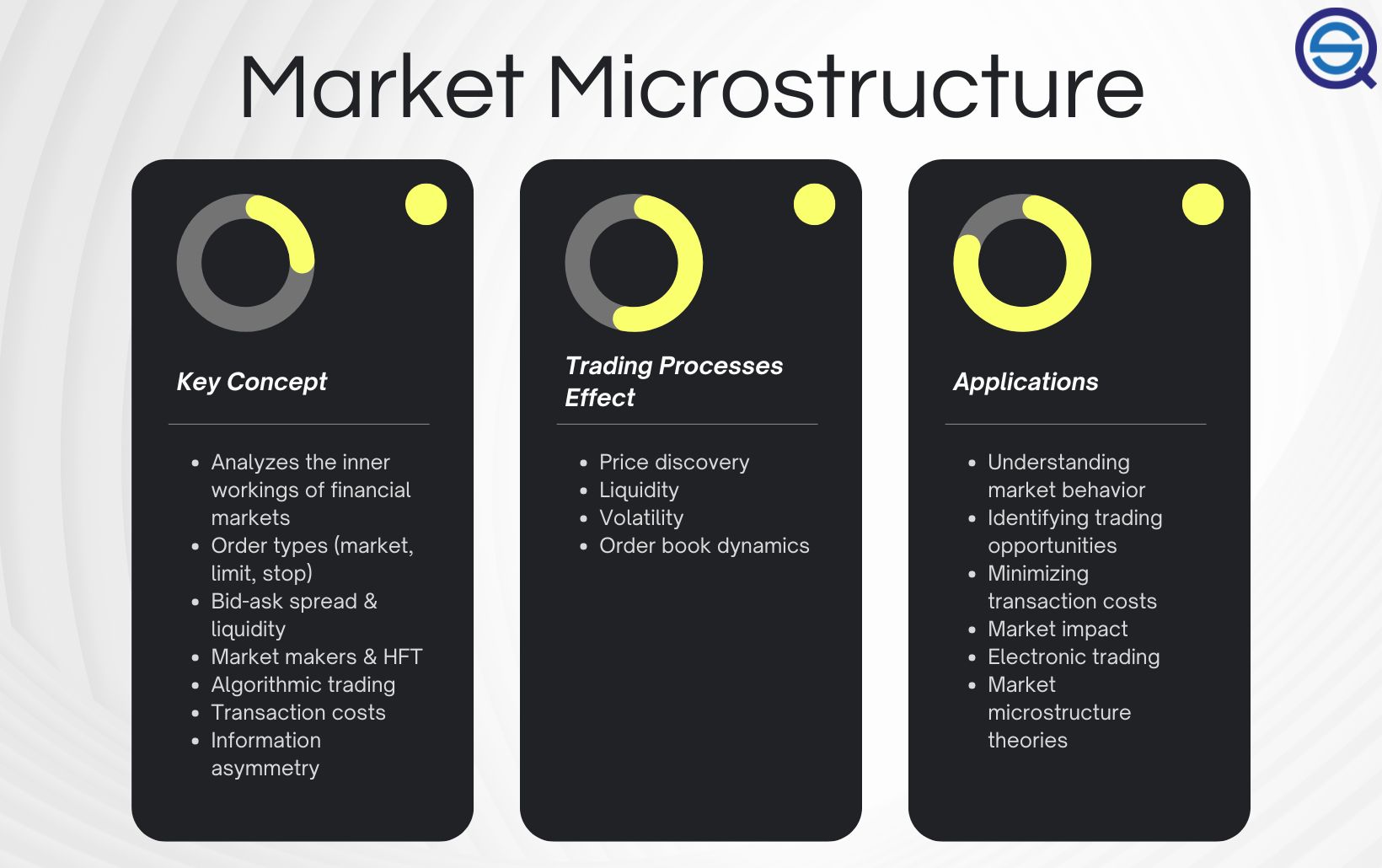

How Does Market Microstructure Affect Day Trading?

Market microstructure reveals how order flow, bid-ask spreads, and liquidity impact price movements. Understanding these details helps day traders anticipate short-term price changes, avoid slippage, and refine entry and exit points. For example, spotting when bid-ask spreads widen signals lower liquidity, warning traders of potential volatility. Microstructure insights also reveal how large trades influence prices, enabling traders to time their moves better. Overall, grasping these micro-level dynamics sharpens day trading accuracy by providing real-time clues about market behavior.

What Are Key Microstructure Factors for Day Traders?

Key microstructure factors for day traders include bid-ask spread, order book depth, trade volume, price impact, and order flow. These elements reveal liquidity, potential price movements, and market sentiment. Understanding how order placement, execution speed, and quote changes influence short-term price action helps traders make precise decisions. Microstructure insights like detecting order imbalances or hidden liquidity improve trade timing and reduce slippage.

How Can Order Book Data Improve Trading Decisions?

Order book data reveals real-time supply and demand, helping traders spot support and resistance levels instantly. It shows how large orders might influence price moves, allowing better timing of entries and exits. By analyzing bid-ask spreads and order flow, traders can detect potential reversals or breakouts before they happen. This insight reduces guesswork, enhances precision, and improves day trading accuracy by revealing market sentiment and liquidity moments.

What Is the Impact of Bid-Ask Spreads on Day Trading?

Bid-ask spreads affect day trading by increasing transaction costs, which can reduce profit margins. Wide spreads make quick trades less profitable and add risk, especially in volatile markets. Narrow spreads allow for more precise entries and exits, improving trading accuracy. Understanding market microstructure helps traders time their trades better, avoiding high-cost spreads during low liquidity periods. Ultimately, tight bid-ask spreads enable more efficient, cost-effective day trading.

How Do Liquidity Levels Influence Trade Accuracy?

Higher liquidity levels reduce bid-ask spreads and price slippage, making trade entries and exits more precise. When liquidity is deep, price movements reflect true value, improving the accuracy of predicting short-term trends. Low liquidity causes erratic price swings and unreliable signals, increasing the risk of false trades. Market microstructure insights show that understanding liquidity helps traders time their moves better, leading to more accurate day trading decisions.

Why Is Price Volume Analysis Important for Day Traders?

Price volume analysis reveals how traders' actions influence market moves, helping day traders identify genuine buy or sell signals. It shows the strength behind price changes, so traders can avoid false breakouts. Understanding market microstructure through volume helps spot liquidity gaps and order flow patterns, improving trade timing. By analyzing volume alongside price, traders gauge market sentiment, making more accurate decisions. Overall, it sharpens day trading accuracy by exposing the real dynamics behind price movements.

How Do Market Depth and Order Flow Help Predict Price Moves?

Market depth shows buy and sell orders at different prices, revealing supply and demand levels that hint at upcoming price movements. Order flow tracks real-time trades, indicating buying or selling pressure. Together, they help traders spot shifts in market sentiment, anticipate support or resistance levels, and time entries or exits more precisely. By analyzing these microstructure signals, day traders can predict short-term price moves more accurately and react faster to market changes.

What Role Do Trade Timing and Speed Play in Microstructure?

Trade timing and speed determine how quickly traders react to market changes, impacting order execution, liquidity, and price efficiency. Fast execution allows day traders to capitalize on fleeting opportunities and avoid slippage, while precise timing helps them enter and exit positions at optimal prices. Microstructure insights reveal how order flow and trade speed influence price movements, enabling traders to anticipate short-term trends and improve accuracy. In essence, timing and speed are crucial for executing trades efficiently and gaining an edge in fast-moving markets.

How Can Understanding Market Maker Actions Boost Trading Precision?

Knowing what market makers do helps you anticipate price moves and avoid false signals. When you understand their order flow and liquidity patterns, you can time entries and exits more precisely. Recognizing their strategies, like spoofing or layering, prevents misreading market signals. This insight allows day traders to react faster to genuine shifts, improving trade success and reducing losses. Overall, understanding market maker actions sharpens your focus on real market trends rather than noise.

What Are Common Microstructure Patterns in Day Trading?

Common microstructure patterns in day trading include bid-ask spread fluctuations, order book imbalances, price gaps, and short-term volume spikes. Traders also watch for order flow patterns, such as aggressive buying or selling, and price reversals at support or resistance levels. These microstructure signals help predict short-term price movements and improve trading accuracy.

How Do News and Microstructure Interact in Short-Term Trading?

News drives short-term market moves, but microstructure insights reveal how trades are executed and how orders impact prices. When traders understand order flow, bid-ask spreads, and liquidity, they can better interpret news reactions, timing entries and exits more precisely. Microstructure helps identify when news has already been priced in versus when it will cause real price swings. Combining news analysis with microstructure signals sharpens short-term trading decisions, reducing false signals and improving accuracy.

How Can Microstructure Data Reduce Trading Risks?

Microstructure data reveals bid-ask spreads, order flow, and liquidity, helping traders anticipate price movements. By understanding how orders are placed and executed, traders can avoid poor entries and exits. This insight reduces slippage and minimizes the impact of sudden market shifts. Using microstructure signals, day traders can refine timing, improve trade accuracy, and manage risk more effectively.

Learn about How to Use Market Microstructure Data to Improve Day Trading Outcomes

What Tools Are Best for Analyzing Market Microstructure?

Best tools for analyzing market microstructure include order book analysis platforms like Bookmap, Level II data feeds, and market depth visualization tools. Trading platforms such as NinjaTrader or Sierra Chart provide real-time order flow and volume analysis. Specialized software like MarketDelta offers footprint charts and order flow analytics. These tools reveal bid-ask spreads, order flow dynamics, and liquidity, helping day traders spot short-term price movements with precision.

How Does Microstructure Impact Spread and Slippage?

Market microstructure influences spread and slippage by determining order flow, liquidity, and bid-ask dynamics. Tight spreads reduce transaction costs, making quick trades more predictable. Deep liquidity minimizes slippage, helping traders execute orders at expected prices. Complex microstructure features like order book depth and trade timing affect price movement, impacting how accurately a day trader can anticipate short-term price changes. Understanding these microstructure elements allows traders to time entries and exits better, reducing unexpected slippage and improving trading precision.

What Are Microstructure Indicators for Entry and Exit Points?

Microstructure indicators for entry and exit points include bid-ask spread, order book depth, trade volume, price impact, and price movement patterns. They help identify liquidity, immediate supply and demand, and short-term trends, signaling optimal moments to buy or sell. For example, narrowing spreads and increasing order book activity can indicate a good entry, while widening spreads or sudden price reversals suggest it's time to exit. Using these indicators allows day traders to time trades more precisely based on real-time market behavior.

How Can Microstructure Insights Improve Trading Algorithms?

Microstructure insights reveal bid-ask spreads, order flow, and liquidity patterns, helping day traders time entries and exits precisely. Understanding how large orders impact prices allows algorithms to predict short-term price moves more accurately. Analyzing order book dynamics helps identify false signals and avoid trap trades. Incorporating microstructure data improves risk management by detecting liquidity gaps and abrupt price shifts. This granular view boosts prediction accuracy, enabling traders to optimize execution speed and reduce slippage.

Learn about How to Use Market Microstructure Data to Improve Day Trading Outcomes

How Do Different Markets and Assets Show Microstructure Variations?

Different markets and assets show microstructure variations through bid-ask spreads, order book depth, trading volume, and price volatility. Stocks might have tight spreads and high liquidity, while cryptocurrencies often have wider spreads and more frequent price jumps. Forex markets typically feature deep liquidity but lower spreads during peak hours, whereas commodities can have larger bid-ask spreads due to lower trading frequency. Recognizing these microstructure differences helps day traders time entries and exits better, anticipate short-term price movements, and avoid slippage, ultimately boosting trading accuracy.

Conclusion about How Market Microstructure Insights Improve Day Trading Accuracy

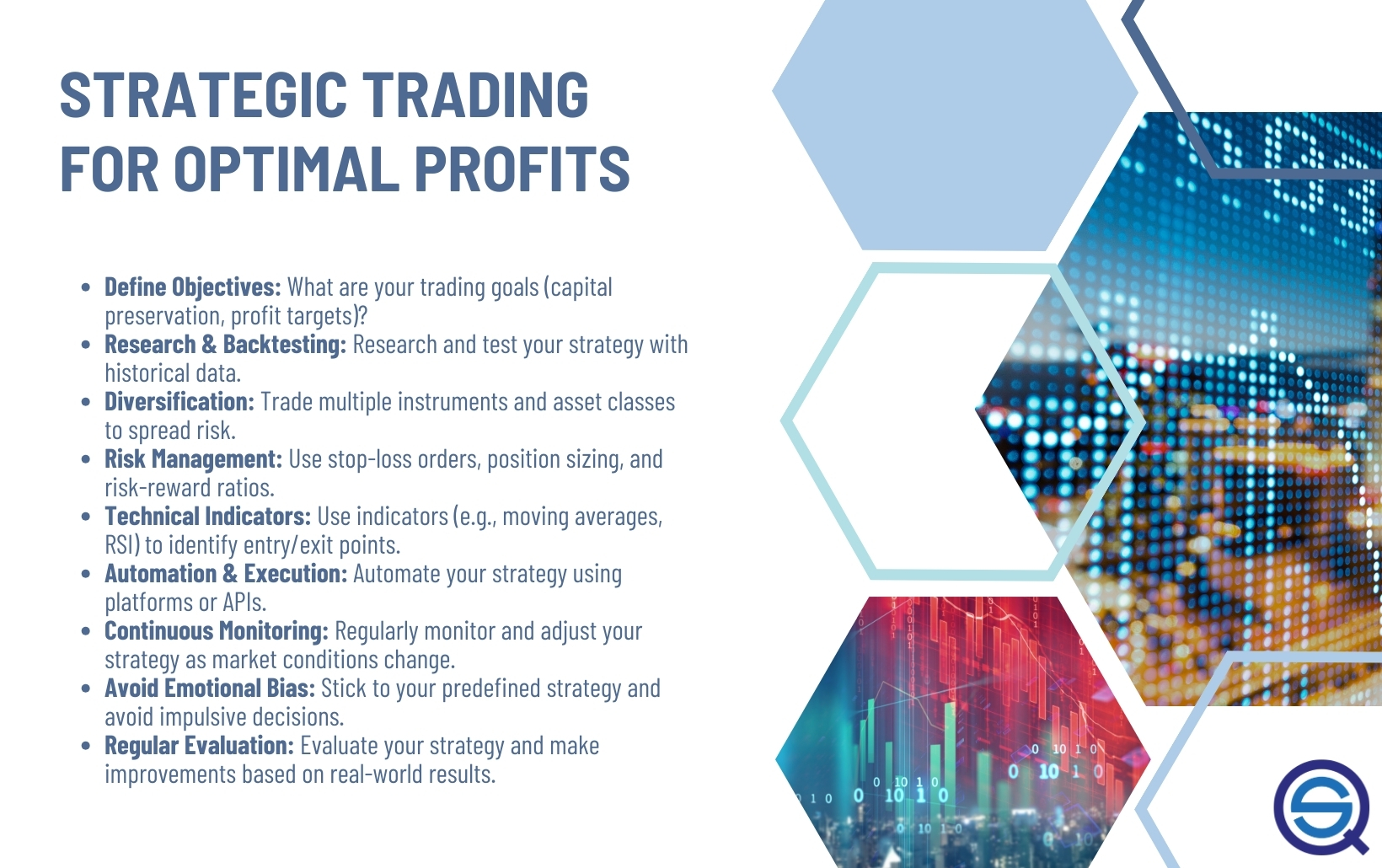

Incorporating market microstructure insights can significantly enhance day trading accuracy by providing a deeper understanding of price movements, liquidity, and order dynamics. By analyzing key factors such as bid-ask spreads, market depth, and trade timing, traders can make more informed decisions and reduce risks. Utilizing tools and data from sources like DayTradingBusiness allows you to leverage these insights for better trading strategies, ultimately improving your performance in the fast-paced trading environment.

Learn about How to Use Market Microstructure Data to Improve Day Trading Outcomes

Sources:

- To fix or not to fix, the Fix: Reassessing the effectiveness of the 4 pm ...

- Market Microstructure - an overview | ScienceDirect Topics

- [2308.14235] An Empirical Analysis on Financial Markets: Insights ...

- Intraday trading patterns in an intelligent autonomous agent-based ...

- Market price determination: Interpreting quote order imbalance ...

- Local mispricing and microstructural noise: A parametric perspective ...