Did you know that the term "dark pool" sounds more like a secretive lair from a superhero movie than a trading platform? In reality, dark pools are essential to understanding the complexities of today's stock market. This article dives into how to detect dark pool activity, offering insights on identifying trading patterns and signs of dark pool transactions. You'll learn about the tools available for tracking this hidden market, the impact of dark pools on stock prices and market liquidity, and how to interpret volume data effectively. Additionally, we’ll explore how to spot unusual activity, the role of Level II data, and best practices for monitoring these elusive trades. With DayTradingBusiness's expertise, you’ll be equipped to navigate the murky waters of dark pool trading with confidence.

How can I identify dark pool trading activity?

Look for unusual spikes in volume without clear public market news, signaling dark pool activity. Use specialized trading tools or platforms that show dark pool order flow or block trades. Monitor price movements that don’t match public order book activity, indicating hidden trades. Check for large, off-exchange trades reported through FINRA’s TRACE system. Pay attention to sudden volume surges during quiet market hours, often linked to dark pool executions.

What are the signs of dark pool transactions?

Signs of dark pool transactions include unusually large volume spikes without corresponding price moves, sudden changes in order book depth, and trades occurring at prices that don’t match public quotes. You might notice a lack of transparency, with no visible order flow or limited data on specific trades. Sharp increases in volume during off-hours or after-hours trading can also indicate dark pool activity. In some cases, price action remains stable despite high-volume trades, hinting that big players are executing large orders quietly.

How do dark pools affect stock prices?

Dark pools can influence stock prices by hiding large trades that might impact the market if visible. When big orders are executed in dark pools, they prevent sudden price swings, allowing institutional investors to buy or sell without revealing their intentions. If dark pool activity increases, it can signal hidden demand or supply, potentially foreshadowing price movements once the trades surface. Detecting dark pool activity involves analyzing unusual trading volume, price discrepancies between dark pools and public markets, and monitoring specialized trading data providers.

Which tools help detect dark pool activity?

Tools like FINRA’s TRACE system, Bloomberg Terminal, and Thomson Reuters Eikon track dark pool trades. Dark pool aggregator platforms such as Lightspeed Trader, MetaStock, and Trade Alert help identify unusual dark pool activity. Some brokers offer proprietary analytics that highlight dark pool order flows. Additionally, specialized algorithms and data feeds from firms like S3 Partners and Nanex analyze dark pool trading patterns.

How can I interpret dark pool volume data?

Look for sudden spikes in dark pool volume compared to average trading activity. Dark pool data often shows large, hidden trades not visible on public exchanges. If dark pool volume exceeds typical levels, it suggests institutional investors are accumulating or liquidating large positions. Use dark pool indicators alongside price action to spot potential trend shifts. High dark pool activity before a move can signal upcoming price changes or market interest in a security.

Are there indicators that signal dark pool trades?

Yes, indicators like sudden spikes in trading volume, unusual order flow patterns, and discrepancies between bid-ask spreads can signal dark pool trades.

Large block trades executed outside regular exchanges often hint at dark pool activity.

Monitoring after-hours or off-exchange trading volume also provides clues.

Some platforms offer dark pool trade data, but much of it remains hidden, so unusual activity in price movements and volume is your best signal.

How do I spot unusual dark pool activity?

Look for sudden spikes in large, unreported trades that don’t match public market trends. Use specialized trading tools or dark pool scanners to identify unusual order flow. Watch for price movements that aren’t supported by visible order book activity. Check for discrepancies between dark pool volume reports and public exchange data. Unusual activity often shows up as large blocks executed quietly, causing little market impact but signaling potential institutional moves.

What is the role of Level II data in detecting dark pools?

Level II data shows real-time order book details, including bid and ask prices and sizes, which helps identify dark pool activity by revealing unusual trading patterns, large hidden orders, or sudden shifts in supply and demand that aren't visible on public exchanges. It allows traders to see potential dark pool executions, such as large block trades executed away from public markets, giving clues about institutional activity. By analyzing Level II data, you can spot discrepancies between displayed orders and actual market moves, indicating dark pool involvement.

How does dark pool activity influence market liquidity?

Dark pool activity boosts market liquidity by providing large traders a way to execute big orders without moving the market. It absorbs substantial buy or sell orders, reducing price impact and spreading liquidity across the market. Detecting dark pool activity helps traders understand hidden supply and demand, which can signal potential price movements and market sentiment.

Can dark pool trading be predicted?

Dark pool trading is difficult to predict because it’s designed to be opaque. While unusual trading volume spikes or large block trades can hint at dark pool activity, they don’t guarantee precise prediction. Some traders analyze order flow and market patterns for clues, but dark pools intentionally hide activity, making detection uncertain.

What are the risks of dark pool trading detection?

Detecting dark pool activity can reveal traders' hidden strategies, potentially exposing sensitive investment moves. It might also lead to increased scrutiny from regulators, risking penalties if illegal practices are uncovered. If firms are caught manipulating or front-running dark pool data, they face reputational damage and legal consequences. Additionally, revealing dark pool activity could give competitors an unfair advantage, compromising proprietary trading algorithms.

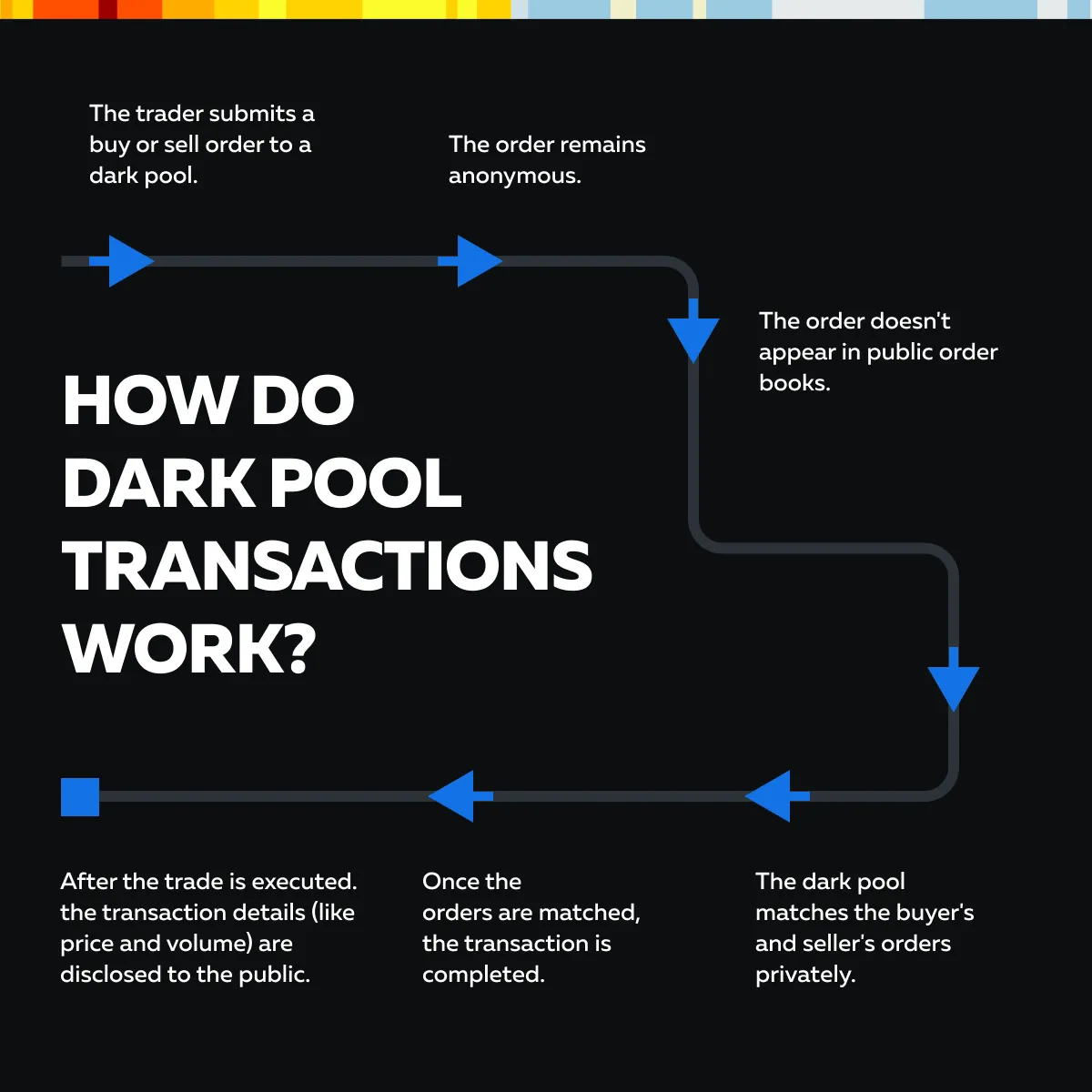

How do dark pools hide large trades?

Dark pools hide large trades by executing them off public exchanges, so they don't appear in regular order books. They use private, opaque platforms that prevent revealing trade size or intentions until after execution. This anonymity makes it hard to spot big trades until the transaction is complete, often showing only as a vague volume spike. To detect dark pool activity, look for unusual price movements, sudden volume surges without public order flow, or discrepancies between reported volume and price action. Some advanced tools analyze dark pool data feeds or track implied trading patterns to reveal hidden activity.

What should traders look for to identify dark pool signals?

Traders should watch for unusual volume spikes in dark pool data, large block trades outside regular exchanges, and sudden shifts in order flow. They can also monitor dark pool indicator tools that highlight significant hidden order activity. Look for patterns like consistent large trades or increased dark pool volume during specific times, signaling institutional interest. Tracking changes in bid-ask spreads and price movements linked to dark pool reports helps confirm activity. These clues point to emerging dark pool activity that can impact the broader market.

How does dark pool activity impact retail traders?

Dark pool activity can hide large trades that move prices without retail traders noticing. It can cause sudden price shifts or increased volatility when these hidden trades hit the market. Retail traders might miss early signals of big institutional moves, leading to less informed decisions. Detecting dark pool activity involves monitoring unusual volume spikes, price divergences, and using tools like Level II quotes or dark pool indicators. Recognizing these signs helps retail traders anticipate potential price swings caused by dark pool trades.

Are there legal ways to track dark pool transactions?

Yes, some legal methods include analyzing publicly available trade data, monitoring SEC filings like Form 13F and Form 13D, tracking unusual trading volumes, and using specialized market surveillance tools that aggregate dark pool activity without violating regulations.

How can I differentiate between dark pool and regular market activity?

Look for unusually large trades executed outside standard exchanges, often reported after the fact. Dark pool activity won't appear on real-time price charts or order books like regular markets. Check for sudden, unexplained price movements or volume spikes that don't match public order flow. Use specialized dark pool tracking tools or data feeds that highlight off-exchange trades. Regular market activity is transparent, with visible order books and real-time quotes; dark pool trades are hidden until after execution.

What are the best practices for monitoring dark pool activity?

Use specialized trading platforms and market data providers that track dark pool trades in real-time. Look for unusual trade sizes, sudden spikes in volume, or activity that diverges from the public order book. Analyze order flow and volume patterns for hidden or off-exchange trades. Cross-reference dark pool data with price movements to spot discrepancies. Keep an eye on Level 2 and Level 3 market data, which can reveal dark pool activity indirectly. Use algorithms or tools designed for detecting dark pool activity to identify potential large institutional trades before they impact the broader market.

Conclusion about How to Detect Dark Pool Activity?

In conclusion, understanding dark pool activity is crucial for traders aiming to navigate the complexities of the stock market. By identifying key signs of dark pool transactions, utilizing specialized tools, and interpreting volume data, traders can gain valuable insights. Level II data plays a significant role in detecting these trades, while recognizing unusual activity can enhance decision-making. Although predicting dark pool trading remains challenging, being aware of its potential impacts on market liquidity and retail trading is essential. For those interested in further enhancing their trading strategies, leveraging the resources and expertise offered by DayTradingBusiness can provide a significant advantage.

Sources:

- Volatility and dark trading: Evidence from the Covid-19 pandemic ...

- Why do traders choose dark markets? - ScienceDirect

- Occasional Paper Series. Dark Pools in European Equity Markets ...

- Understanding the impacts of dark pools on price discovery ...

- Differential access to dark markets and execution outcomes ...

- City goes dark: Dark trading and adverse selection in aggregate ...