Did you know that a significant portion of stock trades occurs in the shadows, away from public view? This article dives deep into the enigmatic world of dark pools, revealing how they influence price movements and affect stock prices. We’ll explore what dark pools are, how they operate, and why traders prefer them for large orders. Discover the impact of dark pools on market liquidity, volatility, and retail investors, as well as their role in price manipulation and market efficiency. We’ll also discuss regulatory oversight and how investors can detect dark pool activity. Join DayTradingBusiness as we shed light on these hidden trading venues and their implications for your trading strategy.

How Do Dark Pools Affect Stock Prices?

Dark pools can cause stock prices to move unpredictably because large trades executed privately aren't visible until after completion. They can create temporary price distortions, as big investors hide their buying or selling activity, leading to less transparent market signals. When these trades are revealed, they can trigger sudden price shifts. Overall, dark pools can influence stock prices by reducing market transparency and impacting the supply-demand balance.

What Are Dark Pools and How Do They Operate?

Dark pools are private trading platforms where large investors buy and sell stocks without revealing their intentions publicly. They operate outside traditional exchanges, allowing traders to execute big orders without causing market swings. Because trades happen in secrecy, dark pools can influence price movements by absorbing large orders quietly, sometimes leading to less price impact in public markets. When big trades occur in dark pools, they can create discrepancies between the dark pool prices and the public market, potentially affecting overall market liquidity and price discovery.

Why Do Traders Use Dark Pools for Large Orders?

Traders use dark pools for large orders to avoid revealing their intentions and prevent market impact, which can move prices against them. Because these private venues hide order sizes and details, big traders can execute trades discreetly without triggering sudden price swings. Dark pools help prevent front-running and minimize market disruption, allowing large trades to be absorbed more smoothly without influencing overall price movements. This secrecy often results in less visible, more controlled price impacts compared to public exchanges.

Can Dark Pools Move Market Prices?

Dark pools can influence market prices by executing large trades away from public exchanges, which can impact the supply and demand balance once the trades are revealed. When big trades happen in dark pools, they can cause price movements once disclosed or when they leak into the broader market. However, because dark pools are private, their direct influence on visible market prices is limited compared to public exchanges. Still, frequent or sizable dark pool activity can signal institutional interest, subtly shaping market sentiment and price trends.

How Do Dark Pools Impact Liquidity?

Dark pools increase liquidity by allowing large trades to happen without moving the market, making it easier for institutional investors to buy or sell big blocks without causing price spikes. They reduce the impact of individual trades on the visible order book, smoothing out price movements. However, they can also hide supply and demand, potentially delaying price discovery and causing sudden swings when the hidden orders are revealed. Overall, dark pools contribute to market liquidity but can obscure true price signals.

Are Dark Pools Responsible for Price Manipulation?

Dark pools can influence price movements by allowing large trades to happen away from public markets, which can hide the true supply and demand. This opacity can lead to price manipulation if traders or institutions execute manipulative trades without immediate market visibility. However, they are regulated to prevent such practices, but manipulation risks still exist, especially when large orders move the market quietly.

Do Dark Pools Cause Price Volatility?

Dark pools can cause price volatility by hiding large trades that suddenly hit the market, leading to abrupt price swings when these trades are revealed. They reduce transparency, which can cause uncertainty and quick price adjustments once the information leaks out. Large, undisclosed trades in dark pools may distort the true supply and demand, sparking sudden movements when they come to light.

How Do Dark Pools Influence Retail Investors?

Dark pools can delay public price discovery, causing retail investors to trade at less transparent prices. They often execute large trades away from public markets, which can lead to sudden price swings once the trades are revealed. This opacity can make it harder for retail investors to gauge true market value, increasing the risk of unfavorable prices. When big institutions trade in dark pools, their activity can indirectly sway the visible prices, sometimes causing retail investors to react to misleading signals. Overall, dark pools can create hidden price movements that impact retail investor decisions and market transparency.

What Is the Difference Between Dark Pools and Public Exchanges?

Dark pools are private trading venues where large investors buy and sell shares without revealing their intentions, preventing immediate market impact. Public exchanges, like NYSE or NASDAQ, are transparent platforms where all orders are visible, and prices are set by supply and demand. Dark pools minimize market impact on big trades, potentially delaying price discovery, while public exchanges promote transparency and real-time price movements. Dark pools can influence price movements by allowing large trades to occur away from public view, which may cause sudden shifts once information leaks or trades are revealed.

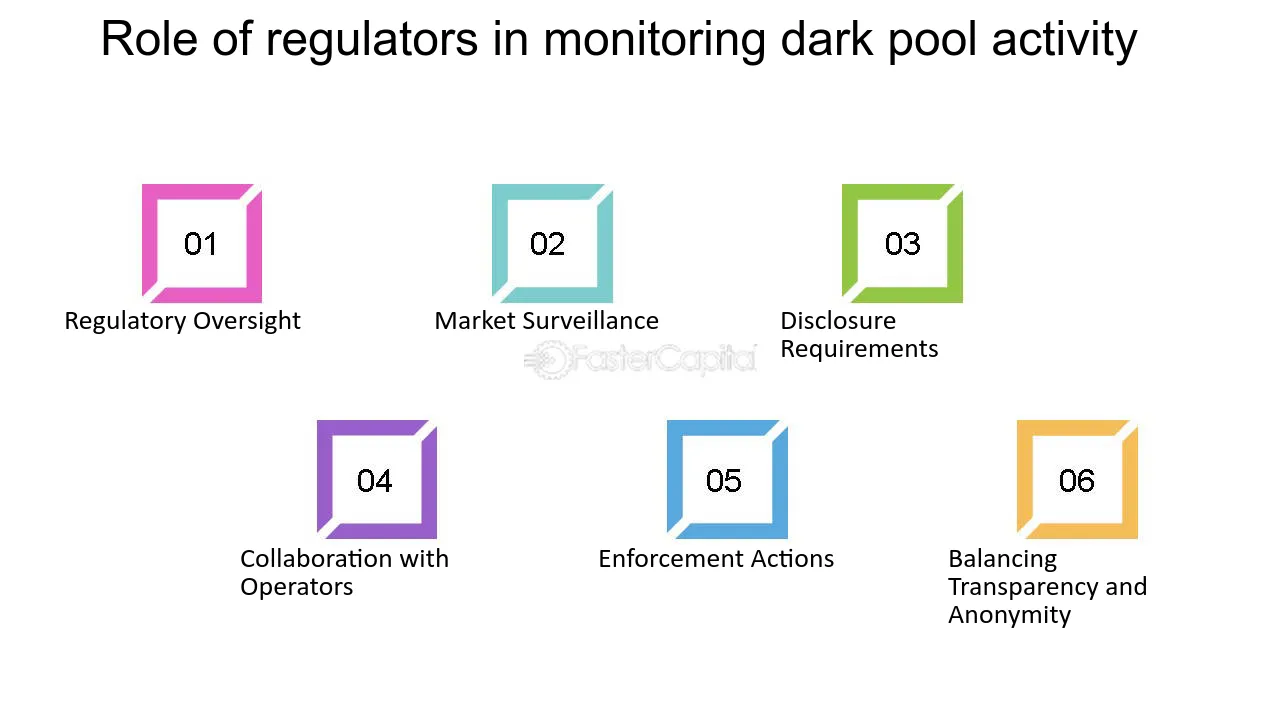

How Do Regulators Monitor Dark Pool Activities?

Regulators monitor dark pool activities through trade reporting requirements, surveillance technology, and data analysis to detect suspicious or manipulative trading. They analyze order flow, look for unusual patterns, and compare dark pool trades with public markets to spot potential price influence or market manipulation.

Can Dark Pools Lead to Price Discrepancies?

Yes, dark pools can cause price discrepancies. They often execute large trades privately, which can lead to differences between the dark pool prices and public market prices. When these trades are revealed, they might shift the overall market, creating temporary price gaps or discrepancies. This happens because dark pools bypass public order books, so the true supply and demand aren’t immediately visible, influencing short-term price movements.

What Role Do Dark Pools Play in Market Efficiency?

Dark pools affect price movements by delaying transparency, which can hide large trades that might otherwise signal market direction. They reduce immediate market impact for big investors, allowing them to execute trades without moving prices sharply. This can lead to less visible supply and demand shifts, sometimes causing sudden price jumps when dark pool activity is revealed. While they help prevent market disruption from large orders, dark pools can also create less efficient price discovery, making true market value harder to gauge quickly.

Learn about What Is the Role of Dark Pools in Market Liquidity?

How Does Order Flow in Dark Pools Affect Price Discovery?

Order flow in dark pools limits public visibility, reducing immediate price discovery. Large trades happen privately, which can delay or obscure true market prices. This can lead to less efficient price movements, as the market reacts to incomplete information. When these dark pool trades eventually surface, they often cause sudden price shifts. Overall, dark pools slow down transparent price discovery but can enable discreet trading without impacting public quotes.

Learn about How Do Dark Pools Affect Price Discovery?

Are Dark Pools Used for Insider Trading?

Dark pools can be used for insider trading because they conceal large trades, making it easier for insiders to hide their activities. Their lack of transparency can distort price movements by delaying the market's reaction to significant information. However, not all dark pools are used for illegal activities; many serve legitimate purposes like reducing market impact.

How Do Dark Pools Impact Market Transparency?

Dark pools limit market transparency by hiding large trade orders from public view, making it harder to see true supply and demand. This secrecy can lead to less accurate price discovery, causing sudden price movements when hidden trades are eventually revealed. Investors may get less reliable signals about market direction, which can increase volatility around dark pool activity.

Learn about How Do Dark Pools Impact Market Fairness?

Do Dark Pools Benefit or Harm Overall Market Stability?

Dark pools can both stabilize and destabilize market prices. They reduce market impact for large trades, preventing sudden price swings, which benefits stability. However, they also hide trading activity, potentially obscuring true supply and demand, leading to less transparency and increased risk of sudden price jumps. Overall, their effect depends on how they're used; they can smooth out big trades but also conceal information that might cause abrupt market movements.

How Can Investors Detect Dark Pool Activity?

Investors detect dark pool activity by monitoring unusual volume spikes, tracking block trades reported after the fact, and using specialized trading platforms or data services that reveal dark pool prints. They also watch for sudden price movements that diverge from public market trends, which can indicate hidden trading activity. Some traders analyze order flow and level 2 data to spot large, off-exchange trades.

Learn about How to Detect Dark Pool Activity?

Conclusion about How Do Dark Pools Influence Price Movements?

In summary, dark pools play a significant role in shaping market dynamics and influencing price movements. They offer benefits such as liquidity and anonymity for large trades, but also raise concerns regarding transparency and potential price manipulation. Understanding the intricacies of dark pools can empower traders to navigate the complexities of the market more effectively. For comprehensive insights and strategies related to dark pools and trading, rely on DayTradingBusiness to enhance your trading acumen.

Learn about How Do Dark Pools Affect Price Discovery?