Did you know that dark pools can sometimes feel like the secret speakeasies of the trading world, where the big players make their moves away from the spotlight? In this article, we delve into the complex role of dark pools in day trading, exploring how they impact trading strategies, stock prices, and market liquidity. We'll uncover what dark pools are and why they matter to traders, as well as the risks and advantages they present. From their influence on bid-ask spreads to how they interact with public exchanges, we’ll equip you with insights to navigate this often-overlooked aspect of the market. Join us as we help you understand how to adjust your trading approach in light of dark pool activity, brought to you by DayTradingBusiness.

How Do Dark Pools Impact Day Trading Strategies?

Dark pools reduce the transparency of large trades, making it harder for day traders to gauge market sentiment. They can cause sudden price movements when big orders are executed quietly, catching traders off guard. Since trades happen away from public eyes, liquidity can vanish unexpectedly, increasing volatility. This can lead to wider spreads and less reliable signals for short-term trades. Overall, dark pools add unpredictability, forcing day traders to adapt their strategies to sudden, hidden market shifts.

What Are Dark Pools and Why Do Traders Care?

Dark pools are private trading venues where large buy or sell orders are executed away from public markets. Traders care because dark pools can hide big trades, preventing market impact and enabling institutional investors to execute large positions discreetly. For day traders, dark pools matter because price movements influenced by hidden large trades can cause sudden volatility or price gaps, making it harder to predict short-term market moves. They also affect liquidity and can lead to less transparent price discovery, impacting trading strategies.

Can Dark Pools Influence Stock Prices During Day Trading?

Yes, dark pools can influence stock prices during day trading. Large trades in dark pools often aren't visible immediately, which can cause sudden price swings once the information leaks or the trades are revealed. Day traders watch dark pool activity because significant volume or large block trades in these private venues can signal upcoming price movements, making it harder to predict short-term trends accurately.

Are Dark Pools Used by Day Traders for Quick Executions?

No, dark pools are not used by day traders for quick executions. They are private venues mainly for institutional investors to execute large trades without impacting the market. Day traders prefer public exchanges for rapid, transparent order execution.

How Do Dark Pools Affect Market Liquidity for Day Traders?

Dark pools reduce available public liquidity, making it harder for day traders to execute large orders without impacting the market. They can cause sudden price moves when large trades are eventually revealed, increasing volatility. While dark pools can hide big institutional trades, they limit transparency, leading to less accurate price discovery for day traders. This reduced visibility can cause slippage and unpredictable price swings, complicating short-term trading strategies.

Do Dark Pools Increase or Decrease Market Transparency?

Dark pools decrease market transparency because they allow large trades to happen away from public exchanges, hiding order details from other traders.

What Risks Do Dark Pools Present to Day Traders?

Dark pools can hide large orders, making it hard for day traders to gauge true market activity. This can lead to sudden price swings when large dark pool trades become public, causing unexpected losses. They reduce market transparency, increasing the risk of trading on incomplete or misleading data. Also, dark pools can create liquidity gaps, making it tricky to enter or exit positions at desired prices. Overall, dark pools can distort price signals, making short-term trading riskier and less predictable.

How Do Dark Pools Interact with Public Stock Exchanges?

Dark pools let large traders buy or sell stocks quietly, without revealing their moves on public exchanges. They don’t impact the visible bid-ask spreads or price quotes directly, so day traders see less immediate market influence from big institutional trades. However, dark pools can cause sudden price swings when large blocks are eventually revealed on public exchanges, affecting short-term trading. They also reduce the overall transparency of the market, making it harder for day traders to gauge true supply and demand.

Can Dark Pool Data Help Day Traders Make Better Decisions?

Dark pool data can help day traders spot large institutional moves before they hit public markets, offering an edge. It reveals hidden trading activity, indicating potential market shifts or liquidity levels. However, dark pools lack transparency and may not reflect overall market sentiment, so relying solely on this data can be risky. Combining dark pool insights with real-time analysis improves decision-making but doesn't guarantee success.

Are Dark Pools More Common in Certain Stock Types?

Dark pools are more common in large-cap, institutional, and high-volume stocks because they allow big players to trade anonymously without impacting the market. They’re less used with small-cap or less liquid stocks, where transparency and liquidity are already limited.

How Do Dark Pools Affect Bid-Ask Spreads in Day Trading?

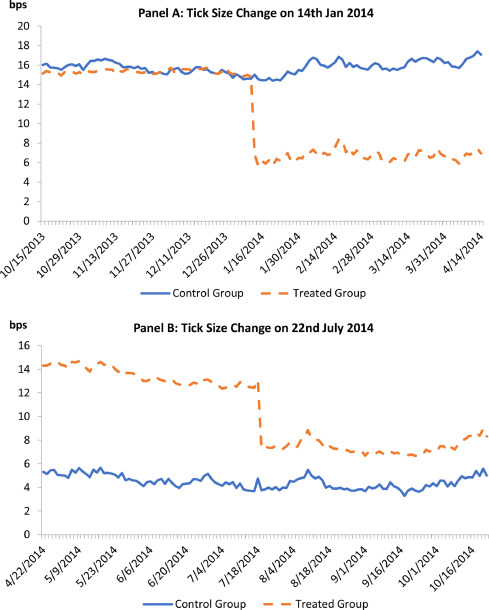

Dark pools can narrow bid-ask spreads in day trading by providing additional liquidity away from public exchanges. This reduces the price gap between buy and sell orders, making trades cheaper and faster. However, since dark pools lack transparency, traders may face less visibility into true supply and demand, potentially leading to sudden spread widenings when orders emerge on public markets. Overall, dark pools influence bid-ask spreads by adding liquidity but can also introduce unpredictability in short-term trading.

Learn about What Is the Future of Dark Pools in Day Trading?

Can Dark Pools Cause Price Manipulation During Day Trading?

Yes, dark pools can enable price manipulation during day trading by hiding large orders, which can mislead traders about true supply and demand, causing them to make decisions based on incomplete information.

Learn about What Is the Future of Dark Pools in Day Trading?

How Do Regulators View Dark Pools and Day Trading Risks?

Regulators see dark pools and day trading risks as threats to market transparency and investor protection. They worry dark pools can hide large trades, potentially manipulating prices. Day trading's rapid, high-volume moves increase volatility and risk for retail investors. Regulators aim to prevent market abuse and ensure fair, open trading environments.

Learn about How Regulators Detect Insider Trading in Day Markets

Do Dark Pools Offer Advantages for Large vs. Small Day Traders?

Dark pools mainly benefit large traders by allowing them to execute big orders without moving the market, reducing impact costs. Small day traders don’t gain much from dark pools because they can’t access these private venues and rely on public markets. Large traders can hide their intentions and avoid revealing their strategies, giving them an edge. Small traders are limited to transparent exchanges, making dark pools less relevant for their quick trades.

Learn about Do Dark Pools Offer Advantages for Day Traders?

How Should Day Traders Adjust to Dark Pool Activity?

Day traders should monitor dark pool activity through specialized data tools to spot large, hidden orders that can signal upcoming price moves. They need to adjust their strategies by verifying if dark pool trades align with public market trends or if they’re offsetting big institutional moves. Incorporating dark pool insights helps avoid being caught off guard by unusual price jumps or drops caused by unseen large trades. React quickly when dark pool volume spikes, as it may hint at upcoming volatility or trend reversals. Stay flexible, use dark pool data as a supplementary signal, and avoid overreacting to isolated dark pool activity.

Learn about How Can Day Traders Benefit from Dark Pool Data?

Conclusion about How Do Dark Pools Affect Day Trading?

In conclusion, understanding dark pools is crucial for day traders aiming to refine their strategies and enhance their trading outcomes. These concealed trading venues can significantly influence stock prices, market liquidity, and bid-ask spreads, while also posing unique risks. By incorporating dark pool data into their analysis, traders can make more informed decisions and navigate the complexities of the market effectively. Staying informed about the dynamics between dark pools and public exchanges is essential for adapting to the evolving trading landscape. DayTradingBusiness is here to provide the insights and tools you need to succeed in this environment.

Learn about What Is the Future of Dark Pools in Day Trading?