Did you know that dark pools are like secret parties in the trading world, where institutional traders can dance without the prying eyes of the public? In this article, we explore the exclusive realm of dark pools—are they really just for institutional traders, or can individual investors join the fun? We’ll clarify what dark pools are, how they differ from public exchanges, and the risks involved. We'll also discuss their impact on market transparency, stock prices, and liquidity, as well as the advantages and opportunities they present for retail traders. Plus, we’ll examine whether dark pools are regulated and what types exist. Join us at DayTradingBusiness to uncover the complexities of dark pool trading and see if it’s a suitable avenue for your investment strategy.

Are Dark Pools Only Used by Institutional Traders?

No, dark pools are primarily used by institutional traders, but some retail traders access them indirectly through brokers.

Can Individual Investors Access Dark Pools?

Individual investors cannot access dark pools directly; these venues are exclusive to institutional traders and large firms.

Why Do Institutional Traders Use Dark Pools?

Institutional traders use dark pools to execute large trades quietly, avoiding market impact and price movements. Dark pools provide anonymity, allowing institutions to buy or sell big blocks without revealing their strategies. They are primarily designed for institutional traders because of the size of their trades and the need for discretion. While some retail traders access dark pools through brokers, the main users are institutional investors seeking to minimize market influence.

How Do Dark Pools Differ from Public Stock Exchanges?

Dark pools are private trading venues where institutional traders buy and sell large stock blocks without revealing their intentions publicly. Unlike public stock exchanges, dark pools lack transparency, so order details aren’t visible until after trades settle. While they mainly serve big institutions seeking to avoid market impact, some sophisticated retail traders access dark pools through brokerage platforms. However, the core purpose remains to facilitate large-volume trades discreetly, not for casual or small investors.

What Are the Risks of Trading in Dark Pools?

Dark pools are mostly used by institutional traders, but they pose risks like lack of transparency, potential for price manipulation, and limited regulation. These risks can lead to less fair pricing, hidden order flow, and increased chances of market abuse. Retail traders generally can't access dark pools, and even institutions face the danger of poor execution and information asymmetry.

Are Dark Pools Regulated?

Dark pools are regulated, but less transparently than public exchanges. They mainly serve institutional traders, like hedge funds and large banks, not individual investors.

How Do Dark Pools Impact Market Transparency?

Dark pools are private trading venues that limit transparency by hiding order details from the public. They primarily serve institutional traders seeking to execute large trades without impacting market prices. While they are mainly used by institutions, some advanced retail traders might access dark pools indirectly through certain brokers, but transparency remains limited compared to public exchanges. Overall, dark pools reduce market transparency by concealing trading activity, which can obscure true supply and demand.

Can Retail Traders Benefit from Dark Pool Data?

Retail traders generally can't access dark pool data directly, as these private trading venues are designed for institutional investors. However, some advanced trading platforms and data providers offer limited insights into dark pool activity, which retail traders can use to gauge market sentiment. While dark pools are mainly for institutions, savvy retail traders can indirectly benefit by monitoring overall dark pool trends through specialized tools. Still, they won't get the granular, real-time data that big investors access.

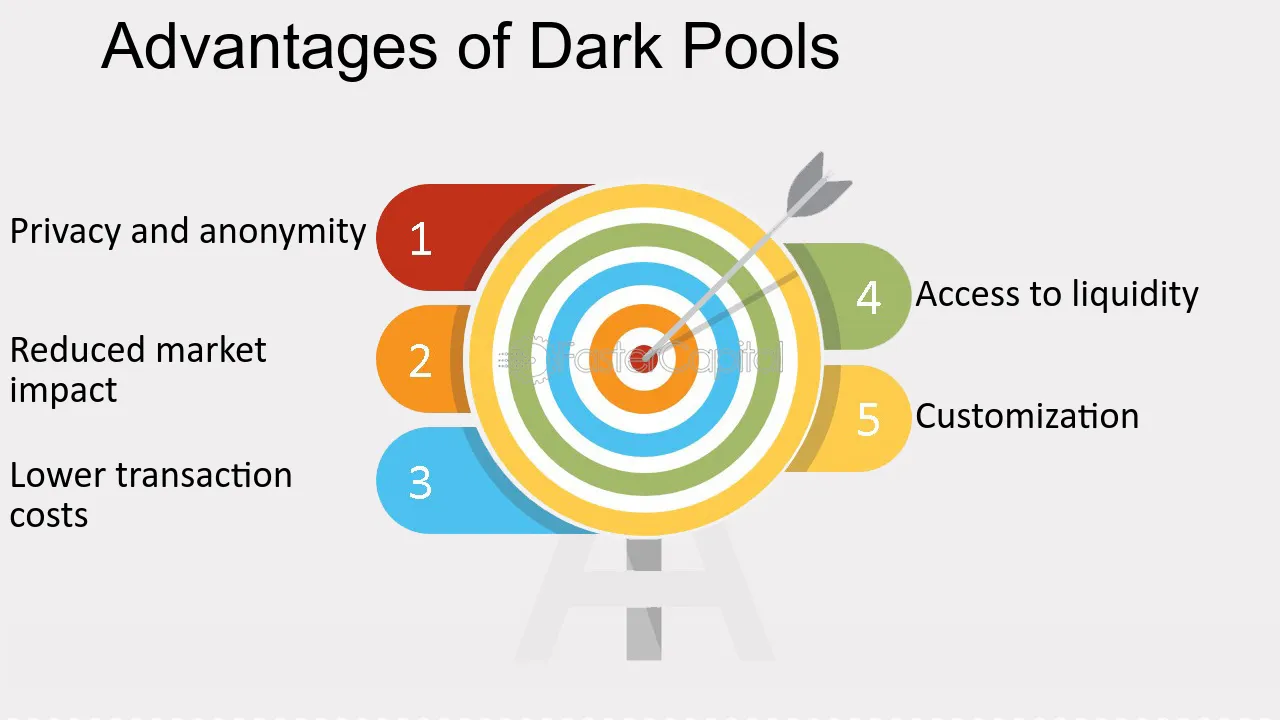

What Are the Advantages of Dark Pool Trading?

Dark pool trading offers advantages like reduced market impact, allowing large traders to execute big orders without revealing their intentions. It provides anonymity, preventing front-running and price swings caused by public order books. Dark pools often have lower transaction costs and can facilitate more efficient execution of large trades. While primarily used by institutional traders, some sophisticated retail investors access dark pools through brokers, but overall, they remain mainly an arena for institutions.

Do Dark Pools Affect Stock Prices?

Dark pools primarily serve institutional traders, but they can influence stock prices by reducing market impact and hiding large orders, which can lead to less visible supply and demand shifts in the public market.

How Do Dark Pools Influence Market Liquidity?

Dark pools boost market liquidity by providing a private space for large trades, reducing price impact. They allow institutional traders to buy or sell big blocks without moving the market, making transactions smoother. While mainly used by institutions, some experienced retail traders access dark pools through specialized platforms. Overall, dark pools help stabilize markets by increasing liquidity but are not exclusive to institutions.

Learn about How Do Dark Pools Impact Market Fairness?

Are Dark Pools Suitable for Small Investors?

Dark pools are primarily designed for large institutional traders, not small investors. They offer anonymity and large transaction sizes, which small investors can't typically access or benefit from. Trying to trade in dark pools as a small investor often isn’t practical or cost-effective.

What Are the Main Types of Dark Pools?

The main types of dark pools are broker-dealer operated, agency-only, and order-execution dark pools. Broker-dealer dark pools are run by large financial firms and often serve their clients directly. Agency-only dark pools match buy and sell orders without taking ownership, focusing on institutional traders. Order-execution dark pools are designed to minimize market impact for large trades, mainly used by institutional investors. Dark pools primarily serve institutional traders, but some also allow participation from qualified retail investors.

How Do Dark Pools Handle Large Orders?

Dark pools handle large orders by aggregating them quietly away from public markets, matching buy and sell sides without revealing the full size upfront. They use algorithms to break big trades into smaller chunks, minimizing market impact and price movement. While primarily used by institutional traders, some sophisticated retail investors access dark pools through certain brokerages.

Can Dark Pools Help Reduce Market Impact?

Dark pools can help reduce market impact by allowing large institutional traders to execute big orders without revealing them to the public. They enable these traders to buy or sell large quantities discreetly, minimizing price swings. While primarily used by institutional traders, some sophisticated retail investors access dark pools through brokers. However, dark pools are mainly designed for institutions aiming to prevent market disruption from large trades.

Conclusion about Are Dark Pools Only for Institutional Traders?

In conclusion, while dark pools are primarily associated with institutional traders, individual investors can also access them, albeit with certain limitations. Understanding the unique features, risks, and benefits of dark pool trading is essential for all traders, regardless of their size. By leveraging dark pool data and recognizing their impact on market liquidity and transparency, both retail and institutional traders can make more informed decisions. For those seeking deeper insights into trading strategies, DayTradingBusiness is here to guide you.