Did you know that even a squirrel can outperform a professional trader if it just randomly picks stocks? Just kidding—trading requires skill, strategy, and the right tools. One such tool is the trailing stop, a powerful method for managing stop-loss risk. This article dives into the essentials of trailing stops, from their definition and functionality to their advantages and ideal usage scenarios. Learn how to set trailing stops on your trading platform, avoid common pitfalls, and determine the optimal distance for maximum effectiveness. Plus, discover how trailing stops can safeguard your profits and adapt to market volatility. Whether you're a beginner or a seasoned trader, understanding trailing stops can significantly enhance your trading strategy. Let DayTradingBusiness guide you through the ins and outs of this essential risk management tool!

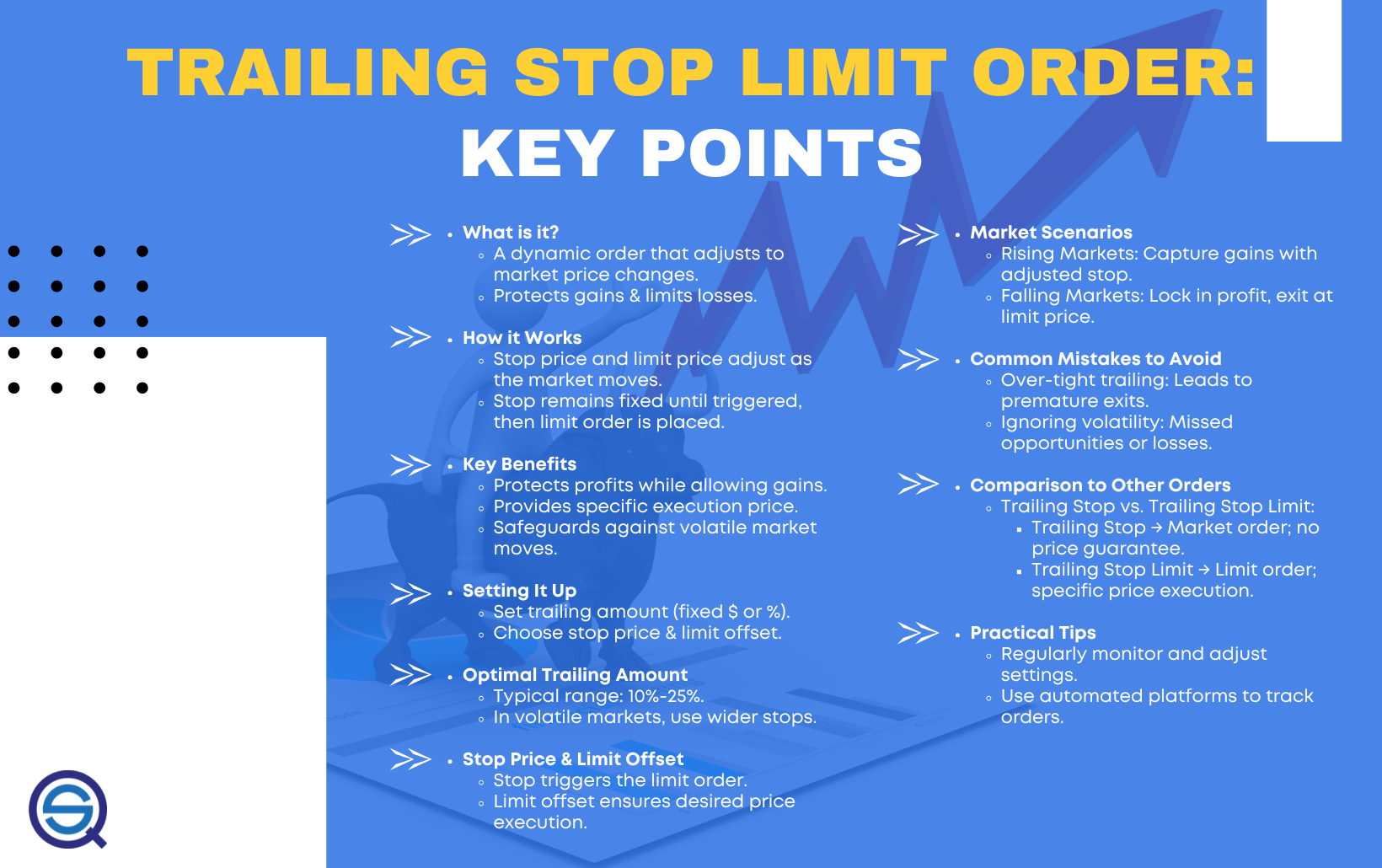

What is a trailing stop and how does it work?

A trailing stop is a dynamic stop-loss order that moves with the price of an asset as it rises. It locks in profits by automatically adjusting upward when the price increases, but stays put if the price drops. For example, if you set a $10 trailing stop on a stock bought at $50 with a $5 trail, the stop will move up as the stock climbs, but won’t move down if the stock dips. If the stock hits $60, the stop moves to $55; if it then drops to $55, the order executes, limiting losses or protecting gains. It helps manage risk by allowing profits to run while capping potential losses.

How can I set a trailing stop on my trading platform?

To set a trailing stop, select your asset on the trading platform, choose the stop-loss or exit option, and then enable trailing stop. Enter the distance or percentage you want the stop to trail behind the current price. Confirm the order, and the platform will automatically adjust the stop as the price moves favorably.

What are the main advantages of using trailing stops?

Trailing stops lock in profits as a trade moves favorably, automatically adjusting to price increases. They help minimize losses by tightening the exit point if the market reverses. Using trailing stops allows for capturing larger gains while reducing emotional decision-making. They adapt to market volatility, giving trades room to breathe but still protecting gains. Overall, trailing stops improve risk management and optimize profit potential.

How do trailing stops help protect profits?

Trailing stops lock in profits by automatically moving the stop-loss level upward as the asset price rises. When the price hits the trailing stop, it triggers a sell, securing gains before the market reverses. This allows you to stay in winning trades longer while limiting potential losses if the trend reverses unexpectedly. For example, if you set a 5% trailing stop on a stock that gains 20%, the stop moves up as the stock climbs, locking in some profit if the price drops back 5% from its peak.

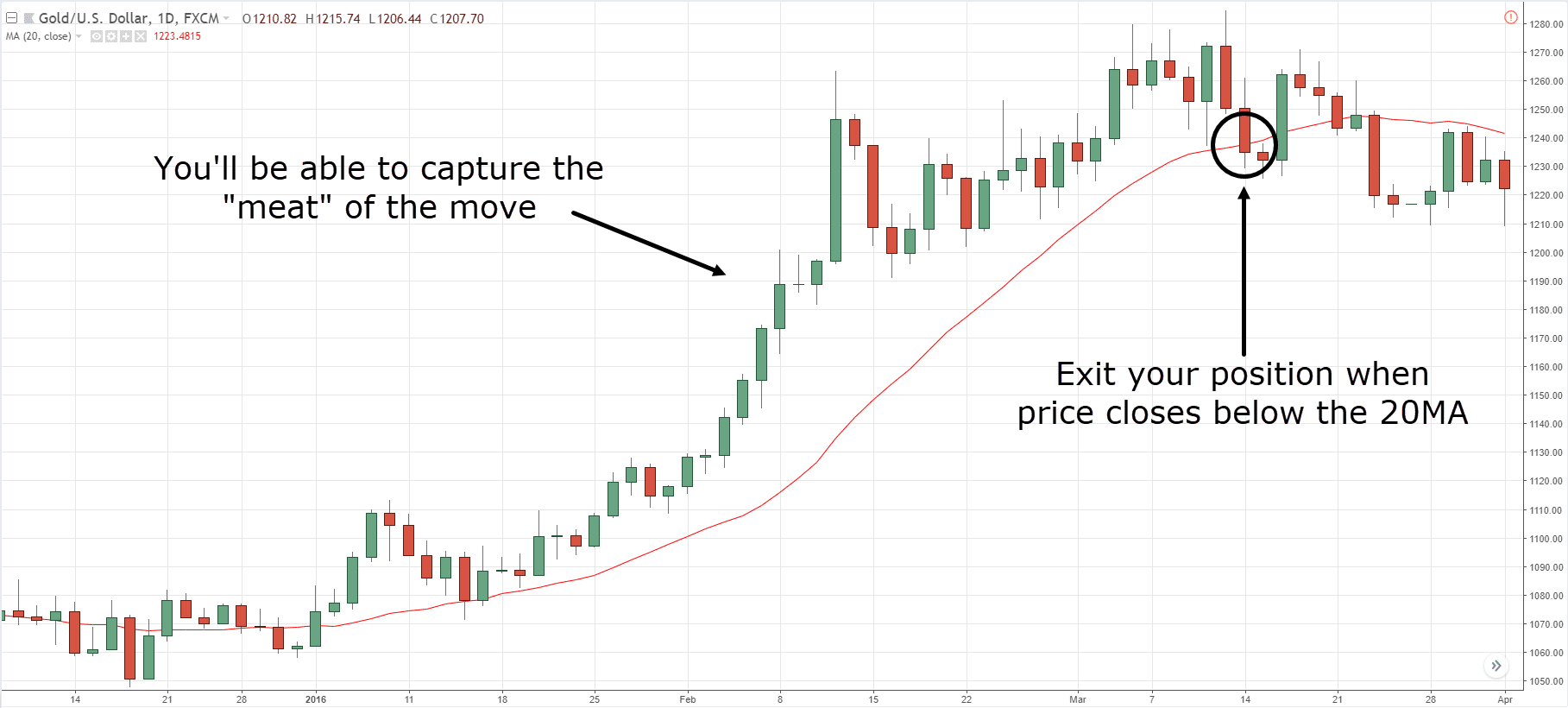

When should I use a trailing stop instead of a fixed stop-loss?

Use a trailing stop when you want to lock in gains as the price moves favorably and allow for market fluctuations, instead of setting a fixed stop-loss that stays constant. It’s best when the market is trending, and you want to protect profits without prematurely exiting. If the price is volatile or reversing suddenly, a fixed stop-loss might be better to limit losses. Use a trailing stop to ride a trend, but switch to a fixed stop if the market becomes choppy.

What are common mistakes to avoid with trailing stops?

Avoid setting trailing stops too tight, which can lead to premature exits on normal price swings. Don’t ignore market volatility—set your trailing stop wide enough to avoid getting stopped out by noise. Forgetting to adjust your trailing stop in trending markets can limit gains; always update as the trend develops. Relying solely on fixed percentage trailing stops without considering price action or support/resistance levels reduces effectiveness. Overusing trailing stops in choppy, sideways markets increases the chance of frequent stops and losses. Lastly, neglecting to review and customize your trailing stop strategy for different assets or market conditions hampers risk management.

How do I determine the best trailing stop distance?

Test different distances based on your volatility; start with 1-2% of the asset price. Observe how your position reacts during normal price swings. Use technical indicators like ATR (Average True Range) to set a trailing stop that matches recent market volatility. If the ATR is $1, consider a trailing stop around $1-$2 to avoid getting stopped out by normal noise. Adjust the distance as the asset's volatility changes and your risk tolerance. The best trailing stop distance balances protecting gains with avoiding premature exits.

Can trailing stops be used for all types of trading assets?

Yes, trailing stops can be used for all types of trading assets, including stocks, forex, commodities, and cryptocurrencies. They adapt to market movement, helping traders lock in profits and limit losses across different asset classes.

How do market volatility and liquidity affect trailing stop placement?

Market volatility causes prices to swing unpredictably, prompting tighter trailing stops to avoid false triggers. High volatility may force you to set stops closer to the current price, risking premature exits. Liquidity impacts stop placement by making it easier to execute stops at desired levels; low liquidity can cause slippage, pushing stops away from intended points. In volatile, illiquid markets, trailing stops need careful adjustment to balance protecting gains and avoiding unnecessary exits.

What are the differences between fixed and dynamic trailing stops?

Fixed trailing stops stay at a set distance from the entry price or a specific price level, regardless of market movement. Dynamic trailing stops adjust as the price moves in your favor, tightening the stop to lock in profits while allowing room for market fluctuations. Fixed stops don’t change once set, risking larger losses if the market reverses; dynamic stops move with the price, helping maximize gains and limit downside.

How do trailing stops impact my trading strategy?

Trailing stops lock in profits as the market moves in your favor by automatically adjusting your stop-loss level. They help limit losses if the price reverses suddenly. Using trailing stops allows you to stay in winning trades longer without manually adjusting your exit point. They add flexibility, letting your gains grow while protecting against sharp reversals. Overall, trailing stops make your trading more dynamic and help manage risk without capping potential upside.

Are trailing stops suitable for beginner traders?

Yes, trailing stops can be suitable for beginner traders because they automatically lock in profits as the market moves favorably, helping manage risk without constant monitoring. However, beginners should understand how to set appropriate trailing distances and avoid over-relying on them, as they still require basic market knowledge. Proper education and practice are essential before using trailing stops effectively.

How can I backtest the effectiveness of trailing stops?

Backtest trailing stops by applying them to historical price data, tracking how they would have triggered sell signals, and measuring outcomes like profit, loss, and drawdown. Use trading software or spreadsheets to simulate different trailing stop distances and observe how they would have performed across various market conditions. Analyze metrics such as win rate, average gain, and maximum drawdown to evaluate effectiveness. Adjust trailing stop parameters and rerun the backtest to find the optimal settings for your strategy.

What risks are associated with using trailing stops?

Trailing stops can trigger premature exits during market volatility, locking in losses or profits before a trend fully develops. They may cause missed gains if the market quickly reverses after a stop is hit. In fast-moving markets, trailing stops can be filled at unfavorable prices due to slippage. Using them too tight can lead to frequent small losses, eating into gains. Conversely, setting them too loose might not protect enough during sudden downturns. Overall, reliance on trailing stops can give a false sense of security and lead to emotional trading decisions.

How do I adjust a trailing stop during a trade?

To adjust a trailing stop during a trade, drag the stop-loss level to a new, more favorable position on your trading platform or manually update the stop-loss order to follow the new price point. If using an automatic trailing stop feature, modify the trailing distance or percentage to widen or tighten the stop as the price moves. Keep monitoring the trade, and tighten or loosen the trailing stop based on your risk tolerance and market movement.

Can trailing stops prevent large losses in trending markets?

Trailing stops can limit large losses in trending markets by automatically locking in profits as the trend moves favorably. When set correctly, they move with the price, helping you stay in strong trends while exiting before a reversal causes significant damage. However, in volatile markets, trailing stops might trigger prematurely, so they’re not foolproof but do help manage risk in trending conditions.

How do trailing stops compare to other risk management tools?

Trailing stops automatically lock in profits as prices rise, adjusting the stop level upward without needing manual updates. Unlike fixed stop-loss orders, they dynamically protect gains and limit losses if the market reverses. Compared to position sizing or diversification, trailing stops offer real-time risk control tied directly to price movements. They’re more flexible than traditional stop-losses, letting profits run while minimizing downside risk. However, they can be triggered by short-term volatility, unlike more conservative risk tools like hedging.

Conclusion about Using trailing stops to manage stop-loss risk

Incorporating trailing stops into your trading strategy can significantly enhance your risk management and profit protection. They allow for dynamic adjustments that align with market movements, making them a valuable tool for both novice and experienced traders. By understanding how to set and adjust trailing stops effectively, you can safeguard your investments and capitalize on market trends. For comprehensive insights and expert guidance, rely on DayTradingBusiness to refine your trading approach and maximize your success.