Did you know that using leverage in trading is like trying to balance a unicycle on a tightrope—one misstep can lead to a spectacular fall? In this article, we delve into the complexities of leverage risk, distinguishing it from other trading risks such as market and credit risk. We explore why leverage is particularly significant in margin trading and how it can amplify both gains and losses. You'll learn effective strategies to manage leverage risk, recognize signs of excessive exposure, and understand its psychological impact on traders. Additionally, we discuss regulatory measures and how brokers work to mitigate these risks. Join us as we clarify the unpredictable nature of leverage risk across various asset classes and its implications for trading strategies and costs. For more in-depth insights, DayTradingBusiness is here to guide you through the intricate world of trading.

What is leverage risk in trading?

Leverage risk in trading is the danger of magnified losses due to using borrowed funds. Unlike market risk or liquidity risk, leverage risk specifically involves the potential to lose more than your initial investment because high leverage amplifies both gains and losses. It’s the risk that small market moves can wipe out your position quickly if you're heavily leveraged, making it more dangerous than other trading risks that don’t inherently involve borrowed money.

How does leverage risk compare to market risk?

Leverage risk arises from using borrowed money, amplifying both gains and losses. If the market moves against your position, leverage can wipe out your capital quickly. Market risk, on the other hand, is the chance that the overall market moves unfavorably regardless of leverage. While market risk affects all traders, leverage risk specifically intensifies the impact of market swings on your account.

What makes leverage risk unique from credit risk?

Leverage risk is unique because it stems from using borrowed money to amplify gains and losses. When leverage increases, small market moves can lead to outsized losses that exceed the initial investment, unlike credit risk, which involves the possibility of a borrower defaulting on debt. Leverage risk directly depends on the amount of borrowed funds and market volatility, making it more about potential losses from amplified exposure. In contrast, credit risk is tied to the borrower’s ability to repay, not the leverage used by the lender.

Why is leverage risk more significant in margin trading?

Leverage risk is more significant in margin trading because it amplifies both gains and losses. When you trade on margin, a small market move can wipe out your entire account or lead to massive profits. Unlike regular trading, where losses are limited to your invested capital, leverage can cause losses to exceed your initial investment, increasing financial risk dramatically. This heightened exposure makes managing leverage risk crucial in margin trading.

How does leverage amplify trading losses?

Leverage amplifies trading losses by allowing you to control a larger position than your actual capital. If the market moves against you, losses grow proportionally, potentially exceeding your initial investment. Unlike other risks, leverage can turn small market moves into significant financial hits quickly, increasing both profit potential and risk of ruin.

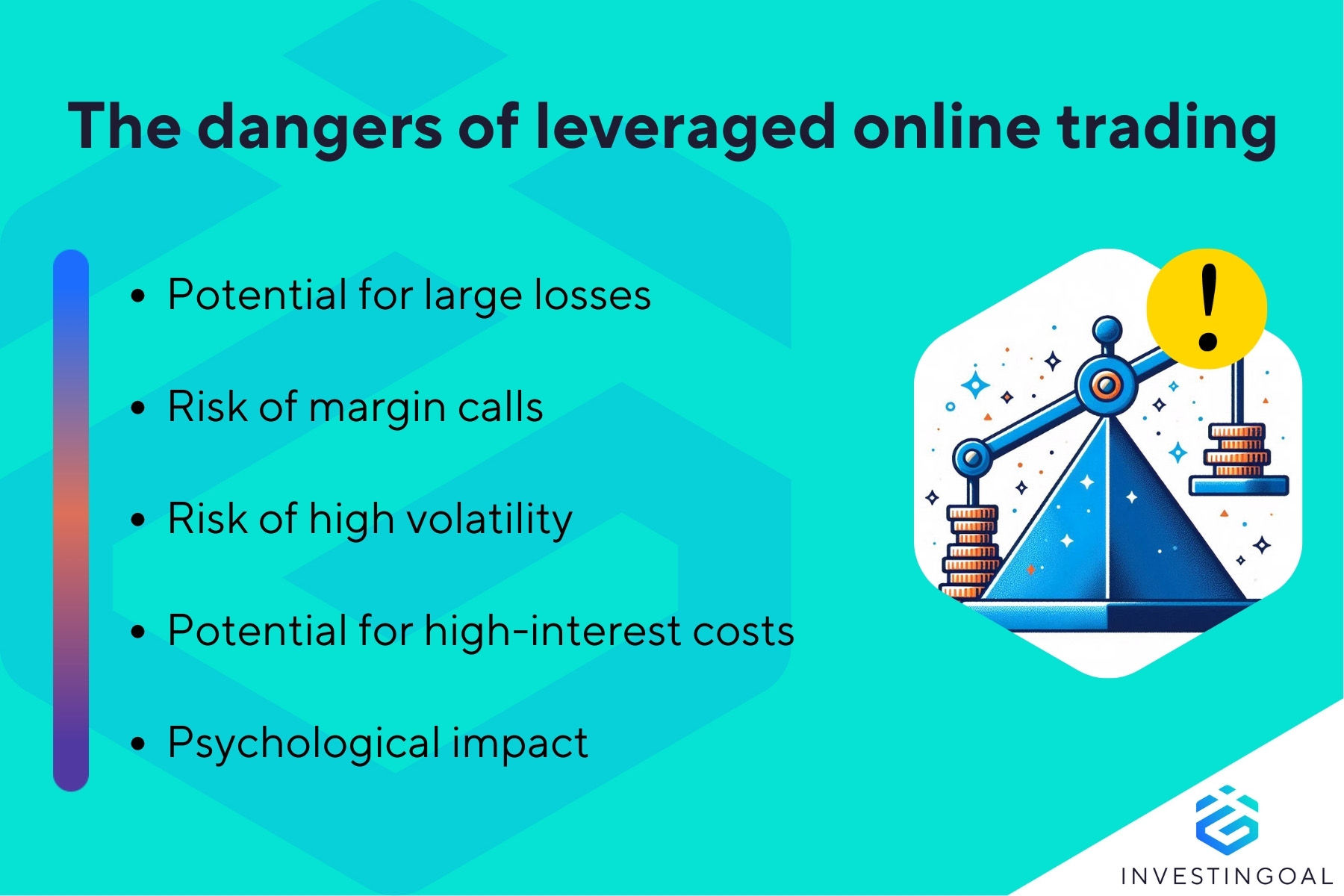

What are the main dangers of leverage risk?

Leverage risk can wipe out your entire investment quickly because small market moves amplify losses. Unlike other risks, it creates a magnified effect, making it easier to lose more than your initial capital. High leverage can lead to margin calls or forced liquidations, even if the market moves slightly against you. It’s riskier than standard trading risks because it increases potential losses exponentially, not linearly.

How can traders manage leverage risk effectively?

Leverage risk differs from other trading risks because it amplifies potential gains and losses, making small market moves impactful. Managing it involves setting strict stop-loss orders, using lower leverage levels, and maintaining ample margin buffers. Traders should also diversify positions to avoid overexposure and regularly monitor leverage ratios to prevent margin calls. Unlike market or liquidity risks, leverage risk specifically relates to the borrowing used to amplify trade size, so controlling leverage is key to effective management.

What are the signs of excessive leverage risk?

Signs of excessive leverage risk include rapid account drawdowns, margin calls happening frequently, and the inability to withstand market swings. Unlike other trading risks, leverage risk amplifies losses because borrowed funds increase exposure, making small market moves more damaging. When traders rely heavily on leverage, even minor downturns can wipe out their capital quickly, highlighting the heightened danger compared to pure market or liquidity risks.

How does leverage risk affect trading psychology?

Leverage risk amplifies trading losses, creating intense stress and fear that can lead to impulsive decisions. It makes traders overly confident or reckless, believing small moves won’t hurt, but then facing rapid margin calls. Unlike market risk, which is about external factors, leverage risk is about how borrowed funds magnify both gains and losses, heightening emotional reactions and impairing judgment.

What are the regulatory measures on leverage risk?

Regulatory measures on leverage risk limit the maximum leverage brokers can offer, enforce margin requirements, and mandate risk disclosures. They aim to prevent traders from taking on excessive debt, reducing the chance of significant losses and systemic instability. Unlike other trading risks like market or liquidity risk, leverage risk specifically addresses the dangers of amplified losses due to borrowed funds.

How does leverage risk differ across asset classes?

Leverage risk varies across asset classes because some, like forex and commodities, often involve higher leverage, amplifying both gains and losses. In equities, leverage is usually lower, so the potential for rapid loss is less intense but still significant. Fixed income typically has minimal leverage, reducing leverage risk but still exposing traders to interest rate fluctuations. Overall, higher leverage in volatile assets increases the risk of margin calls and large losses, making leverage risk more pronounced compared to other trading risks like market or liquidity risk.

Why is leverage risk more unpredictable than other risks?

Leverage risk is more unpredictable because small market moves can cause disproportionately large losses or gains due to high borrowed capital. Unlike other trading risks, leverage amplifies both profits and risks exponentially, making outcomes less stable and harder to forecast. Sudden market swings can wipe out leveraged positions quickly, increasing uncertainty beyond typical risk levels.

How do brokers mitigate leverage risk for clients?

Brokers mitigate leverage risk for clients by setting maximum leverage limits, offering margin calls to prevent account depletion, and providing educational resources on responsible leverage use. They also implement automatic position liquidations if margins fall below required levels. Unlike other trading risks, leverage risk specifically involves the amplified potential for losses due to borrowed funds, making careful margin management crucial.

What is the impact of leverage risk on trading strategies?

Leverage risk amplifies potential losses beyond your initial investment, making trading more volatile. Unlike market or liquidity risks, leverage risk specifically relates to borrowed capital—your gains or losses grow faster. High leverage can wipe out your account quickly if the market moves against you. It forces traders to manage position sizes carefully; otherwise, small adverse moves turn into big financial hits. This risk differs from others because it directly ties your financial stability to borrowed funds, increasing both upside potential and downside danger.

Learn about How to evaluate leverage risk in day trading strategies?

How does leverage risk influence overall trading costs?

Leverage risk increases overall trading costs because it amplifies potential losses and margin requirements, leading to higher capital tied up in maintaining positions. When leverage is high, even small market moves can trigger margin calls or forced liquidations, adding fees and slippage. Unlike market or credit risk, leverage risk directly affects the cost of holding and managing trades, making it more expensive during volatile periods.

Learn about How to evaluate leverage risk in day trading strategies?

Conclusion about How does leverage risk differ from other trading risks?

In summary, leverage risk presents unique challenges that set it apart from other trading risks, such as market and credit risk. Its potential to amplify both gains and losses makes it particularly significant in margin trading. Understanding the dangers of excessive leverage and effectively managing this risk is crucial for traders aiming for long-term success. By remaining aware of the psychological impacts and regulatory measures surrounding leverage risk, traders can better navigate their strategies. For comprehensive guidance on managing leverage risk and enhancing trading performance, DayTradingBusiness is here to support your trading journey.

Learn about How Do Institutional Trading Strategies Differ from Individual Trading?

Sources:

- Revisiting Risk-Weighted Assets “Why Do RWAs Differ Across ...

- Bank profitability, leverage constraints, and risk-taking - ScienceDirect

- The Fed - Quantifying Treasury Cash-Futures Basis Trades

- Responses of FDI to geopolitical risks: The role of governance ...

- Risks and financing decisions in the energy sector: An empirical ...