Did you know that some traders believe their luck can turn around faster than a cat on a hot tin roof? Unfortunately, chasing losses in day trading often leads to a downward spiral rather than a miraculous comeback. This article delves into the critical reasons why chasing losses escalates risk, increasing the likelihood of larger trades and emotional decision-making. It highlights how the fear of further losses can compromise trading discipline and lead to poor risk management. Furthermore, we explore the psychological effects of loss chasing and its detrimental impact on overall trading performance. Finally, we offer strategies from DayTradingBusiness to help traders avoid the pitfalls of this risky habit and maintain a disciplined approach in the face of adversity.

How does chasing losses increase trading risk?

Chasing losses makes traders take bigger, impulsive bets to recover, which often leads to even larger losses. It clouds judgment, making them ignore proper risk management. This cycle of trying to break even quickly increases exposure to market volatility and unexpected moves, amplifying overall trading risk.

Why does trying to recover losses lead to bigger trades?

Chasing losses prompts traders to make bigger trades to recover quickly, increasing risk exposure and potential losses. This behavior often leads to impulsive decisions, ignoring proper risk management, which amplifies the chance of further losses and creates a vicious cycle.

How can chasing losses cause emotional trading decisions?

Chasing losses makes traders feel desperate, pushing them to take bigger, riskier trades to recover. This emotional state clouds judgment, leading to impulsive decisions instead of strategic ones. Instead of sticking to their plan, traders become reactive, increasing the likelihood of bigger losses and spiraling into a cycle of reckless trading.

What is the impact of chasing losses on trading discipline?

Chasing losses in day trading often leads to impulsive decisions, increasing risk exposure. Traders try to recover lost money quickly, abandoning their strategies and risking bigger positions. This behavior typically results in larger losses, damaging discipline and emotional control. It creates a cycle where fear and greed override rational analysis, making disciplined trading almost impossible.

How does the fear of losing more influence trading behavior?

Fear of losing more makes traders chase losses, increasing their risk-taking. They double down to recover previous losses quickly, often ignoring market signals. This behavior leads to bigger trades, bigger losses, and spirals of emotional trading. Chasing losses blinds traders to rational decisions, escalating risk and worsening outcomes.

Why do traders risk more after a loss?

Traders chase losses to recover previous mistakes, feeling the pressure to break even. This mindset pushes them to take bigger, riskier trades without proper analysis. The desire to recoup losses quickly overrides caution, leading to impulsive decisions. As losses mount, the urge to make up for them intensifies, increasing risk exposure and often causing bigger setbacks.

How does chasing losses affect overall trading performance?

Chasing losses in day trading increases risk by prompting impulsive decisions, leading to larger, poorly planned trades. It erodes discipline, making traders more likely to gamble to recover losses instead of following a strategy. This behavior often results in bigger losses, creating a vicious cycle that damages overall trading performance.

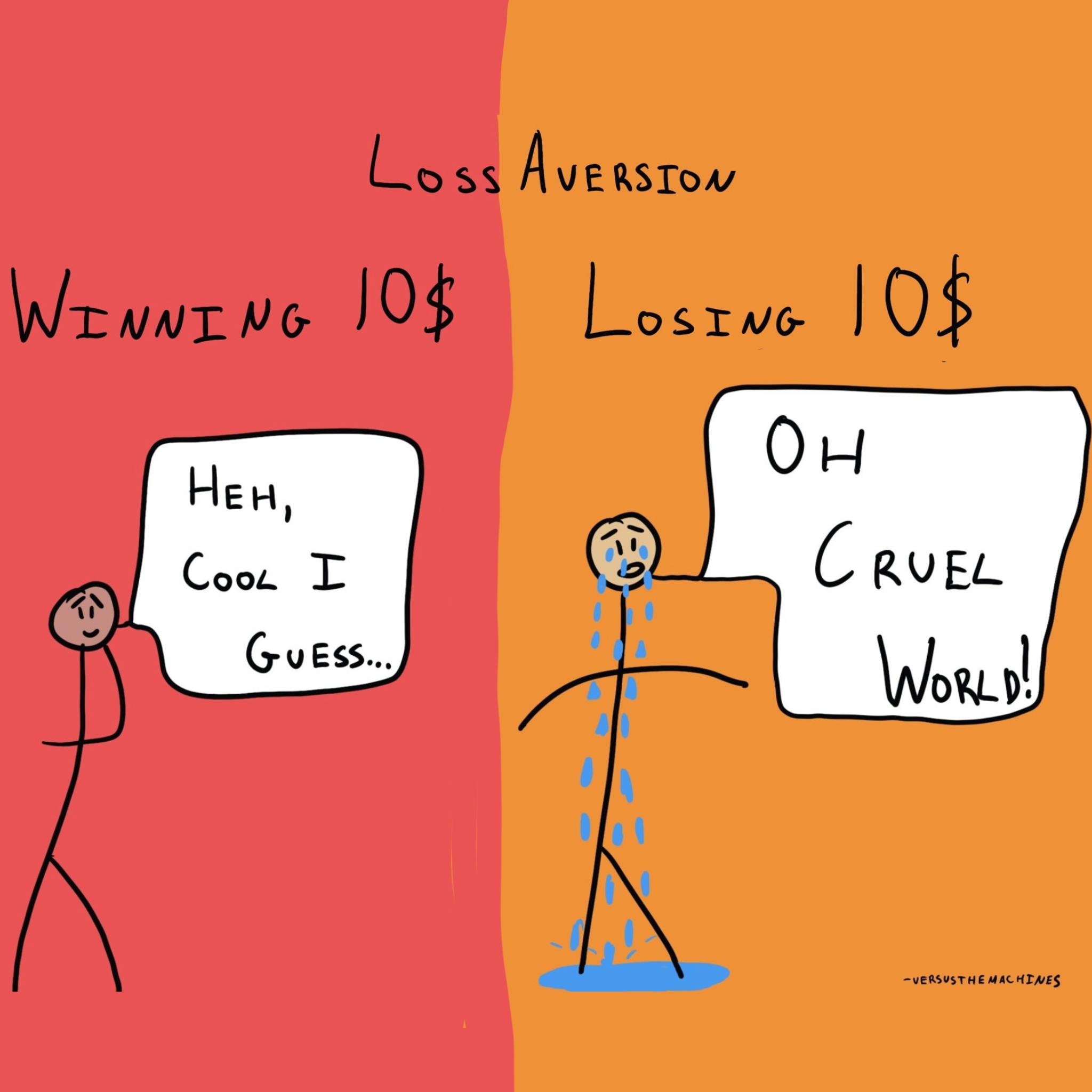

What are the psychological effects of loss chasing?

Chasing losses in day trading increases emotional stress, leading to impulsive decisions. Traders become more risk-seeking to recover previous losses, often ignoring sound strategies. This cycle heightens anxiety, frustration, and panic, impairing judgment. Over time, it can cause a loss of confidence and lead to reckless trading behaviors.

How does loss chasing lead to poor risk management?

Chasing losses in day trading makes traders take bigger, impulsive bets to recover quickly, which amplifies risk. It often leads to ignoring proper risk limits or stop-loss orders, increasing potential losses. This behavior causes emotional decision-making instead of strategic planning, risking larger downturns. Instead of sticking to a trading plan, traders become reckless, exposing themselves to severe financial harm.

Why does the temptation to recover losses escalate risk?

Chasing losses in day trading pushes traders to take bigger, riskier bets to recover money quickly. This behavior often leads to impulsive decisions, ignoring proper risk management. As traders pursue quick gains to offset previous losses, they increase exposure to volatile market moves, raising the chance of even larger losses. The emotional drive to break even clouds judgment, making risky trades more likely.

How can chasing losses cause larger financial setbacks?

Chasing losses in day trading leads to bigger risks because traders often double down to recover what they lost, increasing position sizes and emotional pressure. This impulsive behavior can result in bigger trades on poor setups, amplifying potential losses. It clouds judgment, making it harder to stick to a trading plan, and can spiral into significant financial setbacks as losses mount quickly.

What role do emotions play in loss chasing?

Emotions like frustration and fear drive traders to chase losses, making them ignore risk management. This emotional reaction pushes traders to double down, increasing the chance of bigger losses. The desire to recover losses quickly often leads to impulsive trades, risking more than they should. Chasing losses fueled by emotions erodes discipline and can turn a small setback into a major blow.

How does chasing losses undermine trading strategies?

Chasing losses in day trading makes you take bigger, impulsive bets to recover, which often leads to even larger losses. It erodes discipline, causing you to abandon your proven strategies for risky, emotional moves. This escalation increases exposure to market volatility and can wipe out your capital quickly. Instead of sticking to a plan, chasing losses fuels a cycle of reckless trading that magnifies risk.

Why is loss chasing considered a risky trading habit?

Chasing losses in day trading amps up risk because it pushes traders to take bigger, impulsive bets to recover losses quickly. This often leads to poor decisions, like ignoring market signals or holding onto losing positions longer. The more traders chase, the more they expose themselves to bigger swings and potential losses, creating a vicious cycle. It erodes discipline, amplifies emotional trading, and can wipe out accounts fast.

How can traders avoid escalating risk when facing losses?

Chasing losses in day trading increases risk because traders try to recover previous losses by making bigger, impulsive bets. This often leads to poor decision-making, larger trades, and bigger losses. To avoid this, traders should stick to a predetermined stop-loss, maintain strict risk management, and avoid emotionally driven trades. Staying disciplined prevents small losses from snowballing into catastrophic ones.

Learn about How can traders avoid leverage-related losses?

Conclusion about How does chasing losses escalate risk in day trading?

Chasing losses in day trading significantly escalates risk, leading to poor decision-making and emotional trading. This risky behavior often results in larger trades, undermining discipline and sound strategies. To maintain a successful trading approach, it's crucial for traders to recognize the psychological effects of loss chasing and implement effective risk management techniques. By understanding these dynamics, traders can mitigate the temptation to recover losses and enhance their overall performance. With the guidance of DayTradingBusiness, traders can develop a more disciplined approach to navigating the challenges of the market.

Learn about How can poor risk management lead to losses in day trading?