Did you know that using leverage in day trading is like trying to ride a unicycle on a tightrope—exciting but risky? In this article, we explore the significant impact of leverage on day trading profitability. We’ll break down how leverage affects your profits, the risks of high leverage, and how it can amplify both gains and losses. We'll also discuss optimal leverage levels, margin requirements, and the influence of leverage on trading strategies and psychology. Additionally, we’ll highlight advantages, potential margin calls, and regulatory limits. For beginners and seasoned traders alike, understanding these dynamics is essential for effective risk management. Let DayTradingBusiness guide you through the intricacies of leverage and help you make informed trading decisions.

How does leverage affect day trading profits?

Leverage amplifies day trading profits by allowing you to control larger positions with less capital. When trades go your way, leverage boosts returns significantly. But it also increases potential losses, meaning a small adverse move can wipe out your account quickly. Overall, leverage can magnify gains and risks, making profitability more volatile.

What are the risks of using high leverage in day trading?

Using high leverage in day trading amplifies both potential gains and losses. It increases the risk of quick, significant losses that can wipe out your account. Leverage can lead to margin calls if your trades move against you, forcing you to deposit more funds or close positions at a loss. It also raises the chance of emotional trading, causing poor decision-making. Overall, high leverage makes day trading more volatile and risky, risking your capital more than you might expect.

How does leverage amplify gains in day trading?

Leverage amplifies gains in day trading by allowing you to control larger positions with a smaller amount of capital. When your trade moves in your favor, the percentage profit is multiplied, increasing your overall returns. For example, with 10:1 leverage, a 1% move can turn into a 10% profit on your invested capital. However, it also magnifies losses if the market moves against you, making risk management critical.

Can leverage lead to bigger losses in day trading?

Yes, leverage can lead to bigger losses in day trading. It amplifies both gains and losses, so if the market moves against your position, your losses grow quickly. High leverage increases risk, making it possible to lose more than your initial investment.

What is the optimal leverage level for day traders?

The optimal leverage level for day traders generally ranges from 2:1 to 5:1. Higher leverage increases potential profits but also amplifies risks and losses. Using excessive leverage can lead to rapid account depletion, especially in volatile markets. Many successful day traders prefer lower leverage to maintain better control and reduce risk of margin calls. Always align leverage with your risk tolerance and trading strategy.

How does leverage influence day trading strategies?

Leverage amplifies both gains and losses in day trading, allowing traders to control larger positions with less capital. This can boost profitability when trades move in your favor, but it also increases risk, potentially leading to significant losses if the market moves against you. High leverage encourages aggressive strategies, making quick, sizable profits possible but also raising the chance of margin calls and account wipeouts. Overall, leverage can maximize returns but demands strict risk management to avoid devastating outcomes.

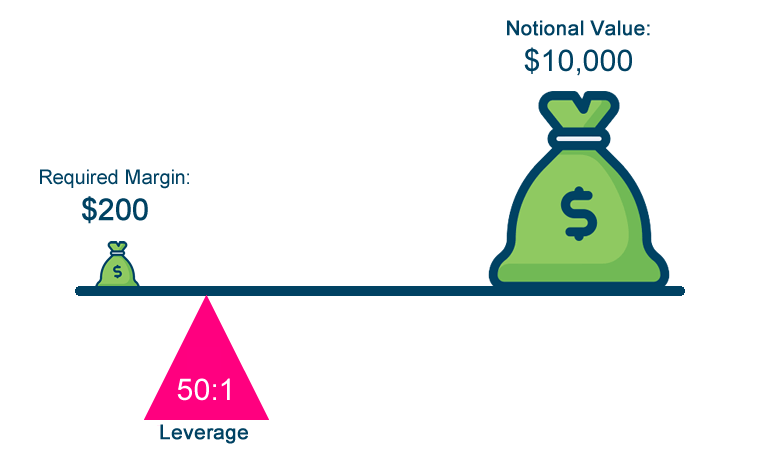

What are the margin requirements for leveraged day trading?

Margin requirements for leveraged day trading typically range from 25% to 50% of the position size, depending on the broker and the asset. Using leverage amplifies both gains and losses, increasing profitability potential but also risk. Higher leverage means lower margin needs, allowing larger positions with less capital, but it can quickly wipe out your account if trades go against you.

How does leverage impact your risk-reward ratio?

Leverage amplifies both potential gains and losses, increasing your risk-reward ratio. With higher leverage, a small price move can lead to bigger profits but also bigger losses, making your trading more volatile. It can boost profitability if your trades work out, but it also raises the risk of significant losses, potentially wiping out your capital quickly.

What are the advantages of using leverage in day trading?

Using leverage in day trading amplifies potential profits because you control larger positions with less capital. It allows quick gains from small price movements, boosting overall returns. Leverage also enables traders to diversify and enter multiple trades simultaneously. However, it increases risk—losses can be magnified just as easily. Proper leverage management can maximize profitability while controlling downside risk.

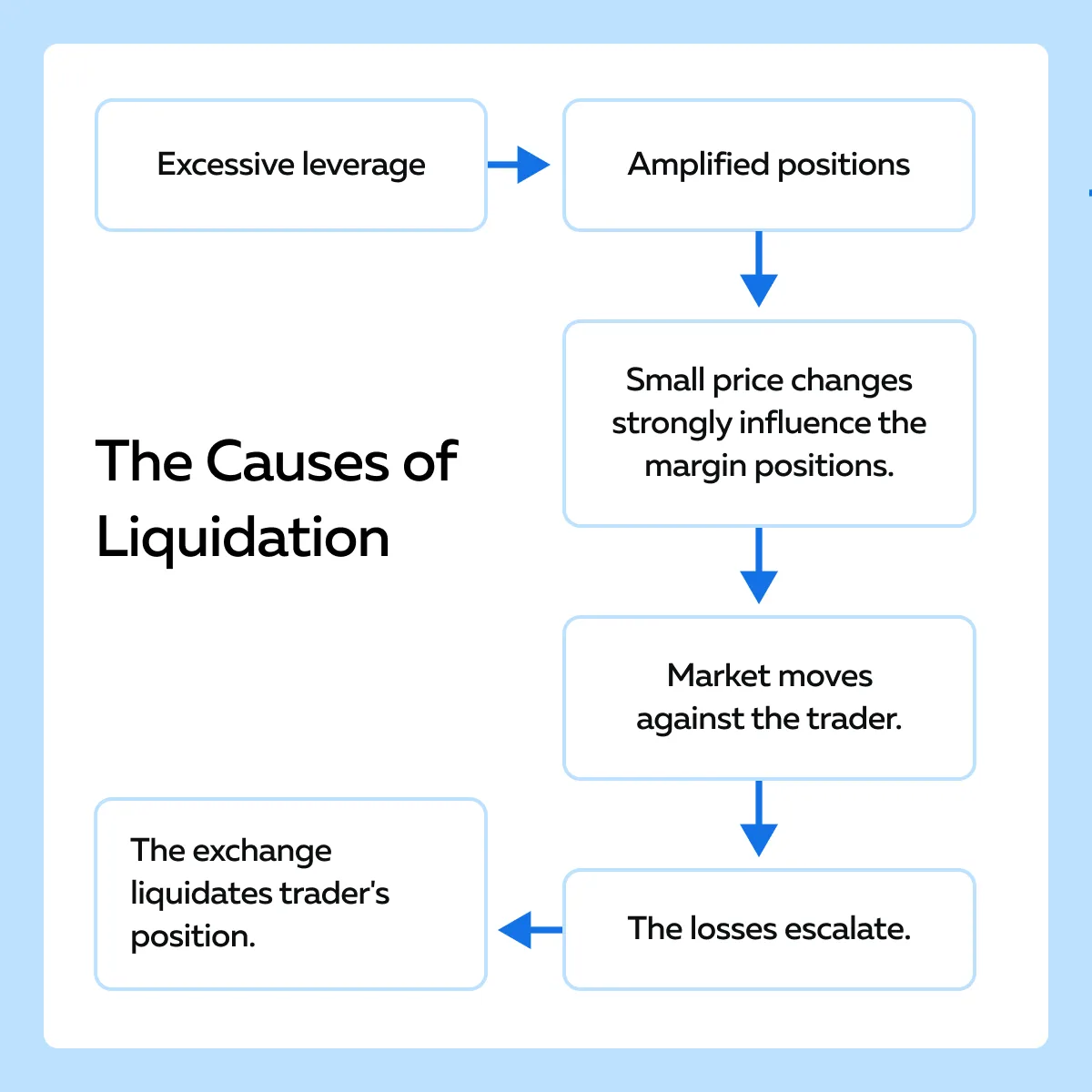

How can excessive leverage cause margin calls?

Excessive leverage amplifies trading positions, so small market moves can wipe out your margin quickly. When the market moves against your leveraged position, your account balance drops fast, triggering a margin call. This forces you to add more funds or close positions to meet minimum margin requirements, often at a loss. High leverage increases the risk of rapid margin calls, undermining day trading profitability.

What should beginners know about leverage in day trading?

Leverage amplifies your potential profits but also increases risk. It allows you to control larger positions with less capital, meaning small price moves can lead to big gains or losses. Beginners should understand that high leverage can wipe out their account quickly if trades go against them. Use leverage cautiously, start small, and always set stop-loss orders to manage risk effectively.

Learn about What should beginners know about legal compliance in day trading?

How does leverage affect trading psychology?

Leverage amplifies both potential gains and losses, which can cause increased emotional swings in day trading. It creates pressure to make quick decisions, leading to fear or greed influencing your mindset. High leverage can make losses feel more personal, triggering panic or overconfidence. This emotional rollercoaster can impair judgment, making it harder to stick to a trading plan. Overall, leverage can boost profitability but also intensifies psychological stress and risk of impulsive trading.

Learn about How does leverage affect day trading psychology?

What are the regulatory limits on leverage for day traders?

Regulatory limits on leverage for day traders vary by country. In the US, the SEC and FINRA typically cap leverage at 2:1 for day traders using margin accounts. In the UK, the FCA limits leverage to 20:1 for major currency pairs and 30:1 for minor pairs, with lower caps for retail clients on other assets. Australia’s ASIC restricts retail traders to 30:1 for forex. These limits reduce traders' risk of large losses, but high leverage can significantly amplify both profits and losses, impacting day trading profitability directly.

How can traders manage leverage risks effectively?

Traders manage leverage risks by setting strict stop-loss orders, using lower leverage ratios, and maintaining proper position sizing. They avoid over-leveraging, regularly monitor market movements, and diversify trades to reduce exposure. Using risk management tools like trailing stops and staying disciplined prevents large losses that leverage can cause.

Does leverage increase the volatility of day trading outcomes?

Yes, leverage increases the volatility of day trading outcomes by amplifying both gains and losses. It magnifies price movements, making profits larger but also risking bigger losses in a short period. This heightened volatility means that day traders using leverage experience more unpredictable and extreme swings in their account value.

Conclusion about What is the impact of leverage on day trading profitability?

In summary, leverage plays a crucial role in day trading profitability, offering the potential for amplified gains while simultaneously increasing risks. Understanding how leverage affects profits, losses, and overall trading strategies is essential for both novice and experienced traders. To navigate the complexities of leverage, it’s vital to implement sound risk management practices and stay informed about regulatory limits. For those looking to deepen their expertise in leveraging strategies, DayTradingBusiness provides valuable resources and insights to help you trade smarter and more effectively.

Learn about How Do Prop Firms Impact Day Trading Profitability?