Did you know that even a squirrel can accurately judge the size of a nut, but many traders struggle to determine the right position size? In day trading, improper position sizing can lead to significant risks and losses. This article dives into what constitutes improper position sizing, its impact on trading risks, and the importance of proper sizing for effective risk management. We’ll explore common mistakes traders make, the role of leverage, and how emotional decisions can skew sizing strategies. Additionally, we’ll discuss the influence of market volatility and provide strategies to help you determine the right position size. By understanding these key points, traders can better navigate the pitfalls of incorrect sizing and enhance their trading success with insights from DayTradingBusiness.

What is improper position sizing in day trading?

Improper position sizing in day trading means risking too much on a single trade, such as using a large percentage of your account on one position. It increases the risk of big losses, wiping out your capital quickly. Overleveraging or not adjusting size to market conditions can lead to emotional trading and poor decision-making. It can cause significant account drawdowns and wipe out your trading capital faster than expected.

How does wrong position size increase trading risks?

Wrong position size amplifies trading risks by overexposing your account to losses, making small market moves wipe out significant capital. It can cause emotional reactions, leading to impulsive decisions or panic selling. Larger-than-appropriate positions reduce your ability to diversify and manage risk effectively. This imbalance increases the chance of devastating losses if the trade moves against you. Proper position sizing protects your capital and keeps risk within manageable levels, preventing catastrophic setbacks.

Can improper position sizing lead to large losses?

Yes, improper position sizing can lead to large losses in day trading because taking too big a position amplifies risk, causing significant financial damage if the trade goes against you.

Why is proper position sizing important for risk management?

Proper position sizing is crucial because it controls potential losses, preventing small mistakes from turning into major financial hits. Improper sizing can lead to overexposure, wiping out your account on a bad trade. It also reduces your ability to diversify trades, increasing risk of significant losses. Without correct sizing, even a profitable strategy can result in ruin if a few trades go wrong. Proper sizing keeps risk within your comfort zone and preserves capital for future trades.

How does overtrading relate to incorrect position sizes?

Overtrading often leads traders to take incorrect position sizes, risking too much money on each trade. When traders overtrade, they tend to ignore proper risk management, increasing the chance of large losses. Incorrect position sizes can amplify small mistakes, making losses bigger than they should be. This combination can wipe out accounts quickly and cause emotional trading decisions. Proper position sizing helps control risk, but overtrading undermines that by pushing traders into aggressive, poorly sized trades.

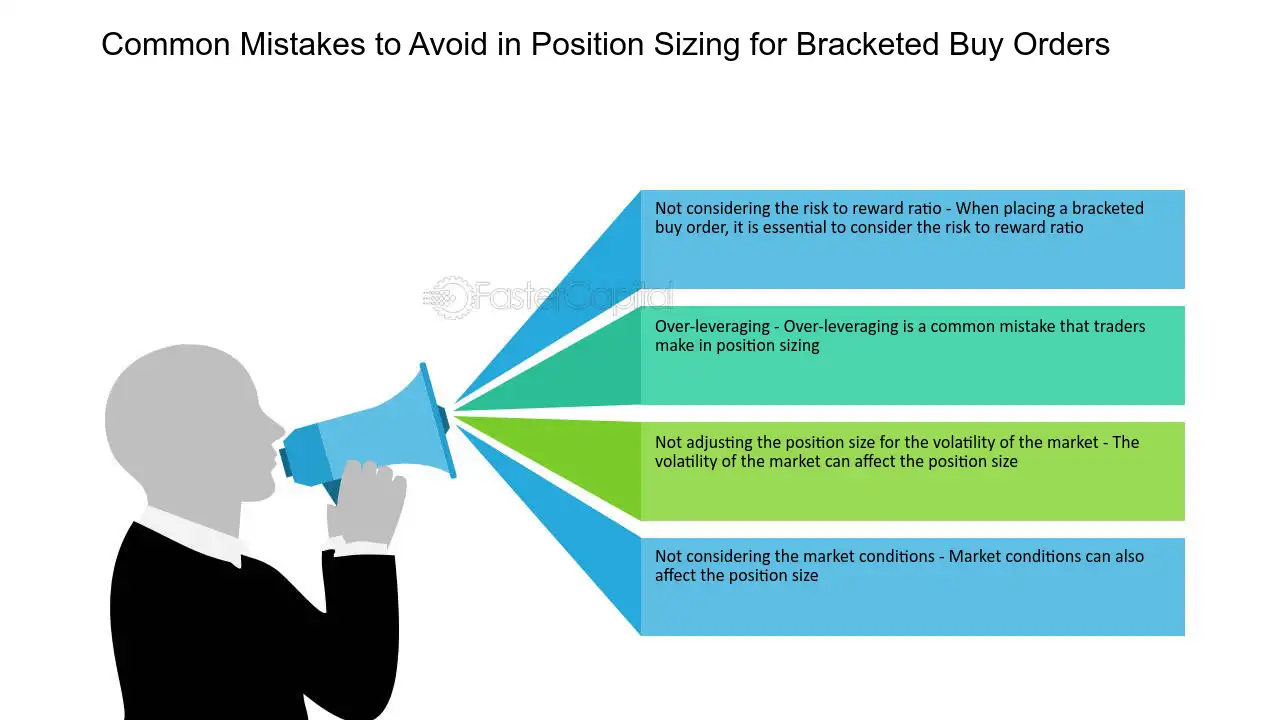

What are the common mistakes traders make with position sizing?

Traders often risk too much on a single trade, ignoring proper position sizing. They neglect to adjust size based on account size or market volatility. Overtrading, or taking too many positions at once, amplifies risk. Failing to use stop-loss orders properly can lead to outsized losses. Ignoring risk-reward ratios and sticking to fixed position sizes without considering market conditions also increase danger.

How does underestimating position size affect profit potential?

Underestimating position size limits profit potential because smaller trades capture less of market moves, reducing gains. It also decreases the impact of winning trades, making it harder to grow your account. You miss out on optimal leverage, which can maximize profits during strong setups. Overly cautious sizing might protect from big losses but caps your earning potential in trending markets. Proper position sizing balances risk and reward, allowing you to capitalize fully on market opportunities.

What role does leverage play in position sizing risks?

Leverage amplifies both gains and losses, making improper position sizing riskier. Using high leverage with large positions can wipe out your account quickly if the trade moves against you. It increases the potential for significant losses beyond your initial investment, raising the risk of margin calls and account depletion. Proper position sizing limits exposure and helps manage risk, especially when combined with appropriate leverage use.

How can improper sizing cause emotional trading decisions?

Improper sizing can lead to emotional trading because it amplifies losses, creating fear and panic. When positions are too large, a small market move can wipe out profits or cause significant losses, making traders anxious. This stress triggers impulsive decisions—like doubling down or exiting prematurely—based on emotions rather than strategy. Overleveraging or underestimating position size erodes confidence, pushing traders to chase wins or avoid risks irrationally. Ultimately, improper sizing fuels emotional reactions that sabotage disciplined trading.

What are the signs of poor position sizing in trading?

Signs of poor position sizing in trading include risking too much of your capital on a single trade, leading to rapid account depletion, and inconsistent trade sizes that cause unpredictable results. You might notice frequent large losses that wipe out gains or a tendency to overtrade because each position feels too small to impact your overall account. It can also lead to unnecessary emotional stress, forcing you to make impulsive decisions. If your trading results show big swings and difficulty sticking to your plan, improper position sizing is likely a cause.

How does position size impact stop-loss effectiveness?

Improper position sizing can make stop-losses either too tight or too loose. If the position is too large, a normal market fluctuation might hit the stop-loss prematurely, causing unnecessary losses. Too small a position, and the stop-loss might be ineffective, not protecting enough capital if the trade moves against you. Proper sizing ensures stops are meaningful and can protect your account without being triggered by normal volatility.

What strategies help determine the right position size?

Proper position sizing depends on risk tolerance, account size, and trade setup. Use a fixed percentage of your capital per trade, typically 1-2%. Calculate the dollar amount you're willing to risk, then determine position size based on stop-loss distance. Avoid risking too much on a single trade to prevent large losses. Always adjust size if volatility increases or if your account balance changes. Proper sizing manages risk, while improper sizing can lead to rapid losses or account blowouts.

How does market volatility influence position sizing decisions?

Market volatility makes proper position sizing crucial because sudden price swings can wipe out your account if you're overexposed. During high volatility, traders often reduce their position size to limit risk, while low volatility might allow larger positions. Ignoring volatility can lead to overtrading, excessive losses, or margin calls, especially if you’re unaware of how big price moves can be. Proper position sizing based on volatility helps manage risk and prevents catastrophic losses in unpredictable markets.

What are the long-term consequences of consistent improper sizing?

Consistent improper sizing can lead to huge losses, wipe out your trading account, and cause emotional stress. Overtrading or risking too much per trade increases the chance of significant drawdowns and makes recovery harder. It also hampers your ability to stick to your trading plan, leading to bad habits and potential burnout. Over time, this can destroy your confidence and limit your growth as a trader.

How can traders avoid the dangers of incorrect position sizing?

Traders avoid the dangers of incorrect position sizing by setting strict risk limits, such as risking only 1-2% of their account per trade. They use proper stop-loss orders to control potential losses and adjust position sizes based on market volatility. Consistently applying a position sizing formula helps prevent overexposure and ensures losses remain manageable, keeping trading capital safe.

Conclusion about What are the dangers of improper position sizing in day trading?

In day trading, improper position sizing can lead to significant financial risks, emotional distress, and missed profit opportunities. Understanding the importance of correctly sizing positions is crucial for effective risk management and achieving long-term success. By recognizing common mistakes and leveraging strategies for optimal position sizing, traders can mitigate risks and enhance their trading performance. For more in-depth insights and guidance on managing position sizes effectively, explore the resources available through DayTradingBusiness.

Learn about What Is Position Sizing in Day Trading?