Did you know that even the best traders sometimes feel like they're playing a high-stakes game of dodgeball? Just like in dodgeball, knowing when to duck and when to throw is crucial—especially when it comes to managing your trading risks. In our article, we dive into the essential strategies for setting effective stop-loss orders, a key tool for limiting your risk in trading. We cover everything from the basics of what stop-loss orders are and how they function, to tips on determining the right levels and types for your trades. Learn how to utilize trailing stop-losses, avoid common pitfalls, and adjust your orders as market conditions change. With insights on maximizing profits and best practices for different assets, this guide from DayTradingBusiness is your go-to resource for navigating the complexities of stop-loss orders in trading.

What is a stop-loss order and how does it work?

A stop-loss order is a trade instruction to sell a security once it reaches a specific price, limiting potential losses. It works by automatically triggering a sale if the market price drops to or below that set level. For example, if you buy stock at $50 and set a stop-loss at $45, the order will execute if the price hits $45, preventing further loss. Properly setting a stop-loss helps protect your capital during volatile market swings.

Why should I use stop-loss orders in trading?

Use stop-loss orders to automatically sell your position if the price drops to a set level, limiting potential losses. They protect your capital by preventing emotional decision-making during market swings. Setting a stop-loss helps you stick to your risk tolerance and avoid large, unexpected losses.

How do I determine the right stop-loss level?

Calculate your maximum acceptable loss based on your trading capital and risk tolerance, then set the stop-loss just beyond a key support or resistance level that invalidates your trade idea. Use technical analysis to identify recent lows or highs as your stop-loss point. Consider market volatility to avoid getting stopped out by normal price swings. Adjust the stop-loss to maintain a favorable risk-reward ratio, typically at least 1:2. Always place the stop where the trade setup’s validity breaks, not just where the price might temporarily dip.

What are the different types of stop-loss orders?

The main types of stop-loss orders are:

1. Stop-Loss Market Order: Executes immediately at the next available market price once the stop price is hit.

2. Stop-Loss Limit Order: Converts to a limit order when the stop price is reached, only selling at or above the set limit price.

3. Trailing Stop Order: Moves with the market price, maintaining a set distance (percentage or dollar amount) to lock in gains and limit losses.

4. Stop-Loss with Guaranteed Execution: Usually offered by certain brokers, guarantees the order will execute at the stop price, regardless of market volatility.

Choose based on your risk tolerance and trading style.

How can I set a stop-loss order on stock trading platforms?

To set a stop-loss order, enter your stock's ticker symbol on your trading platform. Choose the "sell" option and select "stop-loss." Enter the price at which you want the order to trigger—below the current market price for a long position. Confirm and place the order. When the stock drops to that price, the stop-loss becomes a market order, selling your shares automatically to limit losses.

What is a trailing stop-loss and when should I use it?

A trailing stop-loss is a dynamic order that moves with your stock’s price, maintaining a set distance below the current price. Use it when you want to protect gains while allowing room for upward movement. Set it after entering a trade, especially if the stock is trending up, to lock in profits if the price reverses. It’s ideal in volatile markets or when you expect the stock to continue growing but want to limit downside risk.

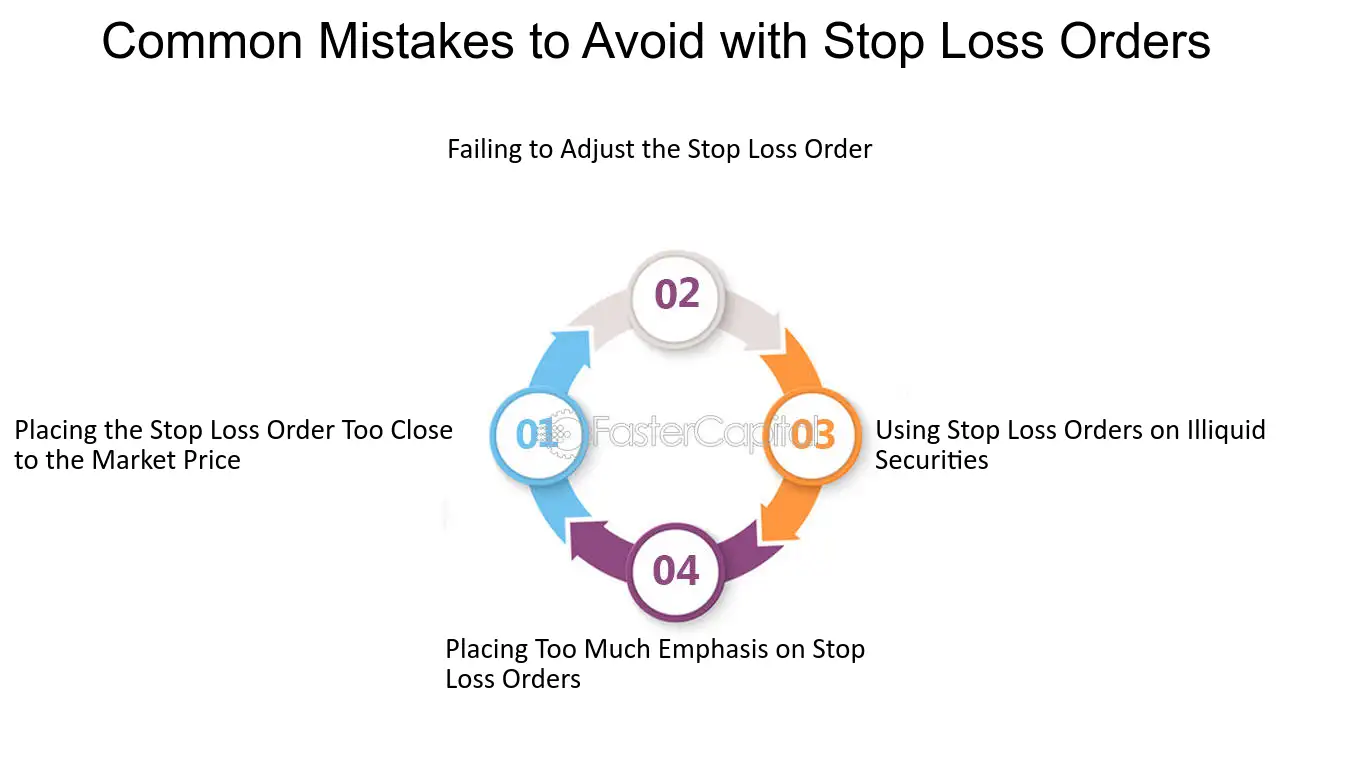

How do I avoid common mistakes with stop-loss orders?

Set your stop-loss based on the asset’s volatility, not just a fixed percentage. Avoid placing stops too tight, which can trigger on normal fluctuations; give your trade room to breathe. Use technical support or resistance levels as reference points for placement. Don't move your stop-loss prematurely—stick to your plan unless the market fundamentals change. Regularly review and adjust your stop-loss as the trade develops to lock in profits or minimize losses. Avoid emotional decisions—trust your analysis over fear or greed.

Can stop-loss orders protect me during volatile markets?

Yes, stop-loss orders can protect you during volatile markets by automatically selling your asset if it drops to a specified price, limiting potential losses.

How do I adjust a stop-loss order as the market moves?

To adjust a stop-loss order as the market moves, move the stop-loss level closer to the current price to lock in gains or further from it to give the trade room to breathe. Use a trailing stop-loss, which automatically raises the stop-loss as the price rises, locking in profits while allowing upside potential. Manually update the stop-loss order through your trading platform whenever the market moves significantly in your favor or against you. Remember, once you set a stop-loss, you need to actively monitor and adjust it to stay aligned with your risk management goals.

What are the risks of setting a stop-loss too tight?

Setting a stop-loss too tight can cause premature exits from trades, locking in losses from normal market fluctuations. It increases the chance of getting stopped out by minor price swings, missing potential gains. This can lead to frequent small losses and reduce overall profitability. Tight stops may also cause emotional stress and impulsive decisions, disrupting a clear trading plan.

How do I decide between a fixed or a dynamic stop-loss?

Choose a fixed stop-loss if you prefer a set price level that stays constant, making it simple to manage risk based on your initial trade. Opt for a dynamic stop-loss if you want it to adjust as the market moves in your favor, locking in profits and reducing downside risk. Fixed is straightforward; dynamic adapts to market volatility. Your decision depends on your trading style, risk tolerance, and whether you want a set exit point or a flexible one based on price movements.

How do stop-loss orders impact my overall trading strategy?

Stop-loss orders protect your capital by automatically selling a position when it hits a set price, limiting potential losses. They help you stick to your risk management plan, preventing emotional decisions during market swings. Effective stop-loss placement keeps losses manageable without cutting into potential gains, balancing risk and reward. Using stop-loss orders can also prevent small losses from turning into big ones, maintaining your trading discipline and confidence.

What factors influence the placement of a stop-loss?

The placement of a stop-loss depends on your risk tolerance, the asset's volatility, support and resistance levels, and chart patterns. Setting it too tight risks being triggered by normal price swings, while placing it too far reduces protection. Traders often base stop-loss levels on recent lows or highs, technical indicators like moving averages, or a fixed percentage of the trade size. The asset’s historical price fluctuations and news events also influence where you set your stop-loss.

How can I use stop-loss orders to maximize profits?

Use a tight stop-loss order just below support levels or recent lows to protect gains. Adjust your stop-loss as the trade moves in your favor, locking in profits. Avoid setting stops too close to market price to prevent premature exits from normal volatility. Consider trailing stops that move up as the price rises, maximizing profits while limiting losses. Always base your stop-loss placement on technical analysis and your risk tolerance.

What are the best practices for setting stop-losses in different assets?

Set stop-losses just below support levels for stocks and forex, below recent swing lows for crypto, and at key technical levels like moving averages. Use a fixed percentage, typically 1-2% for stocks and forex, and 5-10% for more volatile assets like crypto. Adjust stop-losses based on volatility—wider for volatile assets, tighter for stable ones. Avoid setting stops too close, which can trigger false exits; give your trade room to breathe. Consider ATR (Average True Range) to determine optimal stop-loss distance based on recent price swings. Always align stop-loss levels with your risk tolerance and trading plan.

Conclusion about How to set effective stop-loss orders to limit risk

Incorporating effective stop-loss orders is essential for risk management in trading. By understanding their function, determining optimal levels, and using various types, traders can protect their investments and enhance their strategies. Avoiding common pitfalls and adjusting stop-losses according to market movements further improves trading outcomes. For more insights and comprehensive guidance on implementing stop-loss orders effectively, consider leveraging the resources offered by DayTradingBusiness.