Did you know that the average person can only wait about 30 seconds for a webpage to load before losing their patience? In the fast-paced world of day trading, impatience can wreak havoc on your performance. This article delves into the detrimental impact of impatience, exploring how it leads to costly trading mistakes and losses. We’ll examine the ways impatience affects decision-making, encourages skipping crucial research, and increases the chances of overtrading. Moreover, we’ll highlight the importance of trade discipline and risk management, while offering strategies to recognize and combat impatience. By understanding these key points, traders can improve their outcomes and ensure long-term success with the support of DayTradingBusiness.

How does impatience lead to day trading losses?

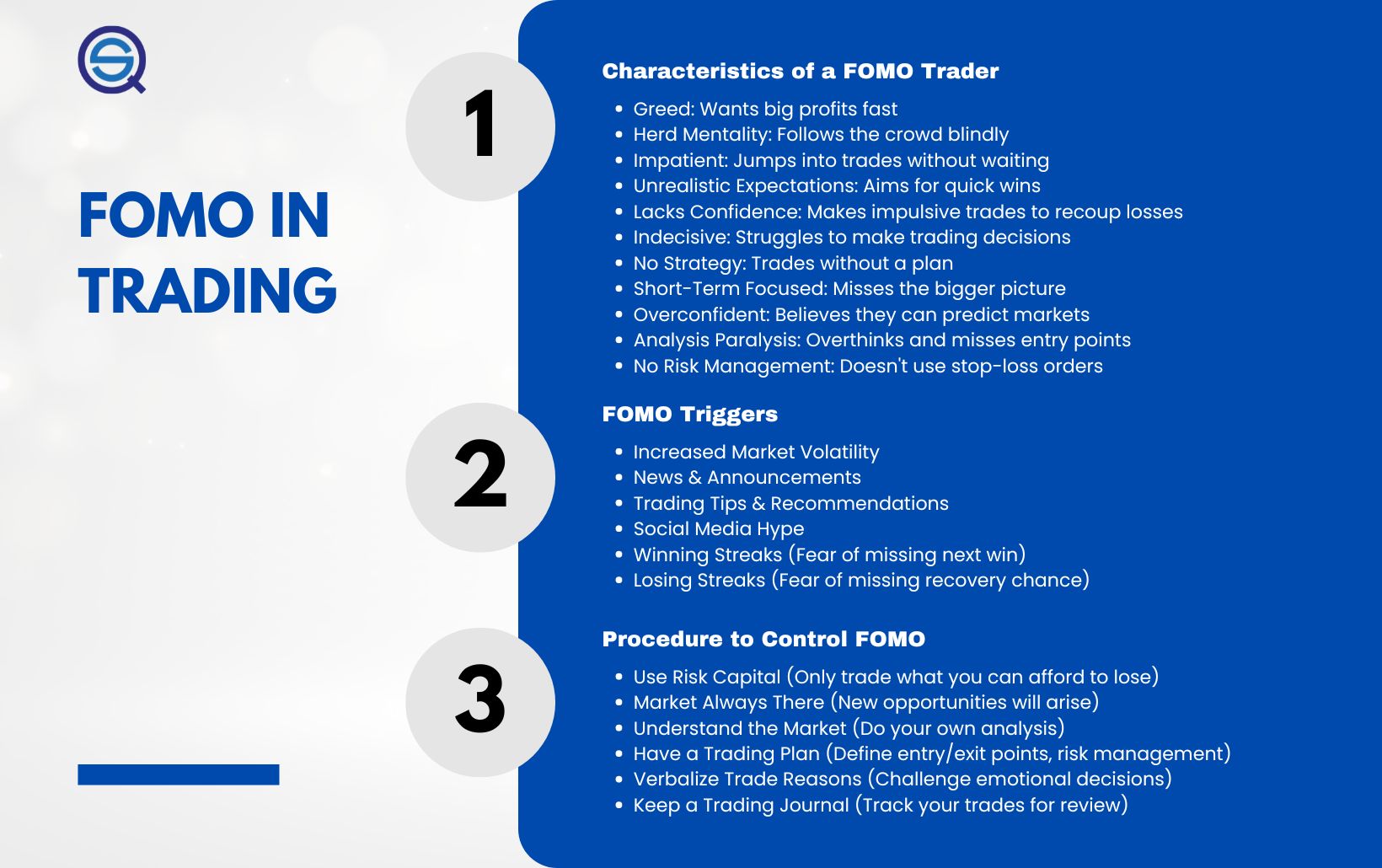

Impatience causes day traders to rush decisions, ignore signals, and chase quick profits, leading to impulsive trades. This often results in entering trades too early or holding onto losing positions, magnifying losses. Impatient traders skip proper analysis, increase risk exposure, and react emotionally to market swings, all of which boost the chance of costly mistakes.

Why is impatience a common cause of trading mistakes?

Impatience leads traders to rush decisions, ignoring analysis and risking impulsive trades. It causes them to exit positions too early or hold onto losing trades, hoping for quick gains. This impatience undermines discipline, increasing errors and losses in day trading.

Can impatience cause traders to skip research or analysis?

Yes, impatience can cause traders to skip research or analysis, leading to impulsive decisions and increased mistakes in day trading.

How does impatience affect decision-making in day trading?

Impatience in day trading leads to impulsive decisions, rushing into trades without proper analysis. It causes traders to chase quick profits, increasing the risk of losses. Impatient traders often exit positions prematurely or hold onto losing trades, magnifying mistakes. This behavior reduces discipline, leading to poor risk management and emotional trading. Overall, impatience heightens the likelihood of costly errors and inconsistent results.

What are the risks of rushing trades due to impatience?

Rushing trades from impatience leads to poor decision-making, increasing the chances of entering bad positions, overtrading, and missing key market signals. It heightens emotional trading, causing more mistakes and bigger losses. Impatient traders often overlook risk management, resulting in larger drawdowns. Overall, impatience damages trading discipline and can wipe out profits quickly.

Does impatience increase the likelihood of overtrading?

Yes, impatience increases the likelihood of overtrading because traders rush into too many trades chasing quick profits, often ignoring proper analysis. Impatient traders tend to ignore risk management, making impulsive decisions that lead to losses. This behavior fuels overtrading, as they try to recover losses or capitalize on fleeting opportunities without careful planning.

How can impatience trigger emotional trading?

Impatience makes traders rush decisions, leading to impulsive trades without proper analysis. It causes them to chase quick gains, often ignoring risk management. This rush increases emotional reactions like fear or greed, fueling more mistakes. Impatient traders tend to hold onto losing trades too long or exit winners prematurely, amplifying losses. Overall, impatience fuels emotional trading, making mistakes more likely and damaging profitability.

What impact does impatience have on trade timing?

Impatience causes traders to rush decisions, leading to premature entries or exits and increasing the likelihood of mistakes. It often results in impulsive trades based on emotions rather than analysis, causing poor timing and potential losses. Impatient traders may hold onto losing positions too long or exit winners too early, disrupting optimal trade timing. Overall, impatience undermines discipline, reducing the ability to wait for the best trade setups and increasing costly errors.

Why do impatient traders often ignore stop-losses?

Impatient traders often ignore stop-losses because they want quick gains and fear missing out, leading them to hold losing positions longer. Their rush to profit blinds them to risk management, increasing emotional trading and mistakes. Impatience fuels impulsive decisions, making stop-loss discipline easy to overlook in pursuit of fast results.

How does impatience influence risk management?

Impatience leads day traders to rush decisions, skipping thorough analysis and increasing impulsive trades. It causes them to exit positions too early or hold losing trades longer, amplifying losses. Impatient traders often ignore proper risk management strategies, like setting stop-losses, risking larger amounts than they should. This impatience-driven behavior results in higher volatility and more frequent mistakes, undermining consistent profitability.

Can impatience cause traders to abandon their strategies?

Yes, impatience can cause traders to abandon their strategies. When traders get impatient, they often make impulsive decisions, like jumping into trades too early or exiting positions prematurely, which leads to mistakes. This rush to quick profits overrides disciplined planning, increasing errors and losses. Impatience undermines consistency, causing traders to stray from proven strategies and chase short-term gains.

How does impatience affect trade discipline?

Impatience leads to impulsive trades, skipping proper analysis and risking bigger losses. It causes traders to exit positions too early or chase quick gains, undermining discipline. This behavior increases mistakes like overtrading and ignoring stop-losses, damaging overall trading performance.

What are the long-term effects of impatience on trading success?

Impatience in day trading leads to impulsive decisions, forcing traders to exit positions early or chase quick gains, which causes inconsistent profits. Over time, this behavior erodes discipline, increases emotional stress, and results in larger losses. Persistent impatience prevents traders from sticking to proven strategies, making them prone to costly mistakes and reducing long-term success.

How can traders recognize impatience early?

Traders recognize impatience early by noticing impulsive trades without proper analysis, skipping stop-loss setups, or rushing into positions under pressure. Impatience leads to hasty decisions, increasing the chance of trading mistakes like overtrading, poor entry points, and ignoring market signals. It often shows as increased emotional reactions, such as frustration or fear, prompting rushed moves that derail strategies. Recognizing these signs early helps traders pause, reassess, and avoid costly errors caused by impatience.

What strategies help reduce impatience in day trading?

Impatience leads to impulsive trades, rushing decisions, and ignoring analysis, increasing mistakes. To reduce impatience, set strict trading plans, take regular breaks, and practice mindfulness to stay calm. Use stop-loss orders to prevent emotional reactions, and focus on quality setups rather than quick profits. Developing discipline and sticking to predefined criteria helps manage impatience and improve trading outcomes.

How does impatience compare to other emotional trading pitfalls?

Impatience leads to impulsive trades, causing overtrading and chasing losses, which often results in bigger mistakes. Unlike fear or greed, impatience pushes traders to enter or exit positions prematurely, skipping analysis and risking poor decisions. It increases the likelihood of holding onto losing trades or jumping into risky setups without proper confirmation, amplifying losses. Overall, impatience accelerates mistakes faster than other emotional pitfalls like overconfidence or revenge trading.

Can patience improve trading outcomes despite initial mistakes?

Yes, patience can improve trading outcomes by helping traders stick to their strategies, avoid impulsive decisions, and learn from initial mistakes. Impatience often leads to hasty trades, increasing errors and losses. Staying patient allows for better analysis, reduces emotional reactions, and helps recover from early mistakes. Over time, patience fosters discipline, leading to more consistent and successful day trading results.

Conclusion about What impact does impatience have on day trading mistakes?

Impatience is a significant barrier to successful day trading, often leading to costly mistakes and losses. It can result in rushed decisions, inadequate research, and poor risk management, ultimately compromising trade discipline. Recognizing and addressing impatience is crucial for any trader aiming to enhance their performance. By implementing strategies to cultivate patience, traders can improve their outcomes and ensure a more disciplined approach to the market. Embracing this mindset is essential for long-term trading success, and resources from DayTradingBusiness can provide valuable insights to help navigate these challenges effectively.