Did you know that using too much leverage can turn your trading account into a rollercoaster ride—exciting at first, but potentially terrifying at the end? In this article, we’ll explore essential strategies for managing leverage risk in day trading. You'll learn how to identify leverage risks and the common dangers that come with them. We’ll discuss setting appropriate leverage limits, using effective risk management tools like stop-loss orders, and the importance of position sizing. Additionally, we’ll cover how market volatility impacts leveraged positions and the regulatory limits every day trader should be aware of. With insights from DayTradingBusiness, you’ll gain the knowledge needed to balance leverage with capital preservation and create a solid leverage risk management plan.

How can I identify leverage risks in day trading?

Look for excessive leverage levels that amplify small market moves into big losses. Monitor your margin use—if your position size is too high relative to your account, risk increases. Watch for volatile stocks or markets with sudden price swings, which can trigger margin calls. Use stop-loss orders to limit potential losses on leveraged trades. Keep an eye on your account’s margin level; a rapid decline signals rising leverage risk. Avoid over-leveraging during uncertain or unpredictable market conditions.

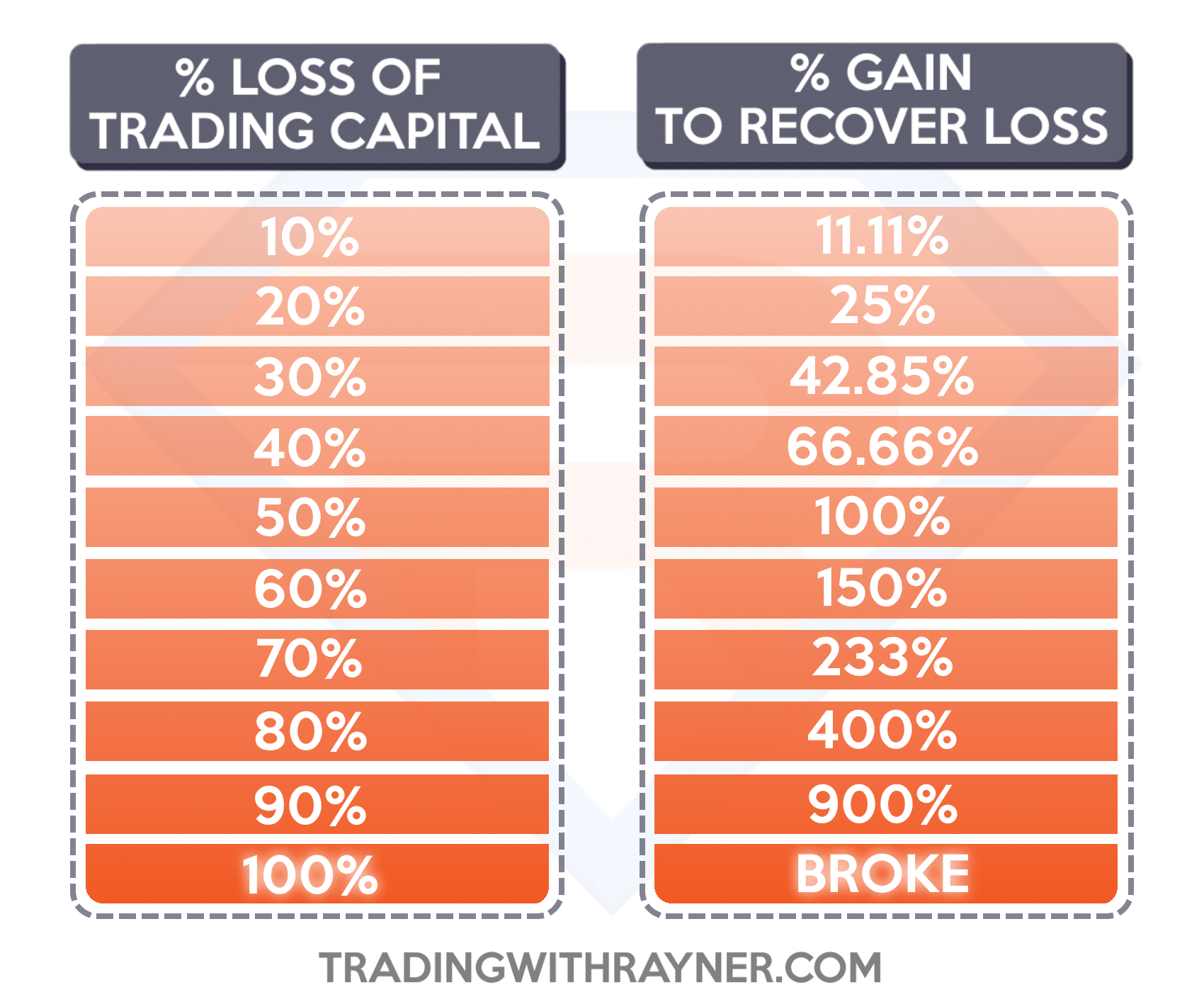

What are the common dangers of using leverage in day trading?

Using leverage in day trading can amplify losses quickly, wiping out your capital if trades go against you. It increases the risk of margin calls, forcing you to deposit more funds or close positions at a loss. Leverage can lead to emotional trading, causing impulsive decisions and bigger mistakes. It also makes your account vulnerable to market volatility, where sudden swings can trigger significant losses. Managing leverage risk means setting strict stop-losses, using lower leverage ratios, and avoiding overexposure to prevent devastating financial impacts.

How do I set appropriate leverage limits for day trading?

Set leverage limits by using a conservative ratio, like 2:1 or 3:1, based on your risk tolerance. Determine your maximum loss per trade and ensure leverage doesn’t amplify that loss beyond your comfort zone. Use stop-loss orders to cap potential losses and avoid over-leveraging on volatile assets. Regularly review your trading performance and adjust leverage to stay within safe risk levels. Never exceed leverage that could wipe out your account with a single bad trade.

What strategies reduce leverage risk during volatile markets?

Reduce leverage risk in volatile markets by lowering your leverage ratio, using tighter stop-loss orders, and avoiding overtrading. Limit position sizes to prevent large losses, and keep cash reserves to cushion sudden swings. Monitor market conditions closely, and don’t chase after quick gains—wait for clear setups. Use risk management tools like trailing stops, and stick to your trading plan without emotional decisions. Diversify your trades to avoid overexposure to single assets.

How does margin call impact leverage management?

A margin call forces traders to either deposit more funds or close positions, limiting leverage use. It caps how much risk traders can take, preventing unlimited losses. When a margin call hits, traders must reduce exposure, which directly controls leverage risk. Proper leverage management means avoiding margin calls by keeping positions within safe limits. Using stop-loss orders and monitoring margin levels helps prevent sudden margin calls during volatile trades.

What are the best risk management tools for leveraged trading?

The best risk management tools for leveraged trading include stop-loss orders, take-profit orders, position sizing, and leverage limits. Use stop-losses to cap losses on each trade, set take-profits to lock in gains, and adjust position sizes based on your risk tolerance. Implement leverage caps to prevent overexposure, and consider using trailing stops to protect profits as the market moves in your favor. Always monitor margin levels and avoid overleveraging to reduce margin calls and account blowouts.

How can I use stop-loss orders to control leverage risk?

Set a stop-loss order just below a key support level to limit potential losses if the trade goes against you. Use tight stop-losses on highly leveraged positions to prevent large drawdowns. Adjust stop-loss levels as the trade moves in your favor to lock in gains and reduce risk. Always place stop-loss orders immediately after entering a trade to avoid emotional decisions. This way, you automatically exit if the market moves unfavorably, controlling leverage risk effectively.

What role does position sizing play in managing leverage?

Position sizing controls how much you trade relative to your account, directly limiting potential losses when using leverage. By adjusting position size, you prevent overextending on risky trades, reducing the chance of margin calls and large losses. It ensures leverage amplifies gains without disproportionately increasing risk, keeping your trading within manageable limits.

How do I balance leverage and capital preservation?

Set strict position limits to control leverage and avoid overexposure. Use stop-loss orders to protect capital if trades go against you. Keep leverage low relative to your account size to reduce risk. Regularly review your trades and adjust leverage based on market volatility. Focus on consistent, small wins instead of chasing big gains with high leverage. Always have a clear risk-reward ratio and never risk more than you can afford to lose.

What are the signs of over-leverage in my trading account?

Signs of over-leverage include frequent margin calls, large swings in your account balance, and difficulty maintaining positions. If you notice your margin level consistently close to the limit or sudden, sharp losses wiping out a significant portion of your capital, you're likely over-leveraged. It can also feel stressful to hold positions, and you might be forced to close trades prematurely.

How can I diversify to lower leverage-related risks?

To lower leverage-related risks in day trading, reduce your leverage ratio, trade smaller position sizes, and use stop-loss orders to limit losses. Diversify your trades across different assets and sectors to avoid overexposure. Avoid putting all your capital into a single trade or asset class. Keep a cash reserve to cushion market swings and prevent overleveraging. Regularly review your trading plan and adjust leverage levels as your experience and market conditions change.

What should I do if my leverage increases my losses?

Reduce or close your position immediately to limit losses. Lower your leverage ratio before trading to minimize risk. Use stop-loss orders to automatically exit trades if losses grow. Avoid overleveraging in volatile markets. Practice risk management by limiting your trade size relative to your account. Regularly review and adjust your leverage to match your experience and market conditions.

How does market volatility affect leveraged positions?

Market volatility increases the risk of leveraged positions by amplifying price swings, which can quickly trigger margin calls or forced liquidations. When markets are volatile, small price movements can wipe out your capital or cause significant losses. To manage leverage risk during high volatility, use tighter stop-loss orders, reduce leverage levels, and avoid overexposing yourself to rapid market swings. Monitoring market conditions closely and adjusting position sizes helps prevent sudden margin calls.

What are the regulatory limits on leverage for day traders?

Regulatory limits on leverage for day traders vary by country. In the U.S., the SEC and FINRA restrict leverage to 2:1 for day traders using margin accounts. In the UK, the FCA caps leverage at 30:1 for major currency pairs and 20:1 for others. Australia’s ASIC limits leverage to 30:1 for major forex pairs. Always check local regulations, as they set the maximum leverage allowed for day trading to manage risk effectively.

How can I create a leverage risk management plan?

To manage leverage risk in day trading, set strict position size limits based on your account balance, use stop-loss orders to limit losses, and avoid overleveraging by keeping leverage low. Monitor margin levels closely, and don’t chase trades beyond your risk tolerance. Practice disciplined trading—only trade setups with clear risk-reward ratios—and regularly review your leverage exposure to prevent excessive risk.

Conclusion about How to manage leverage risk when day trading?

In conclusion, effectively managing leverage risk in day trading requires a proactive approach, including identifying potential risks, setting appropriate limits, and employing robust risk management tools. By utilizing strategies such as stop-loss orders, position sizing, and diversification, traders can mitigate the dangers associated with leverage. Understanding market volatility and regulatory limits is vital for maintaining a balanced trading strategy. For comprehensive guidance and resources on navigating these challenges, DayTradingBusiness is here to support your trading journey.

Learn about How Do Institutional Traders Manage Risk During Day Trading?