Did you know that even the most seasoned traders can be swayed by their emotions, often leading to costly mistakes? In this article, we delve into the crucial role of emotional control in reducing trading risks. Discover how emotions like fear and greed can skew decision-making and what common traps to avoid. Learn practical strategies to maintain calm, develop emotional discipline, and the importance of patience in trading. We’ll also explore how mindfulness can enhance performance and the tools available to help traders achieve emotional balance. With insights from DayTradingBusiness, you’ll be equipped to navigate the psychological landscape of trading for long-term success.

How Does Emotional Control Impact Trading Risks?

Emotional control helps traders avoid impulsive decisions that lead to losses. Staying calm prevents panic selling during downturns or overconfidence after wins. It reduces the likelihood of revenge trading or chasing losses. By maintaining discipline, traders stick to their strategies and risk management plans. Overall, controlling emotions minimizes risky behaviors that can wipe out profits or cause significant losses.

Why Is Managing Emotions Important in Trading?

Managing emotions in trading prevents impulsive decisions that can lead to significant losses. Emotional control helps traders stick to their strategies during market ups and downs, avoiding panic selling or overconfidence. By staying calm, traders can analyze data objectively instead of reacting to fear or greed. This reduces the risk of costly mistakes and improves long-term profitability. Keeping emotions in check also maintains discipline, making it easier to manage risk and follow risk management rules consistently.

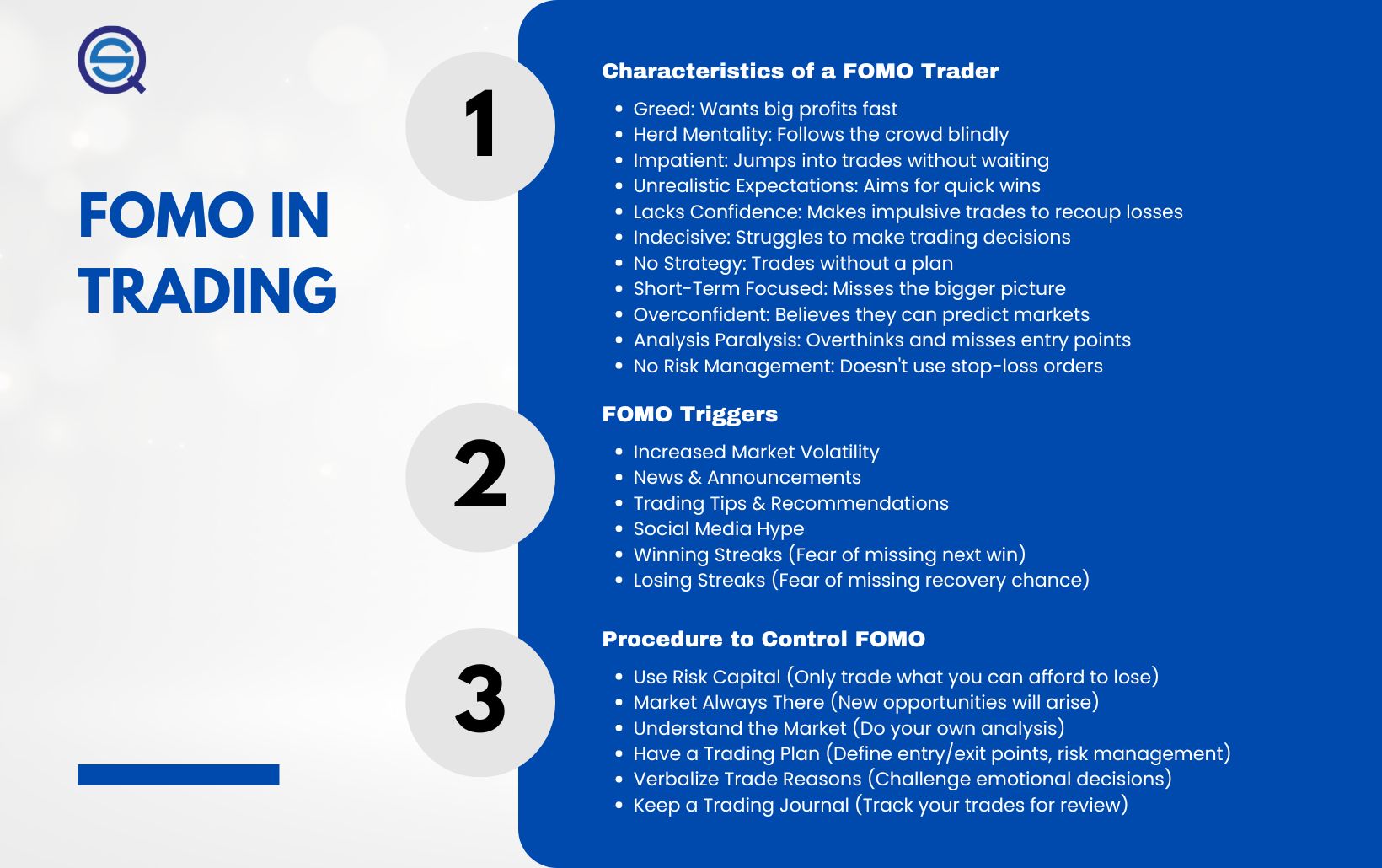

What Are Common Emotional Traps for Traders?

Common emotional traps for traders include fear of missing out (FOMO), greed, overconfidence, frustration from losses, and panic selling. These emotions can lead to impulsive decisions, abandoning strategies, or holding onto losing trades too long. Managing emotions through discipline and self-awareness helps traders avoid these pitfalls, reducing trading risks significantly.

How Can Fear Affect Trading Decisions?

Fear can cause traders to panic sell, miss opportunities, or exit positions prematurely, increasing losses. It triggers impulsive decisions based on emotion rather than strategy, leading to inconsistent results. Managing fear through emotional control helps traders stay disciplined, stick to their plan, and avoid costly mistakes.

How Does Greed Increase Trading Risks?

Greed makes traders chase bigger gains without proper risk management, leading to impulsive decisions and holding onto losing trades. It blinds judgment, causing overconfidence and ignoring market signals. When greed takes over, traders often ignore stop-losses or exit strategies, increasing potential losses. Emotional control helps traders stick to plans, avoid impulsive moves, and manage risks by staying calm and disciplined.

What Are Practical Ways to Stay Calm During Trading?

Practice deep breathing and stay focused on your trading plan. Limit screen time and take regular breaks to prevent stress buildup. Use stop-loss orders to reduce fear of big losses. Keep a trading journal to track emotions and identify triggers. Maintain a healthy routine—exercise, sleep well, and stay hydrated. Develop a mindset that accepts losses as part of trading, not personal failures. Avoid impulsive decisions by waiting for clear setups. Stay disciplined, and remember that emotional control minimizes trading risks.

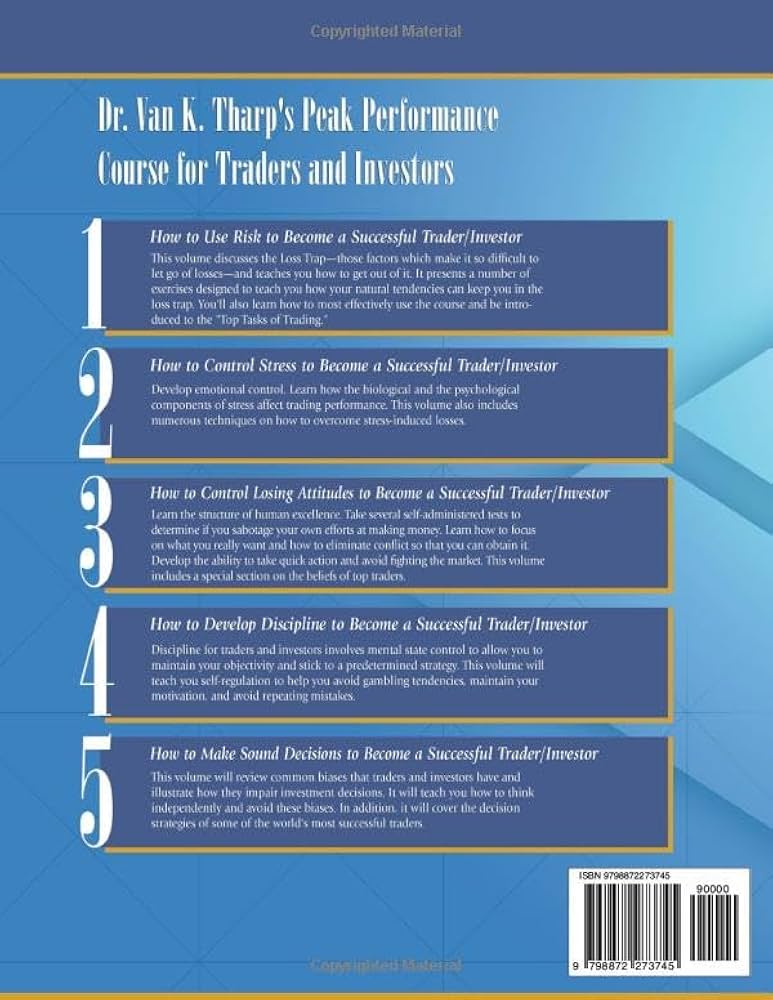

How Can Traders Develop Emotional Discipline?

Traders develop emotional discipline by setting clear trading plans, sticking to predefined strategies, and avoiding impulsive decisions. Practicing mindfulness and keeping a trading journal helps recognize emotional triggers. Limiting exposure to market noise and taking regular breaks prevent emotional fatigue. Consistently managing risk with stop-loss orders reduces anxiety and prevents panic selling. Building confidence through education and experience fosters calmness during volatile moments.

What Role Does Patience Play in Reducing Risks?

Patience helps traders avoid impulsive decisions, reducing the risk of costly mistakes. It allows for better analysis and timing, preventing panic buys or sell-offs. Staying patient means waiting for clear signals instead of reacting emotionally, which lowers the chance of losses. In trading, patience keeps emotions in check and promotes disciplined action, directly cutting down risk exposure.

How Does Overconfidence Lead to Trading Losses?

Overconfidence causes traders to take bigger risks, ignore warning signs, and hold onto losing positions longer. This emotional bias leads to impulsive decisions, skipping proper analysis. As a result, overconfident traders often suffer larger losses when markets move against them. Controlling emotions helps traders stay disciplined, stick to their strategies, and avoid costly mistakes caused by overestimating their abilities.

Why Is Consistent Emotional Control Essential for Long-Term Success?

Consistent emotional control helps traders stick to their strategies, avoid impulsive decisions, and prevent panic selling during market swings. It reduces fear and greed, which often lead to risky trades or holding onto losing positions. By staying calm and focused, traders can analyze market data objectively, minimizing errors and managing risks more effectively. Emotional discipline prevents emotional biases from clouding judgment, ensuring better risk management and long-term profitability.

How Can Mindfulness Improve Trading Performance?

Mindfulness helps traders stay calm and focused, reducing impulsive decisions that lead to losses. By practicing present-moment awareness, traders avoid emotional reactions like fear or greed, which can cause risky trades. It boosts emotional control, making it easier to stick to strategies and manage stress during market swings. Overall, mindfulness sharpens decision-making and minimizes trading risks caused by emotional volatility.

Learn about How Can Mindfulness Improve Trading Psychology?

What Are Effective Techniques to Manage Trading Stress?

Effective techniques include setting strict trading plans, practicing mindfulness to stay present, taking regular breaks to avoid burnout, and maintaining a balanced lifestyle. Developing emotional control helps traders stick to their strategies, avoid impulsive decisions, and reduce the risk of losses caused by fear or greed. Using stop-loss orders and journaling trades also keep emotions in check by providing clear boundaries and insights into your trading behavior.

How Does Emotional Regulation Affect Trading Strategies?

Emotional regulation helps traders stay calm and make rational decisions, reducing impulsive actions like panic selling or overtrading. It prevents fear and greed from clouding judgment, leading to more consistent, disciplined trading strategies. By managing emotions, traders avoid costly mistakes during market volatility, lowering overall trading risks.

Learn about How Do Prop Firms Affect Day Trading Strategies?

How Can Setting Clear Goals Reduce Emotional Trading Errors?

Setting clear goals helps traders stay focused and avoid impulsive decisions driven by fear or greed. When goals are specific, like a target profit or risk limit, emotions fade because actions align with a plan. This reduces reactive trading, preventing panic sell-offs or overconfidence. Clear goals act as a mental anchor, keeping emotional reactions in check and promoting disciplined, rational trading.

Learn about How Can Setting Clear Goals Minimize Psychological Risks?

What Tools Help Traders Maintain Emotional Balance?

Tools like meditation apps, journaling, and stress management techniques help traders stay emotionally balanced. Trading platforms with customizable alerts reduce impulsive decisions. Automated trading systems and stop-loss orders limit emotional reactions during volatility. Regular breaks and mindfulness exercises keep traders centered, preventing emotional overload from market swings.

Conclusion about How Can Emotional Control Reduce Trading Risks?

In summary, mastering emotional control is crucial for minimizing trading risks and enhancing decision-making. By recognizing and managing emotions like fear and greed, traders can avoid common pitfalls and develop strategies that lead to long-term success. Implementing techniques such as mindfulness, setting clear goals, and maintaining emotional discipline can significantly improve trading performance. For traders looking to deepen their understanding of emotional management, DayTradingBusiness offers valuable insights and resources to foster a disciplined trading mindset.