Did you know that the first stock ticker was invented in 1867, and it was only capable of printing one stock price at a time? Fast forward to today, and artificial intelligence (AI) is revolutionizing the way traders manage risk in the fast-paced world of day trading. This article explores how AI enhances risk assessment, monitors market volatility, predicts price movements, and detects fraud, all while helping traders set effective stop-loss and take-profit levels. Additionally, we delve into the benefits of machine learning for reducing losses, analyzing news for trading risks, and diversifying portfolios. While AI offers numerous advantages, it’s also essential to understand its limitations and reliability in detecting market trends. Join us as we uncover how AI can minimize exposure during market crashes and adapt to ever-changing market conditions, all with insights from DayTradingBusiness.

How Can AI Improve Risk Assessment in Day Trading?

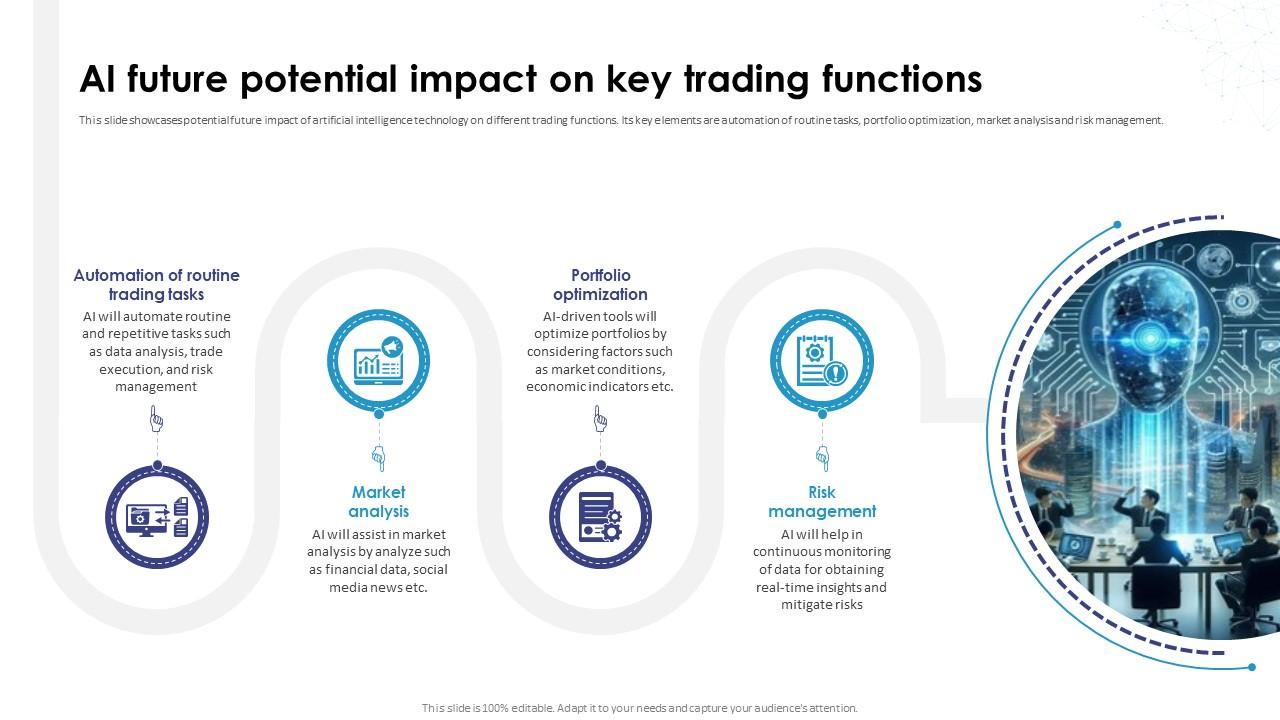

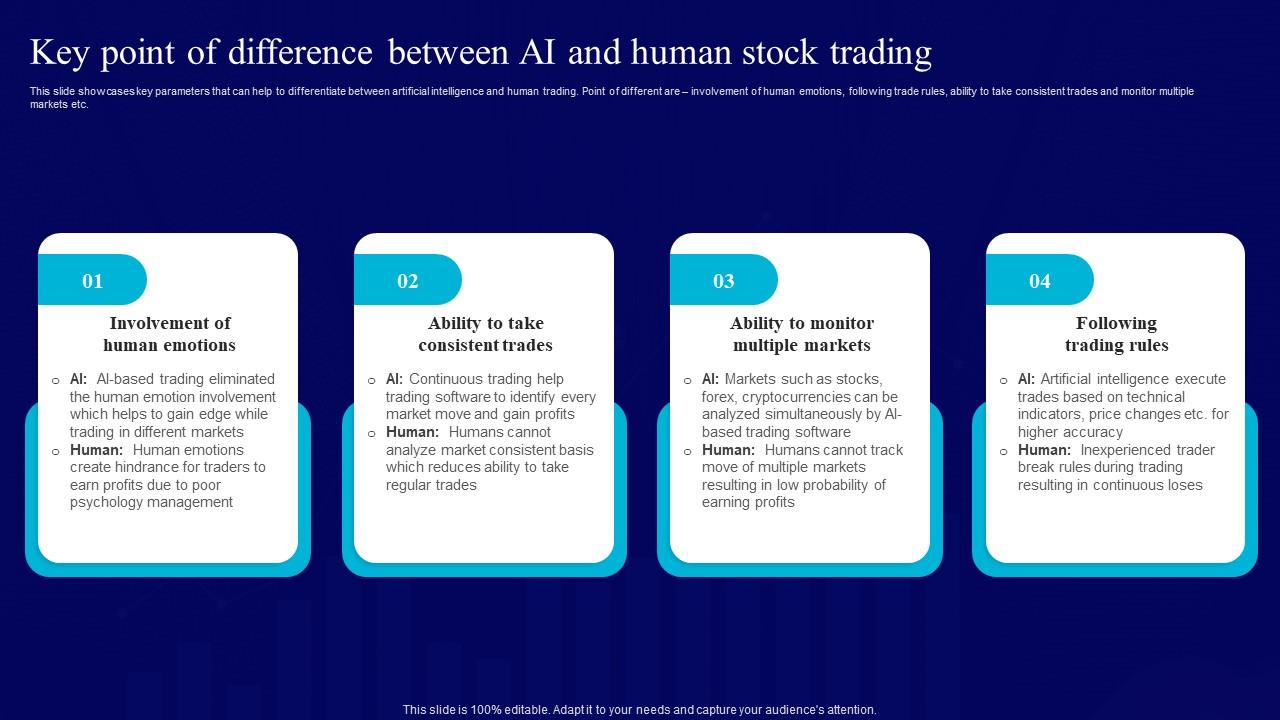

AI improves day trading risk management by analyzing vast market data quickly, identifying patterns, and predicting price movements. It offers real-time alerts for potential losses, automates stop-loss orders, and adjusts trading strategies instantly. Machine learning models detect emerging risks and market volatility, helping traders avoid large drawdowns. Overall, AI provides data-driven insights, reduces emotional trading errors, and enhances decision-making precision.

What AI Tools Are Best for Monitoring Market Volatility?

AI tools like Trade Ideas, Kavout, and TrendSpider excel at monitoring market volatility for day trading risk management. They analyze real-time data, identify sudden price swings, and generate alerts to help traders act quickly. Machine learning models from platforms like Alpha Vantage or QuantConnect predict volatility trends, enabling better decision-making. These tools automate risk assessment, spot patterns, and reduce emotional trading errors by providing timely insights.

How Does AI Predict Price Movements for Better Trading Decisions?

AI predicts price movements by analyzing vast market data, spotting patterns, and using machine learning models to forecast short-term trends. It identifies signals from historical prices, news, and social media sentiments to anticipate market shifts. AI-driven tools adjust risk levels dynamically, set optimal stop-loss and take-profit points, and alert traders to potential downturns. This helps day traders manage risk more precisely and make faster, data-backed decisions.

Can AI Help Detect Fraud and Manipulation in Day Trading?

Yes, AI can detect fraud and manipulation in day trading by analyzing large data patterns, spotting unusual trading activities, and flagging suspicious behaviors in real-time. It uses machine learning models to identify anomalies that human traders might miss, helping prevent market manipulation and fraudulent schemes.

How Can Machine Learning Reduce Trading Losses?

Machine learning identifies patterns and predicts market movements faster than humans, helping traders avoid risky trades. It analyzes vast data sets to spot early signs of downturns, enabling timely exit strategies. Algorithms can set dynamic stop-loss levels based on real-time market volatility, minimizing losses. By continuously learning from past trades, AI improves its risk assessment, making day trading more controlled and less prone to big losses.

What Are the Benefits of AI in Setting Stop-Loss and Take-Profit Levels?

AI improves risk management in day trading by precisely setting stop-loss and take-profit levels. It analyzes real-time market data to identify optimal exit points, reducing losses and locking in gains. AI adapts quickly to market shifts, minimizing emotional decision-making. It uses pattern recognition to predict price movements, helping traders avoid large downturns and maximize profits. Overall, AI enhances accuracy, speed, and consistency in managing trading risks.

How Does AI Analyze News and Social Media for Trading Risks?

AI analyzes news and social media by using natural language processing to detect sentiment, identify trending topics, and spot potential market-moving events. It scans real-time data to assess the emotional tone and relevance of posts, news articles, and alerts. AI models evaluate the credibility of sources and filter noise to gauge market sentiment accurately. By recognizing patterns and sudden shifts in public opinion or news, AI helps traders manage risks, avoid false signals, and make informed decisions quickly.

Can AI Assist in Diversifying Trading Portfolios?

Yes, AI can help diversify trading portfolios by analyzing vast market data, identifying uncorrelated assets, and recommending optimal asset mixes. It detects patterns and trends across different markets, reducing reliance on single assets and spreading risk. AI-driven tools continuously monitor portfolio performance, adjusting allocations to balance risk and maximize returns. This proactive management helps traders avoid overexposure to volatile assets, making diversification more effective.

How Reliable Is AI in Detecting Market Trends?

AI is fairly reliable in spotting market trends because it analyzes huge data sets quickly and identifies patterns humans might miss. However, it’s not foolproof—market volatility and unexpected news can still throw off predictions. For day trading risk management, AI helps by providing real-time alerts, setting automated stop-loss orders, and analyzing historical data to refine strategies. While AI boosts decision-making, traders should combine it with human judgment to manage risks effectively.

What Are Common AI Algorithms Used in Risk Management?

Common AI algorithms used in risk management for day trading include machine learning models like random forests, gradient boosting machines, and neural networks. These algorithms analyze market data to predict volatility, identify risky trades, and optimize stop-loss levels. Natural language processing helps interpret news sentiment and social media signals to assess risk. Reinforcement learning dynamically adjusts trading strategies based on changing market conditions, minimizing losses.

How Does AI Help in Managing Emotional Trading Decisions?

AI analyzes market data in real-time, identifying patterns and predicting price movements faster than humans. It assesses risk by monitoring volatility, stop-loss levels, and position sizes automatically. AI-driven tools provide emotional discipline by removing human bias, preventing impulsive trades driven by fear or greed. They offer personalized risk management strategies, alerting traders to potential losses before they happen. Overall, AI makes risk management in day trading more precise, consistent, and less emotionally influenced.

Can AI Identify High-Risk Trading Opportunities?

Yes, AI can identify high-risk trading opportunities by analyzing market data, detecting patterns, and alerting traders to potential risks in real-time. It uses machine learning models to evaluate volatility, price movements, and news sentiment, helping traders avoid or manage risky trades effectively.

How Does AI Integrate with Existing Trading Platforms?

AI integrates with existing trading platforms through APIs and software plugins, enabling real-time data analysis, pattern recognition, and predictive modeling. It automates risk management by detecting market shifts, adjusting stop-loss orders, and managing trade sizes instantly. AI tools can also simulate scenarios, identify potential risks before trades execute, and provide alerts, helping traders minimize losses and optimize profit strategies.

What Are Limitations of AI in Day Trading Risk Control?

AI in day trading risk control struggles with unpredictable market jumps, sudden news, and black swan events. It can misinterpret complex or ambiguous data, leading to wrong risk assessments. Overfitting to historical patterns makes AI less effective during rare market shifts. It also depends on quality data; poor or biased data skews risk predictions. AI may lag behind real-time events if not integrated with high-frequency data feeds. Lastly, reliance on AI can cause traders to overtrust automated risk controls, missing nuanced human judgment.

How Can AI Minimize Exposure During Market Crashes?

AI minimizes exposure during market crashes by detecting early warning signals through real-time data analysis, enabling traders to quickly exit risky positions. It automates stop-loss adjustments based on market volatility, reducing losses. AI models forecast sudden downturns, prompting preemptive actions. By continuously monitoring market sentiment and patterns, AI helps traders avoid overexposure when turbulence hits, keeping risk levels controlled.

How Do AI Systems Adapt to Changing Market Conditions?

AI systems adapt to changing market conditions by continuously analyzing real-time data, recognizing patterns, and updating their algorithms accordingly. They use machine learning models that learn from new market trends, adjusting risk parameters, and refining trading strategies on the fly. This allows AI to respond quickly to volatility, mitigate potential losses, and seize emerging opportunities in day trading risk management.

Conclusion about How Can AI Help in Day Trading Risk Management?

Incorporating AI into day trading enhances risk management by providing advanced tools for risk assessment, market volatility monitoring, and price prediction. These technologies not only help in setting stop-loss and take-profit levels but also play a crucial role in detecting fraud and managing emotional decisions. While AI offers significant benefits, such as portfolio diversification and trend analysis, it is essential to remain aware of its limitations. By leveraging these AI capabilities, traders can make more informed decisions and minimize losses, ultimately leading to a more strategic trading approach. For comprehensive insights and support, turn to DayTradingBusiness to navigate the complexities of AI in trading.

Learn about How automation can help control stop-loss risk in day trading

Sources:

- Artificial intelligence techniques in financial trading: A systematic ...

- Opinion Paper: “So what if ChatGPT wrote it?” Multidisciplinary ...

- AI revolutionizing industries worldwide: A comprehensive overview ...

- Artificial Intelligence and its Impact on Financial Markets and ...

- Artificial intelligence for cybersecurity: Literature review and future ...

- advances in artificial intelligence: implications for capital market ...