Did you know that the average day trader spends more time analyzing charts than a chef spends perfecting their soufflé? In the fast-paced world of day trading, understanding the differences between manual and AI methods is crucial for success. This article dives into the nuances of manual day trading, highlighting the skills required and the emotional factors at play. It also explores AI day trading, detailing its operational mechanics, technical tools, and advantages over traditional methods. We’ll compare risks, costs, and decision-making processes, while addressing common challenges faced by manual traders. Whether you're contemplating a hybrid approach or seeking the best platforms, this guide from DayTradingBusiness covers everything you need to make informed trading decisions.

What is manual day trading?

Manual day trading is when a trader actively buys and sells stocks, currencies, or commodities based on real-time analysis and personal judgment. It involves making quick decisions without automated algorithms, relying on the trader’s skills, experience, and market intuition. Unlike AI day trading, which uses algorithms and machine learning to execute trades automatically, manual trading requires the trader to monitor markets constantly and execute trades manually.

How does AI day trading work?

AI day trading uses algorithms and machine learning to analyze market data, identify patterns, and execute trades automatically within seconds. Unlike manual trading, where traders make decisions based on their analysis and instincts, AI trading relies on pre-programmed models and real-time data to make faster, data-driven decisions. AI can process vast amounts of information, including news, charts, and historical trends, without emotional bias. Manual traders often rely on intuition and experience, while AI day trading depends on complex algorithms optimized for quick, consistent trades.

What are the main advantages of manual trading?

Manual trading offers the advantage of human judgment, allowing traders to adapt quickly to market nuances and news events. It provides control over trade decisions, enabling personalized strategies and emotional discipline. Traders can leverage intuition and experience to spot opportunities that algorithms might miss. Additionally, manual trading eliminates over-reliance on pre-set algorithms, reducing risks from technical glitches. It’s ideal for those who prefer active involvement and real-time decision-making in day trading.

What benefits does AI trading offer over manual methods?

AI trading offers faster decision-making, real-time data analysis, and emotion-free execution, unlike manual trading which relies on human judgment, slower processing, and emotional biases. It can analyze large datasets instantly, identify patterns, and execute trades automatically, leading to more consistent and potentially profitable results. AI also adapts quickly to market changes, reducing human error and fatigue.

How accurate are AI algorithms in day trading?

AI algorithms in day trading are generally accurate in identifying patterns and executing trades quickly, often outperforming manual trading in speed and data analysis. However, their accuracy depends on data quality, algorithm design, and market conditions. They can make precise decisions based on complex data but still face risks from unpredictable market shifts. Manual trading relies on human judgment, which can be less consistent but more adaptable to sudden changes.

What skills are needed for manual day trading?

Manual day trading requires strong analytical skills, quick decision-making, discipline, risk management, and emotional control. You need to interpret market charts, news, and patterns swiftly. Good intuition and experience help you adapt to fast-changing conditions. Technical analysis and understanding of trading platforms are essential. Unlike AI trading, manual trading relies on human judgment and real-time intuition.

What technical tools do AI traders use?

AI traders use tools like machine learning algorithms, neural networks, algorithmic trading platforms, data analytics software, and automated trading bots. They rely on APIs for real-time market data, backtesting software to test strategies, and cloud computing for processing large datasets. These tools enable AI traders to analyze patterns, execute trades instantly, and adapt strategies dynamically.

Is manual trading more risky than AI trading?

Yes, manual trading is generally more risky than AI trading because humans are prone to emotional decisions and errors, while AI trading relies on algorithms that follow data-driven strategies without emotion. AI trading can process large amounts of data quickly and execute trades consistently, reducing impulsive mistakes. Manual traders may miss opportunities or make costly mistakes due to fatigue, bias, or misjudgment, increasing risk.

How do costs compare between manual and AI trading?

Manual trading costs include higher time investment, potential for emotional errors, and commissions or fees per trade. AI trading reduces ongoing labor costs, automates decision-making, and often lowers transaction fees through faster execution. However, AI systems require upfront investment in technology and data, which can be expensive initially. Overall, AI trading can be cheaper over time due to efficiency, but setup costs are higher upfront.

Can AI trading outperform human traders?

Yes, AI trading can outperform human traders by analyzing vast data faster and making emotionless decisions. AI systems process real-time market data, identify patterns, and execute trades with precision, often faster than humans. While humans rely on intuition and experience, AI uses algorithms and machine learning to adapt and optimize strategies continuously. However, AI can also make mistakes if market conditions change unexpectedly or if algorithms aren’t properly calibrated.

What are the common challenges in manual day trading?

Manual day trading faces challenges like emotional decision-making, inconsistent execution, and slower reaction times. Traders often struggle with maintaining discipline and controlling impulses, leading to costly mistakes. Market volatility can cause hesitation or overtrading, risking losses. Human fatigue and stress impact focus and judgment during long trading sessions. Unlike AI trading, manual trading lacks automation, making it harder to execute rapid, precise trades consistently.

What are the limitations of AI in day trading?

AI in day trading struggles with unpredictable market shocks, lacking the human intuition to interpret news or sentiment. It can also overfit to historical data, making it vulnerable to sudden trend reversals. AI models might misjudge black swan events or rare market conditions, leading to significant losses. Additionally, they require constant updates and monitoring, and their decisions can lack transparency, making it hard to understand why trades happen. Human traders can adapt quickly to new information and market nuances AI might miss.

How do decision-making processes differ in manual vs AI trading?

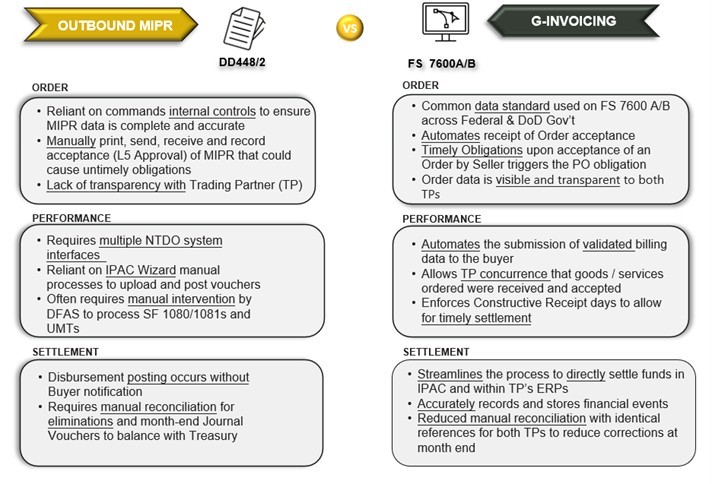

Manual trading relies on human judgment, intuition, and real-time analysis, while AI trading uses algorithms and data patterns to make quick, automated decisions. Humans interpret market news, emotions, and experience, often making subjective choices. AI systems analyze massive data sets instantly, executing trades based on predefined models without emotional bias. Manual trading is slower and prone to mistakes from fatigue or emotion; AI trading is faster, consistent, and can operate 24/7. Decision-making in manual trading involves subjective assessments, whereas AI trading depends on objective data and programmed rules.

What are the typical time commitments for manual traders?

Manual traders often spend several hours daily, usually 4 to 8 hours, monitoring markets, analyzing charts, and executing trades. They need time for research, strategy development, and real-time decision-making, often during market hours. Unlike AI trading, which runs automatically, manual trading demands active involvement, making it a full-time or part-time commitment depending on the trader’s approach.

How do emotional factors influence manual trading success?

Emotional factors heavily influence manual trading success by causing impulsive decisions, overconfidence, or panic during market swings. Traders’ fear or greed can lead to premature exits or holding onto losing positions, skewing judgment. Unlike AI trading, which is emotionless, manual traders rely on feelings that can distort analysis, making consistent profits harder. Managing emotions like frustration or excitement is crucial for maintaining discipline and sticking to strategies. Emotional resilience determines whether a trader follows their plan or reacts impulsively, directly impacting success in manual trading.

Is hybrid trading a good option combining manual and AI?

Yes, hybrid trading combines the strengths of manual and AI trading, offering flexibility and improved decision-making. It allows traders to leverage AI for data analysis and pattern recognition while applying human judgment for market nuances. This approach can reduce emotional bias and enhance trading accuracy.

What are the best platforms for manual trading?

The best platforms for manual trading include MetaTrader 4 and 5, Thinkorswim, TradingView, NinjaTrader, and Interactive Brokers. These platforms offer real-time data, customizable charts, and order execution tools suited for active traders.

What AI trading platforms are most popular?

Popular AI trading platforms include Trade Ideas, TrendSpider, MetaTrader with AI plugins, and eToro’s CopyTrader. They use algorithms to analyze markets, automate trading, and optimize strategies.

How do regulations impact manual and AI trading?

Regulations limit leverage, set reporting standards, and require disclosures for both manual and AI trading. For manual trading, regulations enforce compliance through oversight and restrict certain strategies. AI trading faces rules on algorithm transparency, testing, and risk management to prevent market manipulation. Overall, regulations increase accountability and safety, shaping how both manual and AI traders operate.

Can AI adapt to market changes better than manual traders?

AI can adapt to market changes faster and more consistently than manual traders because it processes vast data in real-time, adjusting strategies instantly. Manual traders rely on intuition and experience, which can lag behind rapid market shifts. AI algorithms identify patterns and react without emotional bias, giving them an edge in volatile conditions. However, manual traders excel at nuanced judgment and understanding unforeseen market events that AI might miss.

Conclusion about What Are the Differences Between Manual and AI Day Trading?

In summary, both manual and AI day trading have distinct advantages and challenges. Manual trading offers control and emotional insight, while AI trading enhances speed and data analysis. As you consider which approach suits your trading style, remember that each method can be effective depending on your goals and resources. For comprehensive insights and support on navigating these trading strategies, DayTradingBusiness is here to help you make informed decisions.