Did you know that some traders spend more time choosing a platform than they do actually trading? In the fast-paced world of day trading, selecting the right platform can make or break your success. This article dives into essential FAQs about day trading platforms, covering everything from what they are and how to choose the best one to security concerns and available features. You'll learn about costs, asset types, order execution speeds, and even customer support options. Plus, discover if free platforms exist and how to practice trading risk-free with demo accounts. Join DayTradingBusiness as we unravel the key elements that will empower your trading journey!

What is a day trading platform?

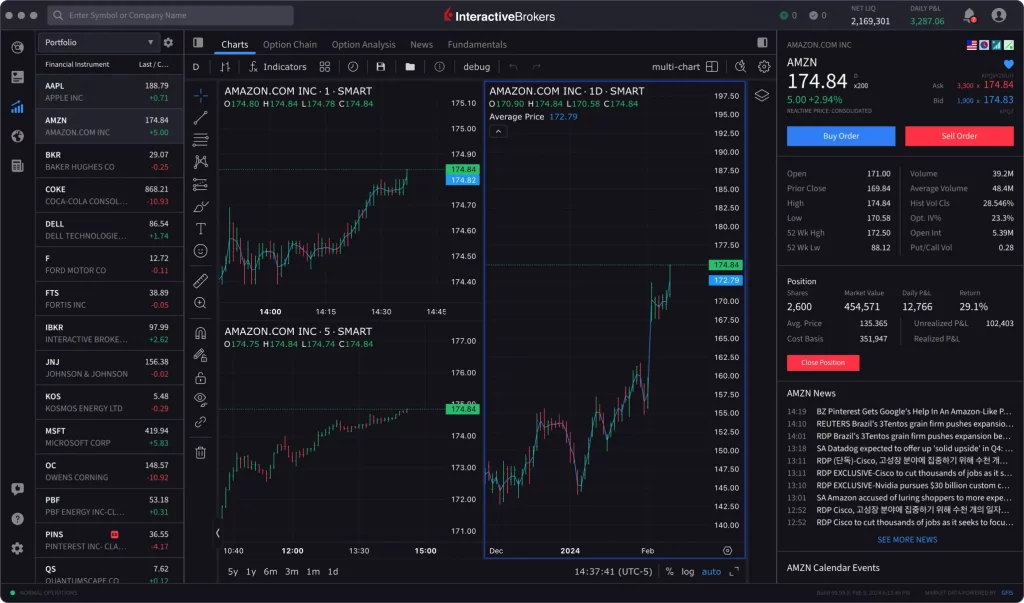

A day trading platform is software that lets traders buy and sell financial assets like stocks, options, or forex within the same trading day. It provides real-time data, charts, order execution, and tools for quick decision-making. Examples include Thinkorswim, MetaTrader, and Interactive Brokers.

How do I choose the best day trading platform?

Look for platforms with low trading fees, fast execution, reliable charting tools, and real-time data. Prioritize user-friendly interfaces and strong customer support. Check if they offer the assets you want to trade and ensure they’re regulated. Test demo accounts to see if the platform matches your trading style.

What features should I look for in a day trading platform?

Look for real-time market data, fast execution speeds, and low latency. Ensure it offers advanced charting tools, customizable indicators, and quick order placement. Check for reliable technical analysis features, paper trading options, and strong security. User-friendly interface and customer support also matter.

Are there free day trading platforms available?

Yes, several free day trading platforms are available, like Webull, Robinhood, and TD Ameritrade’s thinkorswim.

How secure are day trading platforms?

Day trading platforms vary in security; top-tier platforms use encryption, two-factor authentication, and regular security audits. Established brokers are regulated and follow strict compliance standards, reducing risk of fraud. However, no platform is completely immune to hacking or technical issues, so always choose reputable providers and enable all security features.

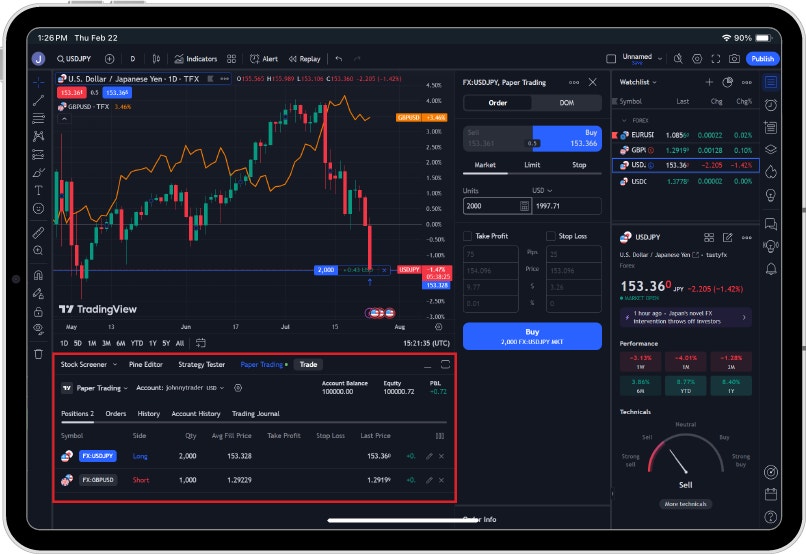

Can I use a mobile device for day trading?

Yes, you can use a mobile device for day trading. Most trading platforms have mobile apps that let you execute trades, monitor markets, and manage your account on smartphones or tablets. Just ensure your device has a reliable internet connection and the app is secure. However, some traders prefer desktops for faster execution and better data display.

What are the top-rated day trading platforms in 2024?

The top-rated day trading platforms in 2024 are TD Ameritrade's thinkorswim, Interactive Brokers, E*TRADE, Webull, and Fidelity Active Trader Pro.

How much does a day trading platform cost?

Day trading platforms typically cost between $0 and $200 per month. Many brokers offer free platforms if you meet certain trading volume or account balance requirements. Premium platforms with advanced tools can cost upwards of $100 to $200 monthly.

What types of assets can I trade on these platforms?

You can trade stocks, options, futures, forex, and cryptocurrencies on these platforms.

How do I open an account on a day trading platform?

Choose a reputable day trading platform like TD Ameritrade, E*TRADE, or Interactive Brokers. Fill out the online application with your personal info, including Social Security number, financial details, and trading experience. Submit required documents for identity verification, such as a driver’s license or passport. Link your bank account for funding. Wait for approval, which can take a few days. Once approved, log in, deposit funds, and start trading.

Learn about How Does Broker Compliance Impact Day Trading Account Security?

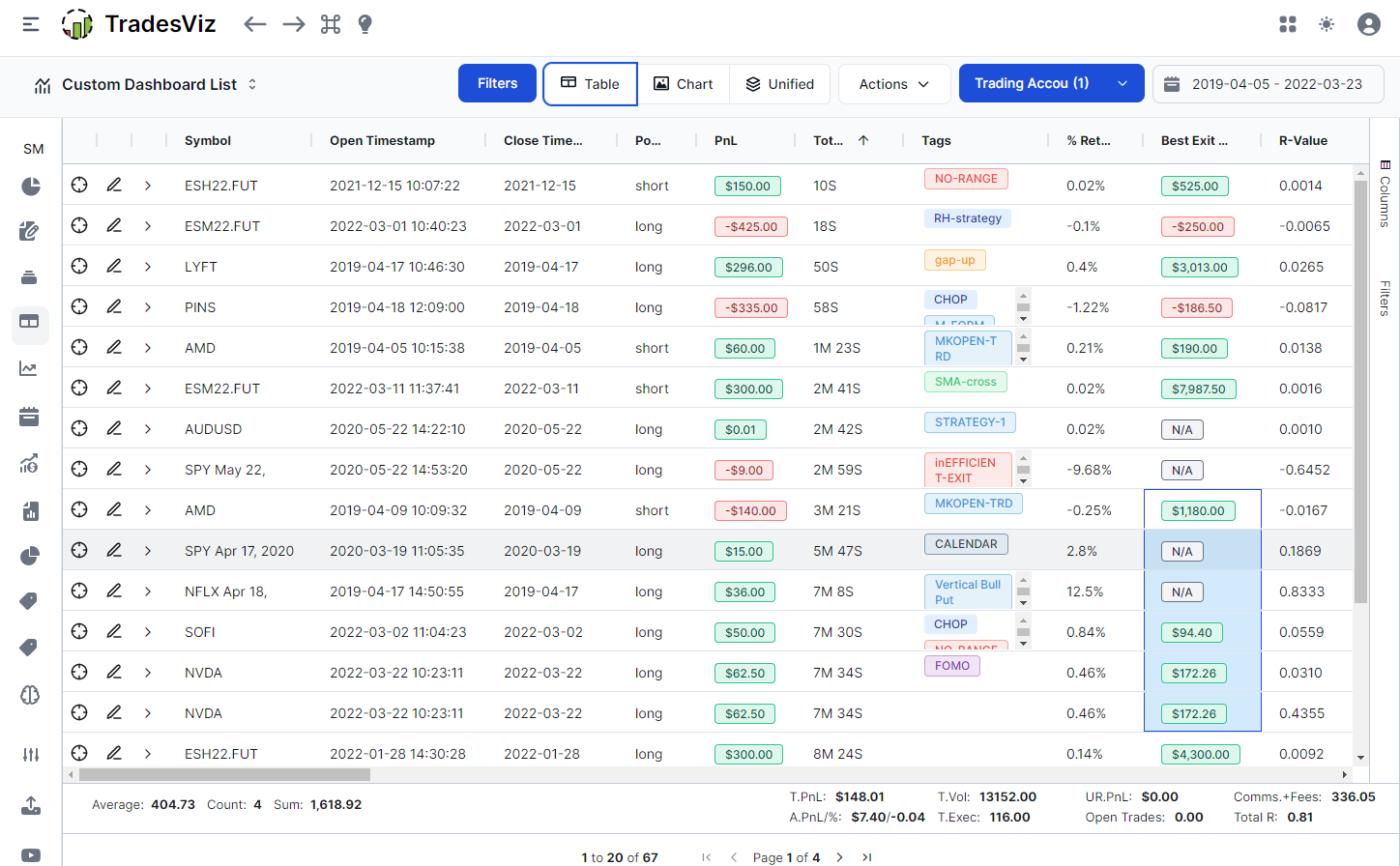

What tools and indicators are included in day trading platforms?

Day trading platforms typically include tools like real-time charts, level II market data, order execution interfaces, and risk management tools. Indicators such as moving averages, RSI, MACD, Bollinger Bands, and volume analysis are standard. They also feature news feeds, customizable alerts, and time-based trading timers. Some platforms integrate pattern recognition tools and backtesting features to optimize strategies.

How fast are order executions on different platforms?

Order executions on day trading platforms vary from milliseconds to a few seconds. High-frequency traders often see sub-10-millisecond execution times, while retail platforms might take 1-2 seconds. Faster platforms like Interactive Brokers or TD Ameritrade’s thinkorswim typically offer near-instant execution, but actual speed depends on market conditions and internet latency.

Can I automate my trades with a day trading platform?

Yes, many day trading platforms offer automation features like trading bots and algorithmic trading tools, allowing you to set up automated trades based on your strategies.

What customer support options do day trading platforms offer?

Day trading platforms typically offer live chat, email support, phone assistance, and comprehensive help centers. Many also include in-platform messaging or chatbots for quick queries. Some platforms provide dedicated account managers or 24/7 customer service, especially for premium users.

Learn about Day Trading Platforms with Customer Support and Resources

Are demo accounts available for practice trading?

Yes, demo accounts are available for practice trading on most day trading platforms.

How do I withdraw funds from my trading account?

Log into your trading platform, go to the withdrawal or cash-out section, select your preferred withdrawal method (bank transfer, e-wallet, etc.), enter the amount, and confirm the transaction.

What are the common risks of using day trading platforms?

Common risks of using day trading platforms include significant financial loss due to rapid market movements, high leverage increasing the potential for big losses, technical glitches or outages disrupting trades, and the temptation to overtrade, leading to poor decision-making. Additionally, inexperienced traders may fall for scams or fake platforms, and volatile markets can wipe out accounts quickly.

Learn about What Are the Risks of Using Non-Compliant Day Trading Brokers?

How do I ensure compliance with trading regulations?

Research the specific regulations in your region, like SEC rules or FCA guidelines. Use a reputable, regulated trading platform that complies with legal standards. Keep detailed records of all trades and fund sources. Stay updated on regulatory changes via official financial authority websites. Follow platform rules and trading limits strictly. Consider consulting a financial advisor or legal expert for tailored advice.

Conclusion about FAQs About Day Trading Platforms

In conclusion, selecting the right day trading platform is crucial for your trading success. By understanding the essential features, costs, and security measures, you can make an informed choice that suits your trading style. Whether you prioritize speed of execution, automation capabilities, or customer support, there are platforms tailored to your needs. For comprehensive insights and assistance in navigating these options, consider the expertise offered by DayTradingBusiness.

Learn about What Are the Most Common Myths About Day Trading Bots?