Did you know that even the most seasoned traders sometimes feel like they're juggling flaming torches while riding a unicycle? Just as they need balance, so do you when navigating the fast-paced world of day trading. In this article, we dive into the importance of day trading platforms equipped with built-in risk management tools. Discover the best platforms that enhance your trading performance with features like automatic stop-loss and take-profit orders, customizable risk limits, and real-time risk analytics. Learn how these tools can significantly reduce trading losses, integrate with technical analysis, and even function on mobile apps. Plus, we’ll explore the costs associated with advanced risk management features and the role of automation in maintaining trading discipline. Equip yourself with the right knowledge from DayTradingBusiness to take control of your trading journey!

What are the best day trading platforms with built-in risk management tools?

Top day trading platforms with built-in risk management tools include Thinkorswim, Interactive Brokers, MetaTrader 5, Tradestation, and NinjaTrader. They offer features like automated stop-loss orders, position sizing, real-time alerts, and risk calculators to manage trading risks effectively.

How do risk management features improve day trading performance?

Risk management features on day trading platforms help by setting stop-loss and take-profit orders automatically, limiting losses and locking in gains. They provide real-time alerts to avoid emotional trading decisions. Position sizing tools optimize trade amounts based on account risk, reducing the chance of large losses. These features help traders stick to predefined risk levels, maintain discipline, and adapt quickly to market changes, ultimately boosting overall trading performance.

Which platforms offer automatic stop-loss and take-profit orders?

Platforms like MetaTrader 4 and 5, Thinkorswim by TD Ameritrade, NinjaTrader, and Interactive Brokers offer automatic stop-loss and take-profit orders.

Can I customize risk limits on top day trading platforms?

Yes, most top day trading platforms with built-in risk management tools allow you to customize risk limits. You can set maximum daily loss, position size, and stop-loss levels to control your trading risk.

Are there platforms that provide real-time risk analytics?

Yes, many day trading platforms offer real-time risk analytics. Thinkorswim, Interactive Brokers, and TradeStation provide live risk assessment tools, including real-time stop-loss tracking, margin monitoring, and volatility analysis to manage trading risks effectively.

How do built-in risk management tools reduce trading losses?

Built-in risk management tools in day trading platforms limit losses by setting stop-loss and take-profit levels, automatically closing trades before losses escalate. They monitor market volatility and adjust positions accordingly, preventing overexposure. These tools help traders stick to predefined risk parameters, reducing emotional decision-making that can lead to bigger losses. By providing real-time alerts and automatic order execution, they enable quick responses to market shifts, protecting capital and maintaining discipline.

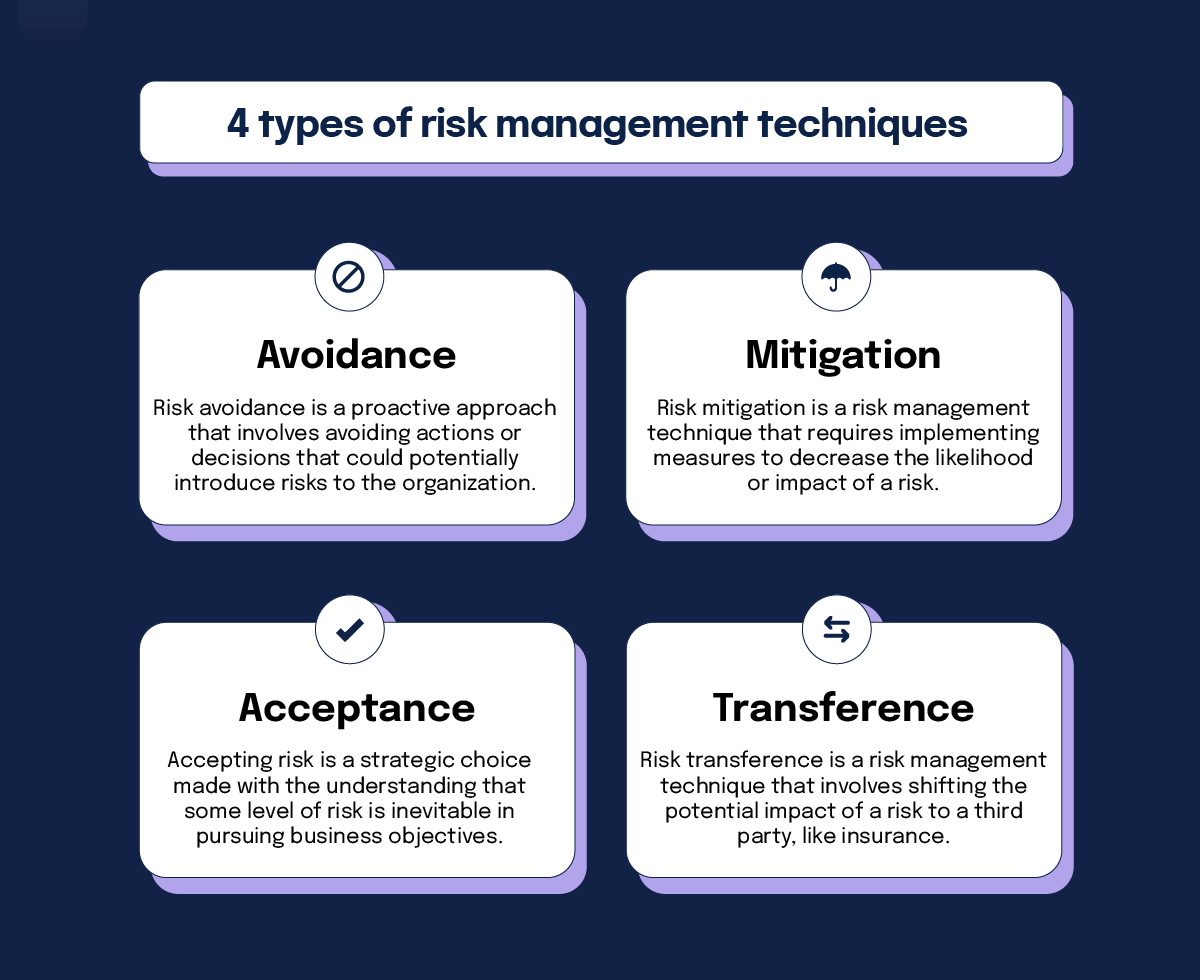

What are the key features to look for in risk management tools?

Look for real-time stop-loss and take-profit orders, customizable risk levels, and automatic position sizing. Ensure it offers alerts for margin calls and risk limits, easy trade tracking, and integration with analytics for assessing potential losses. User-friendly interface and automation features help manage risk efficiently during fast-paced day trading.

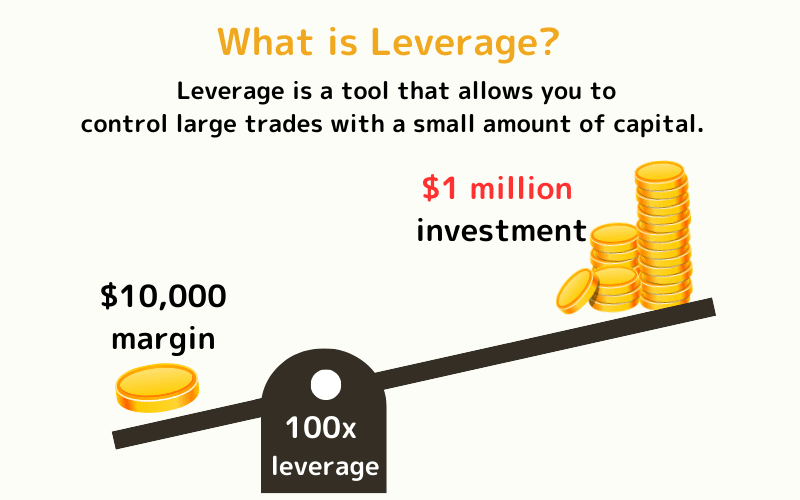

Do all day trading platforms support margin and leverage controls?

No, not all day trading platforms support margin and leverage controls. Some platforms offer limited or no margin trading options, especially if they focus on non-leverage trading or are designed for casual traders. Always check the platform’s features to confirm if margin and leverage controls are available.

How effective are trailing stops in managing risk?

Trailing stops are effective for managing risk by locking in profits and limiting losses as the market moves. They automatically adjust to price changes, reducing emotional decision-making. In day trading, they help protect gains during quick price swings and prevent large losses if the trend reverses. However, in volatile markets, they can trigger prematurely, so their effectiveness depends on setting appropriate distances. Overall, trailing stops are a valuable tool for risk control on trading platforms with built-in risk management features.

Can I set alerts for risk threshold breaches?

Yes, many day trading platforms with built-in risk management tools let you set alerts for risk threshold breaches.

Which platforms offer simulation or paper trading with risk controls?

Thinkorswim, Interactive Brokers, TradingView, eToro, and NinjaTrader offer simulation or paper trading with built-in risk controls.

How do risk management tools integrate with technical analysis?

Risk management tools in day trading platforms integrate with technical analysis by automatically setting stop-loss and take-profit levels based on chart patterns and indicator signals. They adjust position sizes using volatility measures like ATR to control exposure. These tools also flag risky setups identified through technical indicators, helping traders make data-driven decisions. By combining real-time chart analysis with predefined risk parameters, they streamline managing potential losses while capitalizing on technical signals.

Are risk features available on mobile day trading apps?

Some mobile day trading apps offer risk features like stop-loss orders, risk alerts, and position limits. However, the availability varies by platform; not all mobile apps have comprehensive risk management tools. Check each app's features before trading.

What are the costs associated with advanced risk management tools?

Advanced risk management tools in day trading platforms typically cost between $50 and $200 monthly, depending on features like real-time monitoring, automated stop-loss, and position sizing. Some platforms charge setup or licensing fees, and premium tools or analytics can add extra charges. Integration costs or additional data subscriptions may also increase overall expenses.

How does automated risk management impact trading discipline?

Automated risk management enforces strict trading discipline by automatically limiting losses through stop-loss orders and position sizing. It prevents emotional decisions, ensuring traders stick to predefined risk parameters. This consistency helps maintain focus, reduces impulsive trades, and fosters long-term trading habits. Automated tools act as a safety net, encouraging disciplined, rule-based trading on day trading platforms.

Learn about How can poor risk management ruin a day trading account?

Conclusion about Day Trading Platforms with Built-in Risk Management Tools

Incorporating robust risk management tools into your day trading strategy is essential for enhancing performance and minimizing losses. The right platform can offer features like automatic stop-loss orders, customizable risk limits, and real-time analytics, all of which contribute to informed decision-making. By choosing a platform that aligns with your trading needs, you can leverage these tools to maintain discipline and effectively manage risks. For comprehensive insights and guidance on selecting the best day trading platforms, rely on DayTradingBusiness to help you navigate the intricacies of trading.

Learn about Day Trading Software with Risk Management Tools